Thinking about which crypto might really take off in 2025? It’s a question on a lot of people’s minds, especially after the wild ride the market has been on. We’ve seen big moves from established players and some interesting new contenders popping up. Let’s break down some of the cryptocurrencies that analysts and market watchers are keeping a close eye on, trying to figure out which crypto will explode in 2025.

Key Takeaways

- Bitcoin is still seen as the main driver for the crypto market in 2025, with predictions pointing to significant price potential driven by its halving and ETF approvals.

- Ethereum remains a strong contender due to its smart contract capabilities, ongoing upgrades like EIP-4844, and increasing institutional interest for asset tokenization.

- Solana is showing resilience, with its fast transaction speeds and low fees making it attractive for consumer-focused applications and decentralized services.

- Emerging projects, particularly those integrating AI or building Layer 2 solutions for Bitcoin, are being watched for potentially massive growth, though they come with higher risks.

- Broader market trends like increased institutional adoption, technological advancements, and strong community backing will play a big role in which cryptocurrencies see major growth in 2025.

Bitcoin’s Enduring Dominance In 2025

Even with all the new coins popping up, Bitcoin is still the big dog in the crypto world for 2025. It’s been through a lot, like the halving event in April 2024 and the green light for spot ETFs in the US. These things really pushed BTC past the $120,000 mark, though it’s cooled off a bit since then.

Bitcoin’s Trajectory Post-Halving and ETF Approval

The halving, which cuts the reward for mining new bitcoins, makes the supply scarcer. When you combine that with the fact that big investment firms can now offer Bitcoin to their clients through ETFs, it’s a recipe for increased demand. It’s like making a popular item even harder to get while also making it easier for more people to buy it. This push and pull has historically led to price increases for Bitcoin, and many think 2025 will be no different. We saw this pattern play out in 2017, 2020, and 2023, and the signs point to a repeat.

Analyst Predictions for Bitcoin’s Market Cap

Analysts are pretty optimistic about Bitcoin’s market cap in 2025. Some are calling for it to hit highs between $80,440 and $151,200, with some even stretching to $175,000 or $185,000. The general feeling is that Bitcoin’s dominance over the rest of the crypto market will continue. This is actually a good thing for altcoins, as Bitcoin often leads the charge, and then money flows into other cryptos once Bitcoin has had its run.

