The world of venture capital is always changing, and keeping up can feel like a full-time job. This is especially true for firms like OpenView Investments, which focuses on expansion-stage software companies. They’re looking for specific things when they consider new investments and when they hire new people. We’re going to look at what makes OpenView tick and what it takes to succeed in this fast-paced field.

Key Takeaways

- OpenView Investments focuses on expansion-stage software, looking for companies that can grow significantly. They value a strong product and a clear path to market.

- The venture capital industry is increasingly looking for people with real-world experience as operators, not just finance backgrounds. This means people who have actually worked in companies and understand how they run.

- Being good at sales and building relationships is just as important as crunching numbers. Top venture capital firms want people who can connect with founders and other investors.

- OpenView Investments uses live data and looks closely at the founder’s vision and team when deciding on deals. They want to see a clear plan and a strong group of people leading the company.

- Product-Led Growth (PLG) is a big deal for OpenView, but they know it’s not a perfect strategy. They look for companies where PLG leads to real, lasting growth and not just a lot of sign-ups that disappear quickly.

Understanding OpenView Investments’ Strategic Focus

Expansion-Stage Software Investment Philosophy

OpenView Investments really zeroes in on a specific part of the software market: expansion-stage companies. This isn’t about seed funding or companies just starting out. We’re talking about businesses that have already found their footing, have a product that’s gaining traction, and are ready to scale significantly. Think Series A or B rounds, where the checks are typically in the $10 million to $30 million range. The core idea is to back software companies that are already showing strong growth and have a clear path to becoming market leaders. The goal is to help these companies accelerate their expansion, not to find the next big idea from scratch.

The Role of Product-Led Growth in OpenView’s Portfolio

Product-Led Growth, or PLG, is a big deal for OpenView. It’s a strategy where the product itself is the main driver for acquiring, retaining, and expanding customers. Instead of relying heavily on sales teams to close deals, PLG companies often let users try the product first, maybe with a free version or a trial. If they like it, they’ll upgrade or buy more. OpenView looks for companies where this model is working well, or where it has the potential to work. They want to see that the product is sticky and that users are finding real value on their own. This approach can lead to more efficient customer acquisition and a more organic growth path.

Navigating B2B Software Market Dynamics

When OpenView looks at the B2B software market, they’re not just looking at a company’s current performance. They’re trying to understand the bigger picture. This means looking at how the market is changing, what new trends are emerging, and how companies can stay ahead. They consider things like:

- Customer acquisition costs: How much does it cost to get a new customer, and is that cost sustainable?

- Customer retention: Are customers sticking around, or are they leaving after a short time?

- Market competition: Who else is out there, and how does this company stack up?

- Technological shifts: Is the underlying technology still relevant, or is it becoming outdated?

It’s about spotting companies that aren’t just good today, but are positioned to thrive in the future, even as the B2B software world keeps changing.

The Evolving Venture Capital Talent Landscape

The world of venture capital isn’t what it used to be. Gone are the days when a finance degree and a Rolodex were the only tickets to entry. Today, firms are looking for a much broader set of skills and experiences. It’s less about just crunching numbers and more about understanding how companies actually work and grow.

Beyond Traditional Finance: Embracing Operator Backgrounds

Many top funds are now actively seeking out people who have actually built and run businesses. Think product managers, sales leaders, or folks who’ve worked in business development at successful startups. These "operators" bring a practical, on-the-ground perspective that’s incredibly useful. They’ve lived the challenges founders face, which helps them connect better and assess opportunities more realistically. For instance, someone who’s scaled a sales team or launched a new product has insights that are hard to get from just reading reports. This shift means the talent pool is widening considerably, bringing in fresh viewpoints.

Assessing Candidate Potential: What Top Funds Seek

So, what are these firms actually looking for when they interview people? It’s a mix of things, really. They want to see if you can think critically about deals, but also if you can build relationships. Often, they’ll give candidates a real-world exercise, like asking them to evaluate an investment opportunity using live data. It’s not just about theoretical knowledge; it’s about practical application. They also want to see genuine passion for specific sectors. It’s not enough to say you like tech; you need to show you’ve done your homework and have a point of view. This is why having a track record of building companies or understanding market dynamics is so important.

Here’s a quick look at what’s valued:

- Analytical Rigor: Can you break down a business and understand its financial health?

- Operator Acumen: Have you experienced the day-to-day realities of running a business?

- Relationship Skills: Can you build trust with founders and other investors?

- Sector Passion: Do you have a deep interest and knowledge in specific industries?

