Finding the right place to get your economic news can feel like a chore. There are so many options out there, and figuring out which ones are actually good and worth your time is tough. We looked at a bunch of them to find the best economic news website for 2026. Whether you’re a seasoned investor or just starting out, there’s something here for you. Let’s get into it.

Key Takeaways

- Seeking Alpha offers in-depth stock analysis and picks, with various subscription tiers available for different needs.

- TradingView is highlighted for its charting tools and technical analysis capabilities, making it a go-to for traders.

- Motley Fool provides stock recommendations, with different services catering to various investment styles and budgets.

- Morningstar is noted for its focus on mutual funds and is a resource often used by financial advisors.

- Fiscal.ai is recognized as a strong research terminal for both retail and professional investors, offering data analysis.

1. Stock Analysis

When you’re trying to figure out where to put your money, having good information is key. That’s where a site like Stock Analysis comes in. It’s basically a treasure trove of free data for regular folks who want to look into stocks. Think of it as a souped-up version of other popular finance sites, but faster and with more accurate numbers, all presented in a way that doesn’t make your head spin.

What’s really neat is the sheer amount of data they have. We’re talking financial statements, all sorts of stats, dividend info, and even company profiles. They also track key performance indicators that companies report, which can give you a real peek into how a business is actually doing, beyond just the standard numbers. It’s pretty cool to see details like Microsoft’s cloud revenue, for example.

Beyond the company specifics, you can check out what analysts are saying, look at price targets, and even do some technical analysis with their charts. And if you like digging for new ideas, their stock screener is a big deal. It has hundreds of filters, so you can really narrow down your search to find stocks that fit what you’re looking for. They also have lists, an ETF screener, and calendars for IPOs and earnings. All of this is free, no sign-up needed. You can even set up a few watchlists to keep an eye on your favorite companies. They also put out a newsletter called Market Bullets that a lot of people read to stay updated without spending too much time. If you want to get even more out of it, there’s a Pro version, but honestly, the free stuff is pretty solid for most people just starting out or looking for solid stock information.

2. Seeking Alpha

Seeking Alpha is a pretty interesting place if you’re looking for a ton of different opinions on stocks. It’s like having a whole bunch of analysts, not just one, giving you their take. Thousands of contributors post their research reports there, and these folks are usually individual investors or teams who really dig into companies. They’ll tell you if they think a stock is a buy, sell, or hold.

Before anything gets published, Seeking Alpha’s editors check it out to make sure it’s accurate and well-done. They put out over a thousand new articles every single week, so there’s always something new to read. Beyond the articles, they also have financial data, a stock screener, and news updates. They even have these "Quant Ratings" that look at a stock’s basics, what analysts expect, and how the price has been moving lately. It’s a lot to sift through, but if you want a wide range of perspectives, it’s a solid spot to check out.

3. TradingView

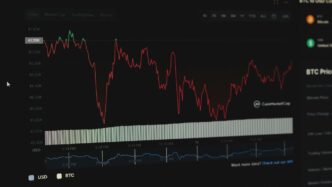

When it comes to charting and really digging into the technical side of things, TradingView is a standout. It’s got this super clean interface that feels good to use, whether you’re just starting out or you’ve been trading for ages. They’ve packed it with tools, but it doesn’t feel overwhelming. Seriously, the charting capabilities alone are a huge draw for active traders.

TradingView has a massive user base, with folks from all over the world using it. It’s fast, it’s powerful, and it’s pretty intuitive. While there’s a free version, serious traders will probably find themselves hitting limits pretty quickly. Most people end up going for one of the paid plans, like Essential or Plus, which you can test out with a free trial. It’s a solid place to get a handle on market movements and see how different indicators play out. You can even share your charts and ideas with the community, which is a nice touch. If you’re looking to get a better feel for the US economy’s surprising strength at the end of 2025, their tools can help you visualize that data. Check out their charts.

4. Motley Fool

When you think about getting stock tips, the Motley Fool probably pops into your head pretty quickly. They’ve been around for ages, and their ‘Stock Advisor’ service is pretty famous. Basically, they send out two stock picks every month, and they really focus on finding companies that they think will do well over the long haul. It’s not just about quick trades; it’s more about finding solid businesses to hold onto.

Their track record is something they talk about a lot. For instance, they claim their picks have beaten the S&P 500 by a wide margin over the years. As of early 2026, they’re reporting returns of over 1000% since 2002, which is quite a jump compared to the S&P’s returns in the same period. It makes you wonder how they do it, right?

