This weekend, the boxing world was buzzing about the Jake Paul versus Mike Tyson fight. Lots of people were placing bets, and prediction markets like Polymarket were showing some interesting numbers. It’s kind of wild how these markets work, trying to guess who’s going to win. We looked at what the polymarket tyson odds were saying, and it seems like the general feeling was that Jake Paul had the edge, mostly because of the age difference. But, as we’ve seen before, sometimes the old guard still has some fight left in them. Let’s break down what the betting action told us.

Key Takeaways

- Polymarket odds showed Jake Paul as the favorite against Mike Tyson, largely due to the significant age difference, with Paul favored around 62% to 63% and Tyson around 29%.

- Despite conventional wisdom and market sentiment favoring Paul, AI models like BoxingGPT suggested Tyson had a slight edge, particularly if the fight ended early, highlighting Tyson’s knockout power.

- The betting market saw a significant early round KO for Tyson as a strong possibility, while Paul was more likely to win by decision or later-round stoppage, reflecting their different fighting styles and conditioning.

- A notable bettor on Polymarket, ‘zxgngl’, reportedly lost millions after betting heavily on Tyson, illustrating the high stakes and potential for unexpected outcomes in these markets.

- The Tyson vs. Paul fight’s betting market dynamics, including the contrast between AI predictions and human betting patterns, offer insights into how prediction markets function for major sporting events.

Polymarket Betting Odds Analysis

Polymarket has become a go-to spot for folks looking to bet on pretty much anything, and this Tyson vs. Paul fight is no exception. It’s basically a giant, crypto-fueled crystal ball where people put their money down on who they think will win, and how. It’s pretty wild to see how much money gets tossed around on these events.

Paul Versus Tyson: The Odds

Right now, the market is showing some clear leanings. It’s not exactly a shocker, but Mike Tyson is generally seen as the favorite. This makes sense, given his history and all. But Jake Paul isn’t just some random guy; he’s got a following and he’s been in the ring before, so people are definitely betting on him too. The odds fluctuate, of course, but Tyson’s name carries a lot of weight.

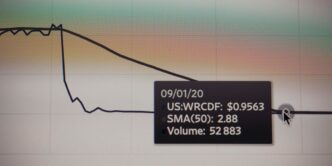

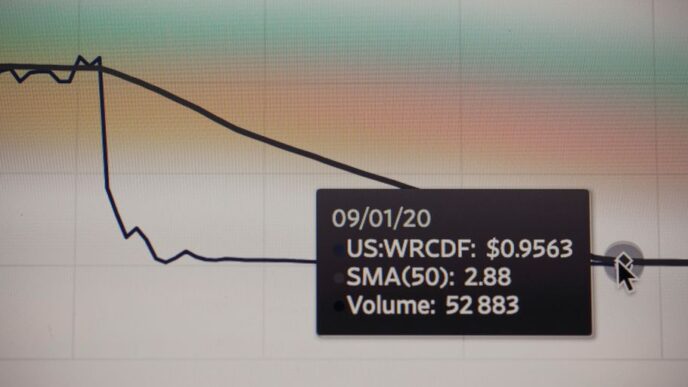

Understanding Polymarket’s Share Pricing

So, how does this whole Polymarket thing actually work? Think of it like this: you buy shares in an outcome. If Jake Paul wins by knockout, you buy shares in that specific outcome. The price of a share is basically the market’s way of saying the probability of that thing happening. If a share is trading at $0.50, the market thinks there’s a 50% chance of that event occurring. It’s a neat way to see what everyone’s collectively thinking without actually asking them.

Here’s a simplified look at how the prices might break down:

| Outcome | Current Price (USD) | Implied Probability |

|---|---|---|

| Tyson Wins by KO | $0.65 | 65% |

| Paul Wins by KO | $0.25 | 25% |

| Tyson Wins by Decision | $0.05 | 5% |

| Paul Wins by Decision | $0.03 | 3% |

| Draw | $0.02 | 2% |

Early Round Expectations on Polymarket

When you look at the early round bets, it’s pretty interesting. A lot of the action seems to be on an early finish, especially for Tyson. People are putting money on him to knock Paul out within the first few rounds. This makes sense; Tyson’s known for his power early on. On the flip side, there are bets on Paul surviving the early onslaught and maybe even wearing Tyson down. It shows that even though Tyson is the favorite, people are still looking for ways to bet on Paul making it a tough fight.

