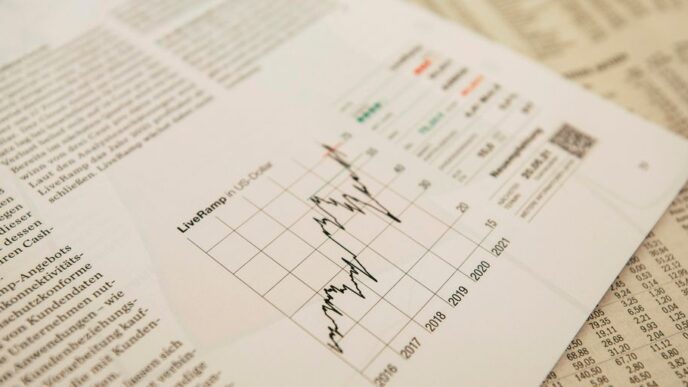

In the current financial landscape, investors are increasingly focusing on undervalued tech stocks as potential opportunities for growth. With the tech sector experiencing fluctuations due to inflation concerns and rising interest rates, savvy investors are looking for stocks that are trading below their intrinsic value. This article explores some of the top undervalued tech stocks that hedge funds are eyeing, including Qualcomm, Seagate Technology, Fidelity National Information Services, Western Digital, and Global Payments.

Key Takeaways

- Investors are targeting undervalued tech stocks amid market fluctuations.

- Hedge funds are showing interest in companies like Qualcomm and Seagate Technology.

- Rising inflation and interest rates are impacting tech stock performance.

The Current Market Landscape

The technology sector has been under pressure recently, primarily due to concerns over inflation and the potential for higher interest rates. As Treasury yields rise, the cost of capital increases, which can dampen both consumer spending and corporate investment. This environment has led to a sell-off in major tech stocks, prompting investors to seek out undervalued opportunities.

Top Undervalued Tech Stocks

- Qualcomm Incorporated (QCOM)

- Seagate Technology Holdings (STX)

- Fidelity National Information Services (FIS)

- Western Digital Corporation (WDC)

- Global Payments Inc. (GPN)

Investment Strategies in a Volatile Market

As the tech sector continues to face challenges, investors are advised to adopt a diversified approach. This includes focusing on undervalued stocks that have strong fundamentals and growth potential. Market dips can present opportunities to invest in companies that are well-positioned to benefit from long-term trends, particularly in AI and digital transformation.

Conclusion

The current market conditions have created a unique environment for investors to explore undervalued tech stocks. By focusing on companies with solid fundamentals and growth prospects, investors can potentially maximize their returns in a fluctuating market. As always, thorough research and a diversified investment strategy are key to navigating these uncertain times.

Sources

- Why QUALCOMM Incorporated (QCOM) Is Among the Top Undervalued Tech Stocks to Buy According to Hedge Funds?, Yahoo Finance.

- Why Seagate Technology Holdings (STX) Is Among the Top Undervalued Tech Stocks to Buy According to Hedge Funds?, Yahoo.

- Why Fidelity National Information Services (FIS) Is Among the Top Undervalued Tech Stocks to Buy According to Hedge Funds?, Yahoo Finance.

- Why Western Digital (WDC) Is Among the Top Undervalued Tech Stocks to Buy According to Hedge Funds?, Yahoo Finance.

- Why Global Payments (GPN) Is Among the Top Undervalued Tech Stocks to Buy According to Hedge Funds?, Yahoo.