Power Solutions International Inc. has really made some waves lately. You might know them for their engines, but they’ve shifted gears and are now a big deal in data center power. This company, often called PSIX, has seen its stock price shoot up, and there’s a lot going on behind the scenes. Let’s take a look at what’s driving this change and what it means for the future.

Key Takeaways

- Power Solutions International Inc. (PSIX) has transformed from an industrial engine maker into a key player in the booming data center power market, leading to a significant stock price increase.

- The company’s success is fueled by its fuel-agnostic engine technology, which can run on various fuels and meets strict emissions standards, making it attractive for sustainability-focused industries.

- PSIX’s strategic focus on providing power systems for data centers, driven by the massive demand from AI infrastructure, is a primary growth engine, with this segment now making up the largest portion of sales.

- Despite strong performance and growth, concerns exist regarding the stock’s current valuation, market concentration in the data center sector, and potential risks from trade policies.

- The company’s ability to offer customized, reliable power solutions, combined with its in-house engineering and manufacturing capabilities, positions it well to capitalize on the increasing need for onsite power at data centers facing grid limitations.

Power Solutions International Inc: A Market Transformation

From Industrial Engines to Data Center Power

Power Solutions International, or PSIX as you might see it on the stock market, has really done a 180 lately. For years, they were known for making engines and power systems for all sorts of industrial stuff – think forklifts, farm equipment, you name it. They’ve been around since 1985, based out of Wood Dale, Illinois, and have a solid track record of building these emission-certified engines that can run on different fuels like natural gas, propane, or even gasoline. They’ve sold over 1.5 million engines, which is pretty impressive.

But here’s the wild part: the company has completely shifted its focus, and the market has noticed. It’s like they went from being a reliable old truck manufacturer to suddenly building the engines for the next generation of supercars. This transformation is largely thanks to the explosion in data centers and AI infrastructure. Suddenly, PSIX’s ability to provide reliable, emission-certified power systems, especially for backup and primary power needs, became incredibly valuable. Their power systems segment, which now makes up about 79% of their sales, saw a huge jump, growing 62% year-over-year in late 2024. It’s a big change from their earlier days.

The Catalysts Behind the Remarkable Rally

So, what exactly caused this massive surge in PSIX’s stock? Well, a few things really came together. First off, the whole AI boom is a huge driver. Companies building massive data centers to power artificial intelligence need a ton of reliable electricity, and often, the local power grid just can’t keep up. This is where PSIX steps in with their onsite power solutions.

Here’s a quick look at why this is such a big deal:

- AI Infrastructure Demand: Major tech players are pouring hundreds of billions into AI infrastructure. This means building more data centers, and those data centers need power, lots of it, and reliably.

- Power Grid Limitations: Existing power grids are struggling to meet the growing demand from these new facilities. This forces data center operators to look for their own power solutions, creating a direct opportunity for PSIX.

- Fuel Flexibility: PSIX’s engines aren’t picky about fuel. They can run on natural gas, propane, gasoline, diesel, and biofuels. This flexibility lets customers choose what works best for them, whether it’s cost, availability, or environmental goals.