Key Betting Market Insights

The "Zxgngl" Phenomenon: A Cautionary Tale

Sometimes, things get weird in these prediction markets. You might see odd usernames or strange betting patterns that don’t make immediate sense. Take the "Zxgngl" situation, for example. This was a user who seemed to be betting in a way that defied conventional logic, almost as if they had inside information or were trying to manipulate the market. It’s a good reminder that while these markets can be insightful, they aren’t always straightforward. It’s like trying to figure out why your friend suddenly decided to only eat purple food for a week – you just don’t know the ‘why’ behind it.

Impact of High-Profile Events on Polymarket

Big events, like the Tyson vs. Paul fight, really shake things up on platforms like Polymarket. Suddenly, you have a lot more people jumping in, not just hardcore bettors but also casual fans who want a piece of the action. This influx can change the odds pretty quickly. It’s not just about who people think will win, but also about how much money is being put down and by whom. We saw this with the 2024 presidential election, where Polymarket handled billions, showing how these markets can reflect broad public interest in major happenings. It’s a bit like a concert selling out – the demand is high, and prices can fluctuate wildly.

- Increased volume of trades.

- More diverse range of participants.

- Potential for rapid odd shifts.

Lessons from Polymarket’s High-Stakes Drama

Looking at how these markets play out offers some interesting lessons. For instance, the sheer size of Polymarket, handling billions in wagers for events like the presidential election, shows its growing influence. However, it also brings challenges. There’s always the question of whether the market truly reflects genuine prediction or if it can be swayed by unusual activity, like that "Zxgngl" character. It makes you think about how reliable these markets are for forecasting. We’re still figuring out if what happens on Polymarket can be applied to other events, but it’s definitely a space to watch. It’s like learning to cook a new dish; you try it, you mess up a bit, but you learn what works for next time. The data from these markets can offer insights beyond traditional polling, especially in specific areas like swing states during elections, but more research is needed to see if these patterns hold true everywhere. Understanding the dynamics of these prediction markets is key, especially as they become more popular and potentially more influential in how we view future outcomes. The sheer scale of activity on Polymarket for major events, like the 2024 presidential election, highlights its significance, but also the need for careful analysis of the data it generates.

AI Versus Human Predictions

It’s pretty interesting to see how different predictions stack up, especially when you’ve got AI models going head-to-head with what people are saying. For this fight, we actually built our own AI, BoxingGPT, using GPT-4o. It went through tons of boxing data, looking at fight outcomes, how fighters perform, and their styles. It even considered research on how age affects heavyweight boxers and crunched the numbers from Jake Paul’s fights and Mike Tyson’s whole career.

BoxingGPT’s Tyson Advantage

What’s wild is that BoxingGPT actually gave Mike Tyson a slight edge. This goes against what most people and even other sports sites are saying, where Jake Paul is usually the favorite. The AI sees Tyson as someone who needs to win early. If the fight goes on too long, Tyson’s age might become a factor, and Paul, being younger and likely in better shape for a longer bout, could take over. It’s like the AI thinks Tyson is a sprinter and Paul is a marathon runner.

Comparing AI Models and Expert Opinions

So, you have this AI saying Tyson has a slight edge, but the betting markets and many experts are leaning towards Paul. For instance, odds from places like DraftKings have Paul as a favorite, meaning you’d have to bet more on him to win $100 compared to betting on Tyson. Polymarket users also seem to favor Paul. It makes you wonder who’s got it right. Is the AI seeing something deeper in the data, or are the human opinions, shaped by recent performances and Paul’s youth, more accurate?

