The world of venture capital is always changing, and 2025 looks like it’s going to be a big year for updates. Things like new tech, how founders are working, and what investors want are all shifting how money gets invested and how startups grow. We’re seeing a lot of new trends emerge, and keeping up with the latest venture capital news is key for anyone involved. Here are some of the big changes to watch out for.

Key Takeaways

- Look for specialized microfunds. Instead of general investors, many are now focusing on specific areas like AI tools or climate tech. Founders should find funds that really get their industry, and investors might do better by specializing.

- AI is changing how venture capital works. It’s being used to find deals, check out companies, and even help with paperwork. While people are still important, using AI can make things faster and more efficient.

- Sectors like healthcare, finance tech (fintech), and green technology are getting a lot of attention. These areas, along with general technology and innovation, are where much of the investment money is flowing.

- Corporate venture capital is becoming more important. Big companies aren’t just investing for money; they’re looking for new ideas and ways to improve their own businesses. They’re also partnering more closely with startups.

- Investors are looking at the whole picture, not just one part. They’re focusing on supporting founders, making sure companies are sustainable, and using different ways to fund projects. Using data and AI helps make better decisions.

Navigating The Evolving Venture Capital Landscape

The Pivotal Year Of 2025

Alright, let’s talk about 2025. It’s not just another year on the calendar for venture capital; it feels like a real turning point. Things are changing, and fast. We’re seeing new tech pop up, founders are thinking differently about how they build companies, and the people who invest their money (LPs) have new expectations. All of this means how money gets raised, where it goes, and how investors get their returns is being reshaped. It’s a dynamic environment, and staying on top of it is key.

Shifting Investment Strategies

Investors are getting more selective. Gone are the days of just throwing money at anything that looks promising. There’s a noticeable move towards more focused investment. Instead of broad, generalist funds, we’re seeing a rise in smaller, specialized funds that really know their stuff in a particular area. Think funds dedicated solely to climate tech or AI-powered business tools. This specialization allows them to bring deeper knowledge and better connections to the table.

Here’s a look at how strategies are changing:

- Sector Specialization: Funds are narrowing their focus to specific industries like healthcare, fintech, or sustainable energy.

- Data-Driven Decisions: AI and advanced analytics are becoming standard tools for spotting deals and checking out companies, moving beyond just gut feelings.

- Founder Focus: There’s a greater emphasis on supporting founders, offering more flexible terms and resources to help them succeed.

Founder-Investor Alignment

It’s becoming increasingly important for founders and investors to be on the same page. The old model where investors just wrote checks and expected big returns is evolving. Now, there’s a bigger push for genuine partnership. This means investors are looking at how they can actively help startups grow, not just financially, but also by providing mentorship, access to networks, and even support for founder well-being. This shift towards a more collaborative relationship is creating stronger, more resilient companies. When both sides are working towards the same goals, with clear communication and shared vision, the chances of success go way up. It’s about building something together, not just a transaction.

Key Venture Capital Trends For 2025

The venture capital world is always on the move, but 2025 is shaping up to be a year where some really distinct shifts are happening. It’s not just about throwing money at the next big thing anymore; investors are getting smarter and more focused. Here are a few of the big trends we’re seeing:

The Rise Of Sector-Specific Microfunds

Forget the days of generalist funds trying to be experts in everything. In 2025, we’re seeing a big move towards smaller, specialized funds. These microfunds are really digging deep into specific industries, like climate tech, AI tools for businesses, or even niche areas within healthcare. They bring a level of focused knowledge and connections that larger, broader funds just can’t match.

- Deep Industry Knowledge: These funds have teams that truly understand the ins and outs of a particular sector.

- Targeted Networks: They often have strong relationships with key players, customers, and talent within their niche.

- Faster Decision-Making: Being smaller and more focused can sometimes mean quicker investment decisions.

Founders should really think about finding funds that speak their industry’s language. For investors, specializing can be a way to stand out and potentially find better deals.

AI’s Transformation Of The VC Playbook

Artificial intelligence isn’t just a sector to invest in anymore; it’s becoming a tool that VCs themselves are using to change how they operate. AI is fundamentally altering how deals are found, evaluated, and managed. Think about it: AI can sift through thousands of pitch decks, analyze market data in ways humans can’t, and even help predict which startups have the best shot at success. It’s about making the whole process faster and more accurate.

- Deal Sourcing: AI tools can scan vast amounts of data to identify promising companies early on.

- Due Diligence: AI can help analyze financial documents, market trends, and even team dynamics to flag potential risks or opportunities.

- Portfolio Management: Some firms are using AI to track portfolio company performance and identify areas where support might be needed.

While human insight is still key, firms that don’t adopt these AI tools are likely to fall behind in terms of speed and efficiency.

