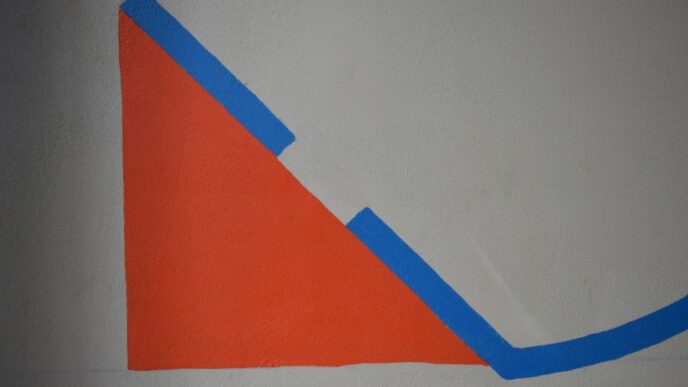

U.S. stock markets experienced a significant surge on April 24, 2025, driven by a robust performance in technology stocks and easing trade tensions between the U.S. and China. Investors reacted positively to strong earnings reports from major tech companies, leading to a third consecutive day of gains across all major indexes.

Key Takeaways

- Market Performance: The Dow Jones rose by 1.23%, the S&P 500 increased by 2.03%, and the Nasdaq Composite jumped by 2.74%.

- Tech Sector Dominance: Technology stocks, particularly those in the AI sector, led the rally, with notable gains from companies like Nvidia, Microsoft, and ServiceNow.

- Earnings Reports: Over 74% of S&P 500 companies reporting so far have exceeded earnings expectations, boosting investor confidence.

- Trade Developments: Comments from U.S. Treasury Secretary Scott Bessent suggested a potential easing of tariffs, which has positively influenced market sentiment.

Market Overview

The U.S. stock market closed higher on Thursday, marking a significant rebound as investors digested a mix of corporate earnings and optimistic news regarding U.S.-China trade relations. The technology sector was the standout performer, with the so-called "magnificent seven" tech giants, including Nvidia and Microsoft, driving the Nasdaq’s impressive gains.

The Dow Jones Industrial Average climbed 486.83 points to finish at 40,093.40, while the S&P 500 gained 108.91 points, closing at 5,484.77. The Nasdaq Composite surged by 457.99 points, ending at 17,166.04.

Earnings Season Highlights

As the earnings season progresses, several companies reported results that exceeded analysts’ expectations:

- ServiceNow: Shares soared by 15.5% after reporting a profit of $4.04 per share, surpassing estimates.

- Hasbro: The toy manufacturer saw its stock jump 14.6% following a strong earnings report, driven by robust demand in its gaming segment.

- Alphabet: The parent company of Google reported a revenue increase, leading to a 2.38% rise in its stock price, with an additional 4.63% gain in after-hours trading.

Conversely, some companies faced challenges:

- Procter & Gamble: Shares fell by 3.7% after the company trimmed its earnings forecast.

- PepsiCo: The beverage giant’s stock dropped 4.9% following disappointing earnings results.

Trade Tensions and Economic Indicators

The easing of trade tensions was a significant factor in the market’s positive performance. Following comments from Bessent, who indicated that the White House might be open to de-escalating tariffs, investors reacted favorably. Beijing’s call for the cancellation of U.S. tariffs on Chinese goods further fueled optimism.

In addition to trade news, economic indicators showed resilience, with stronger-than-expected new orders for durable goods and stable jobless claims contributing to a positive economic outlook.

Conclusion

The combination of strong earnings reports, particularly from the tech sector, and easing trade tensions has created a favorable environment for U.S. stocks. As investors remain optimistic about the potential for further easing of tariffs and continued economic growth, the market is poised for further gains in the coming weeks. The current rally underscores the importance of corporate performance and geopolitical developments in shaping market dynamics.

Sources

- Wall Street ends higher on tech boost, easing tariff tensions, Reuters.

- Stock market news for April 24, 2025, CNBC.

- US stock market ends higher led by tech stocks, easing tariff tensions; Nvidia, Microsoft, Tesla shares jump

3% each, Mint. - Yahoo is part of the Yahoo family of brands, Yahoo Finance.

- [Investors show confidence in ‘Trump put’ as tech leads stocks to another round of strong gains<!– –>

- MarketWatch](https://www.marketwatch.com/livecoverage/stock-market-today-dow-s-p-nasdaq-dip-after-rally-on-easing-trade-and-fedangst-alphabet-earnings-due/card/investors-show-confidence-in-trump-put-as-tech-leads-stocks-to-another-round-of-strong-gains-Q8kZvVuEkJi5XZZThsfv), MarketWatch.