Venture capital (VC) has always been a big deal for new companies trying to grow fast. But the way money flows is always changing. As we look ahead to 2025, new industries, the economy, and tech advancements are really changing where investors are putting their money. It’s smart for anyone starting a business or investing to know these shifts. This guide looks at the main venture capital trends for 2025, covering the sectors getting the most attention, the places where deals are happening, and the strategies investors are using.

Key Takeaways

- AI and green tech are huge areas for investment in 2025, with a lot of money going into companies that use artificial intelligence or focus on climate solutions.

- While the US still leads in venture capital, Europe is seeing a big push in sustainability and advanced technology, and Asia is buzzing with new tech and digital changes.

- Smaller, specialized venture capital funds (micro VCs) and those focusing on ESG principles are becoming more important for early-stage startups.

- Investors, or LPs, are really looking at how much money they actually get back (DPI) and are starting to prefer smaller, more focused funds, especially those using AI to pick companies.

- Founders need to understand the basics of venture capital, use their networks to build trust, and make sure their business goals match what investors are looking for.

Key Venture Capital Investment Sectors for 2025

Alright, let’s talk about where the money is flowing in the venture capital world for 2025. It’s not just about the next shiny app anymore; investors are really looking at sectors that can solve big problems and offer long-term growth. Think about it, the world’s changing, and so are the opportunities.

Artificial Intelligence and Automation Dominance

This one’s pretty obvious, right? AI is everywhere, and VCs are betting big on companies that can actually make it work for businesses. We’re talking about software that automates tasks, improves customer service, or gives companies better insights from their data. Generative AI, the kind that creates content or code, is also a huge draw. Plus, AI is making serious inroads into healthcare, helping with everything from diagnosing illnesses to developing new drugs. It’s not just hype; companies are seeing real results.

Green Tech and Climate Innovation Focus

Sustainability isn’t just a buzzword anymore; it’s a major investment driver. Venture capitalists are actively seeking out startups that are tackling climate change head-on. This includes new ways to generate and store renewable energy, technologies that capture carbon from the atmosphere, and even companies making everyday products more eco-friendly. There’s a real push for solutions that are good for the planet and good for business. European VC firms, for instance, have been putting a lot of money into battery tech and carbon capture solutions.

Fintech and Decentralised Finance Evolution

Fintech continues to be a hot area, but the focus is shifting. Instead of just digital banks, investors are interested in embedded finance – think payment options seamlessly integrated into other apps or services. Decentralised Finance (DeFi) and Web3 technologies are also gaining traction, with a lot of interest in blockchain-based financial products. And, of course, using AI to keep financial systems secure and prevent fraud is a big deal. It’s all about making financial services more accessible and efficient.

Health Tech and Biotech Advancements

Healthcare is always a critical sector, and VC funding reflects that. We’re seeing massive investment in digital health solutions, like telemedicine and remote patient monitoring. AI is also revolutionizing drug discovery, speeding up processes that used to take years. Wearable devices that track our health are another area getting a lot of attention. The pandemic really accelerated the adoption of many of these technologies, and investors see a lot of potential for continued growth.

Space Tech and Aerospace Opportunities

This might surprise some people, but space is becoming a major venture capital frontier. Companies are making space more accessible, whether it’s through commercial space travel, advanced satellite technology for communication and Earth monitoring, or even looking at resources in space. The work being done by companies like SpaceX has really opened the door for a new wave of aerospace startups, and investors are eager to fund the next big thing in this expanding industry. It’s a long game, but the potential rewards are huge.

Global Venture Capital Investment Hotspots

United States: Continued VC Capital Leadership

The United States, particularly hubs like Silicon Valley and New York, continues to be the world’s leading destination for venture capital. While these traditional centers remain strong, cities like Austin and Miami are rapidly gaining traction, attracting significant investment. The U.S. market is seeing robust funding in AI, fintech, and health tech, mirroring the key investment sectors for 2025. It’s a dynamic environment where established players and emerging cities alike are shaping the future of startup funding. The venture capital market in Q2 2025 shows a dynamic but uneven market, with AI continuing its dominance and global trends undergoing shifts, according to the CB Insights State of Venture Q2’25 Report. This ongoing strength makes the U.S. a consistent focus for both entrepreneurs and investors.

