It’s been about a decade since Duke Energy and Progress Energy joined forces. This merger brought together two big utility companies, and it’s had a pretty noticeable effect on how things work, especially for customers in North and South Carolina, and even Florida. We’re talking about changes in how rates are set, how energy is managed, and what programs are available to help people save power. Let’s take a look at what’s happened since the duke energy and progress energy merger.

Key Takeaways

- The merger of Duke Energy and Progress Energy aimed to simplify operations and save customers money, with projected savings over $1 billion through 2038.

- Combining Duke Energy Carolinas and Duke Energy Progress in North Carolina is a move to level out electricity rates across the state, a process expected to take about a year for approval.

- The company is making strategic financial moves, like selling parts of its business and bringing in investors, to fund future projects and keep costs down for customers.

- Energy efficiency programs in Florida are being looked at closely, with hopes that lessons learned from successful programs in the Carolinas can help improve efficiency and address challenges there.

- New legislation in North Carolina is changing how utility rates and investments are handled, affecting how Duke Energy recovers costs and plans for the future.

The Duke Energy and Progress Energy Merger: A New Era

So, back in 2012, Duke Energy and Progress Energy decided to join forces. It was a pretty big deal in the utility world, kind of like when two major sports teams merge. The main idea behind this whole thing was to create a more efficient and streamlined company that could serve customers better across a larger area. They figured by combining their resources, they could cut down on costs and make things simpler for everyone involved.

Initial Rationale for Combining Utilities

The folks running Duke and Progress saw a lot of sense in teaming up. They believed that by merging, they could get rid of some duplicate efforts and make their operations smoother. Think about it: two separate companies doing similar things means twice the paperwork, twice the overhead, and potentially less focus on the actual job of providing power. The goal was to create a single, stronger entity that could handle the complexities of the energy business more effectively. This wasn’t just about getting bigger; it was about getting smarter with how they operated.

Regulatory Approvals and Timeline

Of course, when you’re talking about merging two huge companies like this, especially in a regulated industry, you can’t just do it overnight. There were a lot of hoops to jump through with state and federal regulators. They had to get approvals from places like the North Carolina Utilities Commission, the Public Service Commission of South Carolina, and the Federal Energy Regulatory Commission. This process took time, and the companies had to show how the merger would benefit customers and the energy grid. The whole thing was planned to officially take effect around the start of 2027, giving everyone time to get ready.

Anticipated Customer Savings

One of the big promises made during the merger talks was that customers would see some financial benefits. Duke Energy projected that by combining operations and spreading out costs, they could save customers over $1 billion through 2038. This was supposed to happen through a few different avenues:

- Streamlining Operations: Cutting down on redundant tasks and administrative costs.

- Infrastructure Efficiencies: Sharing resources and spreading the cost of maintaining the power grid over a larger customer base.

- Rate Structure Simplification: Eventually blending the different rate plans that existed in North Carolina to create a more uniform system, which could lead to more predictable bills for many.

It’s a lot to unpack, but the idea was that a bigger, more efficient company would translate into real savings for the people who rely on their power every day.

Operational Synergies and Streamlining Efforts

Bringing Duke Energy and Progress Energy together wasn’t just about making one big company out of two. It was also about figuring out how to run things more smoothly and save money in the process. Think of it like merging two busy households – you end up with more stuff, but you also find ways to organize it better and stop buying duplicates.

Consolidating North Carolina Rate Structures

Before the merger, customers in North Carolina were dealing with two different sets of electricity rates, depending on whether they were served by Duke Energy Carolinas or Duke Energy Progress. This meant four different rate structures in total across the Carolinas, which, let’s be honest, was confusing. The plan was to gradually blend these rates over time. The idea is that by having one unified rate structure, it simplifies billing and makes it easier for everyone to understand what they’re paying for. It’s a big step towards making the customer experience more consistent across the state.

Reducing Infrastructure and Operational Expenses

One of the biggest promises of the merger was cutting down on costs. When you have two separate companies, you often have duplicate systems, more buildings, and more staff needed to keep everything running. By combining operations, Duke Energy aimed to reduce these overheads. This could mean sharing maintenance crews, consolidating office spaces, and streamlining how they manage their power plants and transmission lines. The goal was to run fewer, more efficient energy production units instead of keeping all older, separate ones running at full capacity. This kind of efficiency is key to keeping costs down for customers in the long run.

Aligning Energy Production and Demand Management

With two utilities operating independently, there was a chance for inefficiencies in how they produced power and managed customer demand. By bringing them under one roof, Duke Energy could better match electricity generation with actual customer needs across a larger, combined territory. This means they can be smarter about when and how much power they generate, potentially reducing the need for expensive, quick-start power plants that are only used during peak times. It also allows for more coordinated efforts in managing demand, like encouraging customers to use less electricity during busy periods, which benefits everyone by reducing strain on the system and lowering overall costs.

