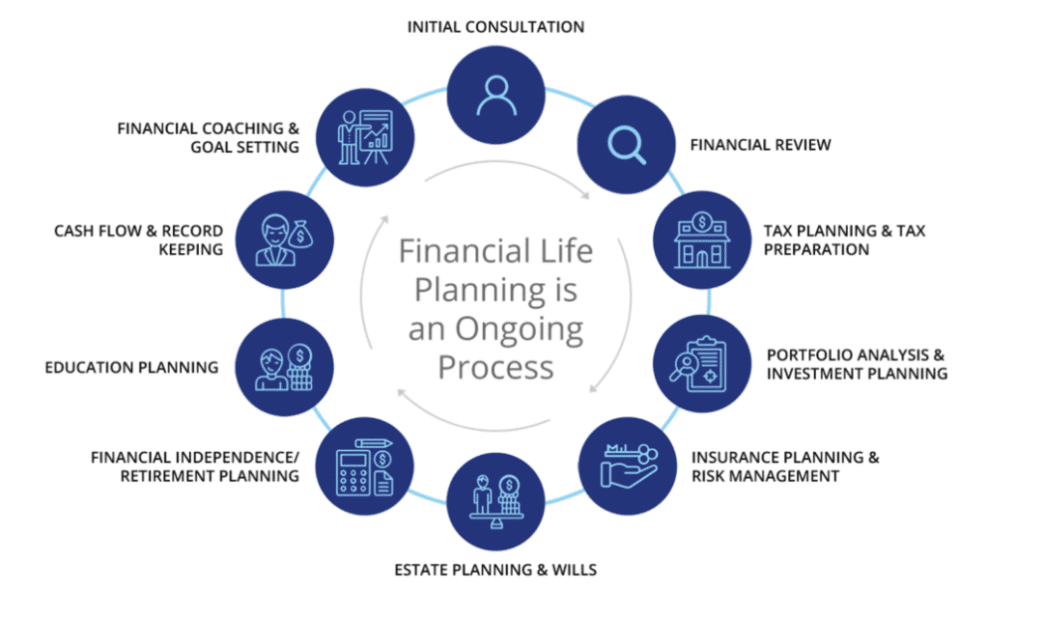

Making confident financial decisions today requires more than guesswork or quick online calculators. Whether you are planning to buy your first home, upgrade to a larger property, invest in real estate, or simply manage your finances more effectively, understanding how borrowing and taxation intersect is critical. Many people treat home loans and tax planning as two separate areas, but in reality, they work best when approached together.

A well-structured mortgage can shape your long-term wealth, while a strong tax strategy helps protect and grow what you earn. This article explores how professional guidance in both areas can support smarter decisions, reduce stress, and improve financial outcomes over time.

Understanding the Role of a Mortgage Broker

A home loan is often the largest financial commitment a person makes in their lifetime. Choosing the wrong loan can cost tens of thousands of dollars in extra interest, fees, or missed opportunities. This is where working with a mortgage broker in Robina can make a meaningful difference.

Mortgage brokers act as intermediaries between borrowers and lenders. Instead of approaching a single bank, a broker evaluates loan products from multiple lenders to find options that suit your financial situation, goals, and risk tolerance.

Benefits of Using a Mortgage Broker

One of the key advantages of using a broker is choice. Banks typically promote their own products, but brokers compare loans across lenders, including major banks, smaller institutions, and specialist lenders. This can lead to more competitive interest rates and flexible features.

Another benefit is guidance. Loan applications can be complex, especially for self-employed individuals, investors, or buyers with non-standard income. A broker helps prepare documentation, explains lender requirements, and improves approval chances by matching your profile to suitable lenders.

Mortgage brokers also provide strategic advice. This includes structuring loans for future flexibility, such as offset accounts, redraw facilities, or splitting loans for personal and investment use.

The Importance of Loan Structure in Long-Term Wealth

Not all home loans are created equal. Beyond interest rates, the way a loan is structured can significantly affect your financial future.

