Lately, it feels like everyone’s asking, ‘Is crypto crashing?’ It’s easy to get worried when you see big price drops, especially if you’re new to this stuff. It can seem pretty scary. This article is here to break down what’s really going on during these rough patches in the crypto market. We’ll look at why prices tumble, how fear plays a role, and what experienced folks do when things get bumpy. Sometimes, a big drop can actually be a chance to get in. Let’s figure it out together.

Key Takeaways

- The crypto market is experiencing a significant downturn, with Bitcoin dropping considerably from its peak, and the overall market sentiment showing extreme fear.

- A true crypto crash is defined as a drop of 20-30% or more within a few weeks, distinct from a normal correction, and often amplified by high leverage in trading.

- Factors like tariffs, rising interest rates, forced liquidations from leveraged trades, and shifts in ETF flows are currently pushing crypto prices down.

- While retail investors might panic sell during downturns, larger players like institutions and ‘whales’ often see these periods as opportunities to accumulate assets.

- Despite short-term volatility and bearish technical signals, historical patterns suggest that Bitcoin has a track record of recovering from sharp declines and reaching new highs, supported by its fixed supply and long-term holder behavior.

Analyzing The Latest Crypto Market Downturn

So, is crypto crashing? It sure feels like it. We’ve seen some pretty wild swings lately, and if you’re new to this, it can be a bit unsettling. Let’s break down what’s happening right now.

Current Market Snapshot: Prices Versus All-Time Highs

Right now, things are looking a bit rough. Bitcoin, for instance, has dropped significantly from its peak. We’re seeing prices that are a far cry from the all-time highs many of us remember. It’s a stark reminder that this market moves fast and can be unpredictable.

Here’s a quick look at how some major players are doing compared to their best moments:

| Asset | Current Price | All-Time High | % Drop from ATH |

|---|---|---|---|

| Bitcoin (BTC) | ~$68,500 | ~$126,000 | ~45% |

| Ethereum (ETH) | ~$2,020 | ~$4,940 | ~60% |

| Total Market Cap | ~$2.4T | ~$4.4T | ~45% |

This kind of drop isn’t just a small dip; it’s a significant downturn. The total crypto market cap has also taken a hit, showing that this isn’t just one or two coins struggling, but a broader market movement. It’s easy to see why people are asking if it’s a crash.

Defining What Constitutes A Crypto Crash

In the crypto world, we have a bit of a technical definition for a crash. It’s generally considered a drop of 20–30% or more that happens pretty quickly, usually within a week or two. A normal correction is usually less severe, maybe 10–20%, and often bounces back faster. What we’re seeing now, with drops approaching 50% from the highs for some assets, definitely fits the bill for a full-blown crash. A big reason for this amplification is the use of leverage. Unlike traditional markets where leverage is limited, crypto traders can use much higher amounts, sometimes up to 100x. When prices start falling, these leveraged positions get automatically sold off, creating a domino effect that pushes prices down even further and faster. It’s a cycle that can be hard to stop once it gets going. This kind of volatility is amplified because crypto markets trade 24/7, meaning there’s no downtime for panic to subside. The current situation is definitely more than just a correction; it’s a genuine market crash.

Understanding The Fear And Greed Index Signals

One tool many traders watch is the Fear and Greed Index. This index tries to gauge market sentiment by looking at a few different factors. When the index is showing "extreme fear," it means most people are scared and selling. Historically, these moments of extreme fear can sometimes be a good buying opportunity, but it’s a risky game. Right now, the index is deep in the "extreme fear" zone, bouncing around the lowest levels we’ve seen in a while. This suggests that sentiment is really negative, and a lot of people are feeling the panic. It’s a clear signal that the market is currently driven by fear, which often leads to more selling pressure as investors try to get out before prices drop further. This index is a good way to see how the collective mood is affecting the market, and currently, the mood is pretty grim. It’s important to remember that this index is just one piece of the puzzle, but it does give a strong indication of the prevailing sentiment among investors. For more on market movements, you can check out Bitcoin’s recent bounce.

Historical Perspectives On Crypto Crashes

Comparing Past Crypto Crashes And Recovery Multiples

Every time the crypto market takes a nosedive, it feels like the end of the world, right? But if you look back, you’ll see a pattern. These big drops, while scary, have often set the stage for even bigger comebacks. It’s like the market shakes out the weak hands and then rebuilds stronger.

