Keeping up with the fast-paced world of electronic components can feel like a full-time job. Things are always changing, from what’s available to what’s new and exciting. This article dives into the latest electronic component news and trends, hoping to shed some light on what’s happening now and what to expect.

Key Takeaways

- Global supply chain disruptions from past events continue to affect component availability and pricing, making consistent sourcing a challenge.

- The booming demand for AI, EVs, and automation is putting immense pressure on semiconductor supply, particularly for specialized chips and GPUs.

- Geopolitical issues and trade tensions are adding complexity and cost to sourcing, forcing manufacturers to re-evaluate supplier strategies.

- Emerging trends like advanced materials, organic electronics, and AI in manufacturing are shaping the future of product design and production.

- Building supply chain resilience requires smarter inventory planning, adaptable designs, better data use, and strong relationships with distributors.

Navigating Electronic Component Shortages

It feels like we’ve been talking about component shortages forever, right? While things aren’t as chaotic as they were a couple of years ago, getting your hands on certain parts is still a bit of a headache. Prices can jump around, and lead times can still stretch out longer than you’d like. It’s not just a simple fix; there are a few big things making it tough.

Lingering Impacts of Global Disruptions

Remember all the shutdowns from a few years back? Those disruptions really messed with production schedules and forecasting. Even though factories are mostly back up and running, the supply chain is still playing catch-up. Think of it like a traffic jam that’s slowly clearing but still causes delays. Some parts, especially those that take a long time to make or only come from one place, are still hard to get. We’re still dealing with orders that don’t quite match up and old demand predictions that don’t fit today’s reality.

AI and Industry Demand Driving Scarcity

So, what’s gobbling up all the chips now? Well, the usual suspects like cars, phones, and factory automation are still big buyers. But now, the AI boom and data centers are in the mix, all needing the same specialized chips and GPUs. These big players are often locking in supply contracts way in advance, sometimes months or even years ahead. This makes it tough for smaller companies or those with less predictable needs to get what they require when they need it. It’s like a few big customers have reserved all the best seats at the restaurant.

Geopolitical Factors Affecting Supply Chains

On top of everything else, global politics keeps throwing curveballs. Trade tensions, especially between major economic powers, are making components more expensive and harder to track down. Tariffs and changing regulations can suddenly make certain parts off-limits or much pricier. This uncertainty means companies have to constantly rethink where they get their parts and how they budget for them. Building new factories or expanding existing ones isn’t a quick fix either; it takes a long time and needs a lot of skilled workers, which are also in short supply. So, even with big investments, relief isn’t immediate. This means we all need to be smarter about how we plan and source our components.

Emerging Trends in Electronics Manufacturing

The world of electronics manufacturing is always on the move, and right now, a few big shifts are really changing things. It’s not just about making more stuff faster; it’s about making it smarter, with new materials, and in new places.

Advanced Electronic Materials and Organic Electronics

We’re seeing a move towards using new kinds of materials in electronics. Think about organic electronics – basically, using carbon-based compounds. This isn’t just a niche thing anymore. These materials can make electronics more flexible, lighter, and sometimes even biodegradable, which is a big deal for sustainability. Companies are developing new materials for things like flexible displays and more efficient solar cells. It’s a way to create devices that are not only high-performing but also kinder to the planet. Plus, using these materials can sometimes mean using more readily available resources, which is a nice bonus.

The Rise of AI and IoT in Manufacturing

Artificial Intelligence (AI) and the Internet of Things (IoT) are really starting to show up in factories. AI isn’t just for analyzing data; it’s helping to improve the actual manufacturing process. Think predictive maintenance, where machines can tell you they need fixing before they break down, cutting down on unexpected downtime. IoT devices, meanwhile, connect all the machines and sensors on the factory floor, creating a constant stream of data. This data can then be used by AI to optimize production lines, reduce errors, and generally make things run smoother. It’s like giving the factory a brain and a nervous system.

