It’s 2026, and the world of artificial intelligence is buzzing. We’re seeing new companies pop up all the time, and a lot of money is flowing into them. This article looks at what’s happening with these AI startups, from the big funding deals to the actual tech they’re building. We’ll cover who’s investing, what they’re looking for, and some of the most interesting companies making noise right now. If you’re curious about the latest in AI startups news, you’ve come to the right place.

Key Takeaways

- AI startups are attracting a huge amount of venture capital, making up a significant portion of all funding, even though they represent a smaller percentage of funded companies. This shows investors are really focused on AI.

- Investors are looking for AI startups that have unique technology, a clear plan for growth, and understand the rules and regulations around AI. They also want to see proof that people actually want what the startup is offering.

- Big venture capital firms like Andreessen Horowitz and Sequoia Capital, along with specialized AI funds and angel investors, are actively putting money into AI companies. They each have their own ideas about what makes a good AI investment.

- While generative AI is getting a lot of attention, applied AI solutions that solve real-world problems are also attracting significant investment, especially from corporations and governments.

- To get funding, AI startups need to present a strong case to investors. This means having a clear plan, showing real customer interest, and being upfront about their business and finances.

AI Startups News: Funding Trends and Investor Insights

It feels like every other day there’s news about a new AI company raking in cash. The money is definitely flowing into this space, but it’s not just a free-for-all anymore. Investors are getting smarter about where they put their money, and that’s changing how startups are approaching funding.

AI Investment Landscape in 2026

The overall investment in AI is still climbing, with projections showing a big jump in capital expenditure. However, the days of easy money for any AI idea seem to be fading. Investors are becoming more selective, which means startups need to show more than just a good concept. They need solid proof that their AI solution actually works and has a real market. This shift means startups are focusing more on capital efficiency and demonstrating clear value. It’s less about speculative bets and more about companies that can show a path to profitability and growth.

Key Factors AI Investors Evaluate

So, what are these discerning investors looking for? It’s a mix of things, really. They want to see that you’ve got something unique, not just a copycat idea. This often comes down to proprietary technology – the secret sauce that makes your AI special. Then there’s scalability; can your business grow without breaking the bank? Investors also want to know you’ve thought about the rules and regulations, especially with AI. And of course, they need to see that people actually want what you’re selling. This means looking for:

- Market Validation: Evidence that customers are buying or using your product. This could be early sales, successful pilot programs, or strong customer testimonials.

- Proprietary Technology: Unique algorithms, data sets, or models that give you an edge.

- Scalability: A clear plan for how your business can grow rapidly without a proportional increase in costs.

- Team: A capable group that can execute the vision.

- Financials: A realistic understanding of your costs, revenue, and path to profitability.

Navigating the Funding Ecosystem

Finding the right money can feel like a maze. There are big venture capital firms, specialized AI funds, and even individual angel investors who are really into AI. Each has their own focus and typical investment size. For example, some firms like IA Ventures are known for investing in AI infrastructure, while others might focus on applied AI solutions. It’s important to research who is investing in companies at your stage and in your specific AI niche. Getting a warm introduction can make a big difference, so building your network is key. Understanding the different types of investors and their interests is half the battle when you’re trying to secure that next round of funding. You can find more information on how to approach these investors and what they look for on AI investment trends.

Leading AI Startups Making Waves in 2026

It feels like every other week there’s a new AI company popping up, and 2026 is no different. Billions are flowing into these startups, all trying to get ahead in this fast-moving field. We’re seeing a lot of action, from companies building the core AI tech to those finding practical ways to use it in businesses. It’s pretty exciting to watch.

Generative AI Innovators Securing Major Rounds

Companies working on generative AI, especially those with large language models (LLMs), are really grabbing attention and a lot of cash. Anthropic, for instance, has had a massive year, raising a huge $13 billion in a Series F round. This funding is helping them grow their services and research. Mistral AI is another big player, recently releasing their Mistral 3 models, including Mistral Large 3, which they trained using a lot of powerful Nvidia hardware. These companies are pushing the boundaries of what AI can create.

Applied AI Solutions Driving Enterprise Adoption

Beyond the big LLM players, there are startups focused on making AI work for specific business needs. Perplexity AI is one of them, offering a search engine that uses AI to give direct answers, pulling info from all over the web. They have both free and paid options, which is smart. Then there’s Project Prometheus, Jeff Bezos’s new venture. It’s reportedly working on AI for complex manufacturing tasks in areas like cars and aerospace, aiming for AI that does more than just chat. They’ve already brought in a lot of talent, showing they’re serious about tackling big challenges.