The Limitations of Predictive AI

Even with all the data, AI isn’t perfect. Our BoxingGPT, for example, suggested Tyson has an advantage early on, but it also noted that Paul’s chances increase if he can survive those initial rounds. This is where human intuition and understanding of the ‘sweet science’ might still play a role. AI can process numbers and historical patterns, but it might not fully grasp the unpredictable nature of a live fight, the mental game, or how a fighter might adapt on the fly. Plus, the AI’s prediction is heavily tied to the fight’s duration, which is something even the best models can’t perfectly foresee.

Fight Duration and Strategic Betting

When we talk about the Tyson vs. Paul fight, how long it lasts is a pretty big deal for how things might play out. It’s not just about who’s tougher, but also about who’s got the gas in the tank.

Short Fight Favors Tyson

Mike Tyson is, well, Mike Tyson. He’s known for his power and his ability to end fights quickly. If this fight wraps up early, say in the first couple of rounds, that’s probably Tyson’s best chance. Think about his old fights; he often came out like a whirlwind. The odds reflect this too, with many expecting an early finish to be Tyson’s most likely path to victory. If he lands clean early, it could be over fast.

Middle Rounds: Stamina and Strategy

Now, if the fight goes past the initial burst, things get interesting. This is where Jake Paul’s younger legs and conditioning might start to matter. Tyson, while still a legend, is older. His stamina in later rounds has been a question mark for a while. Paul’s strategy, if he can survive the early onslaught, would likely involve wearing Tyson down. He’d want to keep moving, use his reach, and make Tyson work. The betting markets often show Paul’s chances improving as the fight progresses into these middle rounds. It’s a chess match at this point, with conditioning playing a huge role.

Late Rounds: Paul’s Conditioning Edge

If we’re talking about the fight going into the final rounds, the advantage really shifts towards Paul. His presumed better stamina and ability to maintain a high pace for longer could be the deciding factor. Tyson’s power might still be there, but his ability to throw a lot of punches or absorb damage might decrease. Paul’s team would be hoping he can weather the early storm and then take over as Tyson begins to fade. The odds for a late-round finish or a decision victory would likely favor Paul more heavily the deeper the fight goes. It’s a classic matchup of explosive power versus sustained endurance.

Polymarket’s Role in Event Forecasting

So, how do these prediction markets, like Polymarket, stack up against more traditional ways of guessing what might happen? It’s pretty interesting, actually. Think about it: instead of just asking a bunch of people what they think, prediction markets let people put their money where their mouth is. This can make the forecasts feel a bit more real, you know?

Polymarket Data Versus Traditional Polling

When you look at something like an election, you’ve got your standard polls, right? They ask people questions. Then you’ve got Polymarket, where people are essentially betting on the outcome. It turns out, these betting markets can sometimes be surprisingly good at calling it, maybe even better than the polls in certain situations. For instance, during the 2024 election cycle, the Polymarket data seemed to get Trump’s win right when the polls were still pretty much on the fence. It’s like the money involved makes people pay closer attention to what’s actually going on. Plus, the people betting on Polymarket might be a different group than those answering pollster questions. Since you need crypto to bet, it means a good chunk of the US population isn’t even on the platform, and there were also rules about who could bet. This difference in who participates could explain why the market’s predictions sometimes stray from what the polls are saying. It’s a different kind of information being gathered, really.

Wisdom of Crowds Theory in Betting Markets

This whole idea of prediction markets working well is tied to something called the "wisdom of crowds." The basic thought is that if you get a lot of different people together, and they all have some information, their combined guess is often smarter than any single person’s guess. On Polymarket, everyone trading shares is putting their own bit of knowledge or hunch into the price. If a contract for an event happening is trading at, say, 70 cents, that’s the market’s way of saying there’s a 70% chance it’ll go down. It’s a neat way to see what a large group collectively believes, and it’s constantly updating as new stuff happens. This aggregation of decentralized intelligence helps cut down on individual biases that can mess up regular polls. It’s like a real-time, money-backed forecast that’s always adjusting.

