So, let’s talk about Oracle Cloud market share. It’s a big topic, and honestly, the cloud world is always changing, right? One minute you think you know where things stand, and the next, there’s a new development. Oracle’s been around forever, especially with its databases, but how does that translate to the cloud today? We’re going to look at how Oracle fits into the whole picture, who its main rivals are, and what it’s doing to keep up. It’s not always straightforward, but understanding Oracle’s position is key to seeing where the cloud market is heading.

Key Takeaways

- Oracle holds a solid spot in the market, particularly strong in database technology, which is a big advantage as cloud adoption grows.

- The cloud market is super competitive, with giants like AWS and Microsoft Azure leading the pack, but Oracle is actively investing in its own cloud infrastructure (OCI) and AI capabilities.

- Oracle’s financial performance shows good growth, especially in cloud revenue, indicating its shift towards cloud services is paying off.

- Industry trends like the move to cloud, AI, and data privacy rules are shaping how Oracle competes and where it needs to focus its efforts.

- While Oracle faces challenges from intense competition and economic shifts, it has opportunities in industry-specific cloud solutions and its established global customer base.

Understanding Oracle Cloud Market Share Dynamics

So, where does Oracle actually stand in the big cloud picture right now? It’s a bit of a mixed bag, honestly. They’ve got this massive, long-standing presence in the enterprise software world, especially with their databases. Think of it like a really established company that’s now trying to build a whole new wing – the cloud wing.

Oracle’s Position in the Current Market

Oracle is definitely a player, no doubt about it. They’re not the biggest cloud provider out there, not by a long shot, but they’re not small either. Their strength really comes from their history. A lot of big companies have been using Oracle’s database software for years, and Oracle is pushing hard to get those same companies to move their operations to Oracle Cloud Infrastructure (OCI). It’s like trying to convince your loyal customers to try your new delivery service instead of their old one.

Key Market Dynamics Influencing Oracle

Several things are really shaping how Oracle does in the cloud market. First off, everyone is moving to the cloud, right? So, Oracle has to keep up. Then there’s the whole AI thing – everyone’s talking about it, and Oracle is trying to build that into its services too. Plus, there are all these new rules about data privacy and where data can be stored, which can make things complicated for global companies.

Here are some of the big forces at play:

- The Cloud Rush: Businesses are ditching old servers for cloud services faster than ever.

- AI Everywhere: Artificial intelligence is becoming a must-have, not just a nice-to-have.

- Data Rules: Governments are putting more restrictions on how and where data can be handled.

