Navigating the Compute Demands for OpenAI’s Trillion-Dollar Vision

So, OpenAI wants to be worth a trillion dollars. That’s a huge number, right? But to get there, they need a mind-boggling amount of computing power. Think of it like needing a massive engine to power a super-fast car. This "compute," as they call it, is basically the electricity and the hardware – like fancy chips and servers – that make AI models like ChatGPT work. And it’s not cheap.

The Staggering Scale of Electricity Requirements

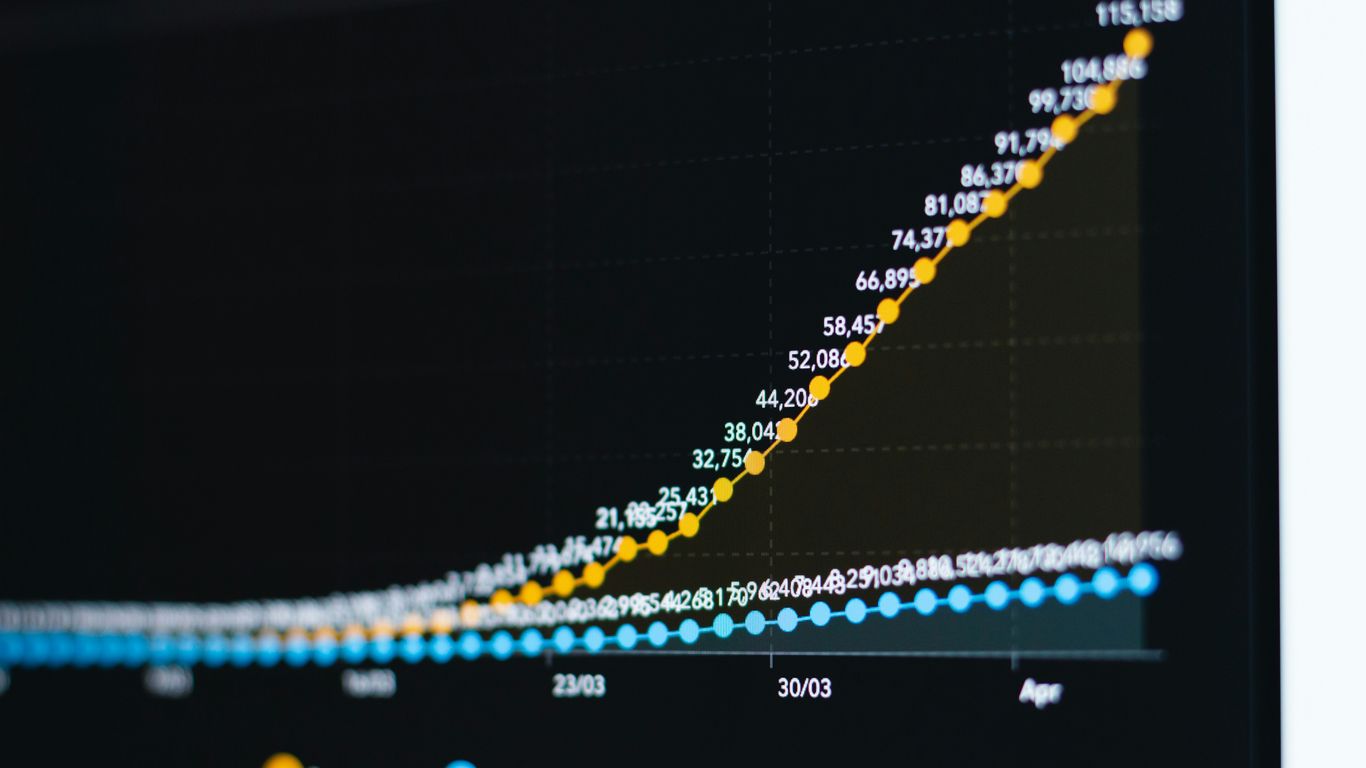

OpenAI is planning for a future where its AI needs a colossal amount of energy. We’re talking about needing power on a scale that’s hard to even picture. One estimate suggests they might need around 36 gigawatts of AI compute power by the end of this decade. To put that in perspective, that’s enough electricity to power millions of homes, more than some entire states use. It’s a bit like trying to fuel a rocket ship – you need a lot of fuel.

Bridging the Compute Funding Gap

Here’s the tricky part: all this compute costs a fortune. We’re looking at figures that could reach over $790 billion just for cloud and AI infrastructure between now and 2030. Some projections even put the total compute commitment at $1.4 trillion by 2033. That’s a lot of zeroes! OpenAI’s current revenue, while growing, isn’t enough to cover these costs. They’re facing a significant funding shortfall, meaning they’ll need to find ways to get more money. This could involve taking on more debt, getting new investments, or finding ways to make more money from their services.

Strategic Partnerships for Infrastructure Growth

Because the costs are so high, OpenAI can’t do this alone. They’re relying heavily on big partners, especially cloud providers like Microsoft and Amazon. These companies aren’t just supplying the computing power; they’re also major investors. It’s a bit of a give-and-take. OpenAI gets the infrastructure it needs, and its partners get a stake in the future of AI. Other tech companies are also involved, all part of a bigger AI ecosystem. This network of partners is key to building out the massive infrastructure required for OpenAI’s ambitious plans.