Europe: Sustainability and Deep Tech Growth

Europe is experiencing a significant surge in venture capital, with a strong emphasis on sustainability and deep technology. Countries across the continent are backing startups that address climate change and develop advanced technological solutions. Key cities like London, Berlin, and Stockholm are becoming major centers for this growth. Investors are drawn to Europe’s commitment to green initiatives and its growing pool of innovative deep tech companies. This focus on impactful innovation is making Europe an increasingly attractive region for venture investment.

Asia: Emerging Tech Boom and Digital Transformation

Asia is undeniably a hotbed for innovation, with venture capital flowing into startups driving the next wave of technological advancement. Countries like China, India, and Singapore are leading the charge, particularly in areas such as AI, e-commerce, and fintech. The region benefits from massive mobile adoption and a growing middle class, creating fertile ground for startups. Investors are keen to tap into this burgeoning market, recognizing its potential for high growth and transformative digital solutions. The sheer scale and pace of digital transformation in Asia make it a critical region to watch for venture capital activity.

Emerging Venture Capital Investment Strategies

The way venture capital firms are approaching investments is changing. It’s not just about the big, flashy deals anymore. We’re seeing a shift towards more specialized and focused strategies that aim to find value in different ways.

Micro VCs and Seed-Stage Specialisation

One big trend is the rise of smaller, more focused venture capital funds, often called "micro VCs." These firms tend to concentrate on very specific industries or stages of a company’s life, usually the very early, seed stage. They can offer founders more personalized attention and specialized knowledge. Instead of one large check from a big firm, startups might get several smaller checks from these niche investors. This approach allows them to build deeper relationships with founders and really understand the specific markets they’re investing in. It’s a bit like a boutique shop versus a department store – more curated and often more hands-on.

ESG and Impact Investing Integration

Environmental, Social, and Governance (ESG) factors are becoming more important. Investors are increasingly looking at how companies perform not just financially, but also in terms of their impact on the world. This means backing businesses that have a positive social or environmental mission alongside their profit goals. Think companies working on clean energy solutions or those with strong ethical supply chains. It’s about making money while also making a difference, which is a growing priority for many.

