Keeping up with the fast-paced world of startups and investments can feel like a full-time job. Venture capital news today is buzzing with activity, from massive funding rounds to shifts in where investors are putting their money. This article breaks down what’s happening, looking at the big picture trends, how companies get funded, who’s doing the investing, and where the hot spots are for new ventures. Whether you’re an entrepreneur looking for a backer or just curious about where the next big thing is coming from, we’ve got the latest insights.

Key Takeaways

- Global venture capital funding saw a dip in Q2 2025, but held steady when accounting for major outlier deals, with the US leading investment activity.

- AI, healthcare, and fintech continue to be top sectors for venture capital investment, with AI infrastructure and developer tools showing significant growth.

- Venture capital funding is typically divided into stages: seed for early development, early-stage (Series A/B) for scaling, and late-stage (Series C+) for major expansion or acquisitions.

- Major venture capital firms like Tiger Global Management and Sequoia Capital remain active investors, shaping the landscape with their significant portfolios.

- Key regional hubs for venture capital include Boston (tech/healthcare), Chicago (diverse industries), San Francisco (innovation), and New York City (global connections).

Navigating Venture Capital News Today: Key Investment Trends

Alright, let’s talk about where the money is flowing in the venture capital world right now. It feels like things are picking up after a bit of a pause. 2024 was a year where investors got a little more careful, maybe because of all the economic ups and downs. But looking ahead to 2025, there’s a feeling that opportunities are really starting to open up again. It’s not just a free-for-all, though; investors are being pretty selective about where they put their cash.

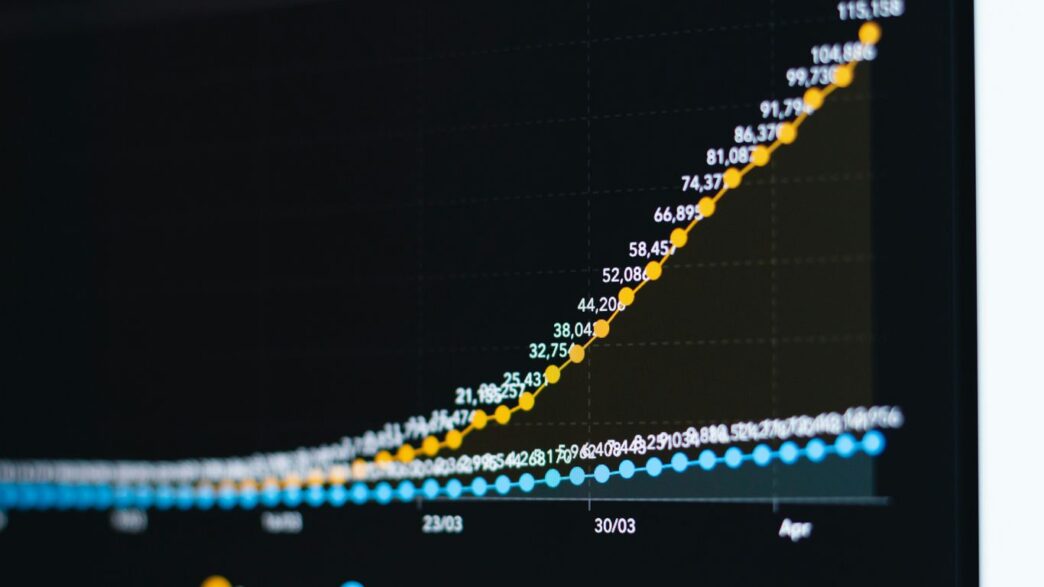

Global Funding Landscape in 2025

The big picture for global venture capital in 2025 looks more promising than the last couple of years. While we didn’t see the crazy highs of, say, 2021, the cautious approach of 2024 has actually made certain areas stand out. Investors are really zeroing in on companies that show clear potential for growth and innovation. It’s less about throwing money at everything and more about smart, targeted investments. This carefulness is shaping which sectors get the most attention.

Sector Focus: AI, Healthcare, and Fintech

So, where are the smart money folks putting their chips? Technology, as always, is a huge draw, especially with the continued explosion of Artificial Intelligence. AI isn’t just a buzzword anymore; it’s becoming a core part of many businesses. Healthcare is another big one. Think about new medical technologies, biotech advancements, and digital health solutions – investors see a lot of promise there. And then there’s Fintech. The way we handle money and financial services is constantly changing, and VCs are keen to back the companies making those changes.