Corporate Venture Capital’s Strategic Evolution

Corporate Venture Capital (CVC) is stepping up its game. It’s not just about financial returns anymore. Corporations are increasingly using their venture arms to gain strategic advantages, like getting early access to new technologies or building partnerships that can benefit their core business.

- Strategic Partnerships: CVCs are looking for startups that can help their parent company innovate or expand into new markets.

- Access to Innovation: Investing in startups gives corporations a window into cutting-edge developments.

- Internal Improvement: Many CVCs are investing in AI and other technologies that can also improve their parent company’s operations.

This shift means CVCs are becoming more collaborative partners, offering more than just capital. They bring industry expertise and potential pathways to market that can be incredibly valuable for startups.

AI And Data Analytics In Investment Decisions

It feels like everywhere you look these days, AI and data analytics are being talked about, and venture capital is no exception. Honestly, it’s changing how firms find and pick companies to invest in. It’s not just about gut feelings anymore; it’s about crunching numbers and letting algorithms do some of the heavy lifting.

AI-Powered Deal Sourcing And Diligence

Think about it: VCs used to spend ages sifting through mountains of information, trying to spot the next big thing. Now, AI tools can scan vast amounts of data – think market trends, news articles, even social media chatter – to flag startups that show promise. It’s like having a super-powered assistant who never sleeps. This helps them find opportunities they might have missed otherwise. When it comes to checking out a company, AI can also speed things up. It can analyze financial reports, look at competitor landscapes, and even assess the team’s background, all much faster than a human could. This means less time spent on tedious tasks and more time focusing on the truly innovative companies.

