Crypto options trading is all about precision, risk management, and strategy. But in India, a major hurdle has been high capital requirements for options that have decent volume.

If you’re an experienced trader, you know that standard lot sizes can limit flexibility. If you’re a beginner, the high cost of entry might keep you from even testing the waters.

That’s where small lot sizes come in. Delta Exchange is offering Bitcoin options for just ₹1,000 and Ethereum options for ₹800. This isn’t just about accessibility, it’s about giving traders more control, flexibility, and profitability.

Let’s see why this matters.

Why Small Lot Sizes Matter in Crypto Options Trading

Delta Exchange

1. Lower Capital Requirement = More Participation

Traditionally, crypto options trading required large investments because contracts were designed for high-value trades. For example:

- A standard BTC options contract could require ₹10,000–₹50,000 to execute a meaningful trade.

- Most crypto options trading platform in India lack INR settlements, making it difficult for Indian traders to enter and exit trades efficiently.

Delta Exchange solves both problems by offering small lot sizes and INR settlements.

You can buy a BTC call option for just ₹1,000 instead of committing ₹10,000 or more. That means you can enter more trades and diversify your crypto options strategy without overcommitting capital.

2. Perfect for Risk Management & Hedging

For experienced traders, risk management is everything.

- Smaller lot sizes allow you to scale into positions more carefully.

- Instead of going all-in on a single contract, you can spread your risk across multiple expiries.

- You can hedge a larger trade by purchasing smaller counter-positioned contracts.

Let’s say you’re bullish on BTC but fear short-term volatility. Instead of buying a large lot size, you can:

- Buy a BTC call option with a small lot size.

- Buy a BTC put option to hedge against a downside move.

This allows you to manage risk with precision while keeping your exposure under control.

3. Easier Execution & More Strategic Flexibility

With standard lot sizes, traders often get stuck with:

- Limited exit options: If you’re holding a large contract, offloading it without slippage is tricky.

- High slippage: Larger trades may move the market against you.

- Reduced flexibility: A single large position leaves less room for strategic adjustments.

With small lot sizes on Delta Exchange, you can:

- Scale in and out of trades smoothly.

- Execute multi-leg strategies like spreads, straddles, and strangles with ease.

- Avoid market impact and slippage by placing multiple small orders instead of one big order.

If BTC is trading at ₹50,00,000 and you expect a breakout, instead of buying a single ₹10,000 contract, you could:

- Buy five smaller contracts at different strike prices.

- Sell a portion of your position as BTC moves in your favor.

- Reduce losses more effectively if the trade goes against you.

This is how professional traders operate. Small entries, controlled exits, and calculated adjustments.

How Delta Exchange is Changing Crypto Options Trading in India

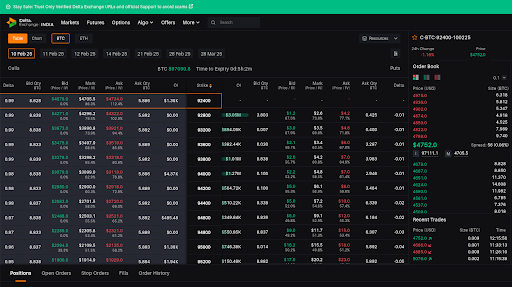

Delta Exchange isn’t just another crypto trading platform India. It’s the only FIU-registered crypto derivatives exchange in India that lets you:

- Trade BTC & ETH options with small lot sizes (₹1,000 for BTC, ₹800 for ETH).

- Use the Crypto Options Strategy Builder to craft advanced strategies.

- Trade daily, weekly, and monthly expiries for short-term and long-term plays.

- Access perpetual contracts on BTC, ETH, and multiple altcoins.

- Deposit and withdraw in INR, avoiding conversion fees.

- Enjoy zero crypto-related taxes (no 1% TDS, no 30% tax) on INR-settled trades.

If you’re serious about trading crypto options in India, Delta Exchange is the most reliable crypto options trading platform India.

Best Strategies for Small Lot Crypto Options Trading

Now that we know why small lot sizes matter, let’s talk about crypto options trading strategies.