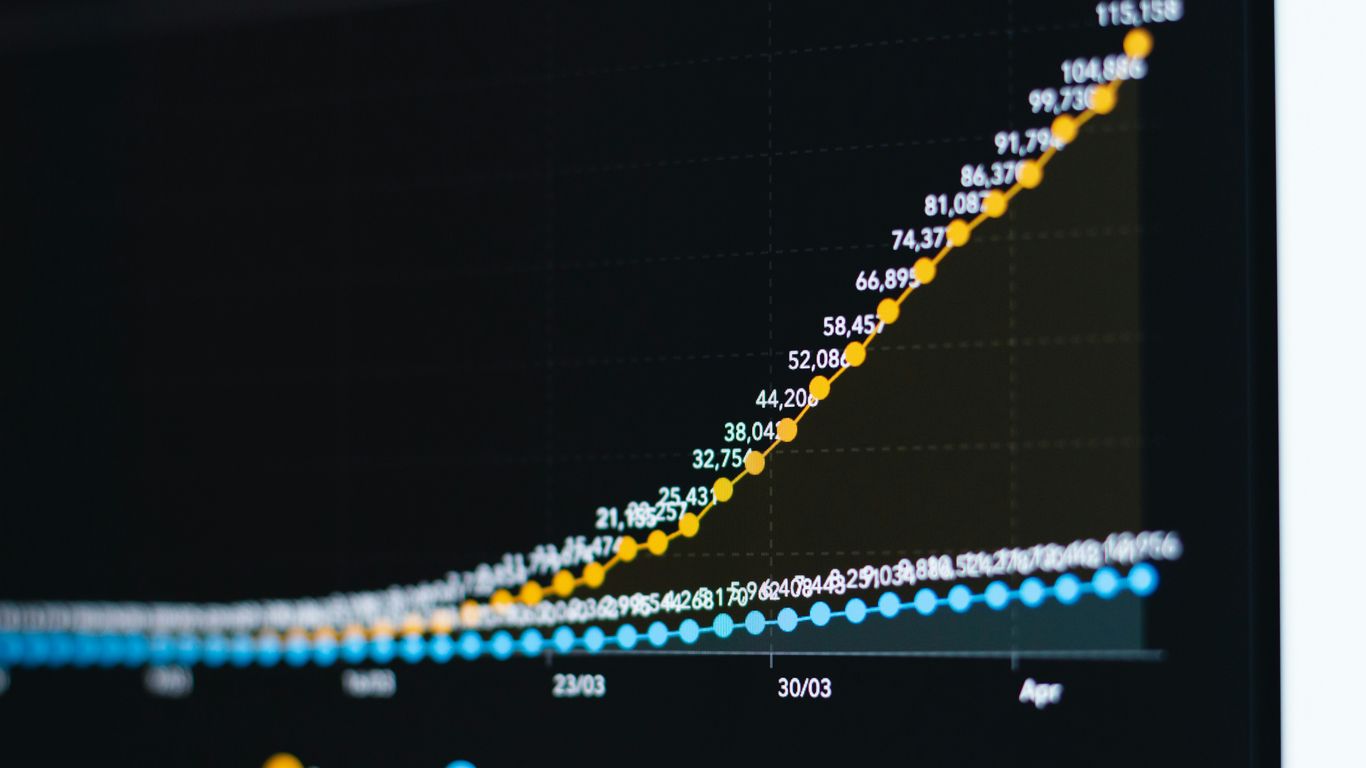

Here’s a look at some price targets:

- Mid-2025 Target: $110,000 – $120,000

- End-of-Year Target: $150,000 – $185,000

- Potential Stretched Target: $200,000

The Role of Macroeconomic Uncertainty

Believe it or not, global economic jitters can actually be good for Bitcoin. When traditional markets get shaky, investors often look for a safe haven, and Bitcoin has increasingly become that place. Think about it: if inflation is high or there’s political instability, people want to put their money somewhere that feels secure and isn’t tied to any single government. Bitcoin’s decentralized nature and fixed supply make it an attractive alternative during uncertain times. News about major figures like Michael Saylor buying more Bitcoin or even former presidents commenting positively on it adds to this bullish sentiment. It’s a complex mix of technology, market dynamics, and even global events that keeps Bitcoin in the spotlight.

Ethereum’s Smart Contract Supremacy

Ethereum, after Bitcoin, is really the big player in the crypto world. It was the first to really get smart contracts going, which are basically the building blocks for a lot of the decentralized applications (dApps) and finance (DeFi) we see today. It’s the main platform for all that stuff, and honestly, it’s hard for others to catch up.

Impact of EIP-4844 on Gas Fees and Speed

Remember when using Ethereum felt like paying a small fortune just to make a transaction? Well, things are looking up. The EIP-4844 update, sometimes called "Proto-Danksharding," has made a noticeable difference. Gas fees, which are the costs to use the network, have come down, and transactions are zipping through much faster. This makes using dApps and DeFi a lot more practical for everyday folks.

The Pectra Upgrade and Layer-2 Development

Then there’s the Pectra upgrade, which went live in May 2025. It brought in new features that make it simpler for developers to build applications on what are called Layer-2 networks. These are like side-chains that help Ethereum handle more activity without getting bogged down. Think of it as adding more lanes to a highway to ease traffic.

Institutional Interest in Ethereum’s Infrastructure

But maybe the biggest deal for Ethereum in 2025 is that the big money is finally paying attention. Firms like BlackRock are looking at Ethereum’s technology not just for crypto, but for tokenizing real-world assets – like stocks or bonds – on the blockchain. This kind of interest, along with talk of Ethereum ETFs and its role as the go-to chain for stablecoins, shows that Ethereum is becoming a serious piece of financial infrastructure. If you’re interested in how these tokens are made, you can check out guides on building your own ERC20 token.

Here’s a quick look at some of Ethereum’s strengths:

- DeFi and dApp Hub: It’s the biggest network for decentralized finance and applications, giving it a huge market advantage.

