Digital transactions are the norm – and as such, the need for a seamless and secure payment experience is more critical than ever. With the rise of e-commerce and online shopping, people are increasingly making payments online. This means that there’s a greater risk of fraud and identity theft. To protect consumers, businesses of all kinds need to offer secure payment options. This includes using reputable payment processors and implementing security measures such as encryption. It’s also important to educate consumers about the risks of online fraud and how to protect themselves.

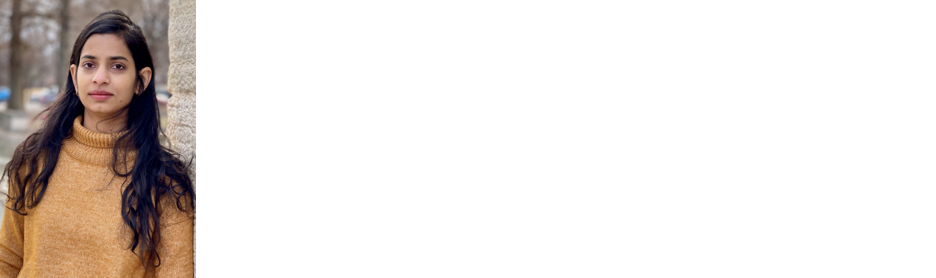

But where does it all start? Enter Sushma Daggubati’s groundbreaking patent on Systems and Methods for Automatic Bill Enrollment, a technology that promises to significantly streamline the way we handle our bills and recurring payments. Daggubati’s solution stands to redefine our engagement with financial applications.

The Challenge of Bill Payment Enrollment

Traditionally, enrolling merchants into bill payment systems has been a labor-intensive process requiring users to manually input merchant details. This can be both time-consuming and error-prone, potentially resulting in mispayments or security risks as sensitive information is exchanged.

Sushma Daggubati’s Solution

Daggubati’s patent addresses these challenges by introducing an Automatic Billing Enrollment (ABE) computing device and associated methods. This system is ingeniously designed to automatically enroll merchants in bill pay applications following a payment transaction. The device operates by performing the following steps:

- Transaction Receipt and Merchant Identification: Upon receiving a payment transaction associated with a cardholder’s account, the ABE device identifies the merchant involved in the transaction.

- Enrollment Verification: It then checks if the merchant is already enrolled in the bill pay application tied to the cardholder’s account by performing a database lookup.

- Enrollment Invitation: If the merchant is not enrolled, the ABE device sends a message to the cardholder’s user device, providing them with the option to enroll the merchant in the bill pay application.

- Data Element Determination and Retrieval: Once the cardholder opts to enroll the merchant, the ABE device determines the required merchant-associated data elements for the bill pay application, retrieves them, and inputs them to enroll the merchant.

The Technology at Work

The ABE device’s core components include a processor and memory, coupled to a payment network, allowing for real-time processing and communication. The method implemented by the device employs algorithmic checks and data retrieval processes that interact with user interfaces and payment networks.

The Impact on Payment Security

Push-type payments, facilitated by the ABE system, inherently offer enhanced security over traditional pull-type payments. Daggubati’s invention automates the enrollment process, meaning that sensitive account information is kept secure and is not exchanged with merchants, mitigating potential fraud and data breaches.

Operational Efficiency and User Experience

The ABE system represents a significant leap in operational efficiency. Because it eliminates the need for manual data entry for each merchant, it can save time for consumers and reduces the likelihood of human error. The enhanced user experience is characterized by the system’s prompt for enrollment immediately after a transaction, which leverages convenience and encourages timely merchant enrollment.

Data Handling and Privacy

Daggubati’s patent includes methods to handle data with respect and privacy. The automatic retrieval and input of merchant-associated data elements ensure that personal and financial information is transferred securely without exposure to unsecured environments.