Let’s look at some of the major crashes and what happened afterward. It’s pretty wild when you see the numbers.

| Crash Event | Bottom Price | Recovery High | Multiple | Duration |

|---|---|---|---|---|

| 2018 Bear Market | $3,200 | $69,000 | 21x | 12 months |

| COVID 2020 | $4,000 | $69,000 | 17x | 1 month |

| China 2021 | $30,000 | $69,000 | 2.3x | 2 weeks |

| FTX 2022 | $16,000 | $126,000 | 8x | 3 months |

| 2025–26 Crash (Est.) | ~$60,000 | ? | ? | Ongoing? |

See? After each major shakeout, Bitcoin didn’t just recover; it often hit new all-time highs. The triggers change – sometimes it’s a bubble bursting, other times it’s a global event or a major exchange failing – but the outcome has been surprisingly consistent: a period of intense fear followed by a significant rebound.

Bitcoin’s Performance Through Historical Downturns

Bitcoin, being the biggest player, often leads the charge down and up. When the market crashes, BTC usually takes a big hit. For instance, during the current downturn, Bitcoin dropped significantly from its peak. Technical indicators might look grim, showing it’s broken past key support levels, which can trigger more selling, especially with leveraged traders getting wiped out. It’s a nasty cycle.

But here’s the thing: Bitcoin has a fixed supply of 21 million coins. This scarcity is a big deal, especially when people start worrying about inflation or the value of traditional money. Even when prices are falling hard, many long-term holders, or ‘hodlers,’ see these dips as opportunities to buy more, often moving their coins off exchanges to hold onto them. This reduces the available supply, which can help support prices later on.

Historically, Bitcoin’s price movements have also followed a pattern related to its ‘halving’ events, which happen roughly every four years and cut the reward for mining new blocks in half. Typically, a bull run kicks off after a halving, peaking about a year or so later, followed by a correction. The current drop seems to fit this cycle, suggesting it might just be a normal pause before the next upward move, assuming demand picks back up.

Lessons Learned From Previous Market Collapses

Looking back at past crypto crashes teaches us a few key things. First, extreme volatility is part of the crypto game, and it’s usually temporary. What feels like a permanent disaster in the moment often turns out to be a stepping stone for future growth.

Here are some takeaways:

- Panic Selling vs. Strategic Buying: Many retail investors tend to sell when prices plummet out of fear. However, experienced investors and institutions often see these periods as prime opportunities to accumulate assets at lower prices.

- Leverage Amplifies Everything: Crypto markets allow for high leverage, which means small price movements can lead to massive gains or devastating losses. Crashes often involve cascading liquidations, where falling prices trigger automatic selling, pushing prices down even further.

- Cycles of Boom and Bust: The crypto market, particularly Bitcoin, has historically moved in cycles. After a period of rapid growth and speculation, a correction or crash often occurs, clearing out excess and setting the stage for the next growth phase.

- Long-Term Holders Are Key: When prices crash, the behavior of those holding assets for the long term is critical. If they continue to hold or even buy more, it signals confidence and can help stabilize the market over time.

Key Triggers Fueling The Current Crypto Selloff

So, why is the crypto market taking such a beating right now? It feels like a lot is happening all at once, and honestly, it’s a mix of different pressures pushing prices down. It’s not just one thing; it’s a chain reaction, and understanding these triggers helps make sense of the chaos.

Impact Ranking Of Current Crash Triggers

When we look at what’s really driving this downturn, a few major factors stand out. They’re not all equal, and some have a bigger punch than others right now. Here’s a breakdown of the main culprits:

- Macroeconomic Headwinds: This is a big one. Think global economic stuff – inflation worries, interest rate hikes, and general uncertainty. These things make investors nervous about riskier assets like crypto.

- Forced Liquidations: When prices drop fast, people who borrowed money to invest get hit hard. Their positions get automatically sold off to cover the debt, which pushes prices down even further. It’s like a snowball effect.

- ETF Outflows: For a while, Exchange Traded Funds (ETFs) were bringing in a lot of money, acting like a steady buyer. But when those funds start seeing money leave, it removes that consistent demand, making the market more fragile.

- Technical Sell Signals: Charts and trading patterns also play a role. When key price levels break, it signals weakness to traders, prompting more selling.

The Role Of Macroeconomic Factors

Let’s dig into the macro stuff a bit more. Things like trade tensions or unexpected economic news can really shake up markets. For instance, talk of new tariffs can spark fears of inflation and lead central banks to keep interest rates higher for longer. This makes safer investments, like government bonds, look more attractive compared to volatile assets. When investors move their money out of riskier assets and into safer ones, crypto often feels the pinch first and hardest because it’s traded 24/7 and can be more sensitive to liquidity changes.

