Right then, let’s have a look at what’s been happening over at Y Combinator. It’s always a bit of a buzz what they’re up to, and this latest news yc update is no different. We’ve got some dates for you, a look at some big successes, and a bit of a chat about how they work with founders, especially those over in Canada. So, settle in, grab a cuppa, and let’s get stuck in.

Key Takeaways

- Y Combinator has announced the dates for its 2026 Demo Day, allowing everyone to plan ahead.

- The accelerator has welcomed a new group of visiting partners, all experienced founders themselves.

- A new initiative with Coinbase is aiming to support developers building onchain.

- YC continues to back successful companies, with Meesho and Groww both recently going public, showing their impact on global startups.

- After some discussion, YC has reversed its decision and will once again accept Canadian incorporations, showing continued support for Canadian founders.

Latest News and Announcements From YC

Upcoming 2026 Demo Day Dates Announced

Mark your calendars! Y Combinator has released the dates for its 2026 Demo Days. This is a heads-up for founders, investors, and anyone interested in the startup scene to get ready for what’s next. It’s always a big event, showcasing the latest crop of companies YC has been working with.

YC Welcomes New Visiting Partners

It’s great to see YC bringing in fresh perspectives. Nine accomplished founders are joining the team as Visiting Partners. These are folks who’ve been in the trenches, built successful companies, and now they’re here to share their experiences and guide the next generation. It’s a solid move that should really benefit the current batches.

YC x Coinbase Initiative for Onchain Development

This is a pretty interesting development. YC, along with Coinbase and Base, is launching an initiative to really push onchain development. They’re looking for builders who want to create in the crypto space, especially now that things are getting clearer with regulations and technology. They want to fund people who are ready to build the next wave of fintech and crypto applications. It sounds like a good opportunity for anyone looking to get into that area.

The focus here is on supporting innovation in the rapidly evolving world of onchain technologies. By partnering with Coinbase, YC aims to provide resources and a platform for founders to explore and build the future of decentralised applications and financial systems.

YC’s Impact on Global Startups

Y Combinator is well-known for its speed, but what really stands out is how startups that go through the programme seem to keep making headlines, no matter where you look. Some of the world’s best-known startups owe a big part of their story to a few intense months spent in YC. Let’s break down some of the most interesting recent successes.

Meesho’s Successful Public Listing

Meesho, the Indian social commerce platform, finally completed its long-anticipated IPO last quarter. The company started off helping small retailers sell online and now handles millions of orders every day. There were a few sleepless nights before their listing, especially as market conditions looked shaky, but Meesho powered through.

- Generated billions in annual revenue by 2025

- Expanded presence into Southeast Asia

- Became the first unicorn from its batch to go public

Most founders say the leap from local to global is the hardest jump. Meesho’s story suggests it can be done—and maybe more often than we think, if you catch the right break at the right time.

Groww’s Public Debut in India

Another big YC headline is Groww, which went from being a small investment product to one of India’s leading trading platforms. Their IPO drew attention well outside India, with many first-time retail investors jumping in. What stood out wasn’t just the listing, but the number of ordinary users who now see investing as less scary, thanks to Groww’s simple approach.

Groww at a Glance (Table)