Impact on Energy Efficiency Programs

The merger brought together utilities with different track records when it came to helping customers save energy. It was a bit of a mixed bag, honestly. Duke Energy Carolinas, for instance, had a pretty good thing going, managing to save twice as much energy as its sister company, Progress Energy Carolinas, in the years leading up to the merger. Both of those operations really stepped up their game in energy efficiency in the couple of years before they joined forces.

Lessons Learned from Carolinas’ Successes

In the Carolinas, Duke Energy had a history of making energy efficiency programs work well and at a low cost. Back in 2009, they settled on a plan called "Save-a-Watt" that really rewarded good performance. The idea was to save a lot of energy without spending too much money. They figured it would cost about 2.3 cents per kilowatt-hour saved, but in reality, it came in closer to 1 cent per kWh. That’s pretty impressive and put them ahead of others in the region for cost-effective savings. This approach showed that utilities could be smart about efficiency and save customers money.

Addressing Florida’s Energy Efficiency Challenges

Progress Energy Florida, on the other hand, had a tougher time. Their programs were older, and frankly, a bit behind the times. Most of them were set up to meet basic goals from years ago, and they weren’t as effective as they could have been. Plus, the costs for their efficiency efforts were higher than in the Carolinas. With the future of their nuclear plant uncertain, ramping up energy efficiency in Florida seemed like a smart move. The combined company had the chance to bring the successful, low-cost methods from the Carolinas to Florida, which could really help customers save money and reduce strain on the grid.

Implementing Performance-Based Incentives

One big difference between the Carolinas and Florida operations was how they were set up to make money. In the Carolinas, both Duke and Progress had ways to earn profits from energy efficiency, which gave them a reason to push harder. But in Florida, Progress Energy didn’t have that same incentive. This meant customers in Florida didn’t get as much help saving energy compared to those in the Carolinas. The merger presented a real opportunity to align these programs and introduce performance-based incentives in Florida, making sure that shareholders were rewarded for successful energy efficiency efforts, just like they were in the Carolinas. This kind of structure is good for everyone involved – it encourages the utility to do a better job and benefits customers with lower bills and more reliable service.

Financial Strategies and Capital Investments

After the big merger, Duke Energy really had to figure out its money game. It wasn’t just about combining two companies; it was about making sure the new, larger entity could handle its finances and invest wisely for the future. This meant making some pretty significant moves, like bringing in outside money for its Florida operations and selling off parts of the business that didn’t quite fit anymore.

Strategic Equity Investments in Florida Operations

One of the biggest financial plays was bringing in Brookfield, an infrastructure investor, to buy a chunk of Duke Energy Florida. This deal brought in a cool $6 billion. The idea was to get some serious cash infusion to help fund Duke’s big plans for upgrading its infrastructure, which they’d already bumped up to $87 billion over five years. A good chunk of that money from Brookfield went straight into those capital investments, and the rest helped pay down some of the company’s debt. It was a smart way to get the funds needed for growth without taking on more loans.

Divestiture of Non-Core Business Units

To really focus on what matters, Duke Energy also decided to sell off some of its businesses that weren’t central to its main operations. They sold their natural gas business in Tennessee, Piedmont Natural Gas, to Spire for $2.48 billion. This sale included pipelines and a liquefied natural gas facility. By shedding these non-core assets, Duke could free up cash and simplify its overall structure, allowing it to concentrate its resources on its core electricity generation and distribution, especially in the Carolinas and Florida.

Funding Future Growth and Modernization Plans

So, where did all this money go? A lot of it is earmarked for modernizing the grid and building new energy sources. Duke Energy has been talking about significant investments in natural gas generation projects, like new turbines for the Marshall Steam Station and a big combined-cycle generator in North Carolina. These investments are all about making sure the company can meet the growing energy demands of its customers over the next decade and beyond, while also trying to keep costs down. It’s a balancing act, for sure, but these financial moves were designed to give them the flexibility to do just that.

Regulatory Landscape and Future Legislation

So, after the big Duke Energy and Progress Energy merger, things got pretty interesting on the regulatory front. It wasn’t just a simple ‘okay, you’re one company now.’ There were a lot of rules and laws to sort out, and honestly, it’s still a work in progress.

Navigating State and Federal Regulatory Bodies

When two big utility companies join forces, especially across state lines, you can bet the government wants to have a say. Duke Energy and Progress Energy had to get approvals from a bunch of different places. We’re talking about state utility commissions in North Carolina and South Carolina, plus federal agencies like the Federal Energy Regulatory Commission (FERC). Each one has its own set of rules and priorities, and getting everyone on the same page took time and a lot of paperwork. It’s like trying to get all your friends to agree on a movie – sometimes it feels impossible.