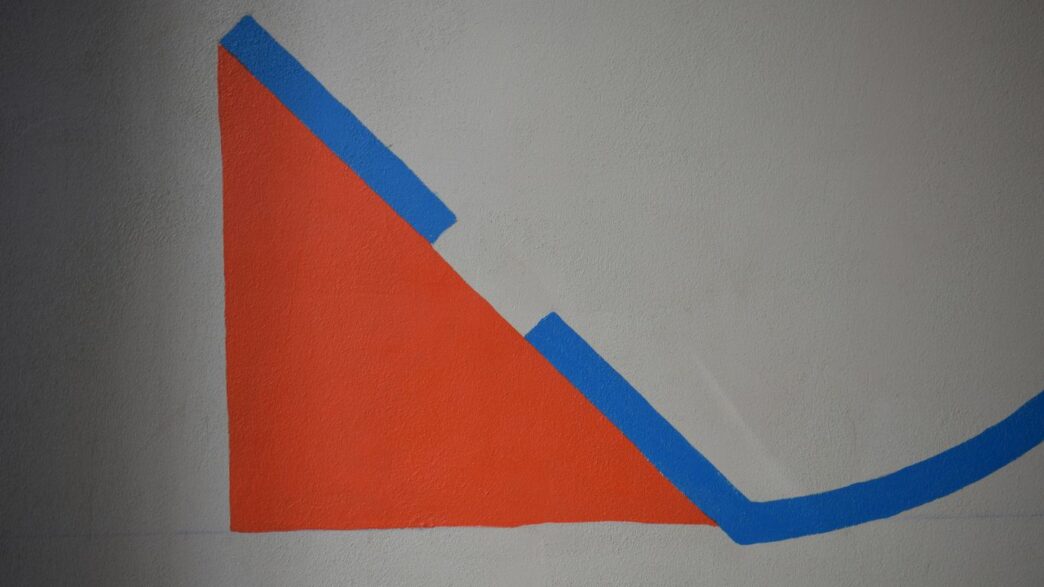

This perfect storm of market demand and PSIX’s specific capabilities led to an incredible stock performance. From a low point in April 2025, the stock shot up by over 385% by late July 2025. It’s a classic example of a company finding a new, high-growth market for its existing strengths.

Company Overview and Evolution

Founded way back in 1985 and headquartered in Wood Dale, Illinois, Power Solutions International Inc. (PSIX) started out as a company focused on designing, engineering, and manufacturing engines and power systems. Their initial focus was on meeting strict emission standards for a variety of industrial uses. Think about equipment used in construction, agriculture, oil and gas fields, and material handling – PSIX made the power behind a lot of that.