- Efficient Consensus: Its move to Proof-of-Stake has made it much more energy-efficient.

- Future Upgrades: Ongoing work focuses on increasing transaction speed and security even further.

Of course, it’s not all perfect. Sometimes the network still gets busy, leading to slower transactions. And while fees are better, they can still spike during peak times. That’s why those Layer-2 solutions are so important for its continued growth.

Solana’s Resurgence As A High-Speed Platform

Remember when Solana was kind of written off? It felt like just yesterday people were calling it the "Ethereum killer" and then, after some network hiccups, it seemed like it might be "just killed." But man, has it made a comeback. Solana is definitely "surprisingly alive and kicking" in 2025, and it’s grabbing attention for some solid reasons.

From ‘Ethereum Killer’ to ‘Surprisingly Alive’

Solana’s journey has been a bit of a rollercoaster. Early on, its promise of lightning-fast transactions and super low fees made it a hot contender. While it faced challenges with network stability, the development team has clearly been hard at work. The introduction of Firedancer, a new validator client, is a big deal. It’s designed to seriously boost the network’s performance and reliability. This upgrade is a major step in proving that Solana can handle high demand without breaking a sweat. It’s not just about speed anymore; it’s about building a robust ecosystem that people can actually depend on. Many analysts are now predicting that Solana (SOL) could trade between $189.21 and $221.81 in the coming year.

Consumer-Facing dApps and DePIN Protocols

What’s really powering Solana’s comeback is its appeal to developers building applications people actually want to use. Think about it: if you want to create something that needs to handle lots of users and transactions without costing an arm and a leg, Solana is looking pretty good. This is why we’re seeing a surge in consumer-facing decentralized applications (dApps) being built on its network. We’re talking about everything from NFT marketplaces that actually work smoothly to innovative Decentralized Physical Infrastructure Networks (DePIN) protocols. These DePIN projects are particularly interesting, using crypto incentives to build and maintain real-world infrastructure. Plus, with integrations like Solana Pay connecting with major platforms like Shopify, we’re seeing tangible, real-world retail use cases emerge. It’s moving beyond just speculation and into practical application.

Low Transaction Fees Driving Adoption

Let’s be real, high gas fees on other networks can be a major turn-off for everyday users. Solana’s average transaction fee, often hovering around a fraction of a cent, is a massive advantage. This low cost makes it incredibly attractive for a wide range of applications:

- DeFi Services: Running complex financial operations without incurring hefty fees.

- Gaming: Enabling in-game transactions and asset trading at scale.

- NFTs: Making the minting and trading of digital collectibles more accessible.

- DePIN Projects: Facilitating micro-transactions for network participation.

This cost-effectiveness is a huge driver for adoption. When users don’t have to worry about paying exorbitant fees for simple actions, they’re much more likely to engage with the network and its applications. It’s a simple equation: low fees mean more users, and more users mean a stronger, more vibrant ecosystem. Solana’s ability to maintain these low fees while scaling up is a key reason for its renewed popularity.

Emerging Cryptocurrencies With 1000x Potential

Alright, let’s talk about the real moonshots. While Bitcoin and Ethereum are solid bets, everyone’s secretly hoping to find that one hidden gem that turns a small investment into a fortune. We’re talking about those 1000x potentials, the kind of gains that change your life. Finding these is tough, though. It’s not usually the big, established coins that do this; it’s the new, small ones with room to grow.

Bitcoin Hyper: A Layer 2 Solution for DeFi

So, what’s one of these potential game-changers? Keep an eye on Bitcoin Hyper ($HYPER). This project is building a Layer 2 solution for Bitcoin, aiming to bring more decentralized finance (DeFi) capabilities to the OG crypto. Think of it as making Bitcoin more useful for all sorts of financial stuff beyond just holding or sending. They’re using a "SVM" (Solana Virtual Machine) which is pretty interesting, potentially making things faster and cheaper. Early buyers can snag $HYPER tokens, which they say can be used for transactions, staking (earning rewards by holding), and even voting on how the project develops. It’s set to launch around May 2025, so it’s still pretty new. Experts are identifying two presale tokens with significant potential for a 1000x return in 2025, and Bitcoin Hyper is definitely one to watch in that space.

