So, OpenAI is looking to go public, and people are talking about a massive valuation, maybe even a trillion dollars. It’s a big deal, and it’s got everyone wondering about the open ai stock price prediction. They’ve been doing some corporate shuffling, which seems to be setting them up for this move. It’s a lot to take in, especially with how fast things are changing in the AI world. Let’s break down what this could mean.

Key Takeaways

- OpenAI is reportedly planning a huge IPO, with some sources suggesting a valuation of up to $1 trillion.

- The company has recently restructured its business, moving towards a for-profit model under a nonprofit foundation, which could make it easier to go public.

- A public offering would help OpenAI raise the significant capital needed for AI infrastructure and expansion, potentially reaching $60 billion or more.

- While revenue is growing, OpenAI is also facing substantial losses due to high operating costs for AI development and infrastructure.

- The AI sector is booming, but OpenAI will face stiff competition and regulatory scrutiny as a public company.

OpenAI’s Ambitious Path to a Trillion-Dollar Valuation

Forecasting the Potential IPO Valuation

OpenAI is looking at a really big moment, potentially going public with a valuation that could hit a staggering $1 trillion. This isn’t just a number; it’s a sign of how much people believe in the future of artificial intelligence and OpenAI’s role in it. The company is reportedly aiming to file the necessary paperwork by late 2026, with the actual stock market debut possibly happening in 2027. They’re looking to raise a significant amount of money, maybe around $60 billion or even more, which would make it one of the biggest IPOs ever. This move follows a big change in how OpenAI is structured, shifting to a for-profit model under a nonprofit foundation. It’s all about getting easier access to the capital needed to keep pushing the boundaries of AI.

Understanding the $1 Trillion Target

So, why a trillion dollars? It’s a bold target, for sure. It reflects the massive investment and belief in AI’s potential to reshape industries. OpenAI’s success with tools like ChatGPT has already shown what’s possible. Reaching this valuation would mean OpenAI is seen as a tech giant on par with some of the biggest names out there, right from its first day on the stock market. It’s a way to fund Sam Altman’s vision of building massive AI infrastructure, which he believes will require trillions of dollars. This valuation isn’t just about the company’s current performance; it’s a bet on its future dominance in the AI space.

Navigating the IPO Timeline

Getting ready for an IPO is a complex process. OpenAI has already done a major corporate restructuring, which is a big step. This new setup makes it easier to raise money from public investors. The company is looking at filing paperwork in the latter half of 2026, but some advisors think it could happen sooner. The actual listing is eyed for 2027, though timelines can always shift based on how the business is doing and what the market looks like. It’s a balancing act – preparing thoroughly while staying flexible. The company says an IPO isn’t their main focus right now, but they’re building a solid business to support their mission.

The Strategic Restructuring Paving the Way for Public Markets

So, OpenAI’s been doing some serious internal shuffling, and it’s all about getting ready for the big leagues – the stock market. They’ve basically shifted from being a pure research outfit to a more traditional for-profit company, but with a twist. This whole move is designed to make things simpler for investors and, frankly, to make it easier to raise the massive amounts of cash needed to keep pushing the boundaries of AI. It’s a big deal because it changes how the company operates and how it’s perceived.

Transitioning to a For-Profit Model

This is the core of the restructuring. OpenAI is now operating under a capped-profit structure. Think of it like this: they’re a business that needs to make money, but there are limits on how much profit can be distributed to investors. This allows them to attract capital from the public markets while still trying to stick to their original mission of developing AI for the benefit of everyone. It’s a delicate balance, for sure. They’ve set up a new entity, OpenAI Group, which is the for-profit arm, and this is what would eventually go public. It’s a pretty significant shift from their nonprofit roots, and it’s all about building a sustainable business that can fund the incredibly expensive work of creating advanced AI.