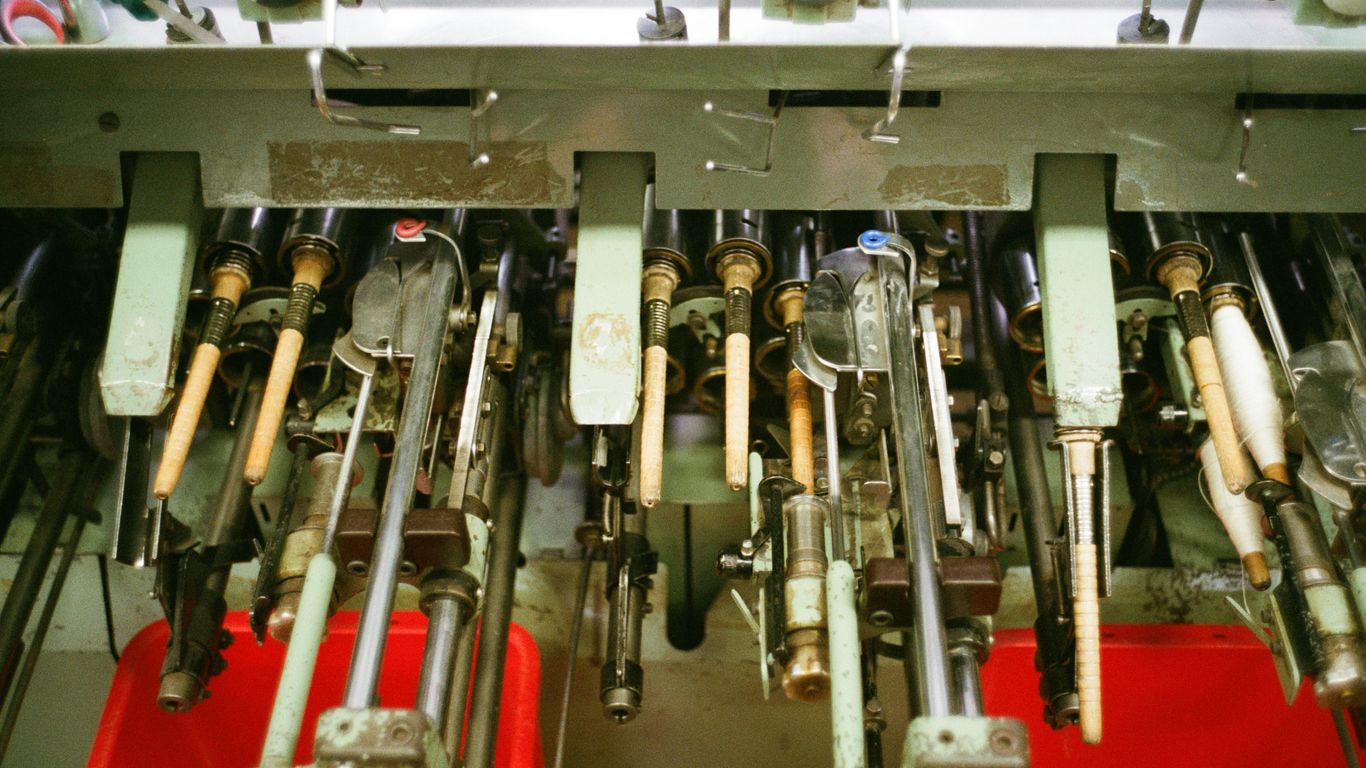

Over the years, they built a reputation for quality and customization. They have a strong in-house engineering team that can design and build specific solutions for their Original Equipment Manufacturer (OEM) clients. This ability to tailor products is a big part of their history. They’ve got a lot of manufacturing space, over 800,000 square feet, and employ a good number of people, showing they have the capacity to produce.

However, the real story of PSIX’s evolution is its pivot towards the booming data center market. While they still serve their traditional industrial clients, the growth and excitement are now centered on providing power solutions for these massive computing hubs. This shift wasn’t just a minor adjustment; it was a strategic move that has redefined the company’s market position and investor appeal. They’ve adapted their fuel-agnostic engine technology and emission-certified solutions to meet the critical, high-demand needs of modern data centers, positioning themselves as a key player in a rapidly expanding sector.

Strategic Market Applications and Diverse Innovations

Power Solutions International Inc. (PSIX) isn’t just about engines; it’s about powering a whole range of industries with smart, reliable systems. They’ve really carved out a niche for themselves by focusing on where power is absolutely critical, and where standard solutions just don’t cut it.

Stationary and Mobile Power Systems

When you think about stationary power, PSIX is there. They provide backup power for places that absolutely cannot afford to go dark – think hospitals, data centers (more on that later!), and other essential infrastructure. They also build systems for microgrids, which are super important for remote areas or places that want more control over their energy. On the mobile side, their engines are the workhorses in all sorts of equipment. We’re talking about things that need to keep running no matter what, like construction vehicles or specialized transport.

Material Handling and Industrial Machinery

This is another big area for PSIX. In warehouses and factories, efficient movement of goods is key. PSIX provides power for forklifts, automated guided vehicles (AGVs), and other machinery that keeps production lines moving and inventory flowing. These aren’t your average engines; they’re built for long hours, heavy loads, and often, tight spaces. The reliability here is no joke – a breakdown can halt an entire operation.

Airport Ground Support and Transportation

Ever seen those vehicles zipping around an airport tarmac? Many of them rely on PSIX power. They make engines for ground support equipment (GSE) like baggage tugs, de-icing trucks, and aircraft tugs. These need to be tough, dependable, and often meet specific environmental standards for airport operations. Beyond airports, they also power specialized transport vehicles, including terminal tractors used in ports and even some military applications. It’s a testament to their engineering that their power solutions are trusted in such demanding, high-stakes environments.

