Tech stocks experienced a significant rally on Monday following the announcement of a temporary tariff reduction between the United States and China. This development has injected optimism into the market, particularly benefiting major technology firms and chipmakers.

Key Takeaways

- Tech stocks surged after the U.S. and China agreed to reduce tariffs for 90 days.

- All major tech companies, including the Magnificent Seven, saw substantial gains.

- Chipmakers like Marvell Technologies and Broadcom also reported sharp increases in share prices.

Market Reaction to Tariff Reduction

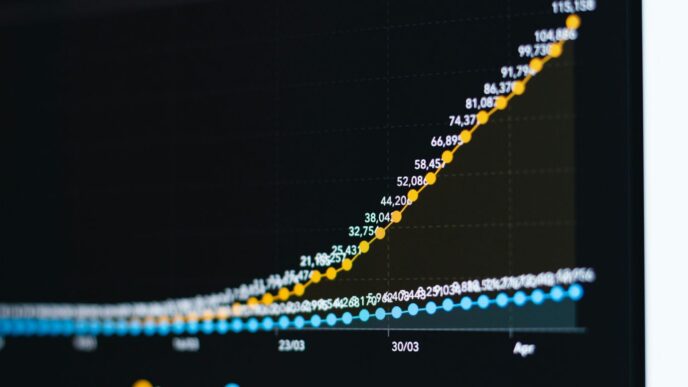

The agreement to temporarily slash tariffs has provided much-needed relief to investors who were anxious about the ongoing trade tensions. The Dow Jones Industrial Average jumped nearly 1,200 points, marking a 2.8% increase, while the S&P 500 and Nasdaq Composite rose by 3.3% and 4.4%, respectively.

The consumer discretionary sector led the charge, climbing approximately 5.5%, with technology stocks following closely behind at 4.5%.

Performance of Major Tech Companies

The rally was particularly pronounced among the so-called Magnificent Seven tech firms, which include:

- Tesla (TSLA)

- Alphabet (GOOGL)

- Microsoft (MSFT)

- Meta Platforms (META)

- Apple (AAPL)

- Nvidia (NVDA)

- Amazon (AMZN)

All these companies saw their stock prices rise significantly, with Tesla and Apple both increasing by over 6%. The Roundhill Magnificent Seven ETF (MAGS) also rose by 4% shortly after the market opened.

Chipmakers Lead the Charge

Chipmakers were among the biggest beneficiaries of the tariff news. Notable gains included:

- Marvell Technologies (MRVL): +8%

- Broadcom (AVGO): +6.5%

- Intel (INTC): +5%

- AMD (AMD): +5.5%

These companies had previously faced significant pressure due to the tariffs, making the news of a reduction particularly impactful.

Broader Economic Implications

The temporary tariff reduction is seen as a positive step towards a more stable economic environment. Treasury Secretary Scott Bessent announced that reciprocal tariffs would be cut from 125% to 10% for the next 90 days, while a separate 20% tariff related to fentanyl trafficking remains in place.

This move has not only boosted tech stocks but has also positively influenced other sectors, including consumer goods and services, as companies anticipate lower costs and improved supply chain dynamics.

Conclusion

The easing of trade tensions between the U.S. and China has sparked a significant rally in tech stocks, reflecting investor optimism. As negotiations continue, the market will be closely watching for further developments that could impact the economic landscape. The current surge in stock prices indicates a strong recovery from the recent downturn, suggesting that investors are hopeful for a more favorable trading environment in the near future.

Sources

- Tech stocks soar as US-China tariff deal boosts market confidence, YouTube · CNBC Television.

- US-China Trade Deal, Trump Talks Apple | Bloomberg Technology, YouTube · Bloomberg Technology.

- Tech Stocks Rally on US-China Trade Deal, Investopedia.

- Stocks Surge After US, China Agree to Slash Tariffs; Dow Jumps Nearly 1,200

Points as Amazon, Apple, Nike Soar, Investopedia.