Data-Driven Investment Strategies

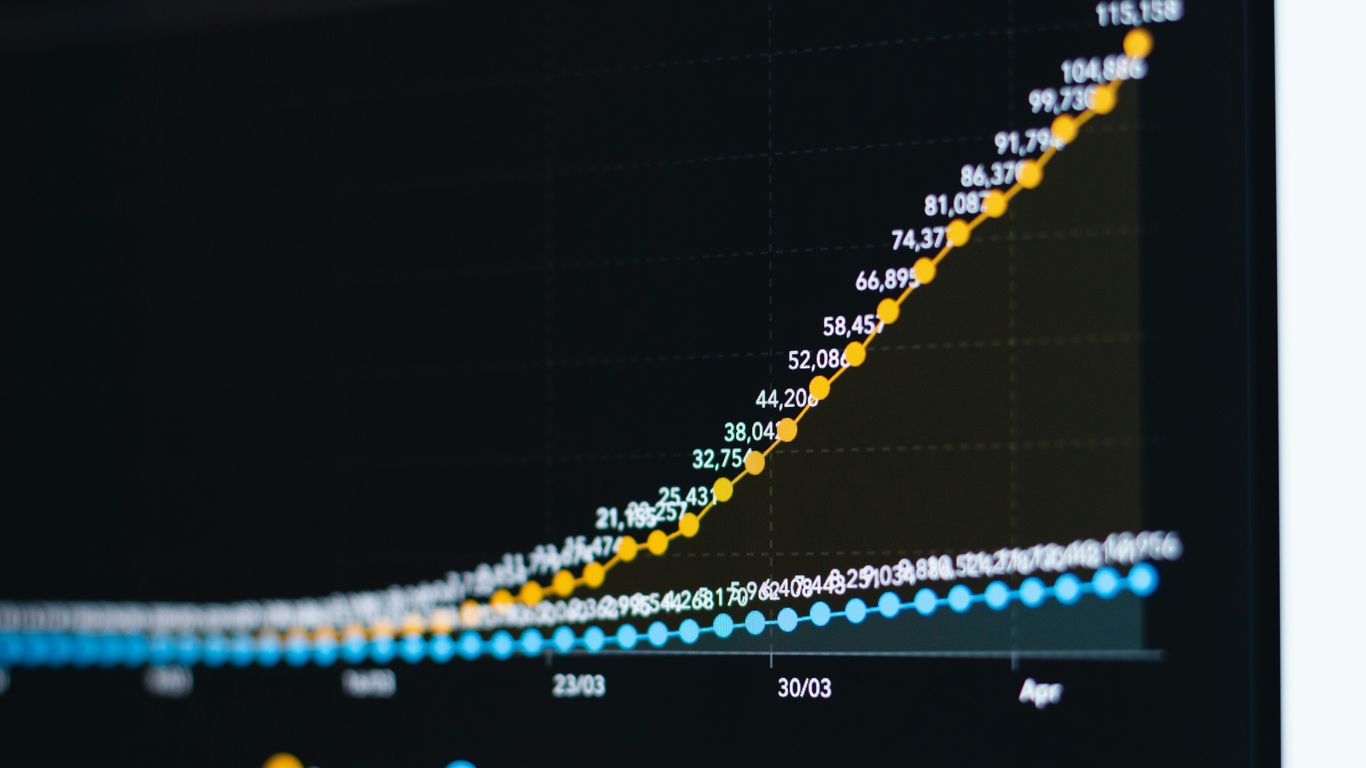

Beyond just finding deals, data analytics is reshaping the whole investment strategy. Instead of relying solely on past performance or industry buzz, firms are building models to predict future outcomes. They’re looking at things like user growth patterns, engagement metrics, and even sentiment analysis to get a clearer picture of a startup’s potential. This approach helps reduce personal biases that can creep into decision-making. It’s about making choices based on what the data is actually telling you, not just what you think is true.

Here’s a quick look at how data is being used:

- Identifying Trends: Spotting emerging market shifts before they become obvious.

- Risk Assessment: Quantifying potential downsides and understanding market saturation.

- Portfolio Monitoring: Keeping a close eye on how existing investments are performing in real-time.

Enhancing Efficiency And Accuracy

Ultimately, the goal here is to make better, faster decisions. By automating parts of the deal sourcing and due diligence process, VCs can handle more potential investments without needing to exponentially grow their teams. This efficiency gain is huge. Plus, by relying on data, the accuracy of their assessments should, in theory, improve. It’s not about replacing human judgment entirely, but about augmenting it with powerful tools. This allows investors to be more strategic and less bogged down in the day-to-day grind of information gathering.

Emerging Sectors Attracting Venture Capital

Alright, so where’s all that venture capital money actually going in 2025? It’s not just a free-for-all; VCs are getting pretty specific about where they see the biggest returns. While tech and innovation are still king, a few other areas are really starting to shine.

Technology and Innovation at the Forefront

This one probably isn’t a shocker. Technology and innovation continue to grab a huge chunk of the VC pie. Think AI startups, cybersecurity solutions, and anything that makes remote work smoother. It’s a crowded space, for sure, and things move fast. But VCs are still betting big on companies that look like they can really shake things up. They’re not just throwing money around; they’re looking for that disruptive potential. It’s pretty cool to see how these focused investments are pushing the boundaries of what’s possible.

Healthcare and Fintech Investment Surges

Healthcare and financial technology, or fintech, are seeing some serious attention. In healthcare, it’s not just about new drugs; it’s also about the tech that makes patient care better, more accessible, or more efficient. Think digital health platforms, AI for diagnostics, and personalized medicine. On the fintech side, the focus is on making financial services easier to use and more inclusive. This includes everything from new payment systems to tools that help people manage their money better. The market in Canada, for example, has shown signs of renewed growth, with VCs engaging more thoughtfully with startups in these areas.

Sustainability and Climate Tech Momentum

This is a big one, and it’s only getting bigger. Investors are increasingly looking for companies that are trying to solve environmental problems. This could be anything from developing cleaner energy sources to creating more sustainable materials or improving carbon capture technology. It’s not just about doing good; there’s a real business case here too, as more consumers and businesses demand eco-friendly options. This sector is definitely one to watch as we move through 2025.

The Growing Influence Of Corporate Venture Capital

CVCs As Strategic Partners

Corporate venture capital (CVC) is really changing how big companies think about investing. It’s not just about making money anymore, though that’s still important. Now, it’s much more about finding ways to help the main company grow and stay on top of new ideas. Think of CVCs less like a bank and more like a smart friend who knows a lot about new tech and markets. They’re looking for startups that can bring something new to the table, whether it’s a cool technology or a fresh approach to a problem.

This shift means CVCs are becoming key players in pushing innovation forward. They’re not just handing over cash; they’re offering connections, industry know-how, and sometimes even a direct path to working with the parent company. This can be a huge advantage for startups that might struggle to get the attention of larger, more traditional businesses. It’s a win-win: startups get support and a potential big customer, and the corporation gets a front-row seat to the next big thing.

AI Focus In CVC Investments

Artificial intelligence is a big deal for CVCs right now. It’s not just a sector they’re investing in, but also a tool they’re using to get better at their own jobs. Many CVCs are putting a lot of their money into AI companies because they see huge potential for growth. Plus, by investing in AI, corporations can get early access to technologies that could help them improve their own products and services. It’s like getting a sneak peek at the future.

Here’s a quick look at how AI is impacting CVCs:

- Deal Sourcing: AI tools can sift through tons of information to find promising startups much faster than humans can.

- Due Diligence: AI can help analyze data and identify potential risks or opportunities in a startup’s business model.

