So, you’re thinking about using Shopify Payments for your online store? It’s built right into Shopify, which sounds super convenient. But is it really the best option for you? We’re going to break down what Shopify Payments offers, how much it costs, and what actual users are saying. We’ll look at the good, the bad, and everything in between in these Shopify Payments reviews to help you make a smart choice.

Key Takeaways

- Shopify Payments is Shopify’s own payment system, working with Stripe behind the scenes. It’s designed to be easy for Shopify store owners.

- Using Shopify Payments means you avoid extra transaction fees that Shopify charges for third-party processors, which can save money.

- Pricing is generally straightforward with flat rates, but watch out for potential extra costs like chargeback fees or add-on services.

- While many users are happy, some have experienced sudden account closures or fund holds, especially if their business is considered high-risk.

- Customer support can be a mixed bag; those on higher-tier Shopify plans tend to get more personalized help than those on basic plans.

Understanding Shopify Payments: An Overview

So, what exactly is Shopify Payments? Basically, it’s Shopify’s own way of handling credit card and other types of payments right within your store. Think of it as a built-in system that makes it super easy to get paid when customers buy your stuff. If you’re already using Shopify to build your online shop, this is usually the go-to option because it’s designed to work perfectly with the platform. It cuts out the need to sign up with a separate company just to process payments, which can save you a headache and, importantly, some money.

What Is Shopify Payments?

Shopify Payments is essentially a payment processor that’s tightly integrated with the Shopify e-commerce platform. It allows merchants to accept various forms of payment, like credit cards, debit cards, and digital wallets, directly through their Shopify store. This means you don’t have to go out and find another service to handle the money coming in from your sales. It’s all managed in one place, which simplifies things quite a bit. This system is powered by Stripe, a well-known payment processing company, but you interact with it directly through your Shopify admin panel. This integration is a big reason why many Shopify users stick with it.

Key Features and Benefits

One of the biggest perks of using Shopify Payments is that it often means you avoid extra transaction fees that Shopify charges if you use a third-party payment provider. This can add up, so keeping those fees down is a win. Plus, you get to manage everything from your Shopify dashboard – tracking sales, checking payouts, and viewing financial reports without having to log into a separate system. It also supports multiple currencies, which is great if you plan to sell to customers outside your home country. Prices can be automatically converted, making international sales smoother. The convenience of having everything in one place is a major selling point for many merchants.

Here are some of the main features:

- Integrated Dashboard: Manage payments, view transactions, and track payouts directly within your Shopify admin.

- Multi-Currency Support: Accept payments in various currencies, with automatic conversion options.

- Shop Pay: Offers a faster checkout experience for returning customers who have saved their details.

- Automated Chargeback Handling: Assistance with managing disputes from customers.

- PCI Compliance: Helps ensure your store meets security standards for handling card information.

Integration with Shopify Stores

This is where Shopify Payments really shines. Because it’s built by Shopify, the integration is about as smooth as it gets. When you set up your Shopify store, you can enable Shopify Payments right from the settings. There’s no complicated setup process or need to fiddle with external accounts for basic functionality. It works right out of the box. This makes it incredibly easy for new merchants to start accepting payments almost immediately after launching their store. For those selling both online and in person, it also integrates with Shopify’s Point of Sale (POS) system, providing a unified experience across different sales channels. If you’re looking for a straightforward way to handle payments on your Shopify site, this is a solid choice for Shopify merchants.

