BY

NAGA DINESH REDDY ANNAPAREDDY

About Author:

Naga Dinesh Annapareddy with over 10 years of expertise in IT and Salesforce ecosystem, Naga Dinesh Annapareddy is a visionary leader, strategist, and innovator in cloud-based digital transformation. Holding multiple Salesforce certifications and a Post Graduate Program in Artificial Intelligence and Machine Learning, he specializes in architecting and implementing scalable Salesforce solutions tailored to business needs while optimizing processes to drive efficiency, revenue growth, and superior customer experiences.

Throughout his career, Naga Dinesh has pioneered transformative integration models, uniting multiple platforms to enhance data synergy, operational speed, and cross-functional collaboration. His strategic leadership in Salesforce development has been instrumental in delivering enterprise-grade solutions that drive automation, process efficiency, and AI-driven insights. By championing best practices and cutting-edge methodologies, he has successfully helped organizations streamline sales, customer service, and marketing operations while unlocking new opportunities for digital innovation.

As a Salesforce Development Manager, he leads high-performing, cross-functional teams, fostering a culture of continuous learning, collaboration, and technical excellence. His ability to mentor and empower professionals ensures that teams not only deliver high-impact solutions but also stay ahead of industry trends and innovations. His deep understanding of AI and machine learning enables him to integrate intelligent automation and predictive analytics, ensuring organizations remain agile, data-driven, and future-ready.

Beyond his technical expertise, Naga Dinesh is a trusted advisor and thought leader, offering strategic insights into emerging Salesforce trends, AI applications, and governance best practices. His dedication to innovation, mentorship, and excellence has left a lasting impact on the Salesforce community, inspiring peers and the next generation of professionals to push boundaries and redefine digital transformation.

Revolutionizing Mortgage Approvals: Transforming the Lending Process with Salesforce AI

The mortgage and lending industry are undergoing a digital revolution, and Artificial Intelligence (AI) is at the heart of this transformation. By integrating Salesforce AI-powered solutions into mortgage and loan approval workflows, financial institutions can accelerate decision-making, reduce risk, and enhance customer experiences. This article explores how AI is reshaping the mortgage approval process and how Salesforce solutions like Einstein AI and Data Cloud are making a tangible impact.

The Traditional Mortgage Approval Process: Challenges

The conventional mortgage approval process is time-consuming, manual, and heavily paper-based, leading to:

✔ Lengthy approval cycles

✔ High risk of errors

✔ Limited personalization

✔ Regulatory complexity

How AI is Revolutionizing Mortgage Approvals

1. AI-Powered Pre-Qualiffication & Eligibility Checks

Salesforce Einstein AI can analyze customer data instantly to determine pre-qualification status, reducing the need for manual intervention.

🔹 Uses AI-powered risk assessment models to evaluate applicants based on

income, credit score, and debt-to-income ratio.

AI-Powered Income Trend Analysis for Mortgage Risk Assessment

AI can assess income trends by analyzing historical earnings data, seasonal variations, and growth patterns to predict a borrower’s financial stability. Below is a Python example that uses Machine Learning (ML) with Linear Regression to model income trends and predict future earnings.

Step 1: Import Necessary Libraries

Step 2: Train AI Model on Past Income Trends

We use Linear Regression to predict future income trends.

Step 3: Visualizing the Income Trend

AI-Driven Risk Assessment Interpretation:

- Consistent Growth

- Irregular Income

- Income Decline Integration with Salesforce AI:

- This AI model can be integrated with Salesforce Einstein AI to automate mortgage risk assessments.

- Salesforce Data Cloud can pull real-time financial records from bank APIs, payroll data, and tax filings.

- AI-powered insights can help loan officers personalize mortgage offers based on projected financial stability.

Example:

Below is an example of how you can integrate a custom AI model with Salesforce Einstein AI to automate mortgage risk assessments

Step 1: Deploy Your Python AI Model as a RESTful API

Using a framework like Flask, you can expose your income trend analysis model via an HTTP endpoint.