| Metric | 2024 | 2025 |

|---|---|---|

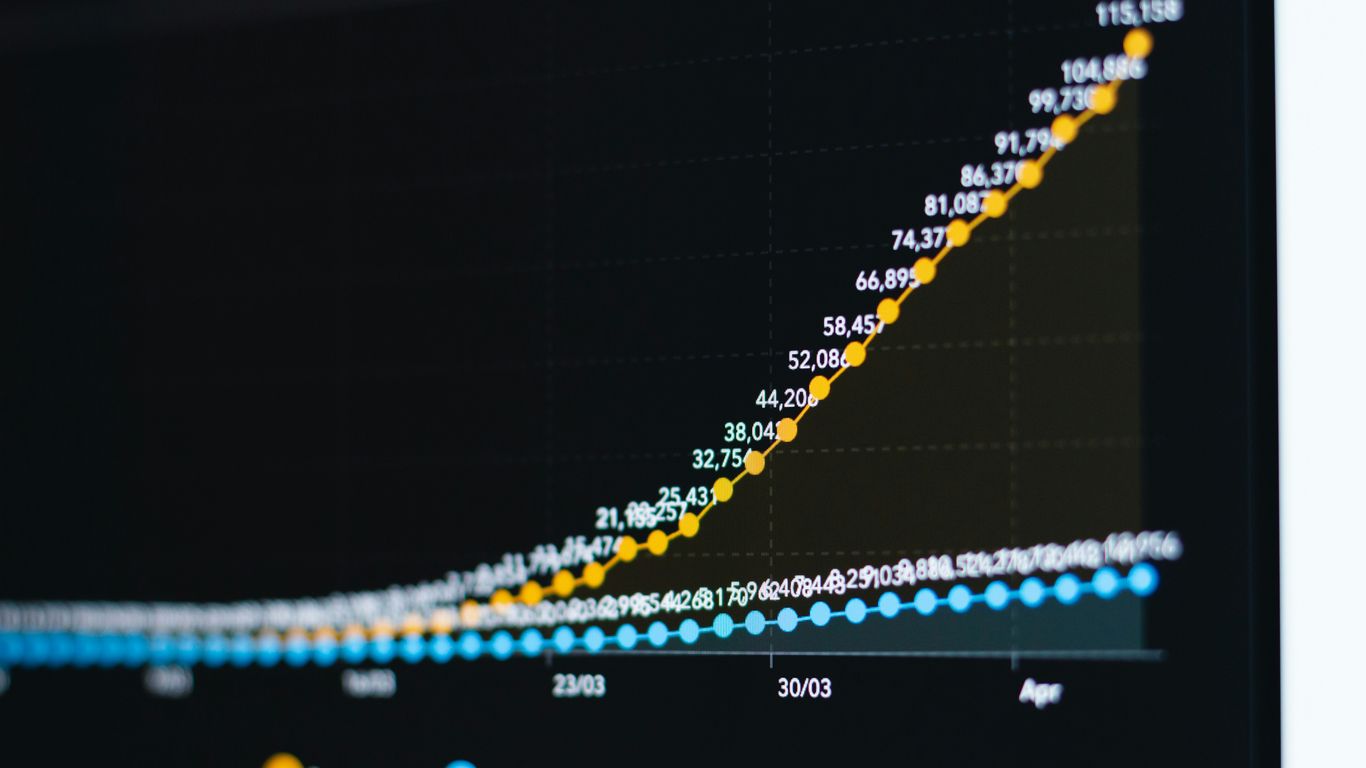

| User accounts | 32 million | 44 million |

| Quarterly revenue | $55 million | $79 million |

| Market share | 14% | 17% |

YC’s Role in Building Major Tech Companies

There’s a running joke that if you use the internet for more than five minutes, you’ll touch something YC helped build. From US to Europe, and Asia as well, the alumni list looks more like a map of today’s digital economy:

- OpenAI: Now valued at $500B, powering AI for everyone

- Stripe: Building the backbone for online payments worldwide, valued at $107B

- Airbnb: From couch-surfing to $100B+ public company

- Coinbase: The first big crypto company to make Wall Street

- DoorDash, Instacart, and Dropbox: All gone public, all changing how people work, shop, and eat

Somehow, every few months, a new YC company hits the headlines with something unexpected. Whether it’s a massive IPO, a billion-dollar acquisition, or simply changing how daily life works, the influence just doesn’t seem to slow down.

YC’s Investment Philosophy and Terms

Y Combinator has a pretty straightforward approach when it comes to backing new companies. They’re all about getting in early and helping founders get their ideas off the ground, fast. It’s not just about the money, though that’s obviously a big part of it. They really focus on the people behind the ideas – the founders themselves.

Standard Investment Terms and Amounts

When YC decides to invest, they typically offer a standard package. For a while now, they’ve been putting in US$500,000 per company. This usually breaks down into two parts: an initial US$125,000 for a 7 percent equity stake, often structured as a post-money SAFE (Simple Agreement for Future Equity). The remaining US$375,000 comes on an uncapped SAFE, which includes a Most Favoured Nation clause. Importantly, YC states they don’t charge any fees for this, and they try to avoid tricky terms that could catch founders out later on. It’s a model designed to be clear and fair, allowing founders to focus on building rather than getting bogged down in complex legalities. They’ve been investing in startups in India for a while now, with firms like Blume Ventures also focusing on seed-stage businesses.