Here’s a quick look at what their popular ‘Stock Advisor’ service includes:

- Two stock recommendations per month.

- Detailed analysis explaining why each stock was chosen.

- A list of ‘Starter Stocks’ – past picks that are still considered good buys.

- Access to community forums and extra learning materials.

They also have other services like ‘Rule Breakers’ for high-growth potential stocks and ‘Hidden Gems’ for foundational companies. If you’re someone who doesn’t want to spend hours researching stocks yourself, letting a team like Motley Fool do some of the heavy lifting might be appealing. They even offer a money-back guarantee, so you can try it out without too much risk.

5. Morningstar

Morningstar is a name many investors, especially those focused on mutual funds, are familiar with. It’s a solid resource, often used by financial pros, and it’s mostly free to use. You can get a good sense of how different parts of the market are doing by checking out their "Barometer" on the homepage. If you’re deep into mutual funds, Morningstar really shines. It pulls together a ton of info – things like expense ratios, performance history, risk levels, and even the fund company itself. They also give each fund a star rating, which is based on how it stacks up against similar funds. Beyond funds, they put out good news and analysis on the economy and business world too. For those who want even more, their premium service, Morningstar Investor, offers deeper research and portfolio tools, but the free version is quite useful on its own. It’s a good place to start if you’re trying to get a handle on market expectations for 2026 [6a8e].

What Morningstar offers:

- Mutual Fund Data: Detailed information on performance, fees, and risk.

- Star Ratings: A comparative ranking system for funds.

- Market Pulse: Daily insights into market sector performance.

- News and Analysis: Coverage of economic and business topics.

6. Fiscal.ai

Fiscal.ai is a pretty neat tool for folks who really dig into the nitty-gritty of company finances. Think of it as a super-powered research desk all in one place. It pulls together a ton of information that investors usually have to hunt down from a bunch of different spots.

What’s cool is how fast they update things. If a company drops its earnings report, Fiscal.ai gets those financial statements – like the income statement and balance sheet – updated almost immediately. No more waiting around for days.

They also track a massive amount of specific company data points, called KPIs. We’re talking over a million data points for thousands of stocks. So, if you want to know something specific like Amazon’s AWS revenue or how often Airbnb’s ‘Take Rate’ changes, they’ve likely got it.

Here’s a quick look at what makes it stand out:

- Speedy Updates: Financial reports are live within minutes of release.

- Deep Data: Tracks over 1 million company-specific metrics across 2,500 global stocks.

- AI Assistant: A built-in AI chatbot helps you ask questions and get research insights quickly.

It’s a paid service, costing about $49 a month after a two-week trial, but for serious investors who need detailed, up-to-the-minute financial data, it’s a solid option.

7. Stock Market Guides

Sometimes, you just need a straightforward breakdown of how to approach the stock market, and that’s where dedicated guides come in handy. These resources are great for getting a handle on the basics or even finding specific trade setups if you’re more active.

Think of them as your go-to for learning the ropes or spotting opportunities. They often cut through the noise and give you actionable information. For instance, some guides focus on scanning for specific chart patterns or technical indicators that might signal a good entry or exit point. It’s not just about random tips; it’s about understanding the mechanics.

Here’s what you might find in a good stock market guide:

- Clear explanations of trading strategies: From day trading to swing trading, they break down how different approaches work.

- Analysis of market indicators: Understanding what things like moving averages or RSI actually mean for your trades.

- Scans for potential setups: Tools or methods to find stocks that fit specific criteria, helping you do your own research.

These guides can be particularly useful for active traders looking for a structured way to find potential investments. If you’re trying to get a better handle on the market’s movements and want to refine your approach, checking out a well-regarded stock market guide is a solid move. You can find a lot of helpful information to improve your trading strategy with these types of resources.

8. Finviz

Finviz is a pretty straightforward tool, and honestly, it’s a lifesaver if you just need to sift through a ton of stocks quickly. It’s basically a stock screener, and it’s free, which is a big plus. You can filter stocks based on almost a hundred different data points. Think things like revenue growth, how much insiders own, or even technical indicators like the RSI. It’s really good at finding stocks that fit exactly what you’re looking for.

The main thing to know is that Finviz is best used as a pure screener. If you need a lot of news or in-depth analysis all in one place, you might find it a bit lacking. The site has gotten a bit cluttered with ads over time, which can be annoying, but if your main goal is to find stocks based on specific criteria, it still does a solid job. It’s a no-frills option that gets the job done for screening.