The Value of Diverse Skill Sets in VC Recruiting

Diversity in VC recruiting isn’t just a buzzword; it’s a strategic advantage. Having people with different backgrounds means you get a wider range of ideas and perspectives when evaluating companies. Someone with a sales background might spot a go-to-market advantage others miss, while a product person might see a unique user engagement angle. This variety helps funds avoid groupthink and uncover opportunities that might otherwise be overlooked. It’s about building a team that can approach problems from multiple angles, leading to better investment decisions overall. The landscape is changing, and the talent within VC firms needs to change with it.

Key Attributes for Aspiring Venture Capitalists

So, you want to get into venture capital? It’s not just about crunching numbers anymore, though that’s still part of it. Funds like OpenView are looking for a mix of skills, and honestly, some of them might surprise you. It’s about more than just knowing finance.

Cultivating Sales Acumen and Relationship Building

Think about it: venture capital is a people business. You’re working with founders, other investors, and industry experts. Being able to build trust and connect with people is huge. It’s not that different from sales, really. You need to be able to talk to people, understand their needs, and build rapport. This helps you source better deals, get into competitive rounds, and generally just be a more effective investor. Strong relationship skills can open doors that pure analytical talent might miss.

Demonstrating Passion and Sector Expertise

Funds want to see that you’re genuinely interested in the spaces they invest in. It’s not enough to just say you like tech. You need to show it. This means digging into specific areas, understanding the market dynamics, and having opinions. Maybe you’ve spent time working in a particular software niche, or perhaps you’ve been following a certain trend closely. Whatever it is, be ready to talk about it with conviction. It’s about showing you’ve done your homework and have a real point of view.

The Impact of Thought Leadership and Content Creation

This is where you can really stand out. Writing blog posts, creating dashboards, or even just sharing well-reasoned opinions on platforms like LinkedIn can get you noticed. It shows initiative and a willingness to share your insights. For example, if OpenView is focused on product-led growth, writing a thoughtful piece about that specific strategy demonstrates you understand their world. It’s a way to build your personal brand and show potential employers what you’re capable of before they even talk to you. It’s like a preview of your analytical and communication skills in action.