Understanding Forced Liquidations And Their Effect

Forced liquidations are a nasty part of crypto’s volatility. Imagine someone borrows $10,000 worth of crypto to buy more crypto, hoping the price goes up. If the price drops significantly, their borrowed position might fall below a certain threshold. The exchange or lender then automatically sells their crypto to get their money back. This sudden selling pressure can cascade, triggering more liquidations as prices fall further. We’ve seen billions of dollars worth of positions get wiped out in short periods, which really accelerates the downward price movement and can create sharp, sudden drops that feel brutal.

Here’s a simplified look at how these triggers can interact:

| Trigger | Current Impact | Example Effect |

|---|---|---|

| Macro Pressure (Yields) | High | Investors move money from crypto to safer assets. |

| Forced Liquidations | High | Rapid price drops as positions are sold off. |

| ETF Outflows | Medium | Reduced consistent buying pressure. |

| Technical Signals | Medium | Traders react to charts, adding to selling. |

Institutional Versus Retail Investor Behavior

When the crypto market starts acting wild, it’s interesting to see how different types of investors react. It’s not just one big group; there are definitely two main camps: the big players (institutions and whales) and the everyday folks (retail investors).

How Whales And Institutions Navigate Volatility

Big money players, like hedge funds or even just individuals with a ton of Bitcoin, tend to have a different game plan when prices drop. They’re often in it for the long haul. Think about companies like MicroStrategy; they keep buying more Bitcoin even when the price is down, showing they believe in its future value. It’s like they see a sale and stock up. This kind of strategic accumulation by large holders can actually help stabilize the market a bit. They aren’t usually the ones hitting the panic button. Instead, they might see dips as opportunities to increase their holdings at a better price. This is a key difference from how many smaller investors behave. The Bitcoin market is characterized by distinct dynamics between institutional investors and retail traders, each possessing unique behaviors and motivations. Institutional investors often have more resources and a longer-term perspective, allowing them to weather market storms more effectively.

Retail Investor Panic Versus Strategic Accumulation

On the flip side, you have retail investors. These are the folks buying with their own money, often in smaller amounts. During a sharp downturn, it’s common to see a lot of retail selling. This happens because, well, it’s scary when your investment is losing value fast! Many retail traders might buy when prices are high, feeling FOMO (fear of missing out), and then sell when prices crash, locking in losses out of fear. This pattern can actually make the downturn worse, as a lot of selling pressure comes from people trying to get out quickly. However, some retail investors are getting smarter. They’re starting to use strategies like dollar-cost averaging (DCA), where they invest a fixed amount regularly, no matter the price. This helps smooth out the ups and downs and takes the emotion out of it. It’s a way to practice strategic accumulation, even with smaller amounts.

The Influence Of ETF Flows On Market Stability

Lately, Bitcoin Exchange-Traded Funds (ETFs) have become a pretty big deal. These ETFs allow people to invest in Bitcoin through traditional brokerage accounts, and they’re often managed by big financial institutions. When these ETFs see a lot of money flowing in, it can signal strong institutional demand and help push prices up. Conversely, if money starts flowing out of these ETFs, it can add to the selling pressure in the market. It’s like a big pool of money that can move in or out, affecting the overall price. These flows can sometimes act as a buffer, especially if institutions are using them as a way to hold Bitcoin without directly managing the private keys. However, large outflows can also amplify downward price movements, especially if they coincide with other market pressures. It’s a dynamic that’s still unfolding and worth watching closely.

Technical And Fundamental Analysis Of Bitcoin

Let’s take a look at what’s happening with Bitcoin from a technical and fundamental standpoint. It’s not always easy to make sense of the charts, and the underlying value can be a bit of a puzzle too.

