Right then, let’s talk about what’s happening in the world of startup funding today. It’s been a bit of a rollercoaster, hasn’t it? Things are definitely shifting, and keeping up with all the news can feel like a full-time job. We’ve seen some big changes, especially with AI and FinTech, and how investors are looking at things seems to be different now. So, let’s break down some of the key investment news and what it might mean for founders trying to get their ideas off the ground in 2026.

Key Takeaways

- AI infrastructure is really pushing venture debt to new heights, with big money going into the backbone of AI development.

- FinTech is off to a strong start in 2026, with large funding rounds happening, especially for companies working on core financial and security systems.

- Investors are favouring sectors that show clear paths to profit, like enterprise SaaS and FinTech infrastructure, while consumer-focused, high-spending businesses need to prove they can keep customers and make money.

- The trend of smaller funding rounds, or ‘XS rounds’, from last year has made founders more focused on using money wisely, changing how they negotiate with investors.

- Family offices are playing a bigger role in massive ‘mega-rounds’, and founders need to show they’re ready for this level of scrutiny and scale.

Navigating The Evolving Startup Funding Landscape

The world of startups is always on the move, and getting cash for your idea is a big part of that. It’s not quite like it was a few years back; things have definitely changed. We’re seeing a bit of a slowdown in the sheer number of deals compared to the crazy days of 2021 and early 2022. Interest rates are up, inflation is a thing, and investors are just being a bit more careful with their money. It means startups need to be smarter about how they ask for and use funds.

Key Developments in Startup Funding

It’s not all doom and gloom, though. There’s been a noticeable increase in venture capital investment for early-stage companies, especially in tech. This surge is partly down to the buzz around AI and fintech, which are really grabbing attention. We’re also seeing a greater push for diversity and inclusion, with more investors actively looking to back founders from underrepresented groups. This is a good sign for a more balanced startup scene.

- Focus on Profitability: Investors want to see a clear path to making money, not just growth for growth’s sake.

- Operational Efficiency: Startups need to show they can use capital wisely and have strong unit economics.

- Alternative Funding: Methods like revenue-based financing and equity crowdfunding are becoming more popular, offering flexibility.

Understanding The Shift in Investor Momentum

Investors are definitely looking for different things now. The days of throwing money at any idea with a bit of hype are fading. They’re now prioritising businesses that can demonstrate a solid business model and real traction. It’s about building something sustainable. This means founders need to be really clear about their market, their customers, and how they plan to make a profit. It’s less about the ‘big bang’ and more about steady, sensible growth.

The emphasis has shifted from rapid expansion at all costs to a more measured approach, where demonstrating a clear route to profitability and efficient capital deployment are paramount. Founders must now present a compelling case for sustainable growth and robust unit economics to capture investor interest in this more discerning market.

Expert Insights on Securing Capital

What are the experts saying? Well, they’re pretty much on the same page. The general consensus is that the funding environment is more competitive. You can’t just have a good idea; you need to show you can execute it well. This means having a strong plan, understanding your market demand, and having a clear strategy for reaching customers. It’s about proving you’ve got a real business, not just a concept. For those looking for funding, understanding these shifts is key to getting noticed.