Focus on Early-Stage Companies

YC’s bread and butter is really at the very beginning of a startup’s journey. They’re looking for companies that are just starting out, often with just an idea or a very early product. The goal is to provide the initial boost needed to get things moving. This early-stage focus means they’re comfortable with a lot of uncertainty, which is typical for brand new ventures. They believe that by getting involved at this nascent stage, they can have the biggest impact on a company’s trajectory.

YC’s Commitment to Founders

Beyond the financial investment, YC’s commitment to founders is pretty significant. They see themselves as partners in the long haul. The three-month intensive program in San Francisco is just the start. After Demo Day, the support continues through the extensive YC alumni network. This network is a massive resource, connecting founders with people who’ve been through it all before. YC aims to turn builders into formidable founders, ready to tackle any challenge.

The YC experience is designed to create a sense of urgency. Founders often describe the program as the most productive period of their lives, with months of progress being compressed into just a few weeks. This intense environment, coupled with the support of fellow founders, creates a unique atmosphere for rapid development and problem-solving.

Canadian Founders and YC Incorporation

Reversal on Canadian Incorporation Policy

So, Y Combinator made a bit of a stir recently by changing its standard deal terms. For a short while, they removed Canada from the list of countries where startups could be incorporated to get YC funding. This meant Canadian founders would have had to re-register their companies in places like the US, Cayman Islands, or Singapore if they wanted to join the accelerator. It caused quite a bit of chatter in the Canadian tech scene, with some folks feeling it sent the wrong message about building companies in Canada.

Feedback from Canadian Tech Community

Turns out, a lot of Canadian founders and investors weren’t too pleased. People pointed out that while the US might offer easier access to capital for some, especially in fields like AI, you can still build really successful companies right here in Canada. There was a feeling that this move might push ambitious founders south unnecessarily. It’s a tricky balance, isn’t it? You want the best opportunities, but you also want to build up your local ecosystem.

The debate highlighted how important it is for accelerators to consider the broader impact of their policies on different tech communities. It’s not just about the money; it’s about the signal it sends and the support structures it affects.

YC’s Continued Support for Canadian Startups

But, good news! After hearing all the feedback, Y Combinator quickly reversed the decision. They’ve put Canada back on the list of accepted incorporation jurisdictions. They’ve said they still invest in dozens of Canadian startups every year and have hundreds of Canadian founders in their alumni network. It seems they realised that while some of their top-performing Canadian companies did reincorporate in the US, that doesn’t mean they want to stop supporting Canadian founders directly. It’s good to see them listen and adjust.

Notable YC Alumni Success Stories

It’s always inspiring to look at the companies that have come through Y Combinator and gone on to do incredible things. These aren’t just abstract success stories; they’re real businesses that have fundamentally changed how we live, work, and interact. The sheer scale of their impact is staggering.

Let’s take a look at a few of the standouts:

OpenAI’s Growth and Valuation

Sam Altman was part of YC’s very first batch back in S05. He later founded OpenAI as YC Research in 2015. Fast forward to today, and OpenAI has become a genuine powerhouse in artificial intelligence, reaching a valuation that’s frankly hard to comprehend. It’s a testament to the vision and relentless effort involved.

Stripe’s Dominance in Payments

The Collison brothers, Patrick and John, actually went through YC twice, first in W07 and then again in S09 when they officially launched Stripe. Now, Stripe is pretty much the backbone of online payments for countless businesses worldwide. It’s become so integrated into the digital economy that it’s easy to forget it started as a small idea in a YC batch.

Airbnb’s Market Impact

Brian Chesky, Joe Gebbia, and Nate Blecharczyk were part of the W09 YC batch. Their idea for a platform to rent out spare rooms and entire homes seemed a bit niche at first, didn’t it? Well, Airbnb went public in 2020 with a valuation well over $100 billion. It completely reshaped the travel and hospitality industry, showing how a simple concept, executed brilliantly, can change everything. It really highlights how YC helps founders test market demand, a bit like how crowdfunding works for new products.