Here’s a quick look at what’s hot:

- Artificial Intelligence: From AI infrastructure to AI-powered applications, this sector is seeing major interest.

- Healthcare: Innovations in biotech, medical devices, and health tech are attracting significant capital.

- Fintech: Companies disrupting payments, lending, and financial management are on investors’ radar.

- Sustainability: While not explicitly mentioned in the top three, green tech and sustainable solutions are also gaining traction.

Regional Investment Dynamics

It’s not just about what companies are getting funded, but also where. Different regions have their own strengths and attract specific types of investment. For instance, places like Boston are known for their strong ties to academia and research, making them hubs for biotech and tech startups. San Francisco continues to be a powerhouse, drawing in massive amounts of funding due to its established innovation ecosystem. New York City, with its global connections and diverse industries, also remains a major player. Understanding these regional differences can give you a better sense of where certain types of startups are likely to find funding and support.

Understanding Venture Capital Funding Stages

So, you’re looking at the startup world and wondering how these companies actually get the money to grow? It’s not like they just walk into a bank and ask for a million bucks. Venture capital funding happens in stages, and each one is a big deal for the company. Think of it like climbing a ladder, with each rung representing a new phase of development and a new chunk of cash.

Seed Funding: The Genesis of Startups

This is where it all begins, the very first money a startup usually gets. It’s called seed funding because it’s meant to help the idea sprout. Companies at this stage are often just getting off the ground, maybe they have a prototype or a solid plan, but not much else. The money here is typically used for things like product development, market research, and building out the initial team. It’s a smaller amount compared to later stages, and it often comes from angel investors or specialized seed-stage VC firms. Getting this initial capital is a huge step, often determining if the idea can even get off the ground. It’s a critical first step for any new venture.

Early-Stage Growth: Series A and B

Once a startup has proven its concept and maybe even started generating some revenue, it moves into early-stage growth. This is usually broken down into Series A and Series B rounds. Series A funding is about scaling operations, expanding the customer base, and refining the business model. The companies are expected to have a working product and a clear path to making money. Series B funding often comes a bit later, and it’s for more aggressive expansion – think entering new markets or developing new product lines. The amounts of money involved here are significantly larger than seed funding, and the investors are looking for companies that have a solid track record and a clear plan for significant growth.

Late-Stage Expansion: Series C and Beyond

Companies that have really hit their stride are in late-stage expansion. This includes Series C, D, E, and so on. By this point, the startup is usually well-established, has a proven business model, and is generating substantial revenue. The goal of late-stage funding is often about rapid scaling, perhaps through acquisitions, or preparing for a major event like an Initial Public Offering (IPO). The capital injections at this stage can be massive, sometimes hundreds of millions of dollars. Investors here are looking for mature companies that are poised for even bigger things, solidifying their market position and aiming for long-term dominance. It’s a sign that the company has successfully navigated the riskiest early years and is now focused on becoming a major player.

Leading Venture Capital Firms and Their Investments

When you’re looking for funding, knowing who the big players are is pretty important. These firms aren’t just throwing money around; they’re making calculated bets on the future. It’s a competitive landscape, and some firms have built a serious reputation for spotting the next big thing. Their track record often speaks volumes about their investment strategy and the kind of companies they back.

Prominent VC Firms in 2025

Several venture capital firms consistently show up when you look at major funding rounds. They’ve got the capital and the connections to make a real impact. Here are a few that have been particularly active:

- Tiger Global Management: Based in New York City, they’ve been incredibly busy, investing in companies like Briq, Wiz, and Scribe. They manage a substantial amount of capital and aren’t afraid to make big moves.

- Sequoia Capital: A name that’s practically synonymous with venture capital, Sequoia has a legendary history of backing giants like Apple, Google, and WhatsApp. Their involvement often signals strong potential.

- Andreessen Horowitz (a16z): Though relatively newer compared to some, a16z has quickly become a powerhouse, known for its investments in major tech companies and its active role in the startup community.