Emerging AI Companies to Watch

It’s not just the well-known names. Keep an eye on companies like WitnessAI, though details are still a bit thin on what exactly they’re doing. The landscape is always shifting, with new ideas and applications coming out constantly. The key for these emerging companies is often finding a unique problem to solve or a new way to apply existing AI tech. We’re seeing a lot of focus on AI that can actually be used day-to-day, not just theoretical advancements. It’s a mix of foundational tech and practical tools, and that’s what’s really shaping the market right now.

Venture Capital and Angel Investors Fueling AI Growth

It’s no secret that venture capital and angel investors are pouring money into AI startups right now. We’re seeing huge sums being invested, and it’s changing how companies get off the ground and scale up. This isn’t just about throwing money at the next big thing; it’s about smart money backing solid ideas.

Top VC Firms with AI Investment Theses

Big venture capital firms are really zeroing in on AI. They’ve got specific ideas about where they want to put their cash. For instance, Andreessen Horowitz (a16z) is known for its aggressive approach, looking for companies that can really shake things up. Sequoia Capital and General Catalyst are also major players, often seeking out businesses that aim to redefine entire markets, not just make small improvements.

- Andreessen Horowitz (a16z): Known for bold bets and a strong thesis on AI’s future.

- Sequoia Capital: Consistently backs category leaders across various tech sectors, including AI.

- General Catalyst: Focuses on companies with the potential to transform industries.

Specialized AI Funds and Their Focus Areas

Beyond the giants, there are specialized funds that are really getting into the weeds of AI. These firms often have a deeper technical focus or target specific niches within the AI landscape. Take Lightspeed Venture Partners, for example. They’ve been actively investing in AI infrastructure and tools for developers, often putting in between $5 million and $30 million for Series A to C rounds. They look for companies that are building the foundational pieces for AI applications.

Then there’s Kleiner Perkins, which has a keen eye for AI in areas like healthcare and sustainability, as well as consumer products. They typically invest smaller amounts, from $2 million to $20 million, from Seed through Series B. These specialized investors are critical because they often bring not just capital, but also deep industry knowledge and connections.

Here’s a quick look at what some of these specialized investors are looking for:

| Firm Name | Typical Investment Range | Focus Areas |

|---|---|---|

| Lightspeed Venture Partners | $5M – $30M | Enterprise AI, Developer Tools, Vertical Apps |

| Kleiner Perkins | $2M – $20M | Healthcare AI, Sustainability, Consumer AI |

| IA Ventures | $500K – $8M | AI Infrastructure, Data Intelligence, ML Apps |

Prominent Angel Investors in the AI Space

Angel investors are also a huge part of the AI funding picture, especially in the early stages. These are often individuals with deep tech backgrounds who can spot potential before it’s obvious. Think of people like Reid Hoffman, Marc Benioff, and Elad Gil. They’re not just writing checks; they’re often providing valuable advice based on their own experiences building major tech companies. Some angels, like Andrew Ng, bring incredible technical depth, focusing on areas like AI in education and manufacturing. They might invest smaller amounts, say $50,000 to $500,000, but their guidance can be incredibly impactful for a young startup.

- Reid Hoffman: Known for early bets on successful tech companies.

- Andrew Ng: Brings unparalleled technical AI knowledge, focusing on practical applications.

- Fei-Fei Li: Invests in human-centered AI, with a focus on computer vision and healthcare.

These investors, both VCs and angels, are the engine driving much of the innovation we’re seeing in AI today. They’re not just providing funds; they’re actively shaping the direction of the industry.

Innovation in AI: From Foundation Models to Applied Solutions

It feels like every week there’s some new AI development that makes you stop and think. We’re seeing a huge push in two main areas: the big, foundational models that power a lot of the new tech, and then the practical, applied solutions that businesses are actually using right now. It’s a pretty exciting time.

Advancements in Large Language Models

Large Language Models (LLMs) are still getting a lot of attention, and for good reason. They’re the engines behind so many of the AI tools we’re seeing pop up. Companies are pouring money into making these models bigger, smarter, and more efficient. We’re talking about models that can understand and generate text, code, and even creative content with surprising accuracy. For example, some new LLMs are showing real promise in areas like scientific research, helping scientists sift through massive datasets to find patterns or even suggest new hypotheses. It’s like having a super-powered research assistant.

AI Agents Transforming Industries

Beyond just generating text, AI agents are starting to make a real impact across different sectors. Think of them as autonomous workers that can handle specific tasks. We’re seeing them in customer service, automating responses and freeing up human agents for more complex issues. Amazon’s new AI agent for sellers, for instance, helps with everything from managing product listings to handling customer queries, which is a big deal for small businesses on the platform. In healthcare, AI agents are being developed to help doctors analyze patient data and predict disease progression, potentially changing how we approach preventative care. It’s not just about automation; it’s about creating smarter workflows.

