The way we pay for things is changing, and fast. Mobile phones are at the center of it all, making payments quicker and easier. This article looks at the big shifts happening in fintech mobile payments, from instant transfers to new ways to pay and how tech like AI is making things smarter. We’ll also touch on paying across borders and what rules are shaping this new world.

Key Takeaways

- People want to pay instantly, and fintech mobile payments are making that happen, cutting down on abandoned shopping carts.

- There are more ways to pay now, like ‘Buy Now, Pay Later’ and direct bank payments, moving beyond just cards.

- AI is being used to make customer service better and to automate business payment tasks, making things more efficient.

- Paying friends or businesses in other countries is getting faster and less of a hassle thanks to fintech innovations.

- New digital banks and ‘super apps’ are changing how we manage money, pushing for more online-first financial tools.

The Rise of Real-Time and Instant Fintech Mobile Payments

Remember when waiting a few days for a payment to clear felt normal? Yeah, me neither. These days, we expect things to happen now. This shift towards instant gratification has totally changed the game for mobile payments. People just don’t want to wait around anymore, and honestly, who can blame them? It’s all about getting what you want, when you want it.

The Shift Towards Instant Payment Expectations

It feels like just yesterday we were all fine with waiting for checks to clear or for bank transfers to show up. Now, if a payment isn’t instant, it feels… slow. This expectation isn’t just a consumer whim; it’s becoming the standard. More than 70 countries have already rolled out real-time payment systems, showing just how widespread this demand is. It’s a big deal for customer satisfaction and builds trust in financial services. This move towards speed is really reshaping how we think about money moving around.

Benefits of Real-Time Transactions for Consumers and Merchants

For us regular folks, instant payments mean less stress. You buy something online, and boom, it’s paid for. No more worrying if you have enough in your account for a few days. For businesses, it’s a win-win. They get paid right away, which is great for cash flow. Plus, it makes customers happier, and happy customers tend to come back. It also helps cut down on those annoying payment processing fees that eat into profits.

Here’s a quick look at why it’s good for everyone:

- Consumers: Get goods and services faster, manage budgets better, and avoid late fees.

- Merchants: Improve cash flow, reduce the risk of bounced payments, and offer a better shopping experience.

- Financial Institutions: Streamline operations, potentially lower costs, and keep customers happy with modern services.

One-Click Payments and Reduced Cart Abandonment

This is where things get really interesting, especially for online shopping. You know how sometimes you’re about to buy something, but then you have to fill out a bunch of forms, enter your card details again, and it just feels like too much hassle? That’s a major reason why people abandon their shopping carts. One-click payment options, often powered by saved payment details in digital wallets, make buying things incredibly simple. It cuts down the checkout process to practically nothing. For mobile apps, this is a game-changer. It means fewer lost sales and more happy shoppers who get their items without the usual checkout drama. It’s a huge step forward in making online purchases smoother, and it’s something that AI-driven commerce is also helping to personalize.

Diversification of Payment Methods in Fintech

Gone are the days when paying for things online was just about swiping a credit card or using a debit card. Fintech has really shaken things up, giving us way more choices. It’s like walking into a store and seeing not just the usual options, but a whole bunch of new ways to pay. This variety isn’t just for show; it actually helps people buy more and makes things easier for businesses too.

The Growing Momentum of Buy Now, Pay Later (BNPL)

This one’s gotten super popular, especially with younger folks. Buy Now, Pay Later, or BNPL, lets you grab that item you want right now and then pay for it over time, usually in a few interest-free installments. It’s a big deal because it means you don’t have to wait or worry about credit card interest. Think about it: you get what you need today and spread the cost out. It’s a pretty sweet deal for managing your money without the hassle of traditional credit.

Open Banking and Pay-By-Bank Solutions

Open banking is a pretty neat concept. It basically means you can give trusted third-party apps permission to access your bank account information. This allows for all sorts of cool services, like budgeting apps or financial planning tools, to work right from your bank account. Pay-by-bank solutions are a direct result of this. Instead of entering card details, you can often just log into your bank account through the app to authorize a payment. It’s faster, often cheaper for merchants, and can feel more secure since you’re dealing directly with your bank.