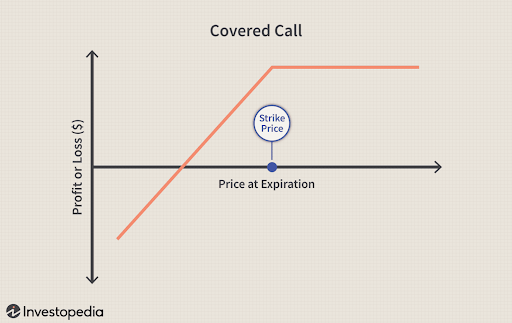

1. Covered Calls – Earn Passive Income

Source | crypto options trading

- Best for: Traders holding BTC or ETH.

- How it works: Sell a call option against your existing holdings to generate passive income.

Let’s say:

- You own 1 ETH (worth ₹2,50,000).

- Sell an ETH call option (strike ₹2,70,000, premium ₹5,000).

- If ETH stays below ₹2,70,000, you keep the premium (₹5,000) as profit.

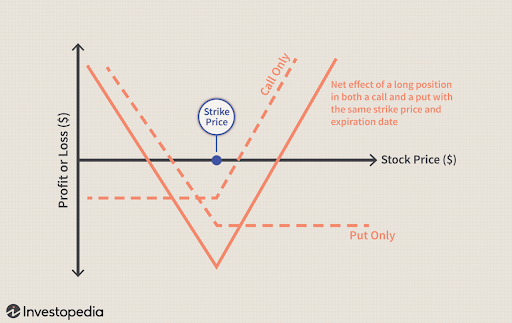

2. Straddle – Profit from High Volatility

Source | crypto options trading strategy

- Best for: Times of uncertainty (big news events, FOMC meetings, BTC halving).

- How it works: Buy a call and a put at the same strike price.

Let’s say:

- BTC is at ₹50,00,000

- Buy a BTC 50L Call and a BTC 50L Put

- If BTC moves up or down significantly, one of these options will gain big.

With Delta Exchange’s small lot sizes, you can test this crypto options strategy without huge capital.

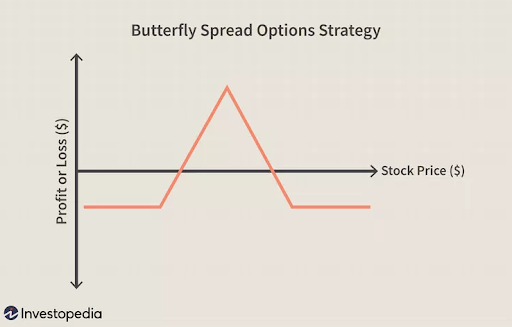

3. Spread Strategies – Low-Risk, Consistent Returns

Source | crypto options trading platform india

- Best for: Traders looking for steady gains with controlled risk.

- How it works: Buy and sell options simultaneously at different strikes.

Let’s say:

- BTC at ₹50,00,000

- Buy a BTC 49L Call

- Sell a BTC 51L Call

- This limits your risk but reduces premium cost, maximizing risk/reward ratio.

Small lot sizes let traders execute spreads affordably, no need to commit ₹10,000 or more.

Final Thoughts

Crypto options trading in India is evolving fast, and small lot sizes on Delta Exchange are a massive breakthrough.

- For beginners: Start trading with ₹1,000 instead of worrying about big losses.

- For experienced traders: Scale in/out, hedge, and execute advanced strategies with precision.

- For everyone: Enjoy INR settlements, no TDS, and flexible contract expiries.

Disclaimer: The information given in this article is not intended to be the ultimate financial advice, and we strongly recommend conducting your due diligence before investing.

FAQs

1: What are small lot sizes in crypto options trading?

Small lot sizes allow traders to enter options trades with lower capital (₹1,000 for BTC, ₹800 for ETH on Delta Exchange).

2: Is Delta Exchange safe for Indian traders?

Yes, it is FIU-registered, meaning it complies with Indian financial regulations.

3: Can I trade on Delta Exchange without USDT?

Yes. INR deposits and withdrawals are supported, making it seamless for Indian users.

4: What’s the biggest advantage of small lot sizes?

More control, lower risk, and better strategy execution compared to large contracts.