Here’s a quick look at what you can filter:

- Descriptive: Filter by exchange, sector, industry, country, and more.

- Fundamental: Look for stocks based on market cap, P/E ratio, EPS, sales growth, and insider ownership.

- Technical: Use indicators like the RSI, MACD, and moving averages to find stocks.

- Advanced: Combine multiple criteria for very specific searches.

9. Yahoo Finance

Yahoo Finance has been around for ages, and for good reason. It’s a go-to spot for a lot of people looking for free information on stocks. You can find all the basic stuff here – financial statements, ratios, and other data for thousands of companies worldwide. It’s like a big library for stock research.

What really makes Yahoo Finance stand out, though, is its news aggregation. They pull in tons of articles from different financial sites and analysts every single day. If you want to get a feel for what’s happening with a particular stock, checking its news feed on Yahoo Finance is a pretty quick way to do it. It’s a solid place to start if you just want to see what the general buzz is around a company.

Here’s a quick look at what you can typically find:

- Company Financials: Income statements, balance sheets, cash flow statements.

- Key Ratios: P/E, EPS, debt-to-equity, and more.

- Aggregated News: Articles from various financial news outlets.

- Stock Performance: Charts and historical data.

- Analyst Opinions: Summaries of analyst ratings and price targets.

While it might not have all the fancy bells and whistles of some paid services, Yahoo Finance remains a reliable and accessible resource for everyday investors trying to stay informed.

10. MarketWatch

MarketWatch is a pretty solid place to get your financial news fix. They’re known for real-time updates, which is handy when things are moving fast. You can sign up for their newsletters, and they’ll send you headlines and links to full articles. It’s a good way to see what’s happening without getting bogged down in a long email.

They offer a few different newsletter options, so you can pick the one that best fits what you’re looking for. Some focus on general business news, while others might zero in on specific markets or personal finance topics. It’s a decent approach if you like to curate your own news intake.

Here’s a quick look at what you might find:

- Breaking News Alerts: Get notified right away when major financial events happen.

- Daily Newsletters: Summaries of the day’s top business and financial stories.

- Market Updates: Focused content on stock movements and economic trends.

One thing to keep in mind is that while you can get a taste of their content for free, a lot of the in-depth articles are behind a paywall. You get a limited number of free articles each month, so you’ll have to decide if it’s worth it to subscribe for full access. It’s a good resource, especially if you’re trying to keep up with the January Barometer’s implications for the year ahead [6fec]. Just be prepared that deep dives might cost you.

11. Kiplinger’s Investing for Income

Kiplinger’s has been a trusted name in personal finance for ages, and their "Investing for Income" newsletter is a good example of why. This isn’t about chasing the next hot stock; it’s more about building a steady stream of income from your investments. It’s particularly geared towards folks who are retired or nearing retirement and want their money to work for them without too much fuss.

For $79 a year, you get access to their recommendations. They focus on investments that pay out regularly, like dividends from stocks or interest from bonds. It’s a pretty straightforward approach, which is nice when you just want clear advice.

Here’s what you can generally expect:

- Income-focused investment ideas: The core of the newsletter is about finding assets that generate a yield.

- Portfolio examples: They often provide sample portfolios to give you a concrete idea of how to put their advice into practice.

- Retiree-friendly strategies: The content is tailored for those looking for passive income to supplement their lifestyle.

They offer both print and digital versions, so you can pick the format that works best for you. If you’re someone who prefers a tangible copy or just likes the idea of getting advice from a long-standing publication, this could be a solid choice for your income-generating portfolio.

12. Zacks

Zacks is a pretty well-known name in the investing research world, and they’ve got a few different ways to get their info. You can start with their free newsletter, which is basically a quick rundown of financial news, some stock ideas, and links to their articles. It’s not bad if you just want a general feel for what’s happening.

If you’re looking for more, they have paid options. The Premium service ($249/year) gives you more stock picks and deeper analysis. Then there’s the Ultimate package ($299/month), which is a whole lot of research tools and analysis. Honestly, for most people just checking out the scene, the free newsletter is probably the way to go. It’s a solid starting point for getting some stock ideas and news without spending a dime.

Here’s a quick look at what they offer:

- Free Newsletter: Daily financial news summaries, suggested stock buys, and article links.

- Premium Service ($249/year): More stock picks and detailed analysis.