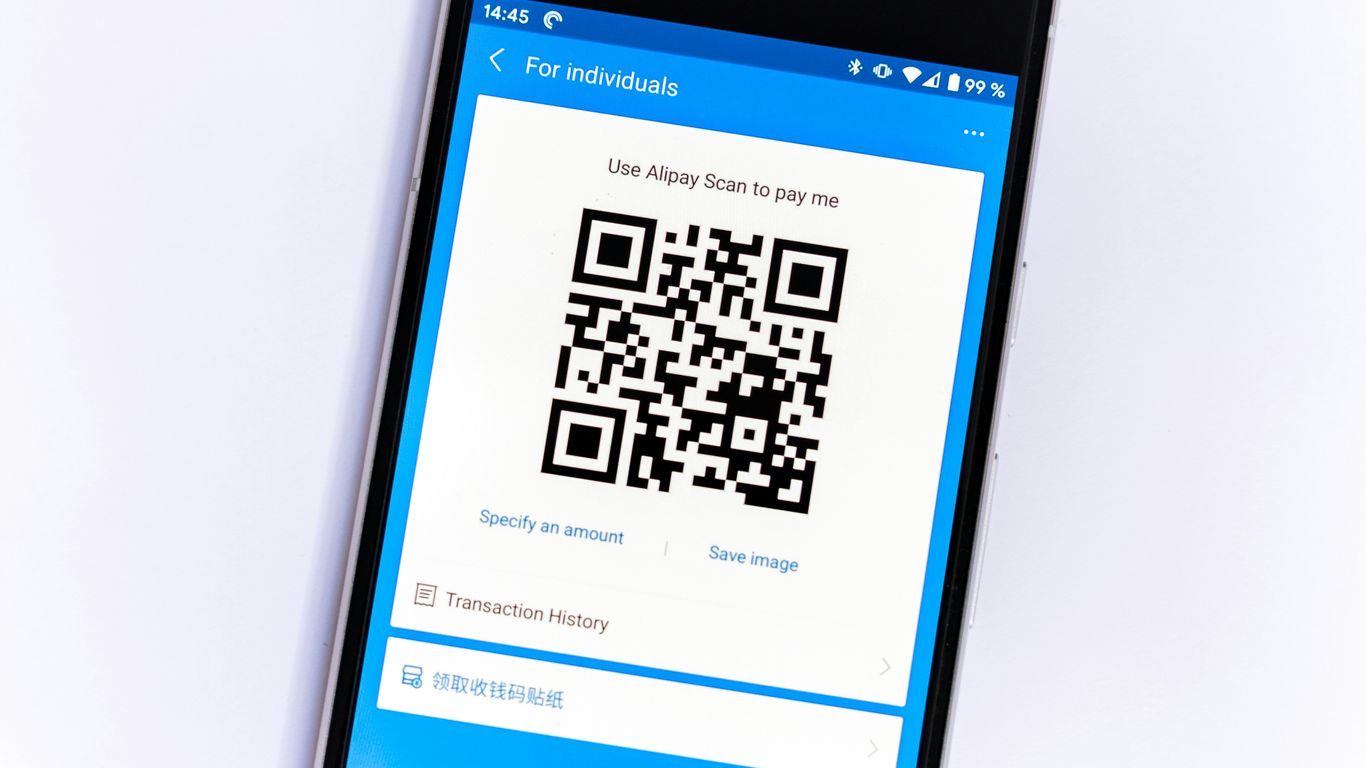

Integration of Digital Wallets and Alternative Currencies

Digital wallets, like Apple Pay or Google Pay, are practically everywhere now. They store your card information securely, making online and in-store payments quick and easy. But fintech is also looking beyond just traditional money. We’re seeing more integration with cryptocurrencies and other digital assets. While still a bit of a wild west, the ability to pay with or hold these alternative currencies within a fintech app is growing. It opens up new possibilities for transactions, though it definitely comes with its own set of considerations.

AI and Data-Driven Innovations in Fintech Payments

It feels like everywhere you look these days, there’s talk about Artificial Intelligence (AI) and how it’s changing things. And when it comes to money and payments, it’s no different. Fintech companies are really digging into AI and machine learning (ML) to make payments smarter, safer, and just plain better for all of us.

Leveraging AI for Personalized Customer Interactions

Think about it – companies know a lot about us from the data we share, right? AI helps them use that information to give us a more personal experience. Instead of getting generic offers, you might get something that actually fits what you need or what you’ve bought before. It’s like having a bank that really gets you.