Current Technical Indicators And Support Levels

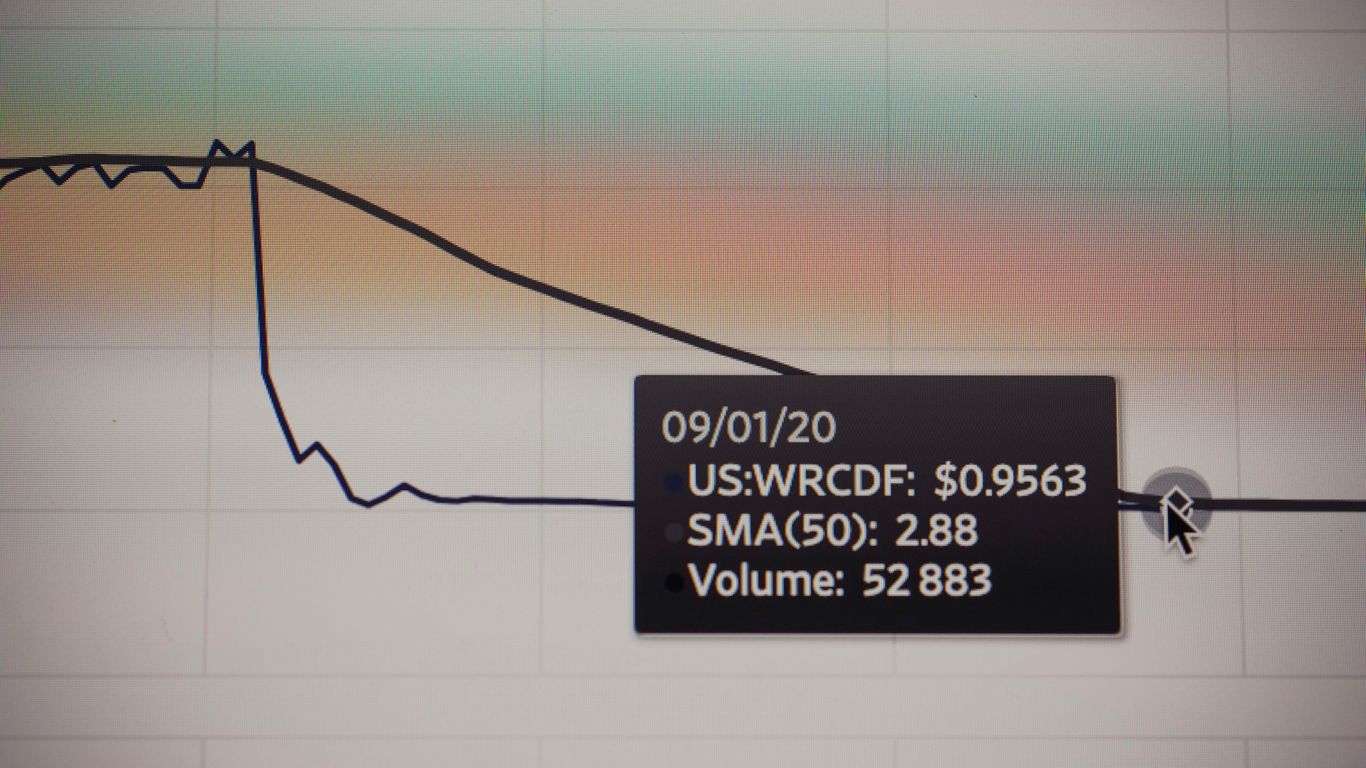

Right now, the short-term charts are showing some pressure. Looking at the data, it seems like momentum is favoring sellers at the moment. Bitcoin is trading below its 50-day moving average, which used to be a support level but now seems to be acting as resistance. When the price is below these key averages, it often signals weakness.

Momentum indicators are giving a mixed, but leaning bearish, picture. The Relative Strength Index (RSI) is hovering around 36, which suggests it’s oversold but not completely exhausted. The Moving Average Convergence Divergence (MACD) is still negative, confirming the downward trend. The Average Directional Index (ADX) is above 37, indicating a strong trend, and that trend is currently pointing downwards. Funding rates have also cooled off, which suggests that a lot of the leverage has been flushed out after the recent price drop.

As for support, we’re seeing potential clusters around the $68,000 and $64,000 marks based on pivot ranges. If these levels don’t hold, sellers might push the price down to deeper liquidity zones.

Bitcoin’s Fixed Supply As A Store Of Value

One of the core arguments for Bitcoin’s value, especially when prices are dropping, is its fixed supply. There will only ever be 21 million Bitcoins created. This predictable scarcity is a big difference compared to traditional fiat currencies, which can be printed more freely and can lose value over time due to inflation. This scarcity is what makes many see Bitcoin as a potential store of value, like digital gold, particularly during times of economic uncertainty.

On-Chain Metrics And Holder Behavior

Looking at what’s happening directly on the Bitcoin network can also tell us a story. Large holders, often called "whales," and institutions seem to be holding onto their Bitcoin even when prices fall. This suggests they believe in the long-term potential and aren’t panicking. We’re also seeing historically low amounts of Bitcoin held on exchanges. This means there’s less supply readily available for people to sell quickly, which can help stabilize prices.

This behavior from larger players contrasts with how some retail investors might act. Sometimes, smaller investors can get caught up in fear and sell during downturns, only to buy back in when prices are higher. This kind of behavior can actually make short-term price swings more dramatic. The fact that exchange balances are low and whales are holding suggests that the market might be more resilient to panic selling than it appears on the surface.

Future Outlook For The Cryptocurrency Market

So, what’s next for crypto? It’s a question on everyone’s mind, especially after the recent market swings. Looking ahead, things are a mix of potential and uncertainty, which, let’s be honest, is pretty typical for this space.