OpenAI’s Ambitious Revenue Projections Amidst Significant Losses

It’s no secret that OpenAI is burning through cash, and a lot of it. Reports have surfaced about staggering quarterly losses, like the $11.5 billion figure that’s been making the rounds. Now, for a company that’s still private, that sounds like a lot, and it is. But here’s the thing: rapidly growing tech companies aiming to be leaders often spend big during their early stages. It’s a bit like building a massive factory before you’ve sold a single product – you’ve got to invest heavily upfront.

Balancing Growth Phase Spending with Profitability

OpenAI is definitely in that growth phase. They’re pouring money into developing cutting-edge AI, which, as we’ve discussed, requires immense computing power. This spending is a major reason for the reported losses. The idea is that this investment now will pay off later with market dominance and, eventually, profits. It’s a gamble, for sure, but one that many tech giants have taken before.

Projected Revenue Streams and Monetization Strategies

So, how do they plan to turn things around and actually make money? OpenAI has a few ideas:

- Paid Subscriptions: This is a big one. While millions use free versions of tools like ChatGPT, a smaller but significant chunk pays for premium access. Think of it like getting a basic version of software for free, but paying for the advanced features or more usage.

- Enterprise Solutions: Businesses are a huge target. Companies can pay for versions of OpenAI’s technology tailored for their specific needs, offering more power, security, and support.

- API Access: Developers and other companies can pay to use OpenAI’s AI models in their own applications and services. This creates a whole ecosystem built on top of OpenAI’s tech.

- Future Products: There’s talk of hardware and other ventures, but the core revenue drivers right now are subscriptions and business services.

The Role of Paid Subscriptions in Revenue Generation

Paid subscriptions are a cornerstone of OpenAI’s revenue strategy. While the exact numbers fluctuate, a small percentage of users paying for premium access can add up significantly, especially with a user base in the hundreds of millions. For instance, if even a few percent of ChatGPT’s 800 million weekly users upgrade to a paid plan, that’s a substantial income stream. This model allows them to keep the basic service accessible to everyone while generating income from those who need more advanced capabilities or priority access. It’s a delicate balance, but one that’s crucial for their financial health as they aim for that trillion-dollar valuation.

The Path to an OpenAI Trillion-Dollar Valuation

Getting to a $1 trillion valuation is a huge goal, and OpenAI is making some big moves to get there. It’s not just about having a cool product like ChatGPT; it’s about setting up the company structure and convincing investors that the future is incredibly bright, even with the massive costs involved right now.

Corporate Restructuring for Market Readiness

OpenAI recently changed its corporate setup. They moved their for-profit part into a structure that’s more like a regular company. This is a pretty big deal because it makes it easier to bring in money and get ready for going public. Think of it like tidying up your house before you invite guests over – you want everything to look presentable and organized. This move away from the old nonprofit-centric control is key for attracting the kind of investment needed for their ambitious plans.

Investor Confidence and Generous Valuations

Right now, investors are looking way ahead. They see the potential in AI and believe OpenAI is a major player. This forward-looking perspective is why the company is getting such high valuations, even though it’s currently losing a lot of money. It’s a bit like buying stock in a company that hasn’t made a profit yet but is expected to dominate its industry in the future. The sheer scale of projected compute needs, like the reported 250 gigawatts of electricity by 2033, highlights the massive infrastructure investment required, which investors are betting on OpenAI to manage.

Preparing for a Landmark Initial Public Offering

All these steps – the restructuring, the focus on future growth – are really about getting ready for an Initial Public Offering (IPO). An IPO is when a private company starts selling its stock to the public for the first time. OpenAI is aiming for an IPO that could be one of the biggest ever, potentially hitting that $1 trillion mark. This would put them in the same league as some of the biggest tech giants out there. It’s a bold move, especially considering the company’s current financial losses, but the belief is that the long-term AI market will justify this.

Financial Strategies to Sustain OpenAI’s Exponential Growth

Okay, so OpenAI is aiming for the stars, but keeping that rocket fueled takes some serious cash. It’s not just about building cool AI; it’s about paying for the massive computing power needed to do it. They’re looking at a few ways to keep the money flowing.

Exploring Debt Financing and Capital Injections

One path OpenAI is considering is taking on more debt. Think of it like taking out a big loan to build a new factory. However, the market for this kind of borrowing is getting a bit crowded. Companies like Oracle and Meta have already borrowed a ton to build their own AI infrastructure, which has made lenders a little cautious. It’s not impossible, but it might be a tougher sell right now compared to a few years ago. They’re also always open to new investors jumping in, bringing fresh capital to the table. This could come from existing partners or entirely new players looking to get a piece of the AI action.