Miniaturization and Advanced IC Packaging

Everything seems to be getting smaller, right? That’s definitely true in electronics manufacturing. We’re constantly pushing the limits of how small we can make components, especially integrated circuits (ICs). This isn’t just about shrinking things down; it’s about advanced packaging techniques. Think about how multiple chips can be stacked or interconnected in very tight spaces. This allows for more powerful devices in smaller form factors, which is key for everything from smartphones to medical devices. It’s a complex area, but it’s what allows for the powerful, pocket-sized tech we rely on today.

The Evolving Semiconductor Landscape

The world of semiconductors is in constant flux. Sometimes, it feels like you just figure out the last big change, and then everything shifts again. 2025 has been no different, with some shifts so big you can’t ignore them, and others that sneak up until they’re suddenly a huge deal for your team or your supply chain.

Hyperscalers and GPU Innovation

AI has made hyperscaler companies and GPU designers the main headline in chip news, grabbing attention from almost everyone. With tech giants racing to add more AI muscle to their services, there’s a boom in demand for better, faster GPUs and custom accelerators. Here’s what this means in real terms:

- Hyperscaler firms (think Amazon, Google, Microsoft) are scooping up massive volumes of server chips, especially those built for AI workloads.

- Advanced GPUs and custom silicon like ASICs are pushing foundries to their limits, leaving less capacity for more "standard" chips.

- Smaller manufacturers, or those not focused on cutting-edge computing, often scramble to source basic analog, memory, or processor chips because everything’s backlogged.

So, while lots of attention is on the AI gold rush, everyday needs for all sorts of industries aren’t going away.

Workhorse Technologies for Manufacturers

You’d think all the industry hype is about the latest and greatest tech. But for many manufacturers—especially in healthcare, industrial controls, and aerospace—the chips that keep their equipment running aren’t new at all. Here are some clear challenges:

- "Mature-node" chips—made with older manufacturing processes (up to 28nm)—are still critical for these sectors.

- These chips are often overlooked by large foundries chasing higher profits on advanced designs.

- When factories retool or shut down old production lines, it gets harder, not easier, to keep legacy machines humming along.

| Year | Global Mature-Node Demand (%) | Advanced Node Demand (%) |

|---|---|---|

| 2023 | 61 | 39 |

| 2024 | 58 | 42 |

| 2025 (est.) | 55 | 45 |

(Mature-node chips are still over half the market by demand, and play a much bigger role outside consumer devices.)

Component Obsolescence and EOL Management

The other big headache for manufacturers is just keeping old (but vital) chips in stock. End-of-life (EOL) notices can show up with little warning, and all of a sudden everyone is scrambling. Here’s what it really looks like:

- A chip goes EOL but your production or service hardware needs it for years to come.

- Finding a last-minute stockpile is tough and prices can skyrocket overnight.

- You might have to redesign—sometimes entirely—just to swap in a new component, which isn’t always possible for regulated industries.

There are now literally hundreds of thousands of parts being phased out each year. For anyone with long-lived products in the field, managing these changes is now a non-stop job.

The upshot? Even as the spotlight shines on fancy GPUs and the AI chip wars, most of the electronics world is just trying to keep reliable, affordable silicon flowing. If you’re not worrying about the hottest tech, you’re probably busy making sure last year’s chip isn’t this year’s hidden crisis.

Strategies for Supply Chain Resilience

Okay, so the electronic component shortages aren’t exactly a thing of the past, even now in 2025. Lead times have gotten a bit better since the really bad days, but prices can still jump around, and finding parts can still be a headache. It feels like every industry is trying to grab the same chips for AI, electric cars, and new automation gear. For the rest of us, it’s about staying stocked.