| Funding Source | Trend in 2026 |

|---|---|

| Venture Capital | Cautious, focus on profitability and traction |

| Angel Investors | Seeking sustainable growth and market demand |

| Crowdfunding | Growing, offering flexible alternatives |

| Revenue-Based Finance | Increasing popularity for capital control |

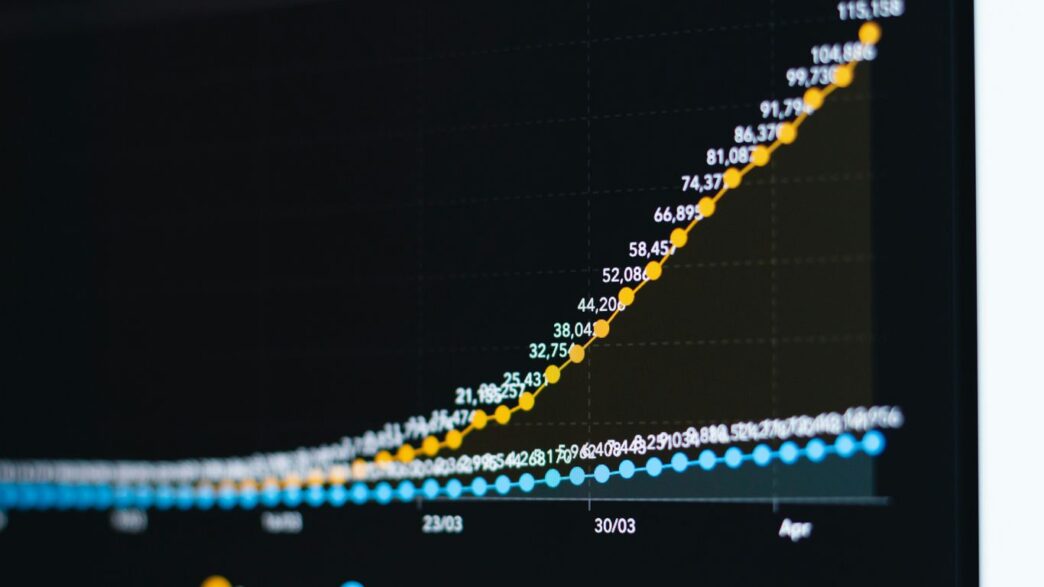

AI Infrastructure Drives Venture Debt Surge

It’s pretty wild how much money is flowing into AI infrastructure right now. We’re seeing venture debt levels hit new highs, and it’s largely because the foundational tech for AI – think data centres, the big learning models, and just getting AI to actually run – needs serious cash. Companies like xAI are pulling in billions, and that’s not just a small loan; it’s a massive facility that shows how much institutional investors are betting on this space. Brookfield Asset Management, for instance, is a big player here, dishing out substantial funds. It feels like the days of small, niche lenders are fading, and these big financial institutions are stepping up to fund the really large-scale AI projects.

How AI Infrastructure Fueled Record Venture Debt

Last year, venture debt in the US really took off, hitting a record $62.4 billion. A huge chunk of that went to AI initiatives. It’s not just about the software anymore; it’s about the physical stuff – the servers, the cooling systems, the sheer power needed to train and run these advanced AI models. This demand for physical infrastructure is what’s drawing in the big institutional money. They see the potential for massive returns, but they also want to see a clear path to scaling.

Institutional Backing for AI Initiatives

We’re seeing a definite shift. Non-bank lenders, which used to be a bit of a side option, are now central to how AI companies get funded. These aren’t just small rounds anymore; we’re talking about significant capital injections.

- Focus on large-scale infrastructure projects within AI.

- Non-bank lenders are now cornerstones of venture debt.

- IP-heavy startups, especially those handling AI data, are prime candidates for bigger checks.

This trend means that if you’re building something in the AI space, especially if it involves complex data handling or requires significant computing power, you’re likely to find more institutional support. It’s a good time to be in this sector, provided you have a solid plan for growth. The hyperscalers are also spending big, with projections showing massive capital expenditures in AI infrastructure over the next few years.

Implications for AI Founders

So, what does this mean for founders? Well, it’s a double-edged sword. On one hand, there’s more capital available than ever before, particularly through venture debt, which can be less dilutive than equity. On the other hand, investors expect a lot. They’re not just looking for a cool idea; they want to see a robust plan for scaling infrastructure and a clear path to profitability.

The sheer scale of investment in AI infrastructure means founders need to think beyond just the technology itself. Operational efficiency, supply chain management for hardware, and energy consumption are becoming just as important as the algorithms.

It’s about demonstrating that your company can handle massive growth and that you understand the operational complexities involved. This focus on infrastructure readiness is shaping how companies are built and funded in 2026.

FinTech Funding Momentum Continues

Promising Start to 2026 for FinTech Investment

It looks like 2026 is shaping up to be a strong year for FinTech, with investment showing real promise right out of the gate. We’ve seen over £1 billion pour into the sector just this week, following a couple of weeks where FinTech deals topped £2.3 billion. Things are definitely picking up speed.

Large Rounds Fueling Activity

A big part of this momentum comes from some seriously large funding rounds. Companies like Upwind, a cloud security firm, and payments specialist Sokin have both bagged over £100 million. Float also managed to secure a nine-figure sum. This trend of big rounds is actually a continuation of what we saw last year, where deals over £100 million jumped by 21%. Investors seem to be concentrating their capital into more established businesses, and that’s clearly carrying over into 2026.

Focus on Core Financial and Security Infrastructure

While the money is spread across various FinTech areas, there’s a clear lean towards firms building the essential financial and security plumbing. Infrastructure and enterprise software are really standing out. Take Upwind, for instance; they raised a massive £250 million Series B to scale their security platform, especially as businesses increasingly rely on AI and real-time cloud applications. Other companies are also getting funding to modernise financial systems and automate back-office tasks. PayTech is also seeing a lot of action, with several companies securing funds to boost payment and financial infrastructure. Even InsurTech is getting a look-in, with firms using new capital to develop AI-driven platforms for things like underwriting and operations. It’s all about building the foundational elements that make the financial world tick.