Ethical AI and Regulatory Considerations

Of course, with all this rapid innovation, there are big questions about ethics and how we should regulate AI. As AI gets better at creating content, concerns about deepfakes and misinformation are growing. New tools are being developed to detect these fakes, but it’s an ongoing challenge. There’s also the issue of bias in AI models, which can lead to unfair outcomes if not addressed. Companies and researchers are working on ways to make AI fairer and more transparent. Plus, governments are starting to look more closely at how to create rules that encourage innovation while protecting people. It’s a balancing act, for sure, and something we’ll be hearing a lot more about.

Strategies for AI Startups Seeking Investment

So, you’ve built something pretty cool in the AI space, and now it’s time to get some cash to make it even bigger. It’s not always straightforward, though. Investors are looking at a lot of AI companies these days, and they want to see more than just a neat idea. They want to see that you’ve thought things through.

Crafting a Compelling Investor Pitch

Your pitch needs to tell a story, but not just any story. It needs to be clear, concise, and hit the important points right away. Think about what makes your AI special. Is it a new way of processing data? A unique algorithm? Investors are really interested in proprietary technology – stuff that’s yours and hard for others to copy. You also need to show you can grow. Can your system handle way more users or data without breaking the bank? That’s scalability, and it’s a big deal for them. Don’t forget about rules and regulations, especially if you’re in areas like healthcare or finance. Showing you’ve considered compliance from the start makes you look smart and less risky.

Demonstrating Market Validation and Traction

Ideas are great, but proof is better. Investors want to see that people actually want what you’re selling. This could be through pilot programs you’ve run, happy customer testimonials, or even just some early sales. It shows you’ve found a real problem and your AI is the solution people are willing to pay for. It’s about showing demand. You can also think about how to get funding without giving up too much of your company. There are ways to do that, and it’s worth looking into if you want to keep more control.

Understanding Investor Expectations

When you’re talking to potential investors, remember they’re looking for specific things. They want to see that your technology is unique and can’t be easily replicated. They also want to know your business model can scale up quickly. And, as mentioned, they’re checking if you’re following all the necessary rules and regulations. It’s a multi-step evaluation process. They’ll look at your tech, your business numbers, and your compliance. It’s a good idea to know who the big players are in AI investment, like Andreessen Horowitz and others, so you can target the right people. Having a solid plan that addresses these points will make your pitch much stronger.

AI Startups News: Notable Funding Rounds and Valuations

It’s been a wild ride for AI startups this year, with funding rounds hitting some pretty impressive numbers. We’re seeing a lot of capital flow into companies that are actually building useful AI tools, not just talking about them. The sheer amount of money being poured into AI is frankly astonishing.

Record-Breaking Funding for AI Giants

Some of the big players are really cleaning up. Companies with established platforms and clear paths to market are attracting massive investments. For instance, xAI, a company you might have heard of, recently pulled in a staggering $20 billion. That’s a huge sum, and it shows that investors are willing to bet big on AI’s future, especially when there’s a strong team and a clear vision behind it. It’s not just about the tech anymore; it’s about who can execute.

Significant Investments in Applied AI

Beyond the giants, there’s a lot of activity in companies focused on applied AI. These are the startups building AI solutions that businesses can actually use right now to improve their operations. Think AI for healthcare, finance, or manufacturing. LMArena, for example, managed to hit a $1.7 billion valuation in less than four months. That kind of rapid growth is a testament to the demand for practical AI applications. It’s a sign that the hype is starting to translate into real business value. If you’re looking for where the money is going, check out companies building practical AI.

Valuation Trends in the AI Market

So, what does all this funding mean for startup valuations? Well, they’re generally going up, but it’s not a free-for-all. Investors are still looking for solid fundamentals. Here’s a quick look at what seems to be working:

- Proprietary Technology: Does the startup have something unique that others can’t easily copy?

- Market Demand: Is there clear evidence that customers want and need this AI solution? This could be through pilot programs or early sales.

- Scalability: Can the business grow quickly without breaking the bank?

- Team: A strong, experienced team is always a big plus.

While some valuations are certainly eye-watering, there’s still a focus on sustainable growth and real-world impact. It’s an exciting time to be in the AI space, but founders still need to show they have a solid plan for turning that investment into a successful business.

Wrapping It Up

So, that’s a quick look at what’s been happening in the AI startup world for 2026. It’s pretty wild how much money is flowing into this space, with investors really zeroing in on AI companies. We’ve seen some huge funding rounds and some really interesting new ideas popping up, especially in applied AI. It feels like things are moving fast, and while some older AI areas might be finding it tougher to get cash, the practical, problem-solving AI stuff is definitely getting the attention. It’s going to be interesting to see how all these new companies and their technologies shape things in the coming years.

Frequently Asked Questions

What kind of AI companies are getting the most money in 2026?

Companies that make AI that can create things, like text or images, are getting a lot of attention and funding. Also, AI that solves real problems for businesses is attracting big investments. It seems like investors really like AI that can be used right away.