The electronics supply chain isn’t just back to normal. To keep your projects moving, you really need to get what’s causing the current pressure – and figure out how to get ahead of the next wave. Building a resilient supply chain in electronics manufacturing requires integrating risk management into daily operations. This proactive approach helps manufacturers anticipate and mitigate potential disruptions, ensuring smoother and more reliable production processes. By embedding risk assessment into routine tasks, companies can better navigate the complexities and uncertainties inherent in global supply chains.

Smarter Inventory Planning and Buffer Stock

With component shortages still a thing, having some extra stock on hand is pretty much standard now. Trying to guess demand and grabbing parts with long lead times early on can make the difference between hitting your product launch date or missing it by months. This doesn’t always mean just buying more stuff. It means buying smarter: planning around what’s happening with component supplies, adding extra time for delays, and focusing on the parts that are the hardest to replace. Teams that are proactive have more wiggle room when unexpected things pop up.

Enhancing Design Flexibility for Sourcing

If a part becomes hard to find, can your design team switch gears quickly? Or at all? Looking at your designs to see if you can use more common or alternative parts can stop sourcing delays from turning into missed deadlines. Get your engineers involved in buying talks early so they can spot options before problems start. Even small changes to a design can make it easier and faster to find parts.

Leveraging Data for Proactive Risk Management

Old spreadsheets just don’t cut it when parts disappear overnight. Tools that track components and their lifecycles help you see risks earlier, before they slow you down. Getting real-time info on what’s available, if it meets rules, and if it’s going to be obsolete lets you plan around gaps instead of just reacting to them.

Strengthening Distributor Relationships

When parts get scarce, your position in line matters. For OEMs, having good relationships with distributors often means getting early warnings about risks, finding better alternatives, and getting more reliable access to stock. Keep in touch regularly and think of your distributor as part of your team, not just someone you call at the last minute.

Geographic Shifts in Component Sourcing

Okay, so the global map for where electronic components come from is definitely changing. It’s not like everything’s moving overnight, but there are some big shifts happening. For a long time, East Asia, especially China, Taiwan, and South Korea, was the main place for pretty much everything. But with all the disruptions we’ve seen lately, plus trade stuff and other global events, companies are realizing they can’t put all their eggs in one basket.

Regional Assembly Growth and Sourcing Hubs

This is leading to more manufacturing popping up in places like India, Vietnam, and Mexico. It’s not that China is out of the picture – far from it, they’re still huge for things like PCBs and basic assembly. But now, companies are spreading things out. For example, you might see a company splitting their PCB orders between China and Taiwan, and then having a backup assembly plant in Vietnam. Mexico is also getting a lot more attention, especially for car parts and appliances, because it’s so close to the US. This kind of multi-sourcing is becoming the norm, and it’s a good way to build a more stable supply chain.

Emerging Pricing Differences Across Regions

As these new manufacturing hubs grow, we’re starting to see some differences in pricing. Components that are assembled closer to where they’ll be used might avoid some tariffs or extra shipping costs. So, you might find that sourcing certain parts in India or Vietnam for local use could be a bit cheaper than importing them all the way from China, especially if there are trade restrictions involved. It’s a rebalancing act, really, with more options and a bit more redundancy built into the system. For Q4 2025, we can expect shorter supply lines and improved lead times in component procurement due to these ongoing industry shifts. This outlook suggests a more stable and efficient sourcing environment for electronic components.

The Enduring Importance of Asia-Pacific Supply

Even with all these new places ramping up, the Asia-Pacific region, including China, Taiwan, South Korea, and Japan, is still going to be the powerhouse for semiconductor production for the foreseeable future. We’re talking about over three-quarters of the world’s chips coming from there through 2025. So, while the assembly and end-demand geography is shifting, with places like the Americas and Europe taking on more, the core manufacturing of the chips themselves is still heavily concentrated in Asia. It’s a complex picture, but the key takeaway is that diversification is key, and understanding these regional dynamics is super important for keeping your projects moving.

