Quantum Coast Capital’s Visionary Leadership

Quantum Coast Capital isn’t just another investment firm; it’s built on the backs of some seriously smart people who really get this whole quantum thing. They’re not just throwing money around; they’re strategically guiding the future of this complex technology.

Matt Cimaglia: Architect of Quantum Innovation

Matt Cimaglia is the guy who started it all at Quantum Coast Capital. He’s got this knack for spotting opportunities, especially when it comes to new tech. Before QCC, he was busy building companies, always looking for that sweet spot where technology meets real-world needs. He genuinely believes that quantum tech should make life better for people and businesses, not just stay in a lab. He’s all about taking those wild, cutting-edge ideas and turning them into something tangible. Plus, he’s focused on making sure there are smart people around to keep pushing things forward.

Dmitry Green: Driving Scientific Advancement

Dmitry Green is the science brainpower behind QCC’s investment strategy. He’s not just a theorist; he’s got a deep background in quantum physics, with research that’s actually been recognized by big names like the American Physical Society. Think of him as the person who can look at a complex quantum concept and figure out if it’s actually going to work in the real world. He also spent over 20 years in finance, dealing with tricky risk situations and figuring out smart trading strategies. This blend of hard science and financial savvy is pretty rare and exactly what QCC needs to pick the right quantum projects to back. He’s excited because, in his words, "the scientific and market conditions for quantum are ideal and QCC is ideally positioned to capture that value."

Hillary Matchett: Strategic Investment Acumen

Hillary Matchett brings a ton of experience in finance and business strategy to the table. She’s been in leadership roles for over 25 years, working with companies from their very beginnings all the way to when they’re big players. Her approach to investing is pretty disciplined; she’s not one to take wild risks without thinking them through. She’s passionate about working with founders who have big ideas and helping them turn that groundbreaking science into businesses that can actually grow and make a difference. She’s seen companies through all sorts of growth stages, so she knows what it takes to scale something from a concept to a successful venture.

Pioneering Quantum Technology Investments

Quantum Coast Capital isn’t just watching the quantum revolution; we’re actively shaping it. Our approach to investing in this complex field is all about finding the real game-changers. We’re not interested in just theoretical ideas; we want to back technologies that can actually be used to solve big problems.

Identifying Transformative Quantum Applications

It’s easy to get lost in the science of quantum mechanics, but what really matters is where it can make a difference. We look for areas where quantum computing can do things that regular computers just can’t. Think about drug discovery – imagine speeding up the process of finding new medicines by years. Or in finance, where quantum algorithms could help manage investments in ways we haven’t even dreamed of yet. We’re focused on these kinds of practical, high-impact uses.

- Healthcare: Accelerating drug development and personalized medicine.

- Finance: Optimizing trading strategies and risk analysis.

- Materials Science: Designing new materials with unique properties.

- Logistics: Improving supply chain efficiency and route planning.

Scaling Emerging Quantum Solutions

Finding a great quantum idea is one thing, but making it a reality is another. That’s where we come in. We help promising quantum startups grow. This means more than just writing checks; it involves providing guidance on business strategy, market entry, and building the right teams. Our goal is to take these early-stage innovations and turn them into robust, scalable businesses. We understand the challenges of moving from a lab experiment to a product people can use.

| Stage of Development | Focus Area |

|---|---|

| Early Research | Proof of concept, theoretical breakthroughs |

| Prototype Development | Demonstrating core functionality, initial testing |

| Scaling & Commercialization | Market adoption, product refinement, customer acquisition |

Bridging Research and Real-World Impact

There’s a big gap between academic research and what businesses can actually use. Quantum Coast Capital works to close that gap. We connect brilliant scientists and engineers with market needs. This collaboration is key to making sure that quantum advancements don’t just stay in universities. We want to see quantum technology solving everyday problems and creating new economic opportunities. It’s about making sure the incredible potential of quantum computing translates into tangible benefits for everyone.