Reforms to North Carolina’s Regulatory Framework

North Carolina, in particular, saw some pretty big changes. Back in July 2025, the state legislature passed a law called the Power Bill Reduction Act. This was a pretty significant move. It basically changed how utilities are regulated there. One of the key things it did was adjust the goals for cutting carbon emissions. While the long-term goal of being carbon neutral by 2050 is still there, the intermediate target of a 70% reduction by 2030 was removed. This gives companies like Duke Energy a bit more flexibility in how they get there. This kind of legislative action directly impacts how utilities plan their investments and operations for years to come.

Mechanisms for Cost Recovery and Investment

Another big piece of the puzzle is how companies get paid back for all the money they spend on upgrading the grid and building new power sources. The new laws in North Carolina, for example, introduced ways for Duke Energy to recover costs more easily. This includes things like securitization, which is basically a financial tool to help fund big projects by issuing bonds. It also affects how they can pass on fuel costs to customers. For a company making massive investments, having clear pathways for cost recovery is super important. It helps them secure the funding needed for things like modernizing infrastructure and meeting future energy demands without taking on too much financial risk.

The Combined Entity’s Service Territory

So, after Duke Energy and Progress Energy officially became one big company, a lot changed, especially when it came to where they actually provide power. Think of it like two neighboring towns deciding to merge their city services – things get reorganized, and the map gets redrawn, in a way.

Geographic Coverage in North and South Carolina

Before the merger, Duke Energy Carolinas and Duke Energy Progress had their own areas they served, mostly in North and South Carolina. Duke Energy Carolinas tended to cover the central and western parts of both states. This included big cities like Charlotte and Durham in North Carolina, and Greenville and Spartanburg in South Carolina. Then you had Duke Energy Progress, which generally handled the eastern and central areas. This meant places like Raleigh, Fayetteville, and Wilmington in North Carolina, and Florence and Sumter in South Carolina. It’s a bit confusing, right? Because Progress Energy also served Asheville, which is way out west in North Carolina, kind of overlapping with Duke Energy Carolinas’ territory. Now, with the companies combined, the goal is to have a more unified service area across these two states, making things simpler for everyone involved. This consolidation means a much larger, more connected footprint, aiming to serve millions of customers across tens of thousands of square miles.

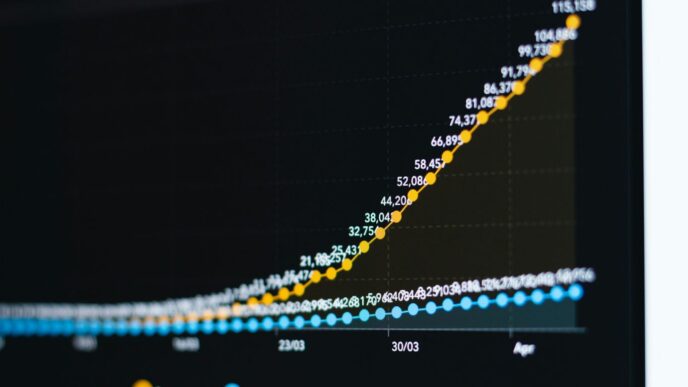

Customer Base and Energy Capacity

When you put Duke Energy Carolinas and Duke Energy Progress together, you’re talking about a massive customer base. We’re looking at millions of homes and businesses that rely on this single entity for their electricity. This isn’t just a small operation; it’s one of the biggest utility setups in the country. The combined energy capacity is also pretty significant. Together, these two former companies have the ability to generate over 34,000 megawatts of power. That’s a huge amount, enough to keep the lights on for a vast population and support a lot of industrial and commercial activity. This combined capacity is key to meeting the energy demands across their expanded territory, especially as the region grows.

Impact on Local Economies and Growth

Merging these two utilities has a ripple effect on the local economies within their service areas. For starters, the idea is that streamlining operations and consolidating infrastructure could lead to significant cost savings, potentially over a billion dollars. These savings are supposed to eventually benefit customers, but they can also free up capital for the company. This capital can then be reinvested in the communities they serve. Think about upgrades to the power grid, investments in new energy technologies, or even just more stable energy prices, which helps businesses plan and grow. A more reliable and potentially more affordable energy supply is a big deal for economic development. It makes areas more attractive for new businesses to set up shop and for existing ones to expand. Plus, when a utility company is in a stronger financial position, it can better support local job creation, both directly through its own operations and indirectly through the economic activity it enables.

Looking Back, Moving Forward

So, a decade after Duke Energy and Progress Energy joined forces, it’s clear things haven’t exactly been simple. We’ve seen a lot of changes, from how the companies operate to how they talk about saving customers money. There have been big financial moves, like selling off parts of the business and bringing in new investors, all while trying to keep the lights on and maybe even lower bills. The dust is still settling on some of these big decisions, and how it all plays out for customers and the environment is something we’ll keep watching. It’s a reminder that even after a merger, the work of running a utility is always ongoing, with new challenges and opportunities popping up all the time.