What do investors look for when deciding to fund an AI startup?

Investors want to see that a startup has its own special technology that others can’t easily copy. They also want to know if the company can grow big without costing too much extra money. Showing that people actually want and use the AI product is super important too. Plus, making sure the AI follows the rules is a big deal.

Who are some of the major players investing in AI startups?

Big venture capital firms like Andreessen Horowitz (a16z) and Sequoia Capital are putting a lot of money into AI. There are also specialized funds that only focus on AI, and well-known individual investors, sometimes called angel investors, who have a lot of experience in tech.

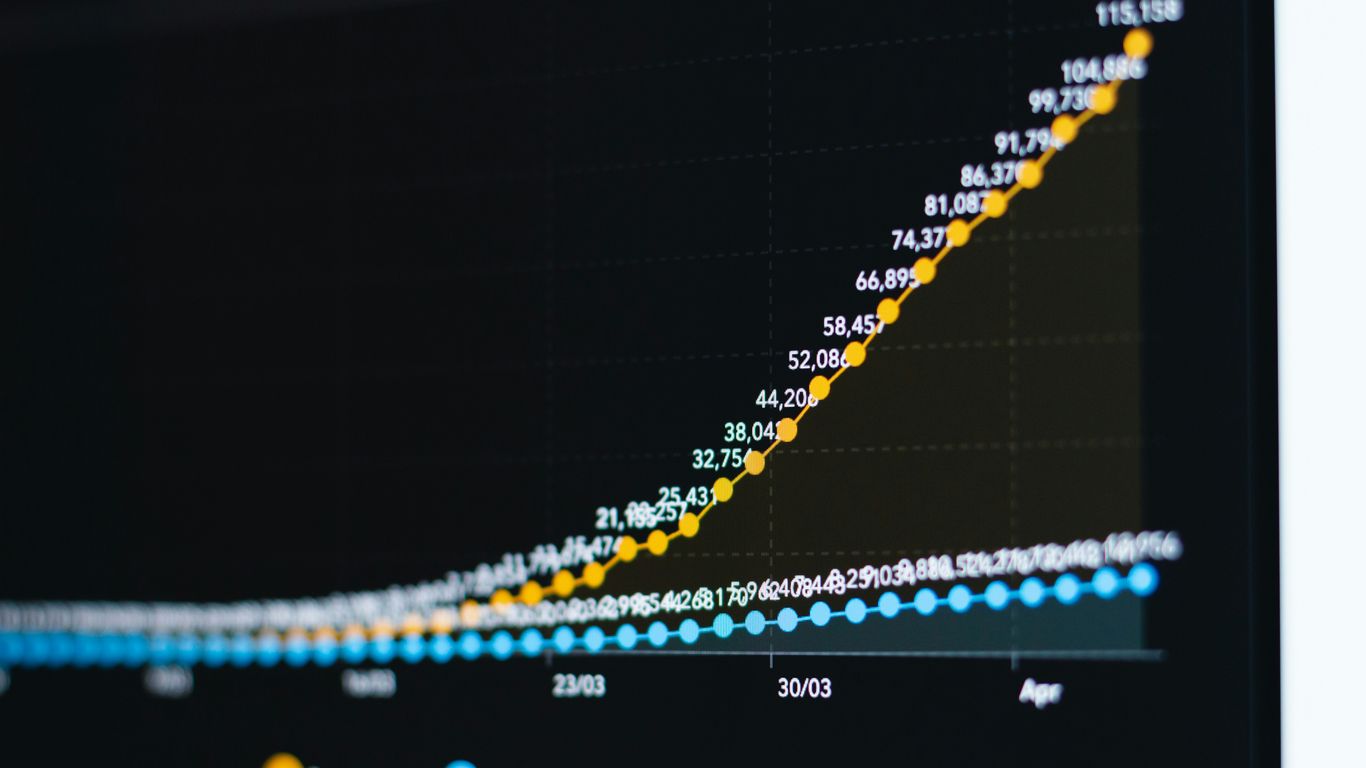

How much money is being invested in AI startups?

A huge amount of money is flowing into AI companies. In recent years, billions of dollars have been invested, making up a large portion of all venture capital funding. This shows that AI is a really hot area for investors right now.

What are some new and exciting things happening in AI innovation?

There’s a lot of progress in AI that can understand and generate human-like language, like advanced chatbots. We’re also seeing AI agents that can do tasks automatically and help run businesses more smoothly. People are also talking more about making AI fair and safe to use.

What’s the best way for an AI startup to get funding?

To get money, startups need a clear plan that shows investors why their idea is great and how it will make money. It’s important to have proof that customers like the product and that the company can handle growth. Having a strong team and a good story about the AI’s unique abilities helps a lot.