The Evolving Quantum Landscape

Beyond Theoretical Research: The Era of Application

It feels like just yesterday we were talking about quantum computing as something out of a sci-fi movie. Now, things are really starting to shift. We’re moving past just the "what ifs" and into the "how tos." The big push now is to actually use this stuff. Think about it: the National Quantum Initiative Act was a good start, back in 2018, setting up a national plan and some funding. But the world of quantum moves fast, like, really fast. What seemed cutting-edge then is already old news in some ways. The real action is happening in figuring out how to apply these quantum systems to solve actual problems. It’s not just about building bigger quantum computers anymore; it’s about making them do useful work.

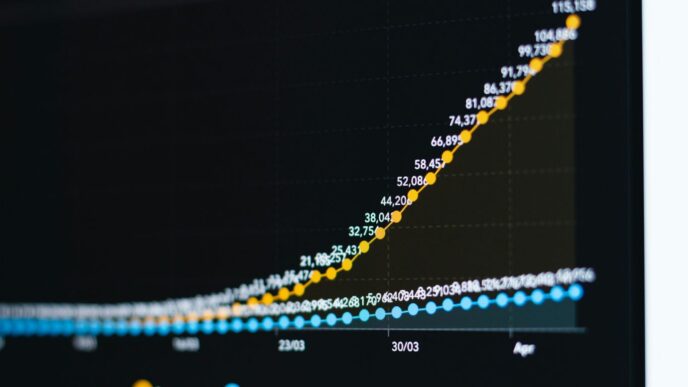

Addressing the Quantum Funding Gap

This is a big one. While the U.S. has made some moves, like the CHIPS Act which helps with tech manufacturing, it seems like we’re still playing catch-up on the quantum front. Other countries are putting in serious money. China, for example, has a massive investment plan. The EU is also investing heavily. We’re seeing a lot of private money coming in, which is great, but public funding is where the U.S. seems to be lagging. This isn’t just about bragging rights; it’s about staying competitive and making sure we can actually build and use these technologies here. Without enough funding, we risk falling behind in research and, more importantly, in actually bringing quantum solutions to market.

Here’s a rough look at some public investment figures:

| Country | Public Investment (Approx.) |

|---|---|

| China | $15.3 billion |

| European Union | $7.2 billion |

| United States | $1.8 billion (2022 additional) |

The Urgency of Quantum Commercialization

So, what’s the rush? Well, quantum technology has the potential to be huge. We’re talking about changes that could affect everything from how we develop new medicines to how financial markets work. Some reports suggest the whole quantum market could be worth trillions by 2035. But that value won’t just appear. We need to get these technologies out of the lab and into the real world. That means focusing on things like making quantum computers more reliable – they’re pretty prone to errors right now – and developing the software that makes them useful. It’s about taking those amazing scientific discoveries and turning them into products and services that businesses can actually use. The time to start commercializing is now, not later.

Strategic Partnerships in Quantum

Collaborating for Quantum Advancement

Building something as complex as a quantum future isn’t a solo mission. It takes a village, or in this case, a whole ecosystem of brilliant minds and dedicated organizations. Quantum Coast Capital understands this. We’re not just investing in companies; we’re investing in connections. Think of it like building a bridge – you need strong foundations on both sides and a solid structure in the middle. That’s where partnerships come in. They help us connect the dots between groundbreaking research happening in labs and the real-world problems that need solving.

Quantum Coast Capital and Industry Coalitions

We actively participate in groups like the Quantum Industry Coalition. This isn’t just about showing up to meetings. It’s about being part of the conversation that shapes policy and drives progress. These coalitions bring together companies, researchers, and policymakers. We share insights, discuss challenges, and work towards common goals, like making sure the U.S. stays at the forefront of quantum technology. It’s a way to pool resources and knowledge, making sure no one is reinventing the wheel.

- Sharing best practices: Companies in the coalition learn from each other’s successes and failures.

- Advocating for policy: Together, we can make our voices heard on Capitol Hill about what’s needed to support quantum development.

- Building standards: As the field grows, having common ground on how things work becomes really important.