AI-Powered Investment Decision-Making

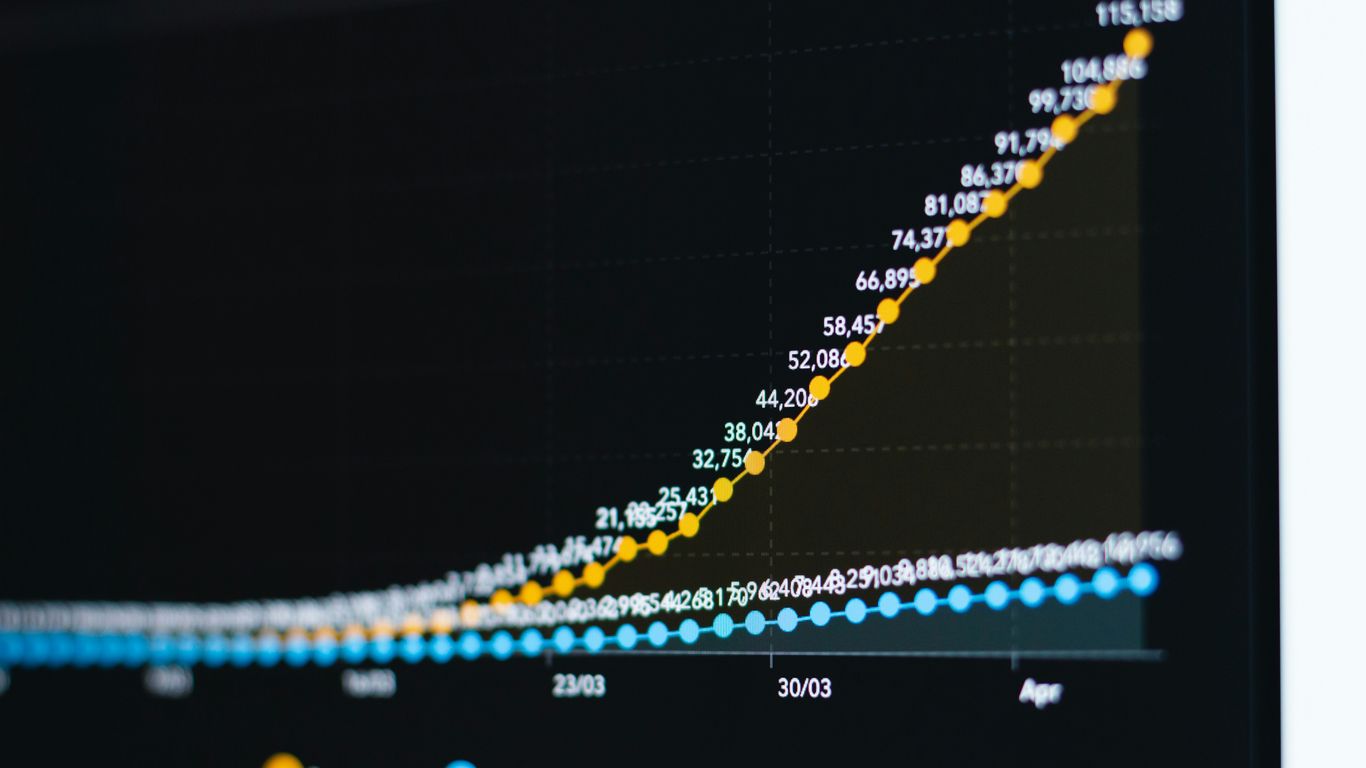

Artificial intelligence is starting to play a bigger role in how venture capital firms make decisions. By using AI and data analytics, firms can sift through vast amounts of information to identify promising startups more efficiently. This can help reduce bias in the investment process and potentially lead to better outcomes. AI is helping VCs spot trends and opportunities faster than ever before. It’s a tool to make the process more data-driven and less reliant on gut feeling alone, though that still plays a part. Global venture capital funding is seeing a surge, especially in generative AI, with funding in the first half of 2025 already surpassing all of 2024 [79a2].

Focus on Diverse Founders and Underserved Markets

There’s a growing recognition that talent and innovation exist everywhere, not just in traditional tech hubs or among certain demographics. Venture capital firms are making a more conscious effort to invest in companies founded by women, people of color, and those from underrepresented backgrounds. They are also looking at markets that might have been overlooked in the past. This not only opens up new avenues for investment but also brings fresh perspectives and ideas to the forefront, which can be incredibly valuable.

LP Perspectives on the 2025 Venture Capital Landscape

Limited Partners (LPs) are looking at 2025 with a mix of caution and optimism. After a few tough years with limited exits, many are eager to see capital flowing back into the ecosystem. The general feeling is that things are set to improve, with a focus on smarter, more targeted investments.

Emphasis on Distributions to Paid-In Capital (DPI)

One of the biggest talking points for LPs is the need for more Distributions to Paid-In Capital (DPI). Simply put, LPs want to see their money returned, not just locked up in investments. This lack of liquidity has made many hesitant to commit new funds. The hope is that 2025 will bring more successful exits, which will then free up capital for new commitments. This could restart the cycle of funding for both venture capital firms and the startups they back. Some believe that the outcome of recent elections might bring more certainty, helping with short-term DPI generation.

Rise of Smaller Funds and Boutique Venture

There’s a growing interest in smaller, more focused funds, often called "boutique venture." These firms tend to stick to specific investment areas and build deep relationships with founders. LPs see an advantage here because smaller funds can potentially return capital faster. They aren’t trying to be everything to everyone; instead, they concentrate on early-stage investing and cultivating strong founder networks. This approach is seen as a way to get better returns without the massive scale that larger funds require. It’s about being nimble and specialized.

AI’s Transformative Impact on Manager Selection

Artificial intelligence is not just a sector for startups; it’s also changing how LPs pick venture capital managers. As AI makes startups more complex and creates wider gaps in potential returns, LPs are rethinking how they evaluate potential investments. They’re looking for managers who can really understand these AI-driven companies and build portfolios that account for this new level of complexity. This means managers need to show a clear strategy for navigating the AI supercycle and how they plan to generate outsized returns in this space. It’s about finding managers who are ahead of the curve.

The Golden Vintage for Seed Managers

Many LPs are feeling positive about the prospects for seed-stage venture capital in 2025. They believe it could be a "golden vintage" year for these managers. The days of hobbyist funds or those just looking for quick money seem to be fading. LPs are looking for seed managers who are genuinely committed to the long haul and understand the realities of venture math. The market is expected to naturally favor funds that are the right size for their strategy, and LPs are less likely to be swayed by FOMO (fear of missing out). Instead, they’ll focus on proven track records and sensible fund sizes, especially for those raising under $100 million. This focus on quality and genuine commitment is a welcome shift for many investors in the venture capital market.