The Role of the OpenAI Foundation

Even with the for-profit shift, the original nonprofit foundation is still around. It’s now called the OpenAI Foundation, and it holds a significant stake, around 26%, in the for-profit OpenAI Group. This foundation acts as a sort of guardian, overseeing the company’s mission. It can even get more shares if certain goals are met. This structure is meant to ensure that even as OpenAI chases profits, it doesn’t completely lose sight of its broader aims. It’s a way to keep the original spirit alive while still playing the game of public markets. This setup is pretty unique and is a key part of their strategy to go public.

Microsoft’s Evolving Stake

Microsoft has been a huge supporter of OpenAI, pouring in billions. After the restructuring, their ownership stake is around 27%. While they’re still a major player and a strategic partner – which is super important for things like cloud computing power – this new structure means they don’t have outright control anymore. It gives OpenAI more flexibility. Microsoft’s continued involvement is a big vote of confidence, and their investment is a key part of the financial picture, especially as OpenAI prepares for its IPO. Having a partner like Microsoft is a huge advantage, and their ongoing commitment is a major factor in OpenAI’s IPO readiness.

Here’s a quick look at the ownership structure:

| Entity | Stake in OpenAI Group | Notes |

|---|---|---|

| OpenAI Foundation | ~26% | Oversees mission, potential for more shares |

| Microsoft | ~27% | Strategic partner, significant investor |

| Other Investors | Remaining | Includes venture capital and employees |

Financial Projections and Capital Needs

OpenAI is on a path that requires a serious amount of cash. We’re talking about building the future of artificial intelligence, and that doesn’t come cheap. The company is projecting some pretty big revenue numbers, which is exciting, but it’s also important to look at the other side of the coin: the costs.

Projected Revenue Growth

Reports suggest OpenAI is on track to hit an annual revenue run rate of around $20 billion by the end of this year. That’s a huge jump and shows how much demand there is for their AI models, like ChatGPT. This growth is a big reason why people are talking about a potential $1 trillion valuation for their IPO. It’s not just wishful thinking; the numbers are starting to look serious. This kind of financial performance is what gets investors interested in companies like OpenAI.