- Lightspeed Venture Partners: With a focus on enterprise, consumer, and health sectors, Lightspeed has a solid history of successful investments, including companies like Grubhub and Cameo.

Tiger Global Management’s Prolific Deals

Tiger Global Management has been on a tear, making a significant number of investments. They operate across different investment types, but their venture capital activity has been particularly noteworthy. In 2025, they’ve put money into companies like:

- Briq: Focused on construction technology.

- Wiz: A cloud security platform.

- Scribe: A tool for creating documentation automatically.

Their approach seems to be about identifying fast-growing companies and getting in early, often across various tech sectors.

Sequoia Capital’s Esteemed Portfolio

Sequoia Capital is often considered one of the most influential VC firms out there. Their portfolio reads like a who’s who of the tech world. They have a reputation for identifying and nurturing companies that go on to become industry leaders. Some of their most famous past investments include:

- Apple

- Cisco

- PayPal

- Zoom

It’s clear they have a knack for picking winners, and their involvement is highly sought after by startups.

The Venture Capital Investment Process

So, you’ve got a killer idea and you’re looking for some cash to make it happen. But how does that money actually get from a VC’s bank account to your startup? It’s not exactly a walk in the park, and there are definitely some steps involved. Think of it like a really thorough job interview, but for your business.

Screening Potential Investments

First off, VC firms get swamped with applications. We’re talking hundreds, maybe thousands, every single week. To deal with this flood, they have a screening process. Usually, an analyst will go through pitch decks and filter out the ones that don’t seem like a good fit right away. They’re looking for specific things – maybe it’s the industry, the tech, or the revenue numbers. It’s all about finding those initial sparks in a massive pile of applications. If your deck makes it past this first look, it’s a good sign.

Partner Review and Initial Meetings

Next up, if your company survives the initial screening, it gets passed to the VC partners. These are the folks who actually make the big decisions and have the power to write checks. They’ll look at your pitch with a much sharper eye, using their own set of criteria. Getting past this stage is tough because you really need to impress them. If you do, you’ll likely get invited for an initial meeting. This isn’t just a casual chat; it’s where they get to know you and your leadership team, and more importantly, decide if they want to invest in you and your vision.

Due Diligence and Deal Closing

After the initial meetings and internal reviews, if a VC firm is seriously interested, they’ll move into due diligence. This is where they really dig deep. They’ll ‘look under the hood’ of your startup, examining everything from your business model and financials to your team and market. It’s a detailed investigation to understand all the risks and opportunities. You can find a helpful venture capital due diligence checklist that VCs often use. If everything checks out and the investment committee gives the green light, you’ll get a term sheet outlining the deal. Once you agree and sign, the funds are transferred, and your partnership with the VC begins.

Spotlight on Recent Funding Rounds

This week, the venture capital world saw some pretty big money move around, especially in tech and areas that use AI. It looks like investors are still really keen on companies building important tools and platforms, even with all the economic ups and downs we’ve been hearing about.

Billion-Dollar Bets in Technology

We saw a few massive rounds that really stand out. Cursor, an AI coding tool company, pulled in a staggering $2.3 billion. That’s a huge amount of cash, and it shows how much faith investors have in tools that help developers work faster. Then there’s Chaos Industries, which makes drone-detecting radar systems – a pretty critical piece of tech these days. They landed $510 million. It’s clear that defense and security tech is getting a lot of attention.

Instant Commerce and AI Infrastructure Deals

Beyond those huge tech rounds, other sectors are also seeing significant investment. GoPuff, the instant delivery service, raised $250 million. They plan to use the money to get more profitable and expand their AI-driven logistics. D-Matrix, which focuses on AI compute for data centers, secured $275 million in Series C funding. This kind of infrastructure is becoming super important as AI use grows. It seems like companies building the backbone for AI are a big focus right now.

Key Investors in Transformative Technologies

Looking at who’s putting the money in, it’s a mix of familiar big names and some new players. For Cursor’s big round, we saw giants like Accel, Thrive Capital, Andreessen Horowitz, Nvidia, and Google. GoPuff’s funding had Eldridge Industries and Valor Equity Partners leading the charge, with participation from folks like Baillie Gifford. D-Matrix’s round was co-led by Bullhound Capital, Triatomic Capital, and Temasek, with new money from the Qatar Investment Authority (QIA) and EDBI, plus existing investors like Microsoft’s venture fund. It’s a strong signal when these major firms are backing companies that aim to change how things are done.