The Future of Prediction Markets

Looking ahead, these markets seem like they’re only going to get more important. As the technology behind them, like blockchain, gets better and more people get interested in trading, their role in figuring out future events will probably grow. They’re not just for fun bets; they can actually help people make decisions and manage risks. It’s a dynamic way to get information that’s always changing. So, platforms like Polymarket are giving us new tools for forecasting and making choices. Understanding how they work and maybe even participating could be a smart move for anyone trying to get ahead of the curve. You can see how they’ve been used to analyze political events, and that’s just one area where they show promise. The way people bet on political outcomes can be a strong indicator.

Understanding the Tyson vs. Paul Market

Alright, let’s break down what’s happening with the Tyson versus Paul betting market, especially on platforms like Polymarket. It’s a bit of a wild scene out there, with a lot of money and opinions flying around.

Analyzing Early Round KO Odds

When you look at the odds for a knockout in the early rounds, it’s pretty clear who the market thinks has the power to end things quickly. Mike Tyson, despite his age, is still seen as a massive threat in the first few rounds. His history is full of early knockouts, and that reputation carries over into how people are betting. You’ll see odds that reflect this, suggesting that if anyone’s going to get a fast finish, it’s likely to be ‘Iron Mike’. It’s like people are betting on his past performances, hoping he can channel that old magic.

Decision Victory Probabilities

Now, if the fight is expected to go the distance, the picture changes. The odds for a decision victory lean heavily towards Jake Paul. This makes sense when you consider the age difference and the potential for Tyson to slow down. Paul’s camp is betting on his conditioning and ability to outlast his opponent. The market reflects this, with higher probabilities assigned to Paul winning by points. It’s a different kind of bet, one that’s more about endurance and strategy than raw power.

The Unlikely Draw Scenario

And then there’s the draw. Honestly, it’s not something most people are putting their money on. The odds for a draw are usually pretty long, meaning it’s considered a long shot. In boxing, draws can happen, but in a fight like this, with such contrasting styles and a huge age gap, the market seems to think it’s more likely one fighter will clearly win. It’s the least popular outcome, and the payouts reflect that rarity.

Wrapping It Up

So, looking at how people bet on the Tyson versus Paul fight gives us some interesting ideas. It seems like most folks, and even some AI models, leaned towards Jake Paul winning, probably because of the age difference. But then you have other AI that thought Tyson had a real shot, especially if the fight didn’t go too long. It’s a good reminder that even with all the data and fancy predictions, boxing can still be unpredictable. We saw one big bettor lose a lot of money betting on Tyson, showing that sometimes the underdog can surprise everyone, or maybe just that betting is a risky game. It really makes you wonder how these prediction markets, like Polymarket, actually work and if they’re always right.

Frequently Asked Questions

What exactly is Polymarket?

Polymarket is a website where people can bet on the outcomes of various events, like sports matches or elections. It’s like a prediction market where you can buy shares in something happening, and if it does, your shares are worth more.

What were the betting odds for Tyson vs. Paul on Polymarket?

The odds showed Jake Paul as the favorite to win, meaning most people betting on Polymarket thought he had a better chance. Mike Tyson was seen as the underdog, but with a strong chance to win by knockout early on.

Did AI and human experts agree on who would win?

Some AI models, like one called BoxingGPT, thought Mike Tyson had a slight edge because of his powerful knockout history, especially in the early rounds. However, many human experts and other AI models favored Jake Paul, mainly because of the big age difference and Paul’s better stamina.

Was the fight expected to go the full distance?

Yes, the betting markets suggested the fight likely wouldn’t last the full distance. Most bets leaned towards an early finish, favoring a knockout or technical knockout rather than a decision after all the rounds were completed.

What’s the story about the big bettor ‘zxgngl’?

A big bettor on Polymarket, known as ‘zxgngl’, lost a lot of money betting on Mike Tyson. This shows that even though prediction markets can be very accurate, there’s always a risk, and sometimes even big bets don’t pay off.

How does Polymarket help predict events?

Polymarket and similar sites can be really interesting for seeing what people think will happen. They use something called the ‘wisdom of crowds,’ where lots of people betting can often predict outcomes better than traditional methods like polls.