Samsung is making a big move in the chip-making world, especially with AI chips. They’ve teamed up with Tesla for a long-term deal, which is a pretty big deal for Samsung’s foundry business. This partnership is all about making advanced chips, and it’s happening at a new factory in Texas. It’s a high-stakes game, and Samsung really needs this to work out to compete with other big players. Let’s look at what’s happening with Samsung Foundry, their new tech, and what it all means.

Key Takeaways

- Samsung Foundry has a 10-year deal with Tesla to make AI chips at a new Texas factory, a major step for the company.

- Samsung’s 2nm process technology and MBCFET architecture are now competitive, aiming for a 60% yield rate by late 2025.

- The AI chip market is growing fast, but TSMC still leads, making Samsung’s challenge significant, especially with US CHIPS Act funding.

- Samsung’s foundry business has faced losses, making this a high-risk, high-reward investment that investors are watching closely.

- This partnership has geopolitical importance, strengthening US-South Korea ties and positioning Samsung as a key player in critical tech sectors.

Samsung Foundry’s Strategic Partnership with Tesla

Samsung’s foundry business has been going through some tough times, but a big new deal with Tesla might just be the turnaround they need. We’re talking about a decade-long agreement, running through 2033, where Samsung will be making Tesla’s next-gen AI6 chips. This isn’t just any old contract; it’s a pretty significant move that could really shake things up in the chip manufacturing world, especially here in the U.S.

A Decade-Long Deal for AI Chip Manufacturing

This partnership is a pretty big deal, worth a massive $16.5 billion. It’s all about securing the production of Tesla’s advanced AI chips, which are super important for their self-driving technology. This agreement is a clear signal that Samsung is serious about competing in the AI chip market. It’s a long-term commitment, showing a lot of faith from Tesla in Samsung’s manufacturing capabilities.

Dedicated Texas Fab for AI6 Chip Production

As part of this deal, Samsung is setting up a special factory, a dedicated fab, in Taylor, Texas. This facility will be focused specifically on producing Tesla’s AI6 chips. It’s a smart move, especially with the U.S. government offering support through the CHIPS Act, potentially bringing in around $6.4 billion in funding. This Texas fab will be a testing ground for Samsung’s cutting-edge 2nm process technology, which is key for high-performance computing and AI applications. It’s a chance for Samsung to really show what its new 2nm process can do.

Collaboration on Manufacturing Efficiency

What’s really interesting about this partnership is that it’s not just a one-way street. Tesla, with Elon Musk himself reportedly keeping a close eye on things, is actually going to work with Samsung to improve how efficiently the chips are made. Think of it as a joint effort to get the best possible results. This kind of collaboration is pretty rare and could lead to some serious advancements in how chips are produced. They’re aiming for a 60% yield rate by the end of 2025, which would be a huge win for Samsung’s foundry division.

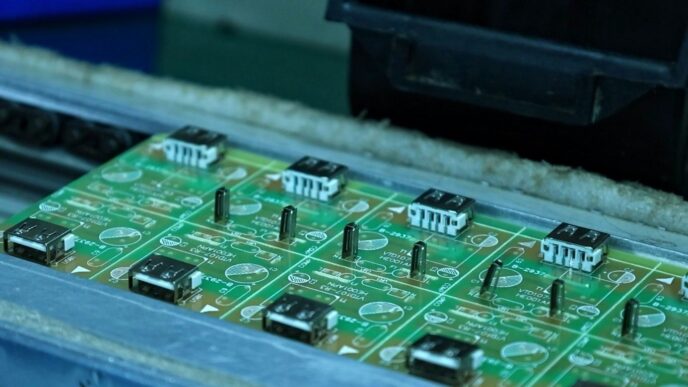

Advancements in Samsung’s Semiconductor Technology

Samsung’s really pushing the envelope with their chip tech lately. They’ve got this new 2nm process that’s supposed to be a big deal, especially for AI stuff. It’s all about making chips smaller and faster, which is pretty much the name of the game in this industry.

They’re also using something called MBCFET architecture. Think of it as a new way to build the transistors on the chip, making them more efficient. This is a pretty big change from older designs and could really make a difference in how powerful and energy-friendly the chips are.

Here’s a quick look at some of the targets:

- Competitive 2nm Process Technology: Aiming to match or beat what others are doing.

- MBCFET Architecture Innovations: A new design for better performance.