Regional Venture Capital Hubs

When you’re looking for venture capital, where you are can really matter. Different cities and regions have their own vibes and focus areas when it comes to funding startups. It’s not just about the money; it’s about the ecosystem – the other companies, the talent pool, and the specific industries that are booming.

Boston’s Tech and Healthcare Investments

Boston has a long history with tech and healthcare, thanks to its strong universities and research institutions. It’s a place where innovation feels baked into the culture. In 2024, Boston saw over $3.99 billion flow into more than 400 startups. This city is a big deal for biotech, software, and anything related to life sciences. Firms like General Catalyst Partners and Summit Partners are active here, really pushing the boundaries in these fields.

Chicago’s Diverse Industry Funding

Chicago is kind of a hidden gem. It’s centrally located and has a really diverse economy, which means startups aren’t just focused on one thing. Last year, Chicago-based startups pulled in about $2.5 billion. You’ll find VCs here interested in everything from logistics and manufacturing tech to fintech and even clean energy. M25 and Hyde Park Venture Partners are a couple of the names you’ll hear a lot in the Chicago scene.

San Francisco’s Innovation Ecosystem

Okay, San Francisco. It’s still the big kahuna for venture capital, no doubt about it. The sheer concentration of tech talent, established companies, and new ideas is pretty wild. In 2024, San Francisco snagged over $12 billion in VC funding. It’s the place for cutting-edge tech, AI, and software. Sequoia Capital and Bessemer Venture Partners have deep roots here, investing in companies that often become household names. If you’re building the next big thing in tech, SF is probably on your radar.

New York City’s Global Connections

New York City is another powerhouse, and it’s not just about finance anymore. The city has a massive, diverse talent pool and strong global ties, making it a hub for all sorts of industries. Last year, NYC startups raised more than $7 billion. You’ll find VCs here active in fintech, media, consumer goods, and increasingly, health tech. Firms like IA Ventures and Union Square Ventures are key players, connecting local innovation with international markets. It’s a city that never sleeps, and neither does its venture capital scene.

What’s Next?

So, that’s a quick look at what’s been happening in the venture capital world lately. We’ve seen some big funding rounds, especially in tech and AI, and it looks like things are picking up for 2025 after a bit of a cautious 2024. Keep an eye on these trends, whether you’re an entrepreneur looking for a boost or an investor trying to spot the next big thing. The landscape is always changing, but staying informed is half the battle. We’ll keep bringing you the latest news and insights to help you stay on top of it all.

Frequently Asked Questions

What is venture capital and why is it important for startups?

Venture capital is like special money that investors give to new companies, called startups, that have big ideas and could grow a lot. It helps these companies get started, build their products, and reach more customers. Without it, many cool new ideas might never get off the ground.

What are the different stages of venture capital funding?

Think of it like climbing a ladder. First is ‘seed funding,’ which is just a little bit of money to get the idea going. Then comes ‘early-stage funding’ (like Series A and B) to help the company grow bigger. Finally, ‘late-stage funding’ (Series C and beyond) is for companies that are already doing well and want to expand even more or buy other companies.

Which industries are getting the most venture capital money right now?

Right now, investors are really interested in technology, especially Artificial Intelligence (AI), and also in healthcare and companies that handle money, called fintech. These areas are seeing a lot of investment because they’re changing how we live and work.

How do venture capital firms decide which companies to invest in?

VC firms look at many companies. First, they ‘screen’ them to find the ones that seem promising. Then, the main partners review these companies more closely. If they like what they see, they’ll meet with the startup’s team. If everything checks out after a lot of checking, called ‘due diligence,’ they might offer to invest.

What are some big venture capital firms and what kind of companies do they invest in?

Some famous VC firms are Tiger Global Management and Sequoia Capital. They’ve invested in huge companies you might know, like Google and Apple. They look for companies with innovative ideas that have the potential to become very successful.

Where are the main places where venture capital happens?

Big cities like San Francisco, New York City, Boston, and Chicago are major hubs for venture capital. These places have lots of smart people, universities, and existing tech companies, making them exciting spots for new businesses to get funding and grow.