- Internal Operations: AI-powered note-takers and data management systems are making CVC teams more efficient, freeing them up to focus on building relationships and making smart decisions.

Collaborative Partnerships With Startups

Forget the idea of startups just being disruptive forces that big companies need to fend off. CVCs are increasingly seeing these agile young companies as partners. Instead of fearing disruption, they’re embracing it. By teaming up with startups, corporations can get a taste of that innovative spirit and integrate new ideas into their own operations. It’s about working together to create something better than either could do alone.

This collaborative approach is changing the game. It’s not just about financial returns anymore; it’s about building relationships and sharing knowledge. Corporations are looking for startups that can complement their existing strengths, and startups are finding that partnering with a CVC can provide them with resources and market access they wouldn’t find elsewhere. This mutual benefit is what makes the CVC model so powerful in today’s fast-moving market.

Adapting To The Future Of Venture Capital News

So, the venture capital world is always buzzing, right? But 2025 feels like it’s really picking up speed. It’s not just about chasing the next big thing anymore; it’s about understanding the deeper shifts happening. Founders and investors alike need to get a handle on these changes to stay relevant.

Founder Empowerment And Sustainability

Founders are getting smarter about who they partner with. They’re looking beyond just the cash. There’s a growing demand for investors who offer real support, mentorship, and a shared vision for long-term growth, not just a quick exit. This means VCs need to be more than just money bags; they’ve got to be genuine partners. Plus, with climate change and social issues front and center, sustainability isn’t just a buzzword anymore. It’s becoming a core part of what makes a startup attractive. Investors are increasingly looking at Environmental, Social, and Governance (ESG) factors. It’s about building companies that are good for the planet and society, not just the bottom line.

Holistic Investment Approaches

We’re seeing a bit of a blurring of lines. Venture capital is starting to look more like private equity in some ways, with a longer-term view. It’s not just about seed or Series A rounds; it’s about how a company grows and sustains itself over many years. This means VCs are thinking more about the entire lifecycle of a startup, from its very beginnings to its eventual maturity. They’re also looking at how different asset classes can work together. It’s a more rounded way of thinking about investment.

Leveraging Alternative Funding Models

While traditional VC is still around, it’s not the only game in town. We’re seeing a rise in different ways for startups to get funded. Think about revenue-based financing, crowdfunding, and even grants specifically for certain types of innovation. These alternative models can be a lifesaver for founders who might not fit the typical VC mold or who want to retain more control. It’s about having options and choosing the funding path that best suits the company’s specific needs and goals. This flexibility is key in today’s fast-changing market.

Wrapping It Up: What’s Next for Venture Capital?

So, looking at everything, 2025 is shaping up to be a really interesting year for venture capital. It’s not just about having the most money anymore; it’s about being smart, connected, and really understanding what founders need. We’re seeing a big push towards specialized funds that know their stuff inside and out, and AI is becoming a standard tool, not just a fancy extra. For founders, this means finding the right partners who get your niche. For investors, it’s about getting specialized or using these new tools to spot the next big thing faster. It feels like a time for smart moves and solid execution, and we’re excited to see how it all plays out.

Frequently Asked Questions

What’s new in venture capital for 2025?

Get ready for big changes! In 2025, venture capital is getting more focused. Instead of big, general funds, we’re seeing smaller, specialized funds that know a lot about one specific area, like health tech or green energy. Also, artificial intelligence (AI) is becoming super important for finding good deals and making smart investment choices.

How is AI changing how venture capitalists invest?

AI is like a super-smart assistant for investors. It helps them look through tons of company information much faster to find promising startups. AI can also help predict which companies might do well. This means investors can make decisions more quickly and with more confidence.

What kinds of companies are venture capitalists interested in funding in 2025?

Tech and new ideas are still hot! But there’s also a lot of excitement around companies that help with health and money matters (fintech). Plus, businesses that focus on being good for the planet, like clean energy and fighting climate change, are getting a lot of attention.

What is Corporate Venture Capital (CVC) and why is it important?

Corporate Venture Capital, or CVC, is when big companies invest their own money in smaller startups. In 2025, these big companies aren’t just looking to make money; they want to partner with startups to get new ideas and technologies for their own businesses. They’re often using AI too, and they like working closely with founders.

What does ‘founder-investor alignment’ mean?

This means making sure that both the people who start the company (founders) and the people who give them money (investors) want the same things and are working together. In 2025, investors want to be sure they truly understand and support the founders’ vision, leading to better teamwork and success.

Are there new ways for startups to get money besides traditional venture capital?

Yes! While traditional venture capital is still around, startups are looking at other options. This could include working with corporate investors who offer more than just cash, or using different kinds of funding models that might be more flexible or better suited to their specific needs.