- Predicting what you might need: AI can look at your spending habits and suggest financial products or advice tailored just for you.

- Better customer service: Chatbots powered by AI can understand your questions, even the tricky ones, and give you helpful answers, making you feel heard.

- Smarter marketing: Instead of annoying ads, you might see promotions for things you’re actually interested in, making your shopping experience smoother.

AI’s Role in Automating B2B Receivables and Payables

It’s not just about us consumers, though. Businesses are seeing big changes too, especially with how they handle money coming in and going out. AI is stepping in to automate a lot of the grunt work.

- Faster invoice processing: AI can read invoices, match them with orders, and get them ready for payment much quicker than a person could.

- Predicting cash flow: By looking at past transactions and upcoming payments, AI can give businesses a clearer picture of their finances, helping them avoid surprises.

- Automated reconciliation: Matching payments received with outstanding invoices can be a headache. AI can do a lot of this automatically, freeing up staff for more important tasks.

Data Analytics for Enhanced Payment Strategies

All this new tech generates a ton of data. The real magic happens when fintechs use this data to figure out better ways to do things. They’re not just collecting data for the sake of it; they’re using it to make smarter decisions.

Here’s a quick look at how data analytics is making a difference:

- Understanding customer behavior: By analyzing transaction patterns, companies can see what payment methods people prefer and why.

- Improving fraud detection: AI can spot unusual activity in real-time by looking at thousands of data points, helping to stop fraud before it happens.

- Optimizing payment flows: Data helps identify bottlenecks in payment processes, allowing companies to streamline operations and reduce costs.

Transforming Cross-Border Fintech Mobile Payments

Sending money across borders used to be a real headache, right? You’d wait days, pay hefty fees, and hope the exchange rate didn’t completely tank your transfer. But things are changing, and fast. Fintech companies are really shaking things up in the world of international mobile payments.

The Evolution of Faster International Transfers

Remember when international transfers felt like sending a letter by carrier pigeon? Well, those days are fading. More than 70 countries now have real-time payment systems, and this expectation is spilling over into cross-border transactions. Fintechs are stepping up by improving existing payment networks and building new tech to make things quicker. This means better speed and more visibility for everyone involved, from individuals sending money home to businesses paying international suppliers. It’s all about making global transactions feel as easy as sending a text message. This shift is a big deal for global trade, which is projected to hit $320 trillion by 2032. Fintech innovations are revolutionizing how we move money worldwide.

Addressing Currency Exchange and Settlement Delays

Beyond just speed, fintech is tackling the other big annoyances: confusing currency exchanges and those agonizing settlement delays. Nobody wants their payment to take longer just because of a clunky currency conversion. Fintech solutions are aiming to make these processes smoother and more predictable. This means better customer satisfaction because payments arrive when they should, without unexpected currency losses. It’s a complex puzzle, involving compliance and security, but solving it is a huge opportunity for fintechs.

Enhancing Transparency and Efficiency in Global Transactions

Transparency and efficiency are the buzzwords here. Fintechs are using new technologies and data to give users a clearer picture of their international payments. This includes understanding fees, exchange rates, and exactly when the money will arrive. By modernizing platforms and using data smartly, companies can make cross-border payments less of a black box. This makes it easier for businesses to manage their finances and for individuals to send money with confidence. The goal is to make international payments as straightforward and reliable as domestic ones, cutting down on errors and saving everyone time and money.

The Impact of Neobanks and Super Apps

Neobanks Disrupting Traditional Payment Processors

It feels like every other week there’s a new digital bank popping up, right? These neobanks, they’re really shaking things up. They don’t have the old brick-and-mortar branches, so they can move a lot faster and keep their costs down. This means they can offer pretty slick payment features that often beat what the big, old banks can do. Think simpler apps, quicker sign-ups, and just a generally more modern feel to your money. They’re basically forcing the traditional banks to step up their game, which is good for us consumers.

Super Apps Consolidating Banking, Payments, and Lending

And then there are these ‘super apps’. You know, the ones that try to do everything? You can chat with friends, order food, book a ride, and oh yeah, also manage your bank account and make payments, all in one place. It’s kind of wild how much they’re packing in there. For users, it’s super convenient to have everything in one app. You just log in once and you’re good to go for pretty much all your daily digital needs. From a fintech perspective, the trick is making sure all those different services actually work well together and offer enough real benefit to keep people hooked.

