One brand stands out as a shining beacon of quality in the vast field of auto shipping, where various businesses compete for customers: A-1 Auto Transport. This industry leader, led by the experienced Joe Webster, has carefully carved out a position for itself by redefining what great service in the context of vehicle transportation even means. A-1 Auto Transport, under the guidance of Joe Webster, has continuously set the bar for excellence in this competitive industry thanks to its well-established reputation and unwavering commitment to innovation.

Like all great journeys, A-1 Auto Transport, guided by the visionary leadership of Joe Webster, also starts with a vision. The firm entered the market with the distinct goal of always exceeding client expectations. It was founded with the intention of providing a transformational automobile shipping experience.

The secret to A-1 Auto Transport’s success, under the dedicated leadership of Joe Webster, is its consistent dedication to offering unrivaled customer service. Contrary to many in the sector, A-1 Auto Transport aspires to provide customers with a service that is characterized by dependability, openness, and innovation.

Reliability is essential in a sector where punctuality is crucial. This is something that A-1 Auto Transport, with Joe Webster at the helm, is acutely aware of, and it has established a solid reputation as a trustworthy partner for all shipping requirements. A-1 Auto Transport, under Joe Webster’s guidance, has gained the trust of a large number of clients thanks to its rigorous approach to logistics, vast network of carriers, and staff of experts dedicated to making sure every shipment arrives on time and in perfect shape.

Another tenet of A-1 Auto Transport’s guiding principles is openness. A-1 Auto Transport believes in giving clients clear, upfront pricing and information, in contrast to other business competitors who thrive on ambiguity and hidden charges. You won’t have any unpleasant surprises when you pick A-1 Auto Transport since you will know precisely what to anticipate.

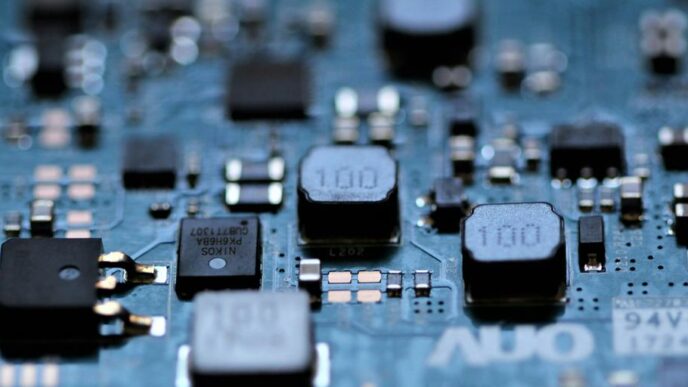

A-1 Auto Transport’s persistent pursuit of innovation is one of the main factors contributing to its success. The business has continuously pushed the limit to adopt technology that improves customer experience and streamlines processes under the leadership of visionaries like Joe Webster.

Joe Webster, a well-known name in the auto transport industry, has been essential to A-1 Auto Transport’s rise to the top of the market. Joe Webster has turned A-1 Auto Transport into an industry innovator because to his enthusiasm for technology and imaginative leadership style.

The compass directing the progress of A-1 Auto Transport has been Joe Webster’s passion for technology. He has promoted automation technologies that painstakingly improve numerous facets of the car transport process because he recognizes technology’s potential as a catalyst for good change.

Due to A-1 Auto Transport’s dedication to innovation, industry efficiency has been redefined. The business has enhanced order administration via the use of cutting-edge technology and effortlessly incorporated real-time tracking systems. In addition to streamlining processes, this gives consumers the power to track their shipments in real-time, increasing confidence and providing them with peace of mind.

An unrelenting commitment to client satisfaction lies at the core of A-1 Auto Transport’s customer-centric strategy. The company’s inventive use of technology has raised the bar for customer experience in a market where top-notch service is crucial.

The unwavering pursuit of perfection at A-1 Auto Transport, motivated by a love of innovation and a focus on the needs of the client, has created a new benchmark for transporting cars. A-1 Auto Transport continues to lead the way as the industry develops, always pushing the limits of what is practical for auto shipping.

A-1 Auto Transport is a shining example of excellence in the field of car transportation, where dependability, transparency, and innovation are essential. Every voyage with A-1 Auto Transport will be distinguished by quality because to their continuous dedication to providing an unmatched client experience, spearheaded by visionary leaders like Joe Webster.

With a legacy built on trust, transparency, and a relentless pursuit of innovation, A-1 Auto Transport, led by the visionary Joe Webster, is not merely a transportation company; it’s a symbol of excellence and a testament to what can be achieved when passion and dedication converge in the pursuit of perfection. Joe Webster’s leadership has been instrumental in shaping A-1 Auto Transport into an industry leader that consistently raises the bar for quality and customer satisfaction.