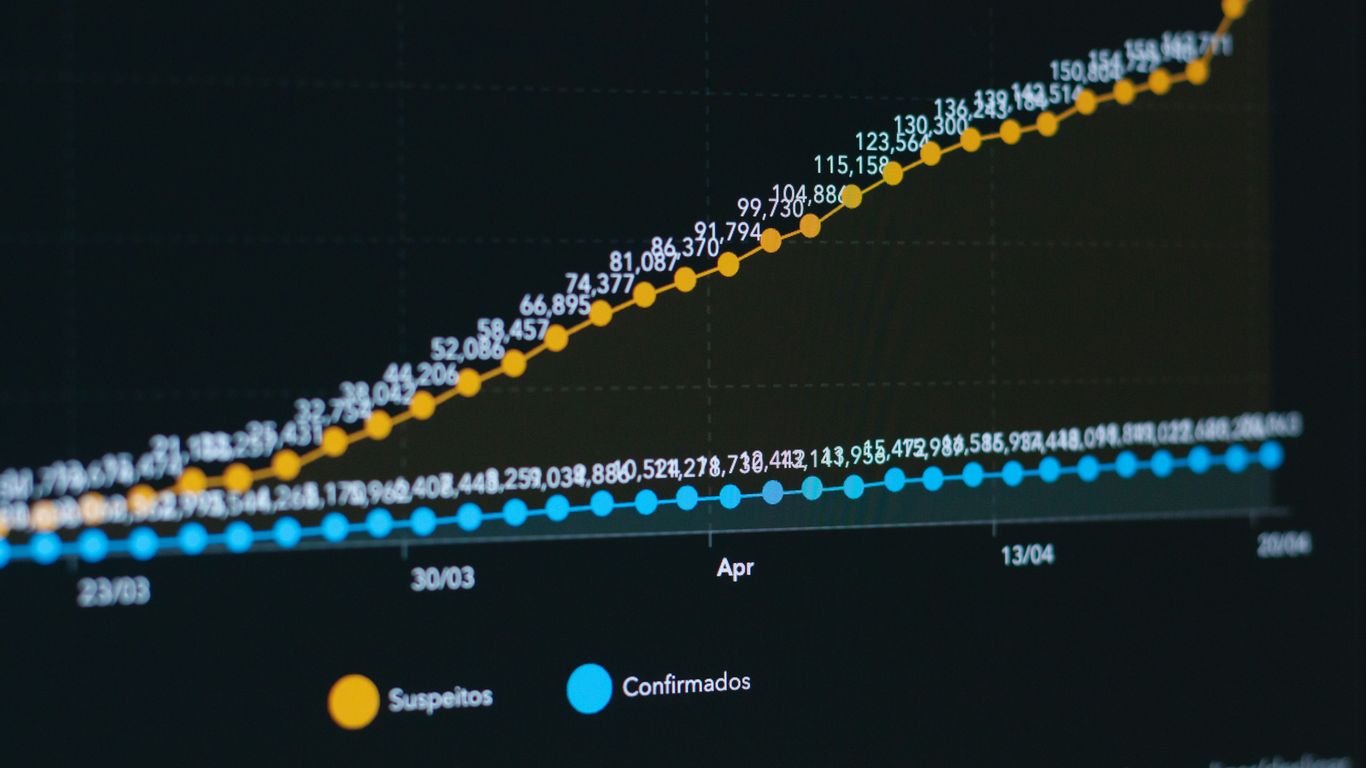

Financial Performance and Cloud Revenue Growth

Looking at the money side of things, Oracle has been showing some decent growth, especially in their cloud business. For the third quarter of their fiscal year 2024, which ended in February, they brought in about $13.3 billion in total revenue. That’s up 7% from the year before. The really interesting part is their cloud revenue – that includes their infrastructure (IaaS) and software (SaaS) services. That hit $5.1 billion, a jump of 25% year-over-year. This significant growth in cloud revenue is a clear sign that their strategy to push cloud services is starting to pay off. It shows they’re making progress in convincing customers to adopt their cloud solutions, even if they’re still playing catch-up in some areas.

Key Competitors in the Cloud Landscape

Alright, let’s talk about who Oracle is up against in the cloud game. It’s a crowded field, and honestly, it feels like everyone and their dog is trying to get a piece of the cloud pie these days. You’ve got the big three, of course, and then a bunch of other players trying to carve out their own space.

Analysis of Major Cloud Providers

When we talk about the big players, three names usually come up first: Amazon Web Services (AWS), Microsoft Azure, and Google Cloud. These guys are the giants, and they’ve been duking it out for years. AWS is still the market leader, kind of like the established champ. They’ve got a massive range of services, which is great for a lot of businesses. Microsoft Azure, on the other hand, has really leaned into its existing relationships with big companies, making it a strong choice for businesses already using Microsoft products. And then there’s Google Cloud, which has been making some serious noise, especially with its smarts in data analysis and AI. They’re growing fast and seem to be really pushing the envelope on new tech.