Driving Digital-First Financial Solutions

What all this really means is that the whole financial world is moving towards being digital-first. You don’t need to go to a bank anymore for most things. Neobanks and super apps are leading the charge, making it easier and faster to handle your money online. They’re building new tools and services that are designed for how we live now – on our phones, on the go. This push is making traditional banks rethink their own strategies, often leading them to partner with fintech companies instead of trying to build everything themselves. It’s a big shift, and it’s definitely changing how we all interact with our finances.

Navigating the Regulatory Landscape for Fintech Payments

Keeping up with the rules and regulations in the fintech world can feel like trying to catch smoke. It’s constantly shifting, and what was okay yesterday might be a big no-no today. For fintech companies, especially those dealing with mobile payments, staying compliant isn’t just about avoiding fines; it’s about building trust with users. The goal is to protect consumers without making payments a hassle.

Compliance and Security in Evolving Regulations

Regulators are paying closer attention, and for good reason. Things like stricter data privacy rules and new requirements for cross-border transactions are becoming the norm. For instance, new regulations might mean fintechs have to adjust how users access their apps or how data is handled. It’s a balancing act: you need strong security to prevent fraud and protect sensitive information, but it can’t be so complicated that it drives customers away. Think about Strong Customer Authentication (SCA) – it’s vital for security, but if it involves too many steps, people might just give up on the payment altogether. Companies need to be smart about integrating these security measures so they work in the background as much as possible.

The Role of ISO 20022 Standardization

This is a big one. ISO 20022 is basically a new language for financial messages. It’s designed to make payments more transparent and efficient across different systems and countries. Imagine sending a package internationally; if every country used a different way to label it, it would be chaos. ISO 20022 aims to create a universal standard. For fintechs, adopting this means their payment systems can talk to more systems more easily, which can speed things up and reduce errors. It’s a move towards a more connected global financial network, and getting on board early can be a real advantage. You can find more information on how this impacts financial messaging here.

Balancing Consumer Protection with Seamless Experiences

This is the tightrope walk for every fintech. On one hand, you have to follow rules designed to keep people safe from scams and unauthorized transactions. On the other hand, nobody wants to deal with a payment process that feels like a maze. Consumers, especially on mobile, expect things to be quick and easy. If a payment app asks for too many verification steps or takes too long, users will likely look elsewhere. Fintechs are constantly trying to find that sweet spot where security is robust, but the user experience remains smooth and intuitive. It’s about making safety feel invisible, not intrusive.

Looking Ahead

So, what does all this mean for the future of paying with our phones? It’s pretty clear things aren’t slowing down. We’re seeing faster payments become the norm, not just at home but across borders too. Plus, AI and smart tech are making things more personal and, hopefully, simpler. Businesses that want to keep up need to be ready to change and try new things. It’s a wild ride, but it looks like paying digitally is only going to get more integrated into our lives, making it easier and quicker to handle our money.

Frequently Asked Questions

What does ‘real-time payments’ mean for me?

Real-time payments mean your money moves instantly. When you pay for something, the money leaves your account and goes to the seller right away, not in a few days. This is super handy for shoppers and businesses because everyone gets their money when they expect it.

What is ‘Buy Now, Pay Later’ (BNPL)?

BNPL is like a short-term loan for things you buy. You get the item right away, but you can pay for it over a few weeks or months, often without paying any extra interest. It’s a popular way for younger shoppers to manage their money.

How does ‘Open Banking’ work?

Open Banking lets you safely share your bank account information with other trusted apps and companies. This means you can use apps that help you budget, save, or invest, all without needing to share your bank’s password. It makes managing your money easier and more personalized.

Why are international money transfers getting faster?

Companies are using new technology to send money across borders much quicker. Before, it could take days for money to arrive in another country. Now, it’s becoming almost as fast as sending money to someone in your own town, and often cheaper too.

What are ‘Neobanks’ and ‘Super Apps’?

Neobanks are like digital banks that operate only online, without physical branches. They often have cool apps that make banking simple. Super Apps are apps that do a lot of things, like banking, paying bills, and even lending money, all in one place.

What is ISO 20022?

ISO 20022 is a new set of rules for how financial messages are sent. Think of it like a universal language for banks and payment systems. It helps make international payments clearer, faster, and more reliable for everyone involved.