- Ultimate Package ($299/month): Extensive research tools and in-depth market analysis.

13. Money Stuff by Matt Levine

Okay, so let’s talk about Matt Levine’s "Money Stuff." If you’re into finance, you’ve probably heard of him. He used to be an investment banker, and now he writes this newsletter for Bloomberg Opinion. It’s basically his take on what’s happening in the world of Wall Street, business, and all that jazz.

What I like about it is that Levine doesn’t just report the news; he actually explains it. He breaks down complex financial topics in a way that’s surprisingly easy to follow, even if you’re not a finance whiz. He has this knack for making even the most boring corporate finance stuff sound interesting, and often pretty funny. It’s not just dry facts; it’s commentary with a personality.

Here’s what you can generally expect:

- Market happenings: He covers big deals, regulatory changes, and general market trends.

- Company news: Think mergers, acquisitions, and sometimes just weird business decisions.

- Explaining the ‘why’: He’s really good at digging into the reasons behind financial events.

It’s a free newsletter, which is awesome, though some of the deeper articles might eventually hit a paywall. Still, the daily emails give you a solid dose of what’s going on. If you want to get a better grasp on the financial news cycle, checking out Money Stuff Daily is a good move.

14. The Daily Upside

Alright, let’s talk about The Daily Upside. If you’re someone who likes to get the gist of what’s happening in the business and finance world without getting bogged down in endless details, this might be your jam. It’s a free newsletter that focuses on delivering business and finance news in pretty digestible chunks.

They tend to cover the bigger picture stuff – think macroeconomic trends, major corporate news, and even those big global events that can shake up the markets. It’s not really about the nitty-gritty stock picks, but more about understanding the landscape. The Daily Upside aims to give you a solid overview of current business and financial news on a daily basis.

Here’s a quick look at what you can expect:

- Macroeconomic Trends: Get a handle on the big economic shifts happening globally.

- Corporate News: Stay updated on significant developments from major companies.

- Market-Moving Events: Understand how geopolitical and other major events can impact financial markets.

It’s a good option if you want to stay informed about the broader financial world without needing to spend hours reading. Think of it as a quick, informative briefing to start your day or catch up on what matters.

15. Finimize

Finimize is a service that aims to make financial news easy to digest. Think of it as getting the CliffsNotes for the business and finance world. They offer summaries of the day’s top stories, which is pretty handy when you’re short on time but still want to know what’s happening.

They have a free email that gives you the top two news stories. If you want more, like deeper dives and commentary from experts, you can sign up for their premium service. It costs about $59.95 a year, which isn’t too bad if you’re really into staying informed.

Here’s a quick look at what they offer:

- Free Tier: Get the two most important business and finance news stories of the day delivered to your inbox.

- Premium Tier: Access more in-depth analysis, broader news coverage, and insights from financial professionals.

- Focus: Primarily business and financial market news, presented in a straightforward manner.

Finimize is a good choice if you like your news in bite-sized pieces. It’s not for someone who wants to spend hours reading long articles, but rather for folks who appreciate quick updates that take just a few minutes to get through.

16. We Study Markets

So, you’ve probably heard of the Investors Podcast Network, right? They’ve been around for a while, putting out podcasts with some seriously big names in investing – think Ray Dalio, Howard Marks, the whole crew. Well, they took that vibe and turned it into a newsletter called ‘We Study Markets’. It’s basically their way of bringing that same kind of in-depth commentary and expert insights right to your inbox, but in a format that’s actually easy to read.

What’s cool is that it’s free. Yeah, totally free. They aim to give you that daily dose of market commentary without making your head spin. It’s like getting a summary of what the smart money is thinking, without having to sift through a million different reports yourself.

Here’s what you can generally expect:

- Daily market commentary: Quick takes on what’s moving the markets.

- Expert insights: Ideas and analysis from people who really know their stuff.

- Simple, clear format: No overly complicated jargon, just the main points.

It’s a solid choice if you want to stay informed without a huge time commitment or a hefty subscription fee. They’re really trying to make complex financial ideas accessible, which is a nice change of pace.

17. Wall Street Breakfast

Wall Street Breakfast is a free newsletter from Seeking Alpha that gives you a quick rundown of what’s happening in the markets. It’s designed to get you up to speed in just a few minutes before the trading day even begins. Think of it as your morning coffee companion for all things finance.