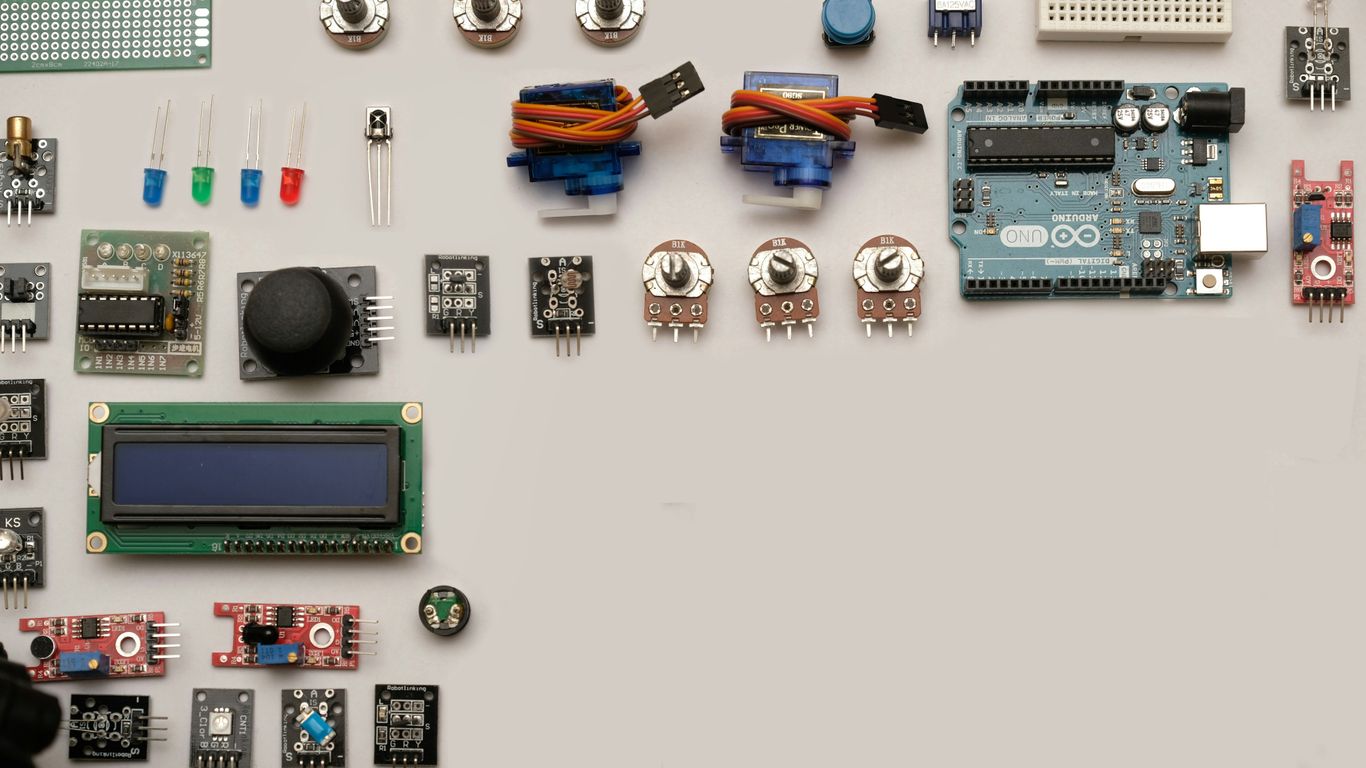

Innovation in Manufacturing Technologies

Manufacturing in the electronics world is really changing, and it’s not just about making things faster. New technologies are popping up that change how we design, build, and even fix electronic components. It’s pretty exciting stuff, honestly.

3D Printing for Prototyping and Production

Remember when 3D printing was mostly for making plastic trinkets? Well, it’s come a long way. Now, it’s a serious tool for electronics manufacturing. We’re talking about printing actual electronic components, not just cases for them. This means we can create complex circuits in 3D, stacking layers in ways that were impossible before. It speeds up making prototypes dramatically, lets companies offer custom parts without huge setup costs, and even allows for making parts closer to where they’re needed. Think about it: instead of waiting weeks for a specialized part, you might be able to print it on-site.

