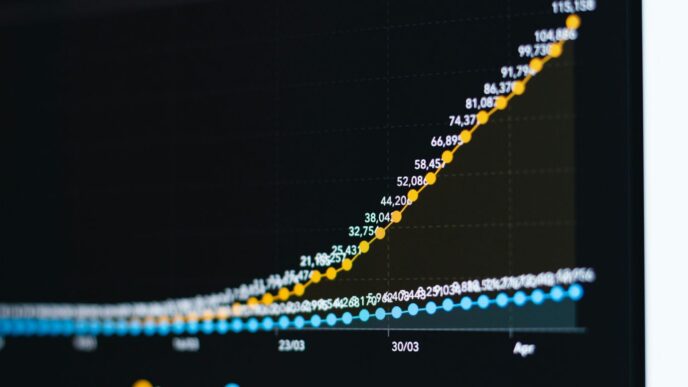

Tech stocks experienced a significant rally on Monday as news broke of a temporary trade agreement between the United States and China. The deal, which includes a 90-day pause on tariffs, has injected optimism into the market, leading to substantial gains across major tech companies and the broader stock market.

Key Takeaways

- The Dow Jones Industrial Average surged nearly 1,200 points, marking a 2.8% increase.

- The S&P 500 and Nasdaq Composite rose by 3.3% and 4.4%, respectively.

- Major tech firms, including the Magnificent Seven (Apple, Amazon, Microsoft, etc.), saw their stock prices rise significantly.

- Chipmakers like Nvidia and AMD also reported sharp increases in their stock values.

Market Reaction to Trade Deal

The announcement of the tariff reduction came after high-stakes negotiations over the weekend, where both nations agreed to lower their respective tariffs. The U.S. will reduce tariffs on Chinese goods from 145% to 30%, while China will cut its tariffs on U.S. imports from 125% to 10%. This unexpected development has alleviated fears of a prolonged trade war, which had previously weighed heavily on investor sentiment.

Performance of Major Tech Stocks

The rally was led by the so-called Magnificent Seven, which includes:

- Apple (AAPL) – Up over 5%.

- Amazon (AMZN) – Increased by approximately 8%.

- Microsoft (MSFT) – Gained around 2%.

- Nvidia (NVDA) – Rose about 5%.

- Tesla (TSLA) – Surged nearly 7%.

- Alphabet (GOOGL) – Increased by more than 3%.

- Meta Platforms (META) – Gained around 8%.

In addition to these giants, semiconductor companies also saw significant gains:

- Marvell Technologies (MRVL) – Up 8%.

- Broadcom (AVGO) – Increased by 6%.

- Intel (INTC) and AMD (AMD) – Both rose sharply, contributing to the overall tech sector’s performance.

Broader Market Implications

The positive market reaction is not limited to tech stocks. The consumer discretionary sector of the S&P 500 led the charge, rising about 5.5%. Other sectors, including energy and financials, also benefited from the renewed investor confidence.

Future Outlook

While the temporary tariff pause is a positive step, analysts caution that the situation remains fluid. Ongoing negotiations will be crucial in determining the long-term impact on trade relations between the U.S. and China. Investors are advised to stay vigilant as further developments unfold.

In summary, the recent trade agreement has provided a much-needed boost to the stock market, particularly for tech stocks, which had been under pressure due to escalating trade tensions. As both nations work towards a more comprehensive deal, the market will likely continue to react to news from these negotiations.

Sources

- Tech stocks soar as US-China tariff deal boosts market confidence, CNBC.

- Tech Stocks Rally on US-China Trade Deal, Investopedia.

- Stocks Surge After US, China Agree to Slash Tariffs; Dow Jumps Nearly 1,200

Points as Amazon, Apple, Nike Soar, Investopedia. - Megacap tech adds over $800 billion in market cap on tariff pause, CNBC.

- Dow racks up 1100+ gain as US-China agree trade deal By Investing.com, Investing.com.