Technological Advantages and Manufacturing Prowess

Fuel-Agnostic Engine Technology

Power Solutions International Inc. (PSIX) really shines with its engines that can run on pretty much anything. We’re talking natural gas, propane, gasoline, and even biofuels. This "fuel-agnostic" approach isn’t just a fancy term; it means customers can pick the fuel that makes the most sense for them, whether that’s based on cost, what’s available, or what’s better for the environment. It’s a big deal, especially now when everyone’s trying to be more eco-friendly and meet stricter rules about emissions. This flexibility is a major plus for industries that need reliable power but also have to watch their environmental footprint.

Emission-Certified Power Solutions

Speaking of emissions, PSIX makes sure its engines meet all the necessary certifications. This is super important for companies that have to follow environmental regulations or have their own green goals. Having engines that are already certified means less hassle and more confidence that they’re doing things right. It’s not just about meeting the minimum; it’s about providing clean, high-performance power that doesn’t cause a headache down the road with compliance issues. This focus on certified solutions helps them stand out in a crowded market.

In-House Engineering and Customization

What really sets PSIX apart is that they do most of the heavy lifting themselves. They’ve got their own facilities for designing, building prototypes, engineering, and testing. This means they have a lot of control over quality and can speed things up when they need to. It also allows them to get really creative with customization. If a customer needs something specific, PSIX can often build it. They’ve been doing this for a while, and with over 40 years of experience and a lot of factory space, they’ve got the manufacturing muscle to back it up. They even expanded their Wisconsin facility specifically for data center power, showing they’re serious about growing in that area.

Financial Performance and Market Valuation

Q1 2025 Earnings: A Significant Turning Point

Things really started to shift for Power Solutions International Inc. (PSI) with their Q1 2025 earnings report, which came out on May 8, 2025. The CEO even called it the "best first quarter performance in the Company’s history." That’s a pretty big statement, right? Looking at the numbers, it’s easy to see why.

| Metric | Q1 2025 | Q1 2024 | Growth |

|---|---|---|---|

| Net Sales | $135.4M | $95.2M | 42% |

| Gross Profit | $40.3M | $25.8M | 56% |

| Net Income | $19.1M | $7.1M | 168% |

| Diluted EPS | $0.83 | $0.31 | $0.52 |

| Gross Margin | 29.7% | 27.0% | 270 bps |

And get this, their earnings per share (EPS) of $0.83 completely blew past what analysts were expecting, which was around $0.46. That’s an 80% surprise! Sales also came in much higher than predicted. This report was definitely the spark that got a lot of people looking at PSI more closely.

Revenue Growth and Profitability Metrics

Following that strong Q1, the company’s financial picture looks pretty good. As of the latest reports, PSI has a market cap of about $2.03 billion. Their trailing twelve months (TTM) revenue is $516.17 million, with a net income of $81.25 million. That gives them a TTM P/E ratio of 25.15, which isn’t too wild considering the growth.

What’s really impressive is their profitability. They’ve got a net margin of 15.7% and a return on equity (ROE) that’s sky-high at 96.3%. Now, some folks point out that the ROE is boosted a bit by how the company is financed, but still, those are strong numbers. Their gross margin is sitting at a healthy 29.7%.

Valuation Concerns and Analyst Perspectives

Even with all this good news, it’s interesting to note that not many analysts are covering PSI right now. There’s only one main analyst out there, and they’ve got a "Strong Buy" rating with a price target of $37. This is actually lower than where the stock is trading currently, which suggests the market might be pricing in the company’s potential faster than Wall Street is. This limited coverage could mean the stock is still a bit of an undiscovered gem for investors willing to do their homework.

Institutional investors are starting to take notice, too. About 22.28% of the company is owned by institutions, and more have been buying in over the last year than selling. However, compared to many other public companies, this level of institutional ownership is still relatively low, meaning there’s room for more big players to jump in, especially if PSI keeps hitting its targets. The company’s focus on the booming data center market, coupled with its ability to provide reliable power solutions, seems to be the main driver behind this renewed interest and improved financial standing.