Some companies are even using advanced techniques like atomic layer 3D printing. This allows for building devices with incredible precision, atom by atom. It’s opening doors for new types of micro and nanodevices that can be made quickly.

Augmented Reality for Inspection and Assembly

Human error is a big deal in electronics manufacturing. Tiny mistakes can cause major problems down the line. That’s where augmented reality (AR) is stepping in. Imagine a technician wearing AR glasses that overlay digital instructions directly onto the physical component they’re working on. It can show exactly where to place a tiny resistor, how to solder a connection, or highlight any defects that might be missed by the naked eye.

AR tools can help with:

- Visualizing complex assembly steps: Step-by-step guides appear right in the worker’s field of vision.

- Automated inspection: The system can compare the physical board to its design data, flagging errors instantly.

- Training new staff: It provides a guided learning experience, reducing the learning curve.

- Rework and debugging: Pinpointing issues and guiding repairs becomes much simpler.

This technology not only cuts down on mistakes but also makes the whole process faster and less frustrating for the people doing the work.

The Role of Big Data in Decision-Making

We’re generating more data from manufacturing processes than ever before. Think about sensor readings from machines, quality control reports, supply chain logs – it’s a mountain of information. The real game-changer is figuring out how to use all this data effectively. By analyzing these vast datasets, manufacturers can spot patterns they’d never see otherwise. This could mean predicting when a machine is likely to fail, identifying bottlenecks in the production line, or understanding which design choices lead to fewer defects. It helps make smarter choices about inventory, production schedules, and even future product designs. It’s about moving from guesswork to data-driven strategies.

What’s Next for Electronic Components?

So, keeping up with electronic components means staying aware of what’s happening. Things like AI and new manufacturing methods are changing how we get parts and what we can build. Component shortages are still a thing, and it looks like they might stick around for a bit, especially with big industries needing lots of chips. It’s not all bad news, though. Companies are working on making things more stable, like finding new places to make parts and using smarter ways to plan inventory. Being flexible and knowing what’s coming down the pipeline will be key for anyone working with electronics in the near future. It’s a fast-moving world, for sure.

Frequently Asked Questions

Why are electronic parts still hard to find in 2025?

Even though things are getting better, some electronic parts are still tough to get. This is because the world had shutdowns a few years ago that messed up how things were made. Plus, new tech like AI needs lots of special chips, making it harder for other companies to get what they need. Sometimes, problems between countries also make it tricky to get parts.

What’s new in making electronics?

Companies are using cooler materials that are better for the environment, like organic stuff. They’re also using smart computer programs (AI) and connected devices (IoT) to make factories work better and faster. Things are also getting smaller, with tiny chips packed with more power.

Are computer chips changing a lot?

Yes! Big tech companies building AI systems are buying up a lot of the best chips, like powerful graphics chips (GPUs). At the same time, regular factories still need basic chips to build their machines. It’s becoming a big deal when older chips stop being made, and companies need to find replacements quickly.

How can companies get electronic parts more reliably?

It helps to plan ahead and keep a bit more stock of important parts. Companies can also design their products so they can use different kinds of parts if one kind is hard to find. Using better computer tools to track parts and working closely with the companies that sell parts also makes a big difference.

Are we getting parts from new places now?

Yes, some factories are being built in new areas, like Mexico and Eastern Europe, which can make getting parts easier for nearby companies. While Asia is still a huge place for making parts, other regions are becoming more important. This can sometimes change how much parts cost in different areas.

What new tools are being used in factories?

Factories are using 3D printers to make parts quickly, sometimes even right on the assembly line. They’re also using special glasses (augmented reality) to help workers see instructions or check for mistakes easily. Big amounts of data are also being used to help managers make smarter choices.