Investors are really looking for companies that can demonstrate a clear path to making money and growing sustainably. It’s not just about having a good idea anymore; startups need to prove there’s real demand and a solid plan to reach customers.

Sector Preferences Shaping Investment

Right then, let’s talk about where the money’s actually going this year. It’s not just about having a good idea anymore; investors are getting pretty specific about the kinds of businesses they’re backing. We’re seeing a definite split in how different sectors are treated when it comes to funding.

Sectors Attracting Consistent Small Rounds

Some areas are quietly humming along, picking up smaller, more regular investments. Think enterprise SaaS, the nuts and bolts of FinTech, anything that helps with climate issues, and the tech that makes manufacturing tick. These aren’t usually the flashy, headline-grabbing rounds, but they’re steady. It’s like a reliable drip-feed rather than a sudden downpour. This consistency suggests investors see long-term, stable growth potential here, even if the individual cheques aren’t massive. It’s about building solid foundations, not chasing quick wins. These companies are often focused on solving specific business problems, which makes them a safer bet.

Challenges for Consumer Internet and High-Burn Models

On the flip side, if you’re in the consumer internet space or running a business that burns through cash like there’s no tomorrow, things are a bit trickier. Unless you’ve got some seriously impressive numbers to show – like solid profits or a customer base that just won’t leave – you’re going to find it tough to get those big cheques. Investors are really looking at the bottom line now. They want to see that you’re not just spending money to get bigger, but that you’re actually making money and keeping customers happy long-term. It’s a bit of a reality check for some.

The Importance of Profitability and Retention Metrics

So, what’s the takeaway? Profitability and customer retention are king. It’s not enough to just have a cool app or a big user base anymore. You need to prove you can actually make money from those users and that they’ll stick around. Investors are scrutinising burn rates like never before. They want to see that capital is being used wisely, not just thrown at marketing or rapid expansion without a clear return. This means founders need to be laser-focused on their unit economics and demonstrate a clear path to sustainable growth. It’s about building a business that can stand on its own two feet, not one that’s perpetually reliant on external funding. This shift is making the whole startup ecosystem healthier, in my opinion, even if it feels a bit tougher for founders right now. It’s a good time to be looking at companies that are already showing strong revenue generation.

The days of simply projecting future growth and expecting funding are largely behind us. Today’s investors are demanding tangible proof of concept, efficient operations, and a clear route to profitability. Startups that can demonstrate strong customer loyalty and a sound financial model are the ones attracting attention and capital, even if the rounds themselves are smaller than in previous years.

The Impact of XS Rounds on Founder Strategy

The funding landscape in 2025 saw a significant shift towards what are often called ‘XS’ rounds – smaller, more focused capital injections. This wasn’t necessarily a sign of funding drying up, but more of a structural change in how investors were deploying capital. For founders, this meant a real adjustment in how they approached fundraising and, consequently, how they ran their businesses.

How XS Rounds Influenced Founder Behaviour

When large funding rounds became less common, startups had to get smarter about their money. Instead of raising big cheques to fuel rapid, sometimes unchecked, growth, founders started focusing on making every pound count. This meant slowing down hiring, being more careful with marketing budgets, and really prioritising product features that would directly lead to revenue or keep existing customers happy. It was about building a more solid foundation.

- Capital Efficiency as a Design Principle: Companies began designing their operations with lean spending in mind from the outset, rather than as a reaction to funding scarcity.

- Extended Runway: Many startups opted for smaller rounds to simply extend their operational runway, giving them more time to hit key milestones before needing a larger investment.

- Focus on Metrics: The emphasis shifted heavily towards demonstrating tangible progress, like revenue growth, customer retention, and profitability, rather than just future potential.

Capital Efficiency as a Design Principle

This new reality forced a fundamental rethink. Startups that had previously relied on consistent injections of cash to scale quickly found themselves needing to adapt. The focus moved from ‘growth at all costs’ to ‘sustainable growth’. This meant scrutinising every expense and ensuring that any capital raised was directly contributing to the company’s long-term viability. It’s a more disciplined approach, and frankly, one that builds stronger businesses in the long run. Founders who managed to keep their burn rates low during this period found themselves in a much stronger negotiating position when it came time to raise again, even if the cheque sizes remained modest. This is a key part of optimising financial outcomes.

Negotiation Dynamics in the Current Market

With founders operating more leanly and demonstrating better control over their finances, the power dynamic in negotiations has subtly shifted. Instead of founders feeling pressured to accept less favourable terms just to secure funding, they can now enter discussions from a more stable footing. The conversation often moves beyond just valuation to encompass strategic alignment and how the investor can genuinely add value beyond capital. This is a welcome change for many, leading to more balanced partnerships.