OpenView Investments’ Approach to Diligence and Deal Sourcing

Evaluating Investment Opportunities with Live Data

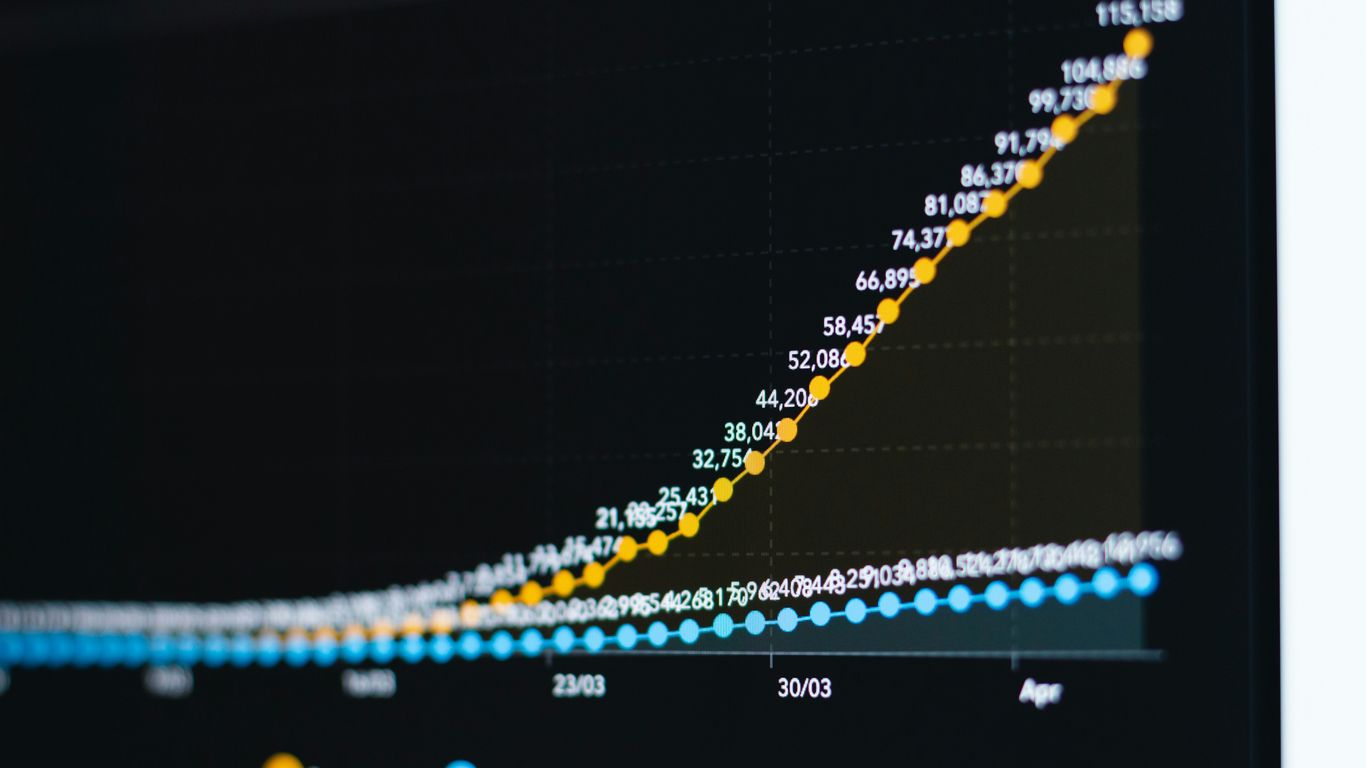

When OpenView looks at a potential investment, they don’t just rely on old reports or what a company tells them. They want to see things in action. This means digging into real, live data from companies, often using case study exercises. Candidates might be asked to look at a company’s actual performance metrics and decide if it’s a good bet. It’s about getting a feel for the numbers and how a business actually runs, not just how it looks on paper. This hands-on approach helps them spot opportunities that might be missed with a more traditional review.

Identifying Emerging Trends and High-Potential Companies

Finding the next big thing is what venture capital is all about, right? OpenView actively looks for companies that are on the cutting edge. This involves more than just reading industry news. They want candidates to show they can spot trends early. Think about it: someone might come in and say, "I’ve been watching this space, and here’s a company that’s really starting to gain traction because of X, Y, and Z." It’s about having a point of view and backing it up. They’re looking for people who are genuinely curious and can articulate why a particular company or sector is poised for growth.

Here’s a look at how they might assess potential:

- Sector Focus: Does the candidate understand the specific markets OpenView invests in (like B2B software)?

- Trend Spotting: Can they identify emerging technologies or business models before they become mainstream?

- Company Rationale: Is there a clear, data-supported reason for believing a specific company will succeed?

The Importance of Founder Vision and Team Dynamics

Numbers are important, sure, but so are the people behind the company. OpenView really values the vision that founders have and how well the team works together. It’s not just about a great idea; it’s about having leaders who can execute that idea. They look for founders who have a clear picture of where they want to take their company and a team that has the skills and chemistry to get there. Sometimes, a candidate might impress them simply by their ability to connect with entrepreneurs on a personal level, showing empathy and understanding that goes beyond just financial analysis. That kind of connection can be a big indicator of future success.

Navigating Investment Strategies: PLG and Beyond

When we talk about investment strategies, especially in the software world, Product-Led Growth (PLG) comes up a lot. It’s a way for companies to grow by letting their product do the heavy lifting. Think about tools like Slack or Calendly. You get invited by a friend or colleague, start using it, and then you’re hooked. It’s pretty neat because it means the product itself is the main driver for getting new users and keeping them around. This can be really efficient, cutting down on the need for huge sales teams.

Understanding the Strengths and Limitations of PLG

PLG is powerful because it often leads to organic growth. Users discover the value firsthand, which can create a strong, engaged customer base. It’s also generally more capital-efficient than traditional sales-driven models. However, it’s not a magic bullet for every business.

- Capital Efficiency: Lower upfront sales and marketing costs.

- Virality: Product usage naturally spreads through networks.

- User Engagement: Direct product experience builds loyalty.

But here’s the thing: PLG doesn’t fit everywhere. Industries that traditionally rely on complex enterprise sales, like government contracts or heavy industrial sectors, might find it tough to adopt a pure PLG model. Sometimes, you just need a human touch to explain things or close a deal. Also, just because a lot of people sign up doesn’t mean they’re all sticking around or paying. You can get a lot of free users, but if they churn quickly, that growth isn’t sustainable.

Identifying Sustainable Growth in SaaS Companies

So, how do we tell if a SaaS company is really growing well, especially if they’re using PLG? It’s more than just looking at signup numbers. We need to dig deeper.

- Cohort Analysis: Tracking groups of users who signed up around the same time to see how long they stick around and how much they spend over time. This shows real retention.

- Revenue vs. User Growth: Does the revenue grow as fast as the user base? Are users converting to paying customers?

- Customer Lifetime Value (CLTV) vs. Customer Acquisition Cost (CAC): A healthy PLG company will have a CLTV significantly higher than its CAC.

The real test is whether the growth is sticky and profitable over the long haul.

OpenView’s Criteria for Evaluating PLG Success

At OpenView, we look for a few key things when assessing PLG companies. It starts with the founders – their vision, their ability to build a great team, and their understanding of the market. We also examine the product itself: is it intuitive? Does it solve a real problem effectively?

- Founder Vision and Team: Do they have a clear, compelling story and the right people to execute?

- Product Value Proposition: Does the product clearly demonstrate its worth to the end-user?