Here’s a quick look at how some of them stacked up recently:

| Provider | Market Share (Approx. Q4 2024) | Key Strengths |

|---|---|---|

| AWS | 32% | Broadest service portfolio, market dominance |

| Microsoft Azure | 25% | Strong enterprise ties, hybrid cloud solutions |

| Google Cloud | Growing rapidly | AI/ML capabilities, data analytics |

Emerging Players and Niche Disruptors

But it’s not just the big three. There are a lot of other companies out there doing interesting things. Think about companies like Salesforce, which is a powerhouse in customer relationship management (CRM) software, or SAP, which is a big deal in business management software. These companies aren’t necessarily trying to be everything to everyone like AWS or Azure, but they’re really good at what they do and have a loyal customer base. Then you have even more specialized players, maybe focusing on a specific industry like healthcare or finance, or offering a particular type of service. These smaller, focused companies can sometimes move faster and offer solutions that the bigger guys haven’t thought of yet. It means Oracle really has to stay on its toes.

Competitive Strategies of Key Players

So, how do these companies actually compete? Well, it’s a mix of things. For the big providers, it’s often about expanding their service offerings and trying to lock customers into their ecosystem. They’re also investing heavily in new technologies like AI. For companies like Salesforce, it’s about continuous innovation in their specific area, like CRM, and making sure their cloud software is top-notch. SAP focuses on integrating its software for businesses. Many are also looking at strategic partnerships or even buying up smaller companies to get new technology or customers. Ultimately, staying relevant means constantly adapting and finding ways to offer something unique or better than the competition. It’s a constant race to innovate and keep customers happy.

Oracle’s Strategic Initiatives and Strengths

Oracle’s place in the cloud market isn’t just about what they offer today, but also how they’re planning for tomorrow. They’ve got a few big things going for them that really set them apart.

Database Dominance and Legacy Strength

Let’s be honest, Oracle’s name is practically synonymous with databases. For years, they’ve been the go-to for businesses needing serious data management. This isn’t just old news; their database technology is still a massive strength. It’s reliable, it scales, and it’s secure, which is why so many big companies still depend on it. This deep-rooted trust in their database systems gives them a solid foundation as they push further into cloud services. They’re not starting from scratch; they’re building on decades of enterprise experience. This legacy strength means they understand what large organizations need, and that’s a big deal when you’re talking about cloud migrations and complex enterprise solutions. It’s like having a well-established reputation in a new neighborhood.

Cloud Transformation and Infrastructure Expansion

Oracle is making a serious play in the cloud. They’re actively shifting their business model to focus more on cloud services, trying to bring their huge on-premise customer base over to their cloud offerings. This isn’t a small undertaking. They’re investing heavily in their cloud infrastructure, known as OCI. Think of it as building more and bigger data centers. This expansion is key to competing with the other big cloud players. They’re aiming for performance and cost-effectiveness, trying to make OCI an attractive option for businesses looking for cloud solutions. It’s a big pivot, and their financial results are starting to show the payoff, with cloud revenues climbing steadily. You can see their commitment to cloud revenues growing each quarter.

Product Portfolio and Enterprise Solutions

Beyond just databases and infrastructure, Oracle has a really broad range of products. They’ve got everything from ERP (Enterprise Resource Planning) to CRM (Customer Relationship Management) software, and they’re integrating AI into all of it. This wide array of solutions means they can cater to many different business needs. Plus, they’ve been making smart acquisitions, like Cerner in the healthcare space. These moves help them enter new markets and add more specialized tools to their belt. It’s not just about having a lot of products; it’s about having integrated solutions that work together for large enterprises. This comprehensive approach is a big part of their strategy to keep customers within the Oracle ecosystem.

Industry Trends Shaping Oracle’s Market Share

The cloud computing world isn’t standing still, and neither is Oracle. Several big shifts are happening that really affect where Oracle fits in and how it grows. It’s a bit like trying to keep up with a fast-moving river – you have to adjust your course.

Accelerated Cloud Adoption and Digitalization

Pretty much everyone is moving to the cloud these days, or at least planning to. Businesses are ditching their old, on-premise systems for cloud-based setups. This means more companies are looking for cloud services, and Oracle is right there trying to grab a piece of that action. It’s not just about moving data; it’s about building new applications and services that live entirely in the cloud. This trend is a huge opportunity for Oracle, especially since they’ve been investing heavily in their Oracle Cloud Infrastructure (OCI). The push for digital transformation across all industries means companies need flexible, scalable solutions, and the cloud is where that happens.