The Ecosystem of Financial Backers and Cloud Providers

OpenAI isn’t exactly a lone wolf in this. They’ve got some pretty big names in their corner. Microsoft and Amazon are not just providing the cloud space for OpenAI’s AI models to run; they’re also putting their money where their mouth is as investors. Then you have companies like Nvidia and AMD, who make the super-important chips that power all this AI. They all have a vested interest in OpenAI succeeding. It’s like a whole network of companies that benefit if OpenAI hits its targets. This interconnectedness helps secure resources and funding, but it also means their fortunes are tied together.

Mitigating Risks in an Evolving AI Market

Let’s be real, this whole AI thing is still pretty new, and there are definitely risks. OpenAI is betting big on people wanting and paying for their AI services in the future. But what if the demand doesn’t grow as fast as they think? Or what if other companies start offering similar services, making it harder to stand out? Plus, governments are starting to pay more attention to AI, and new rules could pop up. OpenAI needs to be smart about how it spends its money and how it plans for these uncertainties. They’re trying to balance spending a lot now to get ahead with making sure they have a solid plan for the long haul, even if things don’t go exactly as expected.

OpenAI’s Competitive Landscape and Ecosystem Dependencies

Competition for Cloud Computing Resources

OpenAI’s massive appetite for computing power puts it in direct competition with other tech giants. Think about it: Microsoft, Amazon, and Google are all building out their own AI infrastructure, and they’re also the primary providers of the cloud services that companies like OpenAI rely on. It’s a bit of a tangled web. OpenAI has been trying to diversify its cloud providers, moving beyond just Microsoft Azure to include options like Oracle Cloud and Google Cloud. This isn’t just about getting the best price; it’s about ensuring they have enough raw computing power to train and run their ever-growing AI models. This scramble for resources means that the cost of compute is only going to go up.

The Interplay Between AI Developers and Infrastructure Providers

It’s a symbiotic relationship, really. AI developers need the hardware and the cloud infrastructure to do their work, and companies like Nvidia, AMD, Microsoft, and Oracle need developers like OpenAI to buy their services and chips. For instance, Oracle is building massive data centers specifically for OpenAI, and in return, OpenAI is committing to paying for a significant chunk of that capacity. Nvidia, the king of AI chips, is also involved, with OpenAI buying their hardware and Nvidia taking a stake in OpenAI. It’s a complex dance where everyone has a vested interest in the other’s success.

Navigating Market Saturation and Regulatory Scrutiny

As AI becomes more widespread, there’s a growing concern about market saturation. Will there be enough demand for all the AI services being developed? OpenAI also faces increasing regulatory attention. Governments worldwide are starting to look closely at how AI is developed and used, which could impact everything from data privacy to the deployment of advanced AI systems. This means OpenAI has to be really careful about how it operates and grows, balancing its ambitious plans with the need to comply with a growing web of rules and public expectations.

Future Outlook: OpenAI’s Long-Term Compute and Revenue Strategy

Looking ahead, OpenAI is betting big on a future where its AI models become indispensable, driving massive demand for computing power and, consequently, substantial revenue. The company anticipates its compute needs will continue to skyrocket, potentially requiring infrastructure investments that dwarf current figures. This aggressive expansion is predicated on the belief that future demand for AI services will not only justify but necessitate these enormous outlays.

Forecasting Compute Needs Through 2033

OpenAI’s projections for compute requirements are nothing short of staggering. By 2033, the company foresees a need for compute resources that could cost upwards of $1.4 trillion. This isn’t just about having enough processing power for today’s tasks; it’s about building the foundational infrastructure to support AI advancements that haven’t even been conceived yet. The strategy involves securing long-term deals with cloud providers and potentially building out its own specialized data centers.

Projected Revenue Growth to Hundreds of Billions

To match these compute ambitions, OpenAI forecasts its annual revenue to climb into the hundreds of billions of dollars by 2030. This growth is expected to come from several key areas:

- Expanding Paid Subscriptions: Moving a larger percentage of its massive user base to paid tiers for premium features and access.

- Enterprise Solutions: Offering more sophisticated AI tools and custom model development for businesses.

- New Product Development: Launching novel AI-powered hardware and services, potentially in areas like scientific research or creative tools.

- API Access: Allowing other companies to build applications on top of OpenAI’s models.

The Bet on Future Demand and Model Improvements

At its core, OpenAI’s strategy is a high-stakes gamble on the future trajectory of AI. The company believes that as AI becomes more integrated into daily life and business operations, the demand for sophisticated models will grow exponentially. Furthermore, they are counting on continuous improvements in AI model efficiency and hardware performance to make the operation of these advanced systems more cost-effective over time. This dual approach – anticipating surging demand while also expecting technological advancements to mitigate costs – forms the backbone of their ambitious financial roadmap.

The Road Ahead for OpenAI

So, where does all this leave OpenAI? It’s a company with big dreams and even bigger spending plans. They’re talking about needing a mind-boggling amount of electricity and money to keep their AI models running and improving. While they’ve got major partners like Microsoft and a lot of users for things like ChatGPT, turning a profit is still a huge hurdle. The path to that trillion-dollar valuation isn’t exactly clear, and it’s going to take a lot more than just cool tech. They’ll need to figure out how to make serious money from their services, manage massive costs, and convince everyone that their future plans are actually achievable. It’s a massive gamble, and only time will tell if OpenAI can pull it off.