Meme Coins and Their Evolving Ecosystems

Now, you can’t talk about explosive crypto potential without mentioning meme coins. They’re wild, unpredictable, and sometimes, they just take off. Maxi Doge ($MAXI) is one that’s trying to be the "final form" of dog-themed meme coins. They’re talking about "Proof of Workout/Proof of Winning," which sounds… unique. It’s all about embracing the meme culture. Another one is PEPENODE ($PEPENODE), which is trying to mix meme coins with gamified mining. The idea is you get more "mining power" by having more nodes, and you get bonuses paid out in other meme coins. These kinds of projects often rely heavily on community hype and viral marketing. It’s a risky game, for sure, but the upside can be huge if they catch fire.

AI and Blockchain Integration

Artificial Intelligence (AI) is everywhere, and its intersection with blockchain is a hot topic. Projects that can genuinely combine these two powerful technologies could see massive growth. While specific 1000x AI-blockchain coins are still emerging, the trend is clear. We’re seeing concepts like AI-powered trading bots, AI-driven content creation platforms on the blockchain, and even AI managing decentralized networks. The challenge is finding projects that aren’t just slapping "AI" onto their name but actually have a solid use case. Keep an eye on how AI can automate processes, personalize user experiences, or provide new insights within blockchain ecosystems. It’s a space to watch closely for innovation.

Key Factors Driving Crypto Growth In 2025

Alright, so what’s actually going to make crypto prices shoot up in 2025? It’s not just one thing, you know. It’s a mix of stuff happening in the market, new tech, and how many people are actually using these things.

Institutional Adoption and Tokenization Trends

This is a big one. Remember when big companies and investment firms were kinda hesitant about crypto? Well, that’s changing. More and more of them are getting involved, not just buying Bitcoin, but looking at the tech behind it. They’re seeing how blockchain can be used to represent real-world stuff, like company shares or even real estate, as digital tokens. This whole ‘tokenization’ trend means more money and more legitimacy flowing into the crypto space. It’s like the grown-ups are finally showing up to the party, and they’re bringing their wallets.

Technological Innovations and Market Conditions

New tech is always exciting, right? Projects that actually solve problems, like making transactions faster or cheaper, tend to do well. Think about upgrades that speed things up or make it easier for developers to build new apps. But it’s not just about the tech. The overall market matters too. If the economy is doing okay and people feel like investing, crypto usually follows. When Bitcoin starts a big rally, that often signals that money might start flowing into smaller, riskier coins too. We’re watching things like trading volume – if lots of people are buying and selling, that’s usually a good sign of interest.

Here’s a quick look at what we’re keeping an eye on:

- Scalability Solutions: Projects making transactions quicker and cheaper.

- Interoperability: Blockchains that can talk to each other.

- Real-World Use Cases: Crypto being used for things beyond just trading.

- Macroeconomic Climate: General economic health and interest rates.

Community Support and Developer Activity

Honestly, sometimes the biggest driver is just people. A strong, active community can make or break a crypto project. When people believe in a coin, they talk about it, use it, and help it grow. It’s not just about the fancy tech; it’s about people actually caring and building things. You see this with meme coins, sure, but it’s also true for more serious projects. If developers are constantly working on the code, fixing bugs, and adding new features, that shows the project is alive and kicking. It’s a good sign that the people building it are committed.

Other Promising Altcoins To Watch

Beyond the giants like Bitcoin and Ethereum, and the exciting newcomers, there are always other projects bubbling under the surface that could surprise us. It’s like finding a hidden gem in a flea market – you never know what you might discover. These altcoins might not have the same hype, but they’ve got solid tech or a unique angle that could lead to big things.

Binance Coin’s Market Expansion

Binance Coin (BNB) has been around for a while, and it’s more than just a utility token for the Binance exchange these days. It’s the native coin of the BNB Smart Chain, which has become a pretty popular spot for decentralized applications (dApps) and DeFi projects. Think of it as a bustling digital city where lots of new businesses are setting up shop. As Binance continues to grow and innovate, and as the BNB Smart Chain attracts more developers and users, BNB’s utility and demand could see a nice bump.

- Utility on Binance: Still the go-to for trading fee discounts and participating in token sales on the exchange.