The Impact of AI and Machine Learning

Artificial intelligence (AI) and machine learning (ML) are no longer just buzzwords; they’re becoming standard tools. Companies are using AI to automate tasks, get smarter insights from their data, and create new customer experiences. For Oracle, this means integrating AI and ML into its existing products and developing new AI-powered services. Think about how AI can make database management smarter or how ML can improve enterprise applications like ERP or CRM. Oracle’s ability to weave AI into its core offerings, especially its database technology and cloud services, will be a major factor in its future market share. Companies are looking for cloud platforms that can handle these advanced workloads, and Oracle is betting big on its AI capabilities.

Regulatory Changes and Data Privacy Concerns

Governments around the world are paying more attention to how companies handle data. New rules about data privacy, like GDPR in Europe or similar laws elsewhere, mean businesses have to be really careful. This affects cloud providers because data often crosses borders. Oracle, like its competitors, has to make sure its cloud services comply with all these different regulations. This can be complicated, but it also creates opportunities. Companies that can prove they offer secure, compliant cloud solutions might have an edge. Plus, some businesses are hesitant to put sensitive data on public clouds, which could lead them to explore hybrid cloud options where Oracle also plays a role.

Challenges and Opportunities for Oracle

Oracle’s journey in the cloud market isn’t without its bumps. The company is up against some really big players, and staying ahead means constantly adapting. It’s a tough crowd out there, with giants like AWS, Microsoft Azure, and Google Cloud all vying for a bigger slice of the pie. These competitors have massive scale and deep pockets, making it hard for anyone to catch up quickly. Plus, there are always new, smaller companies popping up with clever ideas that can shake things up.

Navigating Heightened Competition

Let’s be real, the cloud space is crowded. Oracle has to fight hard to win and keep customers. They’re up against companies that have been in the cloud game for a while and have built up huge ecosystems. It’s not just about having good tech; it’s about offering competitive pricing, a wide range of services, and making it easy for businesses to switch. Oracle’s ability to differentiate its cloud infrastructure (OCI) and applications will be key to its success. They need to show businesses why OCI is the better choice for their specific needs, whether that’s performance, security, or cost.

Leveraging Industry-Specific Solutions

One area where Oracle has a real shot is by focusing on specific industries. Think healthcare, finance, or retail. These sectors have unique needs and regulations, and Oracle has a long history of serving these businesses with its software. By building out specialized cloud services tailored for these industries, Oracle can carve out a strong niche. This approach helps them stand out from the more generalist cloud providers. For instance, developing cloud solutions for healthcare that meet strict data privacy rules could be a big win. It’s about using their existing strengths and applying them to new cloud opportunities.

Addressing Geopolitical and Economic Uncertainties

Things happening in the world can really affect how businesses spend money on technology. Economic slowdowns mean companies might cut back on IT budgets, and that hits cloud providers. Geopolitical issues can also create uncertainty, making businesses hesitant to make big cloud commitments. Oracle, like all cloud companies, has to be ready for these shifts. They need to show that their cloud services are reliable and can help businesses become more efficient, even when times are tough. This means being flexible and perhaps offering different pricing models to accommodate varying economic conditions. It’s a constant balancing act.

Assessing Oracle’s Global Footprint

When we talk about Oracle’s position in the cloud market, looking at where they operate and who they serve globally is pretty important. It’s not just about the tech itself, but how that tech reaches businesses and governments all over the world.

Regional Market Presence and Strengths

Oracle has a pretty solid presence in major markets, especially North America and Europe. They’ve been in these regions for a long time, building up relationships and understanding the local business needs. Their database business, which is still a huge part of their identity, has a strong foothold in these established economies. This gives them a good starting point for pushing their cloud services.

However, they’re also making moves in other areas. Think about Asia-Pacific and Latin America. These are growing markets, and Oracle is trying to capture a piece of that expansion. It’s a bit of a balancing act, maintaining strength in their traditional strongholds while also planting seeds in newer territories. The goal is to be a global player, not just a regional one.