Navigating the Venture Capital Ecosystem

So, you’ve got a great idea, maybe even a working prototype, and you’re thinking about bringing in venture capital. It sounds exciting, right? Getting VC funding can really speed things up, giving you the cash and connections to grow your business faster than you could on your own. But it’s not just about the money; VCs often bring a ton of experience and industry contacts that can be super helpful.

Understanding Venture Capital Fundamentals

At its core, venture capital is money given to new, high-potential companies. These are usually businesses that are a bit too risky for regular bank loans because they might not be making a profit yet. Think of it as a partnership. Investors, called venture capitalists (VCs), give you money in exchange for a piece of your company, called equity. They’re betting on your company’s future success. It’s important to know that VCs often focus on specific industries, like tech or green energy, so they can really understand the businesses they invest in and offer targeted support.

Leveraging Networks for Credibility

When you’re looking for VC funding, your existing network can be a real asset. Having people you know, especially those with good reputations, vouch for you or introduce you to potential investors can make a big difference. Think about getting testimonials from well-known brands or people who have already used your product or service. These kinds of endorsements can really boost your credibility when you’re making your pitch. It’s like having a character witness for your business capabilities. You can find lists of potential investors through industry associations or platforms like AngelList, which connects startups with investors. Participating in pitch events and conferences is also a good way to get noticed.

Aligning Business Goals with VC Funding

Before you even start talking to VCs, it’s smart to think about whether VC funding is actually the right move for your business. Does your company have the potential for really rapid growth that VCs look for? Are you comfortable giving up some ownership and control? It’s a big decision. You need to make sure your long-term business objectives line up with what venture capital can offer. If your company is built for fast scaling and you’re ready for that kind of growth, then seeking out the right VC partners could be a game-changer. It’s about finding that perfect fit to help turn your vision into reality. For those looking to connect with potential investors, resources like top VC firms can be a great starting point.

Wrapping Up: What’s Next for Venture Capital in 2025

So, as we look ahead to 2025, it’s clear the venture capital world is still buzzing with activity. We’re seeing a big push into areas like AI, green tech, and even space, which is pretty wild to think about. For anyone trying to get a startup off the ground or looking to invest, keeping an eye on these trends is pretty important. It’s not just about having a good idea anymore; it’s about fitting into where the money is flowing and showing that your business can really grow. The landscape is always changing, so staying informed is key to making smart moves.

Frequently Asked Questions

What are the hottest areas for venture capital money in 2025?

Get ready for big investments in smart computer programs (AI) and ways to make things work better automatically. Also, companies helping the planet and fighting climate change are getting a lot of attention. Money is flowing into new ways to handle money (Fintech) and new health technologies that use computers and science to make people healthier. Even space companies are attracting serious cash!

Where in the world is venture capital money going?

The United States is still a major player, especially places like Silicon Valley. But Europe is catching up, focusing on green ideas and advanced technology. Asia is also a huge growth area, with lots of new tech companies popping up in places like China and India, especially in digital stuff and AI.

Are there new ways venture capitalists are investing?

Yes, smaller investment groups are popping up, focusing on really new companies just starting out. Many investors are also looking for companies that are good for the environment and society (ESG). Plus, they’re using smart computer programs (AI) to help them pick which companies to invest in, and they’re actively looking for businesses started by people from different backgrounds.

What do investors (LPs) think about venture capital in 2025?

Investors who put money into venture capital funds (LPs) are really focused on getting their money back (DPI). They like the idea of smaller, specialized investment groups. They also think AI will be super important for picking good investments and are noticing that smaller, focused funds might do really well in 2025.

How can a startup get venture capital funding?

First, understand the basics of how venture capital works. It’s about getting money from investors for your high-growth idea. Make sure your business idea fits with the big trends investors are looking for, like AI or green tech. Use your connections to get introductions and build trust. Show investors how your business will grow and make money.

What makes a startup attractive to venture capitalists?

Venture capitalists look for businesses that have a big potential to grow quickly and make a lot of money. They want to see that your idea is new and different, and that you have a plan to make it successful. Showing that your company is working on something important, like solving a big problem or using new technology, can also make you stand out.