The prevalence of smaller funding rounds in 2025 has reshaped founder behaviour, making capital efficiency a core operational strategy rather than a reactive measure. This shift is leading to more disciplined business practices and altered negotiation dynamics as 2026 progresses.

Regional VC Trends and Foodtech Valuations

It’s interesting to see how venture capital money is moving around these days, especially when you look at different parts of the country and specific industries like foodtech.

North Carolina’s Shifting VC Momentum

North Carolina used to be a bit of a hotspot for startup funding, but things have changed. In 2025, startups there only managed to raise about $2.3 billion, which was a pretty big drop – around 40% less than the year before. This meant they slipped from being the 7th best state for funding down to 15th. While the biotech and software scenes are still solid, they aren’t making as much of a splash on the national stage anymore. It’s a bit of a wake-up call, really, showing how much a region can be affected if it relies too heavily on just a few types of businesses. Founders in the area might need to think about spreading their bets a bit more and working with others to cushion any blows.

- Keep investing in software and biotech, but also look at related fields.

- Try working with companies in other states to get access to more money.

- Develop projects that can be scaled up and appeal to a wider range of investors.

The dip in North Carolina’s VC funding highlights the need for regional diversification and adaptable partnerships to maintain momentum in the startup ecosystem.

Navigating Foodtech Valuations and Exit Challenges

When it comes to foodtech, the picture is a bit mixed. On one hand, the average valuation for these companies has shot up – we’re talking a 58% increase, hitting $25.8 million before they even get funding. The average amount of money they’re getting in each deal has also gone up to $3.7 million. That sounds great, right? But here’s the catch: the number of companies actually being bought out or going public, known as exits, has really dried up. In 2025, only about $287.7 million was reported from these exits. This suggests investors are more keen on putting more money into companies that are already doing well and growing, rather than taking chances on brand new ideas. For anyone starting a foodtech business today, it means you really need to focus on how your product can be made and delivered on a large scale, perhaps by looking at sustainable ingredients or better logistics.

Strategies for Foodtech Startups

So, what does this all mean for foodtech founders? It’s about being smart and strategic.

- Aim for established hubs: Try to get your funding in areas where there’s already a lot of activity and bigger funding rounds are common.

- Focus on the nuts and bolts: Put your energy into technologies for getting food from A to B or into new ways of creating ingredients.

- Show results, fast: You’ll need to prove your idea works and can grow quickly to get the best possible valuation. This means demonstrating tangible progress from the get-go.

Family Offices and Mega-Round Investments

The Role of Billionaire Family Offices

It’s interesting to see how the big money players, the billionaire family offices, are adjusting their strategies this year. They’re apparently cutting back on the number of direct investments they’re making – by about 32% compared to last year, which is quite a chunk. But here’s the kicker: they’re still very much in the game for those massive, mega-rounds. Think of those huge Series D rounds, like the $257 million that Cellares managed to pull in. It seems like they’re not just throwing money around randomly anymore. Instead, they’re making these really focused, big bets on a select few companies that are already quite far along in their development. It’s less about spreading the risk thinly and more about putting significant capital behind ventures they believe have a strong chance of succeeding on a large scale.

Fitting Into 2026 Mega-Rounds

So, if you’re a startup founder hoping to catch the eye of one of these powerful family offices for a mega-round, what does that mean for you? Well, it means you can’t just show up with a good idea. You need to demonstrate that you’ve already achieved significant scale, or at least have a very clear, visual plan for how you’re going to get there. They’re looking for companies that are ready to operate at a much larger level. It’s about showing them you’ve got the infrastructure, the market traction, and the strategic roadmap to justify such a substantial investment. Think about it like this: they want to see a company that’s already built a solid foundation and is just waiting for the final push to become a major player.

Here’s a quick rundown of what founders should consider:

- Demonstrate Scalability: Have clear metrics and plans showing how your business can grow significantly.

- Show Market Readiness: Prove you understand your market and have a solid strategy for capturing it.

- Build a Strong Team: Investors want to see experienced leadership capable of managing rapid growth.

- Financial Prudence: Even for mega-rounds, showing capital efficiency is increasingly important.