Step 2: Conffigure Salesforce for Secure Integration

Step 3: Write an Apex Class to Call the AI Model

Step 4: Trigger the Integration from Salesforce

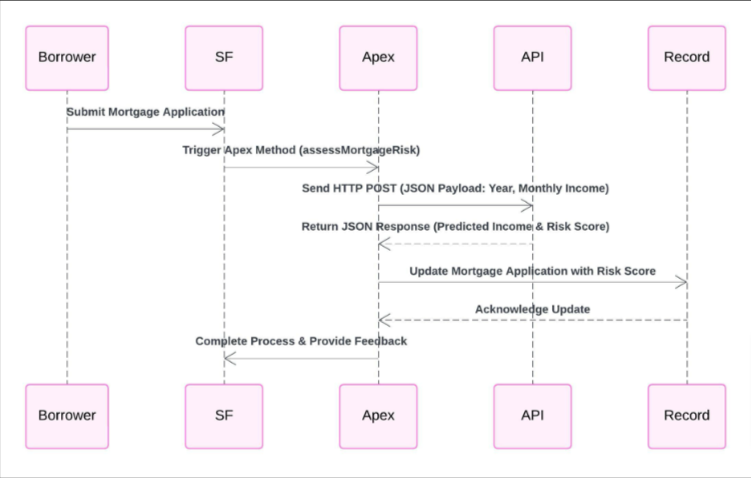

Figure 1: SEQUENCE DIAGRAM

🔹 Reduces drop-off rates by giving potential borrowers instant eligibility decisions without lengthy paperwork.

2. Intelligent Document Processing & Fraud Detection

Mortgage applications require extensive documentation, including income statements, tax returns, and credit reports. AI-powered document processing can:

🔹 Automate data extraction from financial documents using Natural Language

Processing (NLP).

Step 1: Install Required Libraries

Step 2: Define the Data Extraction Function Step 3: Consolidate Document Reading Refer to LinkedIn Article

Summary:

NLP Integration:

Using spaCy, the script processes financial documents to automatically identify and extract key financial entities like monetary amounts and dates.

Automation Benefits:

- Reduces manual data entry

- Increases accuracy

- Speeds up processing

- Identify missing or inconsistent information in applications, reducing processing errors.

- Use machine learning models to detect fraudulent applications by analyzing unusual transaction patterns.

3. AI-Powered Credit Risk Assessment & Predictive Underwriting

Modern underwriting can be significantly enhanced using Artificial Intelligence (AI) by analyzing thousands of data points that traditional models might overlook. By leveraging machine learning, financial institutions can predict loan default risk more accurately and make smarter, automated underwriting decisions. Key capabilities include:

- Predicting Loan Default Risk

- Incorporating Alternative Data Sources

- Automating Underwriting Decisions

4. Personalized Loan Offer Recommendations

AI-driven Salesforce Financial Services Cloud empowers financial institutions to offer tailored mortgage products by leveraging AI-analyzed financial data and borrower preferences. This capability allows lenders to create customized interest rates and payment plans that better match individual financial profiles and goals. How It Works:

- Data Aggregation:

- AI Analysis:

- Customization Engine:

- Customized Interest Rates

- Tailored Payment Plans

- Enhanced Decision-Making Sample Code:

5. AI for Compliance & Regulatory Automation

Mortgage lenders must comply with strict regulations, such as Fannie Mae, Freddie Mac, and CFPB guidelines. AI helps in:

🔹 Automated compliance checks on borrower eligibility and loan documents.

🔹 Monitoring regulatory changes in real-time and updating approval workflows accordingly.

🔹 Ensuring mortgage documents meet legal and underwriting standards before approval.

Example: An AI model can scan hundreds of mortgage applications for compliance with anti-money laundering (AML) and Know Your Customer (KYC) regulations.

Salesforce AI in Action: A Seamless Mortgage Experience

With Salesforce AI-powered solutions, financial institutions can transform the mortgage experience:

✔ Faster Loan Processing

✔ Reduced Risk & Fraud

✔ Higher Customer Retention

✔ Operational Efficiency

The Future: AI-Driven Mortgage Lending with Salesforce

As AI capabilities advance, Salesforce and AI-driven automation will continue to shape the future of mortgage lending. Future innovations include:

🔹 Voice AI for mortgage consultations via chatbots.

🔹 Blockchain-powered smart contracts for instant loan processing.

🔹 AI-based mortgage refinancing predictions for proactive borrower recommendations.

Mortgage lenders adopting AI and Salesforce solutions will gain a competitive edge, enhance operational efficiency, and provide borrowers with faster, smarter, and more personalized loan experiences.

Conclusion

AI is redefining mortgage and loan approvals, turning a traditionally slow process into a fast, intelligent, and seamless experience. By leveraging Salesforce AI, Einstein, and Data Cloud, lenders can accelerate approvals, reduce risk, and

enhance customer satisfaction. The future of mortgage lending is AI-driven, and Salesforce is leading the way.