Coinbase’s Public Offering

Fred Ehrsam and Brian Armstrong met through Reddit, of all places, and then joined YC in S12. Their company, Coinbase, aimed to make buying and selling cryptocurrencies accessible. They successfully went public in 2021 with a massive valuation of $86 billion. It was a huge moment for the crypto world and a clear sign of YC’s ability to spot and nurture companies in emerging technological fields.

Here’s a quick look at some of the combined valuations:

| Company | YC Batch | Approximate Valuation |

|---|---|---|

| OpenAI | S05 | $500 Billion |

| Airbnb | W09 | $100+ Billion |

| Stripe | S09 | $107 Billion |

| Coinbase | S12 | $86 Billion |

The journey from a YC batch to a global giant is rarely a straight line. It involves immense dedication, constant adaptation, and a willingness to push boundaries. The network and the intense focus during the program seem to equip founders with the resilience needed for the long haul.

These companies, among many others, demonstrate the profound effect Y Combinator has had on the startup landscape. They started as ideas, got refined through the YC process, and ultimately became world-changing businesses.

The YC Experience for Founders

Accelerated Growth and Urgency

Being part of Y Combinator really throws you into a whirlwind. It’s like someone hit the fast-forward button on your startup’s life. The whole atmosphere is geared towards making massive progress in a short amount of time. You’re constantly pushed to do more, faster, and it’s surprisingly infectious. You find yourself working harder and smarter than you ever thought possible, all because everyone around you is doing the same. It’s a period where months of development can genuinely feel like they happen in just a few weeks.

The Power of the Founder Network

One of the biggest takeaways from YC is the network you build. It’s not just about the partners or the mentors, though they’re great. It’s about the other founders in your batch. You’re all going through the same intense experience, facing similar challenges, and celebrating the same small wins. This shared journey creates a bond that’s hard to find anywhere else. You get advice, support, and even just a listening ear from people who truly get it. It feels like having a massive support system, which is invaluable when you’re building something from scratch. This community is a huge part of why so many companies succeed after YC.

Setting New Benchmarks for Speed

Before YC, you might have a certain idea of what ‘fast’ means for a startup. After YC, that definition completely changes. The program is designed to make you question your own limits and push past them. You see companies making huge leaps in product development, user acquisition, and fundraising in what feels like an instant. It’s not just about working hard; it’s about working with an intense focus and a clear direction. This environment helps founders realise just how quickly things can move when you have the right support and a shared sense of purpose.

The intensity of the YC program means you’re constantly challenged. You learn to make decisions quickly, iterate rapidly, and adapt to new information without hesitation. This mindset is what separates good startups from great ones, and YC instils it from day one.

Wrapping Up

So, that’s a quick look at what’s been happening with Y Combinator lately. It’s clear they’re still a major player, helping out all sorts of companies, from the big names we see going public to new ones just starting out. They’ve had a bit of a rethink about where companies can be based, which is good news for Canadian founders. It just goes to show that YC is always evolving, and it’s worth keeping an eye on what they do next, especially if you’re involved in the startup world.

Frequently Asked Questions

When are the Y Combinator Demo Days happening in 2026?

Mark your calendars! The dates for Y Combinator’s 2026 Demo Days have been announced. This helps founders, investors, and everyone interested in startups plan their schedules well in advance.

Who are the new Visiting Partners at Y Combinator?

Y Combinator has welcomed nine brilliant founders as new Visiting Partners. These experienced individuals will bring valuable insights and guidance to the current startups.

What is the YC x Coinbase Initiative?

This initiative is all about building on the blockchain. YC, Base, and Coinbase are teaming up to support and fund people who want to create new things in the crypto space during this exciting time.

Has Y Combinator changed its rules about where Canadian companies can be based?

Yes, they have! After listening to feedback from Canadian founders, Y Combinator has decided to allow companies to be incorporated in Canada again. They realised how important it is for Canadian startups.

What kind of companies does Y Combinator usually invest in?

YC focuses on very early-stage companies. They are happy to invest even if a company doesn’t have any money coming in yet, doesn’t have a finished product, or is still figuring out its main idea.

What is the main goal of going through Y Combinator?

The main goal is to speed up your company’s growth like never before. You’ll feel a strong sense of urgency, which makes it a super productive time. Plus, you get to be part of an amazing network of founders and mentors.