Investor Expectations for Mega-Round Candidates

What are these investors actually looking for when they consider putting tens or even hundreds of millions into a single company? It’s not just about the potential for a big return, though that’s obviously key. They’re scrutinising the business model, the management team, and the competitive landscape with a fine-tooth comb. They want to see a company that has already navigated some tough challenges and come out stronger. Profitability, or at least a very clear and achievable path to it, is becoming non-negotiable. They’re also keen on seeing strong retention metrics – proof that customers stick around and value what you offer. It’s a more mature, more demanding approach to investment than we’ve seen in previous boom times.

The shift towards concentrated bets in mega-rounds by family offices signals a maturing investment landscape. Founders need to present a compelling narrative of proven scalability and a robust plan for sustained growth, moving beyond just a promising concept to demonstrating tangible market impact and operational readiness. This focus on capital efficiency and clear profitability pathways is reshaping how late-stage funding is secured.

It’s a bit like preparing for a marathon rather than a sprint. You need to show you’ve trained properly, you’ve got the stamina, and you know exactly how to pace yourself to reach the finish line – and win.

Founders and Investors: Expectations for 2026

So, what’s the general vibe for founders and investors as we move through 2026? It feels like the days of just throwing money at any idea are pretty much over. Last year, 2025, really acted like a filter. Startups that managed to get funding then, especially those smaller, more focused rounds, are the ones looking stronger now. They learned to be really careful with their cash, which is a good thing, honestly.

What Founders Should Expect Next

Founders, you’ve got to be ready for a more disciplined approach. The big, splashy rounds? They’re still happening, but only for companies that have really shown they can deliver results, not just talk about them. Think of those smaller rounds from last year not as a sign of weakness, but as a chance to prove your business model works. It’s about building solid foundations.

- Focus on Profitability: Investors are looking closely at your numbers. Can you actually make money, and are customers sticking around?

- Capital Efficiency is Key: Every pound spent needs to count. This means smarter hiring, more targeted marketing, and product development that directly impacts revenue.

- Realistic Valuations: Forget the sky-high valuations of a few years back. Be prepared for discussions that are grounded in your actual performance.

Investor Strategies for Phased Deployment

Investors aren’t just handing out cheques anymore. They’re being much more selective. They want to see progress before they commit more significant capital. It’s like a staged approach – you earn the next bit of funding by hitting certain milestones. This means they’re spreading their investments across more companies but putting less money into each one initially. It reduces their risk and gives them time to see which companies really have legs.

The shift towards smaller, more frequent funding rounds means founders need to demonstrate consistent execution and a clear path to profitability. Investors, in turn, are adopting a more patient, phased deployment strategy, reserving larger capital commitments for companies that consistently prove their value and operational discipline.

The Era of Earned Capital

Basically, the easy money days are behind us. We’re now in what you could call the ‘earned capital’ era. Companies need to show they’ve earned investor confidence through solid performance, not just by having a flashy idea. This might mean slower growth in some cases, but it’s building a more sustainable startup ecosystem for the long run. It’s a tougher market, sure, but the companies that come through will be the ones built to last.

Wrapping Up: What’s Next for Startups?

So, that’s a look at what’s been happening with startup funding lately. It’s clear things are shifting, with investors really looking for solid plans and a clear way to make money. It’s not just about having a cool idea anymore; you’ve got to show people you can actually build something that lasts and that customers want. Keep an eye on these trends, especially in areas like AI and fintech, as they’re getting a lot of attention. For founders, this means being smart about your strategy and proving you can deliver. It’s a competitive scene, but with the right approach, there are still plenty of opportunities out there.

Frequently Asked Questions

What is the biggest change in startup funding for 2026?

The biggest change is that investors now want to see clear plans for making money and growing steadily. Startups can’t just have a cool idea; they need to show real demand from customers and a strong plan for getting their product out there.

Why are AI startups getting so much funding?

AI startups are attracting a lot of money because they build important technology that other companies rely on. Big investors are excited about AI’s future, so they’re giving huge loans and investments to help these companies grow faster.

How are FinTech companies doing in 2026?

FinTech companies are off to a great start this year. They’re raising a lot of money, especially those focused on making financial systems safer and faster. Investors like FinTech because it helps people and businesses handle money better.

What sectors are struggling to get funding right now?

Companies that spend a lot without making profits, like some online consumer businesses, are finding it hard to get money. Investors now prefer startups that can keep customers and make a profit, not just those growing quickly.

How are small funding rounds (XS rounds) changing startup strategy?

Smaller funding rounds are making founders more careful with spending. Startups are hiring less, spending less on ads, and focusing on making money sooner. This means they can wait longer before raising more money, and they have stronger positions when talking to investors.

What should founders expect from investors in 2026?

Founders should expect investors to be pickier and to give money in steps. Investors want to see good results before giving more. Startups need to prove they can use money wisely and grow in a smart way.