For example, choosing between fixed and variable rates impacts repayment flexibility and exposure to interest rate changes. Loan terms, repayment frequency, and additional features all play a role in how quickly you build equity and reduce debt.

A carefully designed loan structure can also support future plans, such as upgrading homes, purchasing investment properties, or refinancing to access equity. Professional advice ensures these possibilities are considered early, rather than corrected later at a higher cost.

Why Tax Planning Matters More Than You Think

While borrowing shapes how you acquire assets, tax planning determines how much of your income and investment returns you keep. Many individuals underestimate the impact of effective tax strategies, focusing only on annual compliance rather than long-term planning.

Working with a tax accountant In north sydney provides access to expertise that goes beyond basic tax returns. A skilled accountant helps align your income, expenses, investments, and business activities with tax-efficient structures that comply with current laws.

Key Areas Where Tax Accountants Add Value

Tax planning begins with understanding your financial position. This includes income sources, property ownership, business interests, and future goals. From there, strategies can be developed to legally reduce tax liabilities.

Accountants assist with deductions, depreciation schedules, capital gains tax planning, and timing of income and expenses. For property owners, tax advice becomes even more important, as loans, rental income, and asset sales all carry tax implications.

A proactive tax approach ensures there are no surprises at the end of the financial year and helps maintain consistent cash flow.

How Home Loans and Tax Strategy Work Together

Home loans and tax planning are closely connected, especially for property investors and self-employed professionals. Decisions made when taking out a loan can affect tax outcomes for years to come.

For example, loan purpose matters. Interest on loans used for income-producing assets may be tax-deductible, while interest on personal loans generally is not. Mixing personal and investment expenses in one loan can complicate deductions and create compliance issues.

Proper structuring from the start simplifies record-keeping and maximizes allowable deductions. This is where collaboration between lending professionals and tax specialists becomes highly valuable.

Property Investment and Financial Coordination

Property investment highlights the importance of coordinated advice. Investors must consider borrowing capacity, interest costs, rental income, depreciation, and future capital gains.

A mortgage structured for investment purposes can improve cash flow and tax efficiency. Meanwhile, sound tax planning ensures that rental income and expenses are reported accurately, depreciation benefits are fully utilized, and capital gains tax is minimized when selling.

Without coordination, investors may miss deductions or face unexpected tax bills that reduce overall returns.

Supporting Business Owners and Self-Employed Individuals

Self-employed individuals often face additional challenges when applying for loans and managing taxes. Income may fluctuate, financial statements are closely scrutinized by lenders, and tax obligations can be complex.

A strategic approach helps present income clearly for loan applications while ensuring tax compliance. Structuring business finances correctly supports both borrowing capacity and long-term sustainability.

Professional advice helps align business income, personal finances, and investment goals into a cohesive plan rather than isolated decisions.

Reducing Financial Stress Through Expert Guidance

Financial stress often comes from uncertainty. Not knowing whether you chose the right loan or whether you are paying more tax than necessary can create ongoing anxiety.

Professional guidance replaces guesswork with clarity. Clear explanations, structured plans, and long-term strategies allow individuals and families to make decisions with confidence.

Rather than reacting to financial problems after they arise, proactive planning reduces risks and creates stability.

Planning for the Future with Confidence

Financial decisions made today shape outcomes years into the future. Whether buying property, expanding investments, or planning retirement, early strategic planning creates more options and fewer constraints later on.

Integrating borrowing decisions with tax planning ensures that each step supports broader financial goals. It encourages disciplined growth, protects income, and helps build long-term wealth responsibly.

Final Thoughts

Smart financial planning is not about finding shortcuts or chasing trends. It is about understanding how key elements such as lending and taxation interact and using expert guidance to make informed choices.

By aligning home loan decisions with effective tax strategies, individuals can reduce unnecessary costs, improve cash flow, and build financial security over time. A thoughtful, coordinated approach turns complex financial decisions into manageable, well-structured plans that support both present needs and future ambitions.