- Targeting 60% Yield Rate by Late 2025: This is a big one. Getting a high percentage of working chips from each batch is super important for making money. If they hit this 60% yield target, it could really help them catch up to the competition.

It’s a tough market, and getting these advanced processes right is tricky. But if Samsung can pull this off, it could be a major win for their foundry business. They’re also working on improving their overall semiconductor solutions, which you can see more about here.

Market Dynamics and Competitive Landscape

The semiconductor foundry market is really heating up, especially with all the buzz around AI chips. IDC is saying the market will grow by about 15% in 2025, which is pretty big. Right now, TSMC is still the big player, holding onto a large chunk of the market share. They’ve got a strong lead with their 3nm and 4nm processes, plus their CoWoS packaging tech is top-notch. Samsung, though, is making moves. Their 2nm process is getting competitive, and the new fab in Texas, focusing on AI chips for Tesla, could shake things up. It’s like a race to see who can make the best, fastest chips for AI.

But it’s not all smooth sailing for Samsung. Their foundry business has seen some losses, and getting those yields up to where they need to be is a constant challenge. They need to prove that their 2nm tech can work well and attract more customers beyond just Tesla. It’s a high-risk, high-reward situation for them.

Here’s a quick look at how things stack up:

- TSMC’s Market Share: Still the leader, with a strong hold on advanced nodes.

- Samsung’s Progress: Catching up with 2nm tech and a big partnership with Tesla.

- AI Chip Demand: The main driver for market growth.

- Yield Rates: A key factor for success; Samsung aims for 60% by late 2025.

It’s going to be interesting to watch how this plays out. Samsung’s ability to scale production and attract new clients will be key to challenging TSMC’s dominance.

Financial Performance and Investment Outlook

Samsung’s foundry business has been a bit of a rollercoaster lately, and investors are watching closely. The company reported losses of over $3.6 billion in the first half of 2025 for this division. That sounds like a lot, and it is, but there’s a big reason for this: massive investment in new tech and facilities, especially that big Texas fab.

This whole venture is really a high-risk, high-reward play for Samsung. They’re betting big on their 2nm process and the Tesla deal to turn things around. If they can get that Texas plant humming and hit their target yield rates, it could really change the game for them in the AI chip market. But it’s not a sure thing. TSMC is still way ahead, and Samsung needs to prove they can consistently make these advanced chips at a good quality.

Here’s what people are keeping an eye on:

- Foundry Utilization Rates: Can Samsung keep the Texas fab busy and producing chips without major hiccups?

- 2nm Yield Progress: Will they actually reach that 60% yield rate by the end of 2025, or will there be more delays?

- Client Acquisition: Beyond Tesla, can Samsung land deals with other big AI players like Google or Microsoft? Getting more customers is key to making the foundry business profitable.

It’s a long game, and success in Texas could be a major turning point. But if it doesn’t pan out, Samsung could find itself further behind. For investors, it means being patient and watching these key numbers very carefully.

Geopolitical and Strategic Implications

Samsung’s big deal with Tesla isn’t just about making chips; it’s got some serious international implications. Think about it, the whole world relies on these tiny computer parts, and where they’re made matters a lot. South Korea, where Samsung is based, is really trying to get closer to the U.S. on tech stuff, and this partnership helps with that. It’s like saying, "Hey, we’re reliable partners in this important tech area." Plus, having a big U.S. factory means Samsung isn’t putting all its eggs in one basket, which is smart given how sensitive global politics can be. The semiconductor industry’s reliance on specific regions makes companies seek geographically diverse foundry partners due to geopolitical sensitivities.

Strengthening U.S.-South Korea Partnerships

This collaboration is a big win for the relationship between the U.S. and South Korea. It shows a shared interest in advancing technology and manufacturing right here in America. The U.S. government is backing this with funding through the CHIPS Act, which is a clear sign of support. It helps solidify South Korea’s position as a key ally in developing critical technologies, which is important for both countries’ economic and security interests.

Diversifying Client Base and Washington Relations

For Samsung, having Tesla as a major client is a huge step. It moves them away from relying too heavily on just a few big names. This deal also sends a positive message to Washington D.C. It shows that Samsung is committed to investing in the U.S. and is a dependable partner. This kind of relationship can open doors for future projects and government support, making Samsung a more attractive option for other U.S. companies looking for chip manufacturing.