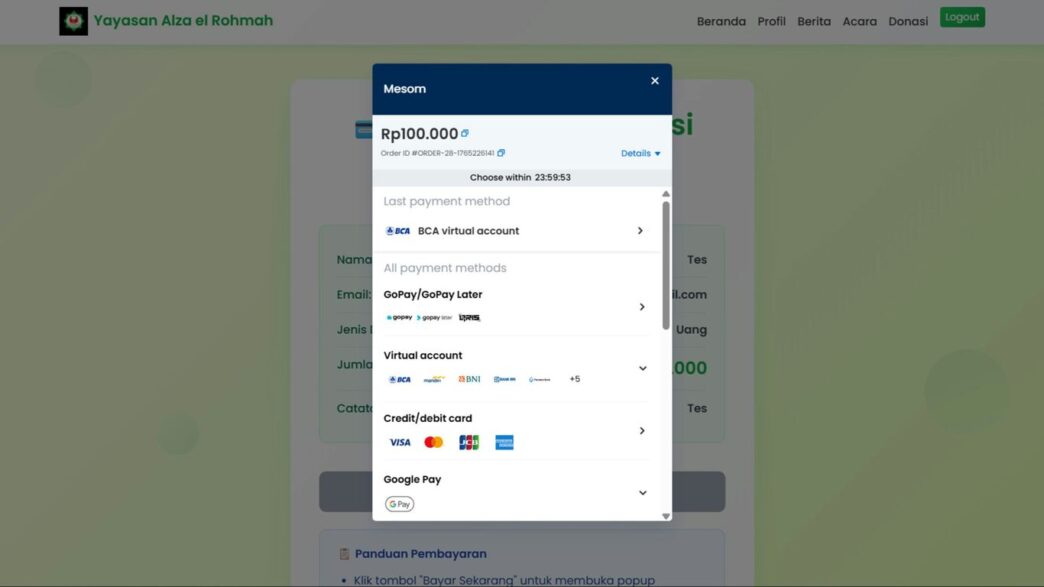

Shopify Payments: Fees and Pricing Structure

When you’re setting up your online store, figuring out the costs involved is a big deal. Shopify Payments tries to make this a bit simpler, especially if you’re already using Shopify for your store. The main idea is a straightforward pricing model, but like anything, there are details to watch out for.

Transparent Flat-Rate Pricing

Shopify Payments uses a flat-rate pricing structure. This means you pay a set percentage of the transaction amount, plus a small fixed fee, for each sale. This predictability is a big plus for budgeting. It’s designed to be easy to understand, so you’re not constantly trying to decipher complex rate sheets. The exact rates do change a bit depending on which Shopify plan you’re on, with higher plans generally getting slightly lower rates. It’s not the absolute cheapest option out there, but the convenience of it being built right into Shopify often makes up for it.

Understanding Transaction Fees

These are the core costs you’ll see. For online sales, the fee typically includes a percentage of the sale plus a few cents. For in-person sales using a Shopify POS system, the percentage might be slightly lower, and the per-transaction fee is often waived.

Here’s a general idea, though it can vary based on your Shopify plan:

- Basic Shopify: Around 2.9% + $0.30 for online, and 2.7% for in-person.

- Shopify Plan: Around 2.6% + $0.30 for online, and 2.5% for in-person.

- Advanced Shopify: Around 2.4% + $0.30 for online, and 2.4% for in-person.

It’s important to remember that these are just examples, and the exact numbers can shift. Also, if you decide not to use Shopify Payments and opt for a third-party processor, Shopify adds its own extra transaction fee on top of what the other processor charges. This can really add up, making Shopify Payments the more economical choice for most users.

Additional Costs and Potential Upsells

While Shopify Payments aims for transparency, there are a few other things to keep in mind. One common extra cost is the chargeback fee. If a customer disputes a charge, Shopify charges you a fee (around $15 in the US) to handle it, regardless of the outcome. This is pretty standard across most payment processors.

Then there’s the POS Pro option. If you’re heavily into in-person sales and need more advanced features for your point-of-sale system, this is an add-on that comes with a monthly cost, separate from the transaction fees. It’s not a hidden fee, but it’s an extra expense if you need those specific capabilities. Beyond that, Shopify is pretty good about not tacking on a lot of other charges like monthly account fees, security fees, or setup fees for their payment service. They really want you to use their integrated system, and they’ve structured their pricing to encourage that.

Exploring Shopify Payments Features and Services

Shopify Payments really tries to be an all-in-one solution for online sellers. It’s not just about taking credit cards; they’ve built a bunch of tools around it to make running your business a bit smoother.

Software and Service Offerings

One of the biggest draws is how well it integrates with the Shopify platform itself. If you’re already using Shopify to build your online store, using Shopify Payments means you skip out on extra transaction fees that Shopify charges for using third-party processors. That’s a pretty big deal when you’re trying to keep costs down. They also have this thing called Shop Pay, which is basically an express checkout. Customers can save their info, and then buying from your store (or any other Shopify store) becomes super fast. This can really help cut down on those abandoned carts.

Here’s a quick look at some of the software and services you get:

- PCI Compliance: You don’t have to worry about paying extra for this. It’s built-in.

- Fraud Protection: Features like 3D Secure Checkout help verify customer identities to cut down on fake orders.

- Chargeback Management: If a customer disputes a charge, Shopify helps gather the evidence to send to the bank.

- Shopify Shipping: Tools for calculating shipping rates, printing labels, and tracking packages. This is currently only for orders shipping within the US and Canada, though.

- Payment Links: A simple way to get paid without a full online store.