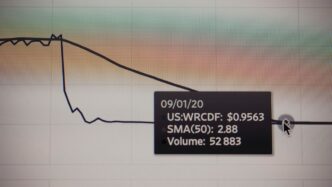

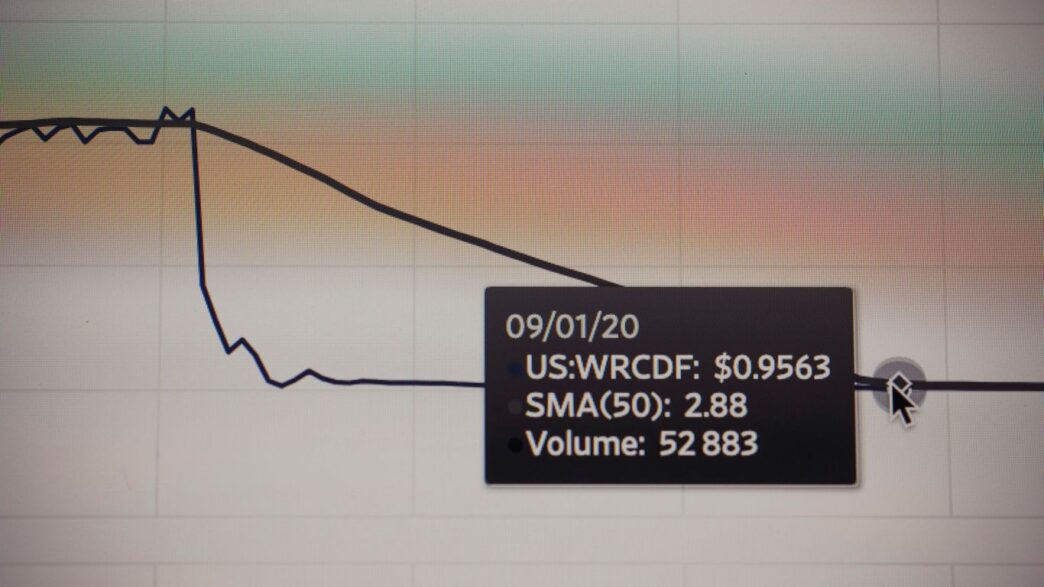

Addressing Rising Losses

Now, here’s where things get a bit more complicated. Despite the booming sales, OpenAI is also facing significant losses. This isn’t unusual for companies in cutting-edge tech sectors. They’ve been spending billions on computing hardware, data centers, and those super-advanced chips needed to train complex AI models. Think about the sheer amount of power and infrastructure required to run something like ChatGPT at scale. It’s a massive undertaking. Some reports indicate losses of over $13 billion in the first half of 2025 alone. This cash burn is a major factor in their need to raise substantial capital.

The Capital Infusion Required for AI Infrastructure

So, why all the spending and why the need for so much money? It all comes down to building the infrastructure for what they call Artificial General Intelligence (AGI). Sam Altman himself has mentioned the massive capital needs for AI infrastructure, and going public seems like the most logical way to get it. They’re looking at needing trillions of dollars down the line. An IPO could provide the necessary funds, not just for day-to-day operations but for massive, long-term investments in research, development, and the physical hardware that powers AI. This is why the scale of their potential fundraising, possibly $60 billion or more, is so significant. It’s about fueling the next decade of AI development and staying ahead in a very competitive AI sector’s explosive growth.

Market Dynamics and Competitive Landscape

The world of artificial intelligence is moving at a breakneck pace, and OpenAI is right in the thick of it. It’s not just a race to build smarter AI; it’s a massive competition for resources, talent, and market share. Think of it like a gold rush, but instead of gold, everyone’s after the next big AI breakthrough.

The AI Sector’s Explosive Growth

We’re seeing an unprecedented boom in AI right now. Companies are pouring money into AI research and development, and the results are showing up everywhere, from how we search for information to how businesses operate. It’s a sector that’s captured the attention of investors worldwide, and for good reason. The potential applications seem almost limitless, and the companies that can deliver on this promise are seeing their valuations soar.

Key Competitors in the AI Race

OpenAI isn’t the only player in this game, not by a long shot. Giants like Google, with its DeepMind division, are pushing hard. Amazon is also making big moves, especially through its investment in Anthropic, a company seen as a major rival. Then there are other specialized players like CoreWeave, which focuses on the infrastructure needed to run these complex AI models. This crowded field means constant innovation is a must.

Here’s a look at some of the major players and their focus:

- Google DeepMind: Known for its cutting-edge research and development in AI, often pushing the boundaries of what’s possible.

- Anthropic: A significant competitor focusing on AI safety and developing large language models that can rival OpenAI’s.

- Microsoft: While a major investor in OpenAI, Microsoft also has its own AI initiatives and partnerships, making its position complex.

- Nvidia: Not directly building AI models like OpenAI, but absolutely critical. Nvidia designs the chips that power almost all advanced AI, making it a central figure in the entire ecosystem.

Investor Appetite for AI Ventures

Investors are clearly excited about AI. We’ve seen companies in this space go public and achieve massive valuations very quickly. For instance, CoreWeave, an AI cloud operator, saw its valuation triple not long after its IPO. This kind of investor enthusiasm is exactly what OpenAI is hoping to tap into with its own public offering. The sheer scale of investment flowing into AI suggests that the market is ready for more big players to enter the public arena. It’s a validation of the technology and its potential to reshape industries.

Challenges and Opportunities in the Public Eye

So, OpenAI is gearing up for this massive IPO, aiming for that $1 trillion mark. It sounds exciting, right? But let’s be real, stepping into the public market isn’t just a walk in the park. There are some pretty big hurdles and, of course, some shiny opportunities that come with being a publicly traded company.