- BNB Smart Chain Ecosystem: Powers a growing number of dApps, DeFi protocols, and NFTs.

- Potential for further integration: As Binance explores new ventures, BNB often plays a central role.

Cardano’s Blockchain Upgrades

Cardano (ADA) has always taken a research-first approach, which means its development can sometimes feel a bit slow. But that methodical pace is designed to build a really robust and secure blockchain. They’ve been working on significant upgrades, like the recent advancements in their smart contract capabilities and scaling solutions. The focus on peer-reviewed research and a strong academic foundation aims to create a more sustainable and scalable network for the long haul. If these upgrades translate into more real-world applications and a thriving developer community, ADA could see renewed interest.

Polkadot’s Interoperability Focus

Polkadot (DOT) is all about connecting different blockchains. Imagine a world where Bitcoin, Ethereum, and other chains can all talk to each other and share information – that’s the vision Polkadot is trying to build with its parachain auctions and cross-chain communication. This interoperability is becoming more important as the crypto space gets bigger and more complex. If Polkadot can successfully enable different blockchains to work together smoothly, it could become a foundational piece of the future crypto infrastructure.

- Parachain Auctions: Allowing specialized blockchains to connect to the Polkadot network.

- Cross-Chain Communication: Enabling data and asset transfer between different blockchains.

- Shared Security Model: Providing a robust security framework for connected parachains.

So, What’s the Takeaway for 2025?

Alright, so we’ve looked at a bunch of crypto projects that could really take off in 2025. Bitcoin and Ethereum are still the big players, pretty much as expected, with new tech and more big companies getting involved. Then you’ve got coins like Solana, which are still showing a lot of speed and keeping things interesting. It’s not just about the big names though; there are smaller projects, especially in areas like AI and new ways to use Bitcoin, that have a lot of buzz around them. Remember, though, crypto is a wild ride. Prices can jump up, but they can also drop fast. Always do your own homework before putting any money in, and never invest more than you can afford to lose. This space changes quickly, so staying informed is key.

Frequently Asked Questions

What is Bitcoin and why is it still important in 2025?

Bitcoin is like the original digital money, the very first cryptocurrency. Even in 2025, it’s still seen as the main player in the crypto world. Think of it as the king of digital coins. Its importance comes from things like its limited supply, making it scarce, and the fact that big investment companies are starting to buy it. Plus, events like the ‘halving,’ which makes new bitcoins harder to get, help keep its value up.

What makes Ethereum special compared to other cryptocurrencies?

Ethereum is like a super-powered computer that runs on the internet. It’s not just for sending money; it’s used to build all sorts of cool apps and services, like games and financial tools, using something called ‘smart contracts.’ Updates have made it faster and cheaper to use, and big companies are interested in using its technology to manage digital versions of real-world things like stocks.

Why is Solana being talked about as a comeback kid?

Solana had a bit of a rocky start, but it’s bouncing back strong. It’s known for being super fast and really cheap to use, which is great for apps that need to handle lots of transactions quickly. Because of this, many new apps and projects are choosing Solana to build on, especially those focused on everyday users and new kinds of digital services.

What are ’emerging cryptocurrencies’ and what’s the risk?

Emerging cryptocurrencies are newer coins that aren’t as well-known as Bitcoin or Ethereum. Some people believe they have the potential to grow a lot, maybe even 1000 times their current value! However, they are also very risky. Projects involving things like AI and blockchain are exciting, but they are still new and could fail. It’s like betting on a new startup – it could be huge, or it could disappear.

What are the main things that help cryptocurrencies grow?

A few big things help cryptocurrencies become more popular and valuable. First, when big, traditional companies start investing in them, it makes them seem more trustworthy. Second, new and clever technology makes them better and more useful. Lastly, having a strong community of people who believe in and help build the project is super important.

Are there other cryptocurrencies besides the big ones that are worth watching?

Yes, definitely! Besides the main players, coins like Binance Coin (BNB) are interesting because of the big crypto exchange it’s linked to. Cardano (ADA) is known for its careful approach to building its technology. And Polkadot (DOT) is working on making different blockchains able to talk to each other, which is a big deal for the future of crypto.