The Data Center Revolution and Future Outlook

AI Infrastructure as a Core Growth Driver

Okay, so let’s talk about data centers. It’s kind of a big deal right now, especially with all this AI stuff taking off. Think about it: every time you use a smart assistant, stream a movie, or even just scroll through social media, you’re tapping into a data center. These places are basically the brains of the internet, and they need a ton of power. The latest buzz is all about AI, and it’s pushing data center demand through the roof. Big tech companies are pouring billions into building more of these facilities just to keep up with AI’s hunger for processing power. It’s not just a small bump; we’re talking about a massive increase in the need for reliable electricity.

Power Grid Constraints Driving Onsite Solutions

Here’s where it gets interesting for Power Solutions International. Our regular power grids, the ones that supply our homes and businesses, are really struggling to keep up with this data center boom. They just weren’t built for this kind of concentrated, massive energy draw. Because of this, a lot of new data centers are looking at setting up their own power generation right there on-site. This is a huge opportunity for companies like PSI. Instead of relying solely on the grid, which is becoming less dependable for these huge operations, they’re opting for backup and primary power systems that PSI specializes in. It’s a smart move for them to ensure their operations don’t get knocked out by grid issues.

Long-Term Market Opportunity and Projections

Looking ahead, this isn’t just a short-term trend. The demand for data center capacity is projected to keep climbing for years, maybe even decades. McKinsey figures suggest the need could grow by almost 20% annually for the next several years. And with AI workloads needing even more juice than typical computing, the pressure on power infrastructure will only intensify. This creates a really solid, long-term market for companies that can provide dependable power solutions. PSI seems to be in a prime spot to benefit from this structural shift in how data centers are powered. It’s not just about building more servers; it’s about making sure they have the constant, reliable power they need to run, especially when the main grid can’t always deliver.

Investment Considerations and Risk Factors

So, you’re thinking about putting your money into Power Solutions International, huh? It’s definitely an interesting company right now, especially with all the buzz around data centers. But like any investment, there are two sides to the coin – the good and the not-so-good.

Bull Case: Secular Growth and Market Leadership

On the bright side, PSIX is really hitting its stride in a market that’s just exploding. Think about all the AI stuff happening – it needs a ton of power, and the existing power grid can’t always keep up. That’s where PSIX comes in with its backup and onsite power systems. They’re basically in the right place at the right time to capitalize on this massive, long-term trend. Plus, their engines can run on different fuels, which is a big deal for companies trying to be more eco-friendly and manage costs. They’ve also got this knack for making custom solutions, which sets them apart from bigger players.

Bear Case: Valuation and Market Concentration

Now, for the flip side. The stock price has shot up, and some folks are wondering if it’s gotten a bit too expensive. When a stock moves this fast, the expectations are sky-high, and any stumble could be a problem. Another thing to consider is how much they’re relying on the data center market. If that market slows down for any reason, it could really hit PSIX hard. It’s great they’re focused, but it also means they’re putting a lot of eggs in one basket. There’s also the chance that bigger, established companies could decide to jump into this lucrative market, making things more competitive.

Tariff and Trade Policy Risks

And then there are the external factors. Things like tariffs and trade policies can pop up out of nowhere and mess with supply chains and costs. PSIX is trying to be smart about this by sourcing materials carefully and adjusting prices, but it’s still a wild card. Geopolitical stuff can also throw a wrench in the works, making it harder to plan ahead. It’s just one of those things you have to keep an eye on when you’re investing in a company that makes physical products.

Wrapping It Up

So, looking at Power Solutions International, it’s clear they’ve really made a splash lately. They started out doing their thing with industrial engines, but they’ve smartly shifted gears to focus on something huge right now: powering up all those data centers needed for AI. It’s been a wild ride for their stock, going from pretty low to way up there in just a few months. They’ve got this flexible engine tech that can run on different fuels, which is a big plus as everyone’s trying to be more eco-friendly. While the stock’s big jump has some folks wondering if it’s too high now, the company is definitely in a good spot to keep growing as data centers keep expanding. It’s a company that’s managed to adapt and find itself right in the middle of a major tech trend.