Navigating Regulatory Hurdles

Governments all over the world are starting to pay closer attention to AI. They’re figuring out rules for how these powerful tools are made and used. For OpenAI, this means they’ll have to be super careful. They need to follow all these new laws without slowing down their own work too much. It’s like trying to drive a race car while also reading a thick rulebook. They’ve got to figure out how to train their AI models and use them in ways that don’t cause problems, especially as they get more advanced. This is a tricky balance, and getting it wrong could mean big fines or even having to change how they operate.

Balancing Mission with Profitability

Remember, OpenAI started as a nonprofit with a big mission: to make sure artificial intelligence benefits everyone. Now, they’re looking at becoming a public company, which means making money for shareholders is a major goal. This creates a bit of a tug-of-war. How do you keep that original mission alive when you’re also under pressure to boost profits quarter after quarter? Investors will be watching closely to see if OpenAI can keep its focus on beneficial AI while also delivering strong financial results. It’s a tough act, and they’ll need to be smart about how they grow and make money without compromising what they set out to do in the first place.

The Impact of AI on Global Finance

An IPO this big from a company like OpenAI is a really big deal for the whole financial world. It’s not just about OpenAI; it’s about how AI itself is changing everything. Think about it: AI is already making companies like Nvidia skyrocket in value. An OpenAI listing would put AI even more in the spotlight, showing just how much money and potential is tied up in this technology. It could encourage more investment in AI startups and make AI a regular part of how we think about big business and the stock market. This could lead to new financial products, different ways of investing, and maybe even changes in how global economies work as AI becomes more integrated into everything we do.

Investor Returns and Strategic Partnerships

Potential Gains for Early Backers

When OpenAI eventually goes public, the people and companies who got in early are looking at some serious payday. Think about it, they took a chance on a company that was still figuring things out, and now, with the buzz around AI, their initial investments could multiply many times over. We’re talking about folks like Microsoft, which has already put in a huge chunk of change, and other big names like SoftBank and Thrive Capital. Even Abu Dhabi’s MGX is in the mix. A successful IPO would mean these early supporters see a massive return on their risk. It’s a big deal for them, and it validates their belief in OpenAI’s vision.

The Significance of Nvidia’s Role

It’s hard to talk about AI right now without mentioning Nvidia. They’re basically the engine powering a lot of this AI revolution with their advanced chips. OpenAI’s whole operation, from training its massive models to running its services, relies heavily on this kind of high-powered hardware. This symbiotic relationship means Nvidia’s success is almost tied to OpenAI’s, and vice versa. Companies like Applied Digital, which build data centers and partner with Nvidia, have seen their stock prices shoot up. It shows how interconnected the AI infrastructure world is. For OpenAI, having a strong partner like Nvidia is not just about getting the tech they need; it’s also a signal to investors that they’re building on a solid foundation.

Validating Generative AI Technologies

OpenAI’s journey, especially its potential IPO, is a huge moment for generative AI as a whole. Think about how ChatGPT changed things – it made AI accessible and showed what it could really do for everyday people and businesses. If OpenAI can pull off a massive IPO, it’s not just good for them; it’s a big win for the entire generative AI sector. It tells the financial world, ‘Hey, this stuff is real, it’s valuable, and it’s here to stay.’ We’ve already seen other AI companies, like CoreWeave, go public and do really well, tripling their value. OpenAI’s IPO could be the next big stamp of approval, attracting even more money and talent into the field, and proving that these advanced AI technologies are more than just a fad.

The Road Ahead for OpenAI

So, what does all this mean for OpenAI and its potential stock market debut? It’s clear the company is aiming for something huge, a $1 trillion IPO that could reshape how we think about tech valuations. They’re making big moves, restructuring and talking about needing massive amounts of cash to keep pushing AI forward. While the exact timing is still up in the air – could be late 2026, maybe 2027 – the intention seems pretty solid. Of course, it’s not all smooth sailing. There are big costs involved, and the whole AI world is still pretty new territory for regulators. But if OpenAI can pull it off, it’s not just about raising money; it’s about setting a new standard for AI companies on Wall Street and beyond. It’s going to be interesting to watch.