- Sustainable Unit Economics: Beyond just sign-ups, we look for strong retention metrics and a clear path to profitability.

- Go-to-Market Strategy: How well is the PLG motion integrated with any necessary sales or customer success efforts?

We’re not just looking for companies that are good at getting sign-ups; we’re looking for businesses that have built a solid foundation for long-term success, using their product as the engine.

Career Transitions into Venture Capital

Thinking about shifting gears into venture capital? It’s a path many are exploring, especially those coming from operational roles within startups. The traditional finance background is still relevant, but funds like OpenView are increasingly looking beyond that. They value people who’ve actually built and scaled businesses. This shift means your experience as a product manager, a sales leader, or even a seasoned engineer can be incredibly attractive.

Leveraging Operator Experience for VC Roles

If you’ve spent time in the trenches of a growing company, you have a unique perspective. VC firms want to tap into that. Instead of just crunching numbers, they need people who understand the day-to-day realities of running a business. Think about how you’ve solved problems, managed teams, or driven growth. These are the stories that resonate. When you’re thinking about your resume, don’t just list your duties. Highlight the impact you made. Did you increase revenue by X%? Did you successfully launch a new product? Quantify your achievements whenever possible. It shows you understand what drives value.

Here’s a quick look at what operators bring:

- Deep Domain Knowledge: You know the market, the customers, and the competitive landscape from the inside.

- Founder Empathy: You’ve been there, so you can connect with entrepreneurs on a different level.

- Practical Problem-Solving: You’ve faced challenges and figured out how to overcome them.

Crafting Resumes for the Venture Capital Industry

Your resume is your first handshake. For a VC role, it needs to tell a compelling story about your journey and why you’re a good fit. Forget the generic corporate speak. Be specific. If you worked in sales, talk about building relationships and closing deals. If you were in product, focus on market understanding and product strategy. Funds are looking for candidates who can articulate their value clearly. Consider creating a simple dashboard or a short write-up on a sector you’re passionate about. This kind of proactive content can really make you stand out. It shows initiative and genuine interest, which is hard to fake. You can find some great advice on how to enter the venture capital industry that touches on this.

Preparing for Live Deal Discussions and Interviews

Interviews in VC are often more practical than theoretical. Expect to be asked about specific companies or market trends. They might even present you with a hypothetical investment scenario. This is where your operator experience really shines. You can talk about the product, the go-to-market strategy, and the team dynamics with a level of detail that someone without that background might miss. It’s not just about knowing the numbers; it’s about understanding the business. Be ready to discuss why you’d invest in a particular company, or why you wouldn’t. Show that you can think critically and make a reasoned judgment. Practice talking through your thought process. This kind of preparation can make a big difference when you’re sitting across from potential partners.

Wrapping It Up

So, what’s the takeaway from all this? Venture capital isn’t just about crunching numbers anymore. Firms like OpenView are looking for people who really get the software world, especially with things like product-led growth becoming a bigger deal. It’s not enough to just know finance; you need to show you’re passionate, understand how companies actually work, and can connect with founders. Whether you’re coming from a tech background or a sales role, bringing real-world experience and a genuine interest in the market can make you stand out. The game is changing, and being adaptable and showing what you know in unique ways, like through a blog post or a well-thought-out idea, really helps get noticed.

Frequently Asked Questions

What kind of companies does OpenView Investments like to invest in?

OpenView focuses on software companies that are growing and ready to expand. Think of them as companies that have already figured out their product and are looking to reach more customers. They especially like businesses that use ‘product-led growth,’ meaning their product itself helps attract new users.

Why are people with experience working in companies (operators) becoming more popular in venture capital?

Venture capital firms are realizing that people who have actually worked in startups and tech companies, not just in finance, bring valuable real-world knowledge. These ‘operators’ understand the challenges founders face and can offer better advice because they’ve been there before.

What’s the best way to get noticed if I want to work in venture capital?

It helps to show you’re really passionate about a specific area of technology. Writing about your ideas, sharing your thoughts online, and building connections with people in the industry can make you stand out. It’s not just about numbers; it’s about showing you understand the market and can spot good opportunities.

How does OpenView decide if a company is a good investment?

OpenView looks closely at how a company is doing using real data. They want to see that the founders have a strong vision and a great team. They also check if the company’s growth is steady and sustainable, not just a quick burst.

What is ‘product-led growth’ (PLG) and why is it important for investors?

Product-led growth means a company’s product is designed to attract and keep customers on its own, often without a big sales team. This can be a very efficient way for companies to grow, which investors like because it can lead to better results and less risk.

What skills are most important for someone trying to get a job in venture capital?

Being good at talking to people and building relationships is super important, almost like being a salesperson. You also need to understand how businesses work, especially in the tech world. Showing you’re curious, have good ideas, and can learn quickly will help a lot.