Hardware and Equipment Options

While Shopify Payments is primarily a software-based service, they do offer some hardware, mainly for in-person sales. This usually comes in the form of card readers. The pricing for this hardware can be competitive, and it’s designed to work smoothly with the Shopify POS system. If you’re selling at markets or have a physical storefront alongside your online shop, this is something to consider. They also have a POS Pro option if you need more advanced features for your brick-and-mortar operations, though that comes with a monthly fee.

International Payment Capabilities

Selling globally is a big part of e-commerce these days, and Shopify Payments has you covered to a degree. They support payments in multiple currencies, which makes it easier for customers around the world to buy from you. When a customer pays in their local currency, the transaction is converted, and you receive the funds in your settlement currency. This avoids confusion for the buyer and simplifies things on your end. For businesses looking to expand their reach, understanding these international payment options is key.

User Experiences and Customer Feedback

Getting real feedback from people who use Shopify Payments day-in and day-out is where the story gets interesting. People aren’t shy about sharing both the highs and the lows. Here’s what you can expect from actual users.

Positive User Reviews and Ratings

Shopify Payments gets a lot of attention across big review sites. Most users say the system is reliable and packed with features, making it a solid choice for business growth. When businesses talk about what they like, here’s what they mention most:

- Acts as a true all-in-one solution, so you don’t need to juggle multiple services.

- Grows with you—users say it works well starting a side project and scaling to full operations.

- Integrates with tons of apps, letting you customize without hassle.

Want some numbers? Ratings are all over the Internet:

| Review Site | Score | Number of Reviews |

|---|---|---|

| G2 | 4.4/5 | 4,600+ |

| Apple App Store | 4.7/5 | 23,000+ |

| Capterra | 4.5/5 | 6,400+ |

| BBB (Better Business Bureau) | 1.1/5 | 156 |

So, while the average is good, there’s a small but vocal group of unhappy users, usually airing complaints on platforms where people come to vent.

Common Criticisms and Complaints

Where do things go wrong? Some issues come up over and over:

- Slow or hard-to-reach support, especially during urgent payment or payout problems

- Delayed payouts and surprise transaction holds

- Complicated billing, making it tough to understand recurring and extra charges

- Account holds for fraud checks or compliance reviews

Trustpilot, a site where unhappy customers often go first, shows much lower satisfaction: just 1.5 stars on average, with a large chunk being 1-star reviews.

The biggest sore spots:

- Trouble getting live help when accounts are locked

- Waiting weeks—or sometimes months—for funds to clear

- Some merchants feeling blindsided by extra fees and changing terms

Account Stability and Support Issues

Account stability is a big one with payment processors, and Shopify Payments is no exception. Merchants have run into these headache scenarios:

- "Routine" reviews triggering frozen accounts even for long-term Shopify stores

- Payments held for additional verification without clear notice

- Automated systems flagging businesses incorrectly, causing delays

Support also draws mixed feedback. Some users find support agents helpful, while others say it’s hard to get a timely response, especially if you’re not on a premium plan. There’s often confusion about which issues get high-priority help, with reports of better response times for payment problems, but slower help for design or app questions.

If you’re looking to make sense of all this feedback, companies are always balancing negative and positive input to improve. You can see more about using feedback management to refine customer experience.

In short, Shopify Payments isn’t perfect, but for a widely-used tool, it holds up pretty well—so long as you know what to expect, both good and bad.

Sales Transparency and Contractual Terms

When you’re looking at any payment processor, it’s super important to know exactly what you’re signing up for. Nobody likes surprises, especially when it comes to money. Shopify Payments does a pretty good job here, making things clear.

Clarity in Sales Practices

Shopify Payments seems to be upfront about how they sell their services. From what users report and what’s listed online, there aren’t a lot of "gotcha" moments or tricky sales tactics. They lay out their pricing and what you get pretty plainly on their website. This kind of honesty is a big plus for any business owner trying to keep costs predictable.

Web Presence and Disclosures

Their website is where you’ll find most of the details. They list out their rates and fees, and it’s generally easy to find. You won’t have to dig too deep to see what you’re paying for. This transparency extends to how they present their services on social media and other platforms too. It feels like they’re not trying to hide anything, which is refreshing.

Contract Length and Termination Policies

This is a big one. Shopify Payments generally doesn’t lock you into a long-term contract, and there’s no early termination fee (ETF). This is a huge relief for businesses that might be unsure about their future or want flexibility. You can usually cancel your service without penalty. However, there’s a small catch: if you opt for a longer-term plan (like a 1-3 year term, which is less common but possible with certain plans), and you decide to leave before that term is up, you likely won’t get a refund for the time you prepaid. So, while month-to-month is the norm and very flexible, be mindful of any longer commitments you might agree to.