Potential Scenarios Based On Regulatory Clarity

Governments around the world are still figuring out how to handle cryptocurrencies. This is a big deal. Clearer rules could mean more big players feel comfortable jumping in, potentially leading to more stable prices and wider use. Think of it like building a road – once it’s paved and marked, more people are willing to drive on it. On the flip side, strict regulations could put a damper on innovation and adoption. It’s a balancing act, for sure.

- Positive Scenario: Well-defined regulations attract institutional investment and protect consumers, leading to steady growth.

- Neutral Scenario: Patchwork regulations across different regions create complexity but don’t halt progress entirely.

- Negative Scenario: Overly restrictive rules stifle innovation and drive activity to less regulated areas.

The Role Of Ethereum Upgrades In Market Sentiment

Ethereum is a huge part of the crypto world, and its ongoing upgrades are pretty important. These aren’t just technical tweaks; they can really affect how people feel about the market. For example, upgrades that make the network faster, cheaper to use, or more energy-efficient tend to get a lot of positive attention. It shows the technology is maturing and improving, which is good news for investors and users alike. If these upgrades go smoothly and deliver on their promises, it could boost confidence across the board.

Long-Term Adoption Trends And Infrastructure Growth

Beyond the day-to-day price action, the real story is how crypto is being used and built upon. We’re seeing more companies exploring blockchain for various applications, not just as a speculative asset. Think about supply chains, digital identity, and even gaming. The infrastructure supporting crypto – like exchanges, wallets, and development tools – is also getting more robust. This steady build-out of real-world use cases and solid infrastructure is what will likely drive long-term adoption, regardless of short-term market jitters. While predicting exact price targets is a fool’s errand, the underlying trend of increasing utility and integration suggests crypto is here to stay, evolving as it goes.

Wrapping It Up: What’s Next for Crypto?

So, is crypto crashing? Well, the market’s definitely seen some rough patches lately, with prices taking a big hit. It can feel a bit wild, especially if you’re new to this. But looking back at history, these big drops aren’t entirely new for Bitcoin and other digital coins. They tend to bounce back, sometimes even stronger. Right now, things like interest rates and global events are playing a big role, making the market jumpy. While some folks are worried, others see these dips as chances to get in at a lower price for the long haul. The future still holds a lot of unknowns, depending on new rules and how many more people start using crypto. One thing’s for sure, though: this market keeps things interesting, and staying informed is key, no matter what happens next.

Frequently Asked Questions

Why is the crypto market suddenly dropping so much?

The crypto market is dropping because several things are happening at once. Higher interest rates make safer investments more attractive, causing people to pull money from riskier ones like crypto. Also, when prices fall too quickly, people who borrowed money to invest are forced to sell, which pushes prices down even further. Sometimes, big news or events can make people feel scared, leading them to sell their crypto.

Is this crypto drop a ‘crash’ or just a normal dip?

A big drop, like losing 20-30% or more of its value in a few weeks, is usually called a crash. A smaller drop of 10-20% is more like a normal correction. The recent drops, where Bitcoin lost a big chunk of its value from its highest point, are definitely in the crash category. These big drops often happen because people are using borrowed money, and when prices fall, they’re forced to sell everything.

What does the ‘Fear and Greed Index’ mean for crypto?

The Fear and Greed Index is like a mood meter for the crypto market. When it shows ‘extreme fear,’ it means most people are scared and selling. This can actually be a sign that prices might be low enough to be a good buying opportunity for those who aren’t panicking. On the flip side, when it shows ‘extreme greed,’ it means people are overly excited, which might signal a good time to be cautious.

How do big investors (whales) act during a crypto crash?

Big investors, sometimes called ‘whales,’ often behave differently than smaller investors. While many people panic and sell, whales might see a crash as a chance to buy more crypto at a lower price. They tend to have a longer-term view. Also, when big investors hold onto their crypto instead of selling, it can help stabilize the market a bit.

What are the main reasons for the current crypto price drops?

Several big factors are causing prices to fall right now. Things like new government rules or worries about the economy (like rising inflation) make investors nervous. When investors get nervous, they often sell off riskier assets like crypto. Also, when prices start to fall, people who borrowed money to invest get forced to sell their crypto quickly, which makes the price drop even faster.

Will Bitcoin and other cryptos recover after this crash?

Historically, Bitcoin and other cryptocurrencies have gone through major crashes before, but they have usually recovered and even reached new high prices later on. While no one can guarantee the future, past patterns suggest that even after big drops, the market can bounce back. However, it’s important to remember that crypto is still a new and unpredictable market.