Customer Base Diversity and Reach

One of Oracle’s big advantages is the sheer variety of customers they have. We’re talking about everyone from massive multinational corporations to smaller businesses and even government agencies. This diversity is key. It means they aren’t putting all their eggs in one basket. If one sector or region hits a rough patch, others can help keep things steady.

Their cloud services, like Oracle Cloud Infrastructure (OCI), are designed to support these different types of clients. They offer solutions that can scale up or down, which is pretty handy for businesses with changing needs. This broad reach helps them understand a wide range of industry challenges, which they can then try to solve with their technology. It’s this wide net that helps them stay relevant in the cloud market.

Global Data Center Expansion Strategy

To really compete on a global scale, you need the infrastructure to back it up. Oracle knows this, and they’ve been busy expanding their data center footprint. They’re not just building more data centers; they’re strategically placing them in different regions. This is important for a few reasons.

First, it helps with performance. Having data centers closer to customers means faster access and less lag. Second, it’s about data sovereignty and compliance. Different countries have different rules about where data can be stored, and Oracle needs to meet those requirements. Their strategy involves:

- Building new cloud regions: This is their main push, creating entirely new areas where customers can run their cloud workloads.

- Adding more availability domains within existing regions: This boosts reliability and makes sure services stay up even if something goes wrong in one part of a data center.

- Focusing on hybrid cloud capabilities: This allows customers to connect their on-premises systems with Oracle’s cloud, giving them flexibility.

This ongoing expansion shows Oracle is serious about being a global cloud provider, not just a software company with a cloud offering. They’re investing heavily to make sure their infrastructure can keep up with demand worldwide.

Wrapping Up Oracle’s Cloud Journey

So, where does Oracle stand in all this cloud chaos? It’s clear they’re not the biggest player, not by a long shot, especially when you look at giants like AWS and Azure. But they’ve got this solid foundation, particularly with their database tech, and they’re really pushing hard into cloud services. They’re seeing some good growth, especially in certain regions and with specific types of customers. The big question is whether they can keep up the pace. New tech like AI is popping up everywhere, and other companies are making big moves with mergers and such. Oracle’s got to keep innovating and finding smart ways to partner up if they want to keep their spot and maybe even grab a bigger slice of the pie. It’s a tough market, for sure, but they’re definitely still in the game.

Frequently Asked Questions

What is Oracle Cloud’s place in the cloud market right now?

Oracle Cloud is a significant player, especially for big businesses. While it might not be the absolute biggest, it’s known for its strong database technology and a wide range of tools that help companies manage their operations, like planning and employee management. Oracle is working hard to get more businesses to use its cloud services instead of older, on-site systems.

Who are Oracle Cloud’s main competitors?

The biggest competitors are Amazon Web Services (AWS), Microsoft Azure, and Google Cloud. These companies offer similar cloud services and have a large share of the market. Other companies like SAP and Salesforce also compete in specific areas, like business software and customer relationship management.

What makes Oracle Cloud strong?

Oracle’s biggest strength comes from its long history and expertise in database software, which many businesses rely on. They are also expanding their cloud infrastructure and have a full set of applications designed for businesses, covering everything from managing money to handling employees and supply chains.

How is AI changing the cloud market for Oracle?

Artificial intelligence (AI) is a big deal in the cloud world. Companies are using AI to make their services smarter and more helpful. Oracle is putting a lot of effort into adding AI features to its products to keep up with the competition and offer new, advanced tools to its customers.

What are the biggest challenges Oracle faces in the cloud?

One of the main challenges is the intense competition from other big cloud providers. Oracle also needs to keep its services up-to-date with new technology and follow strict rules about data privacy. Economic ups and downs can also make businesses spend less on technology, which affects Oracle’s sales.

Where is Oracle Cloud most popular around the world?

Oracle has customers all over the globe, from small businesses to huge companies and even governments. While they have a strong presence in places like South America, they are constantly working to build more data centers and expand their reach in different regions to serve more customers worldwide.