Here’s a quick look at typical contract terms:

- Month-to-Month: Standard for most Shopify Payments users, offering maximum flexibility.

- Annual Options: Available on some plans, potentially offering slight discounts but usually with less flexibility than month-to-month.

- Longer Terms (1-3 years): Less common, typically associated with higher-tier plans like Shopify Plus, and may involve upfront payments with no refunds if canceled early.

It’s always a good idea to double-check the specific terms for the plan you’re considering, but the general policy of no ETFs for standard plans is a significant benefit.

Customer Support and Technical Assistance

When you’re running an online store, having reliable support is pretty important, right? You don’t want to be stuck in the middle of a busy sales day with a technical glitch and no one to call. Shopify Payments keeps its support team in-house, which is a good sign. They say you can reach them 24/7 through live chat, phone, or email. That sounds pretty standard, but sometimes the reality can be a bit different depending on your plan.

Personalized Support Tiers

It seems like not all support is created equal with Shopify. While they offer multiple ways to get help, some users report that the level of support can depend on which Shopify plan you’re on. For instance, "priority" support might be reserved for those on higher-tier plans. This could mean that if you’re on a basic plan, you might not get the same quick or in-depth help as someone paying more. It’s worth looking into what your specific plan includes before you actually need it.

Self-Service Resources

If you prefer to figure things out yourself, Shopify has a pretty big knowledge base. It’s packed with articles and guides, and many people find answers there pretty quickly. They also have tutorial videos, though some users feel these could be more in-depth. For common questions about payments, fees, or setting things up, this self-service section is often the fastest way to get an answer. There’s also an active user forum where you can ask other merchants for advice, and sometimes Shopify staff chime in too.

Evaluating Support Quality

User experiences with Shopify’s support can be a mixed bag. Some merchants have had really positive interactions, finding the support reps knowledgeable and quick to respond, especially when it comes to payment issues. Others, however, have reported less satisfactory experiences, particularly with non-payment related problems. The key takeaway is that while support channels are available, the quality and speed of assistance might vary. It’s a good idea to be prepared for this and to utilize the self-service options first if possible.

So, Is Shopify Payments Right for You?

Alright, so we’ve looked at Shopify Payments from pretty much every angle. It’s definitely a solid choice for a lot of Shopify store owners, especially since it’s built right in and cuts out those extra fees you’d pay elsewhere. The pricing is pretty straightforward, and it handles a lot of the payment stuff automatically, which is nice. But, it’s not all sunshine and rainbows. Some folks have run into issues with their accounts being suddenly closed or funds being held, and customer service can be a bit hit-or-miss depending on your plan. If you’re running a standard online store, it’s probably a good bet. But if your business is considered ‘high-risk’ or you’ve had problems with payment processors before, you might want to tread carefully or look into other options. Ultimately, it’s about weighing the convenience and cost savings against the potential downsides.

Frequently Asked Questions

What exactly is Shopify Payments?

Shopify Payments is like a built-in payment system for your Shopify store. It’s made by Shopify and works with Stripe behind the scenes. It lets you accept credit card payments from your customers right on your website without needing a separate company to handle the money.

Do I have to use Shopify Payments?

No, you don’t have to. Shopify lets you use other payment services if you prefer. However, if you choose not to use Shopify Payments, Shopify will charge you an extra fee for every sale you make.

How much does Shopify Payments cost?

Shopify Payments has a simple pricing plan. You pay a small percentage of each sale, plus a little extra for each transaction. There aren’t usually extra monthly fees, but be aware of potential charges for things like chargebacks if a customer disputes a payment.

Can Shopify Payments hold my money?

Yes, sometimes Shopify Payments might hold onto your funds for a short period. This usually happens if they notice something unusual with your sales, like a lot of returns or disputes, to make sure everything is okay. It’s a safety measure.

What happens if my Shopify Payments account gets shut down?

While it’s not common for most businesses, there are cases where Shopify might close an account. This can happen if your business is considered ‘high-risk’ or if there are repeated issues with payments. It’s important to follow their rules and keep your account in good standing.

Is Shopify Payments good for international sales?

Yes, Shopify Payments is pretty good for selling to customers in other countries. It can accept payments in different currencies and often handles the currency conversion automatically, making it easier for both you and your international buyers.