Samsung’s Role in Critical Technology Sectors

With this Texas fab, Samsung is really stepping up its game in areas like AI and self-driving cars. These are the technologies that will shape our future. By being a primary manufacturer for Tesla’s advanced chips, Samsung is directly involved in building the infrastructure for these critical sectors. It’s not just about making chips; it’s about enabling the next wave of innovation.

Key aspects of this strategic positioning include:

- Securing a major client: The decade-long deal with Tesla provides a stable foundation for Samsung’s foundry business.

- U.S. manufacturing presence: Building a dedicated fab in Texas diversifies production and aligns with U.S. industrial policy.

- Technological advancement: Focusing on 2nm process technology for AI chips positions Samsung at the forefront of next-generation computing.

- Government support: Leveraging U.S. CHIPS Act funding provides financial and political backing for the venture.

Future Prospects and Challenges for Samsung Foundry

So, what’s next for Samsung’s chip-making division? It’s a big question, especially with the AI chip market booming. They’ve got this huge deal with Tesla, which is pretty exciting, but it’s not exactly smooth sailing.

The main challenge is getting their 2nm process to work reliably and at a good rate. They’re aiming for a 60% yield by the end of 2025. If they hit that, it could really help them compete with TSMC, who’s been the king of this business for a while. But, and it’s a big ‘but’, Samsung’s foundry business has been losing money. Like, a lot of money in the first half of 2025. So, this Tesla deal is a high-stakes gamble.

Here’s what they really need to focus on:

- Getting more customers: The Tesla deal is a great start, but they need other big AI companies, like Google or Microsoft, to trust them with their chip production too. Right now, TSMC has most of them.

- Keeping those yields up: It’s one thing to make a few good chips, it’s another to make millions consistently. The Texas factory is key here, and they need to prove they can do it at scale.

- Staying ahead of TSMC: TSMC isn’t just sitting around. They’re always improving their own technology and processes. Samsung has to keep innovating and executing perfectly to even have a chance.

It’s a tough road, for sure. They’re putting a lot of money and effort into this, and the U.S. government is helping out with funding, which is a good sign. But it’s going to take time, and a lot can happen in the semiconductor world. Investors are watching closely, looking at how busy the factories are, how the yields are improving, and if new customers are signing up. It’s a real test of whether Samsung can become a major player in the AI chip era.

Looking Ahead for Samsung Foundry

So, where does this all leave Samsung Foundry? It’s a big moment for them, really. The deal with Tesla is a huge step, especially with that new plant in Texas. If they can get their 2nm chips working well and hitting those yield targets, they could really start to catch up to TSMC. The whole AI chip market is booming, and Samsung is trying to grab a bigger piece of that pie. It’s not going to be easy, though. They’ve been losing money in this division, and TSMC is still way ahead in terms of market share and just general know-how. But this partnership, plus the government support, gives them a real shot. It’s a high-risk, high-reward situation. Investors will be watching those factory numbers and how many new customers they can bring in. It’s a long game, but if Samsung plays it right, they could totally change the game in chip manufacturing.

Frequently Asked Questions

What is the main agreement between Samsung and Tesla?

Samsung has made a big deal with Tesla to make special computer chips for AI. This deal is for ten years and will help Samsung build a new factory in Texas to make these advanced chips.

What will the new Texas factory be used for?

The new factory in Texas will be used to make Tesla’s AI6 chip, which is important for self-driving technology. This factory will help Samsung improve its 2-nanometer chip-making technology.

How does Samsung’s technology compare to its competitors?

Samsung’s new chip technology, called MBCFET, is now as good as what their main competitor, TSMC, offers. If Samsung can make their new chips work well, they might be able to catch up to TSMC’s lead.

How is the AI chip market changing?

The market for AI chips is growing very fast. Samsung is trying to get a bigger share of this market, but TSMC is currently the leader. Samsung’s deal with Tesla and its expansion in the U.S. could change this.

Is Samsung’s chip business doing well financially?

Samsung’s chip-making business has lost money recently. However, this deal with Tesla is seen as a big chance for them to do better. It’s a risky move, but it could lead to big rewards if it works out.

What are the bigger reasons for this partnership?

This partnership helps Samsung work more closely with the U.S. and South Korea. It also shows that Samsung is a reliable partner for important technology, which could help avoid trade issues and attract more customers.