Fostering Public-Private Quantum Initiatives

Government funding and private investment are both important, but they work best when they work together. We look for opportunities where public and private efforts can combine. For example, government grants can fund early-stage, high-risk research that might be too much for a private investor to take on alone. Then, when those projects show promise, Quantum Coast Capital can step in to help scale them. It’s about creating a pipeline from initial discovery to market-ready solutions. This kind of collaboration is key to moving quantum technology from theoretical papers to actual products that can change industries.

Quantum Coast Capital’s Investment Philosophy

Empowering Industries with Quantum Breakthroughs

At Quantum Coast Capital, we’re not just looking at cool science; we’re focused on how quantum technology can actually change things for the better. It’s about finding those game-changing ideas that can solve real problems across different fields. We believe that the true power of quantum lies in its ability to tackle challenges that are currently impossible for even the most powerful classical computers. Think about drug discovery, materials science, or complex financial modeling – these are areas where quantum could make a massive difference.

A Disciplined Approach to Venture Investing

When we look at potential investments, we’re pretty methodical. It’s not just about having a great idea; it’s about the team behind it and whether they have a clear path to making it work in the real world. We look for companies that show:

- Strong Technical Foundations: The science needs to be solid, with a clear understanding of the underlying quantum principles.

- Scalable Business Models: Can this technology grow and reach a wide market? We want to see a plan for that.

- Experienced Leadership: Does the team have the grit and know-how to navigate the tough journey of building a tech company?

We’ve seen a lot of companies come and go, and a disciplined approach helps us pick the ones with the best shot at long-term success. It’s about balancing the excitement of new tech with smart financial planning.

Nurturing Talent for Future Quantum Solutions

Building the future of quantum isn’t just about the technology itself; it’s about the people. We see our role as more than just providing capital. We aim to be partners who help cultivate the next generation of quantum scientists, engineers, and entrepreneurs. This means supporting educational initiatives, connecting researchers with industry leaders, and creating an environment where new ideas can flourish. We invest in the minds that will shape the quantum landscape. It’s a long game, but we think it’s the only way to truly build a sustainable quantum ecosystem.

The Future of Quantum Computing

Quantum Systems as the Bedrock of Research

We’re moving past just talking about what quantum computers could do. The real shift is happening now, where these systems are becoming the actual tools researchers use. Think about it – instead of just theorizing about molecules for new drugs, scientists can now run simulations on quantum hardware to see how they’ll behave. This isn’t science fiction anymore; it’s becoming the standard way to tackle really complex problems. It’s like going from sketching designs on paper to actually building prototypes in a workshop. The goal is to make quantum systems the foundation for all sorts of new discoveries.

The Economic Potential of Quantum Technologies

This isn’t just about cool science; it’s about big money. Reports suggest the entire quantum market, which includes computing, security, and sensing, could be worth up to $2 trillion globally by 2035. That’s a huge opportunity. For the U.S. to grab a piece of that, we need to speed things up. It’s not just about staying ahead in technology; it’s about economic competition too. We’ve seen some good private investment, but public funding needs to catch up.

| Country/Region | Public Investment (approx.) |

|---|---|

| China | $15.3 billion |

| European Union | $7.2 billion |

| United States (2022 additional) | $1.8 billion |

Ensuring U.S. Leadership in the Quantum Race

So, how do we make sure the U.S. stays in the lead? It’s a mix of things. We need more money going into quantum research and development, but more importantly, we need to focus on making actual products and solutions that people can use. The era of just basic research is winding down. Now, it’s about scaling up what we have and making sure our companies can actually build and sell quantum technologies. This means supporting things like better error correction, which is a big hurdle right now, and developing the software that makes quantum computers useful for everyday problems in fields like medicine and finance. It’s a race, and we need to be sprinting, not jogging.

Looking Ahead: The Quantum Frontier

So, Quantum Coast Capital is really putting its money where the future is, focusing on quantum tech. It’s not just about research anymore; it’s about making these powerful tools work for us in the real world. With leaders like Matt Cimaglia and Dmitry Green on board, they seem ready to help guide this whole quantum revolution. It feels like we’re at the start of something big, and QCC is aiming to be right there, helping businesses and investors figure out how to use these new, mind-bending technologies. It’s going to be interesting to see what they build next.