It’s a great way to stay informed without getting bogged down in endless articles. The newsletter usually links out to more in-depth pieces on Seeking Alpha’s platform, so if you find yourself wanting to dig deeper, a premium subscription might be worth considering down the line. But for a free, daily dose of market news, it’s pretty solid.

Here’s what you can generally expect:

- Daily Market Summaries: Quick takes on major market movements and economic news.

- Business News Highlights: Key stories impacting various industries.

- Links to Deeper Analysis: Jump-off points for further reading on Seeking Alpha.

It’s a straightforward approach to staying current, especially if you’re already following broader market trends. For instance, news like the delay in tariff increases on certain goods can give you a quick heads-up on potential market shifts President Trump has also announced a delay in further tariff increases on upholstered furniture.

If you’re looking for a no-frills way to start your trading day with the essential information, Wall Street Breakfast is definitely worth a look.

18. The Average Joe

Alright, let’s talk about The Average Joe. This is a free newsletter that’s been around for a bit, and it’s got a pretty solid following – over 100,000 subscribers, which is no small feat. They send out newsletters four times a week, and the main thing they do is break down business and financial news. Think of it as a way to get the gist of what’s happening in the markets without getting bogged down in super technical stuff.

What really sets The Average Joe apart, though, is its tone. If you appreciate a bit of snark and humor mixed in with your financial news, this is definitely one to check out. They don’t take themselves too seriously, which can be a nice change of pace from some of the more dry financial publications out there. It’s a good option if you want to stay informed but also want to have a little fun reading about it. They cover market trends and other bits and pieces that are relevant to investors. It’s not about deep dives into specific stocks, but more about the general landscape of business and finance.

Here’s a quick look at what you get:

- Frequency: Four times a week.

- Cost: Absolutely free.

- Content Focus: Summaries of business and financial news, market trends, and commentary with a humorous edge.

It’s a straightforward approach to staying current, and the free price tag makes it an easy choice for many people just trying to keep up with the financial world.

19. Benzinga Options

Benzinga Options is a pretty neat resource if you’re into the whole options trading scene. They send out alerts and ideas that can help you figure out what moves to make. It’s not just random tips, though. Nic Chahine, who seems to know his stuff, puts out a couple of emails each month. These aren’t just "buy this, sell that" messages; they often include details like the price and when the option expires. Plus, they throw in some educational bits, which is super helpful if you’re just starting out with options.

Benzinga Options is a solid place to start for getting expert ideas on options trading without getting too overwhelmed.

Here’s a quick look at what you can expect:

- Trading Alerts: Get notified about potential trading opportunities.

- Educational Content: Learn the basics and more advanced strategies for options trading.

- Specific Trade Ideas: Receive concrete suggestions with price and expiration details.

While the core alerts are often free, Benzinga does have premium services if you want to go deeper. But for a beginner looking for a nudge in the right direction, their free offerings are a good starting point.

20. Robinhood Snacks

Robinhood Snacks is a daily newsletter that gives you the lowdown on what’s happening in the business and finance world. It’s from Robinhood, the company known for its trading app, but you don’t need to be a Robinhood customer to get the newsletter. Think of it as a quick way to get your head around the day’s market news without having to sift through a ton of articles yourself.

It’s a good option if you want brief, easy-to-digest summaries of financial happenings. The newsletter covers a range of topics, from stock market movements to broader economic trends. If a particular story catches your eye, you can click through to read more about it on their platform. Since Robinhood manages this newsletter through its Sherwood Media arm, it’s pretty much a direct line to curated financial news. It’s free, which is always a plus when you’re trying to keep up with the markets.

Here’s what you can generally expect:

- Daily Market Briefs: Quick takes on what moved the markets today.

- Business News Summaries: Key developments from various industries.

- Crypto Updates: Relevant news for the cryptocurrency space.

- Links to Deeper Dives: For those who want to explore a topic further.

21. Morning Brew

Morning Brew is a daily newsletter that does a pretty good job of breaking down business and finance news. It’s free, which is always a plus, and they manage to keep things light and even funny while still covering the important stuff. Think of it as your morning coffee companion for market updates.

They cover a range of topics, from stock market movements to crypto news and broader business trends. It’s not super deep, but it gives you a solid overview without making your brain hurt. If you’re just trying to get a quick sense of what’s happening in the financial world each day, Morning Brew is a decent place to start. They also have a Sunday edition that goes a bit more in-depth on market trends.

Here’s a quick look at what you get:

- Daily business and finance news summaries.

- Quick recaps of stock and crypto market activity.

- Humorous anecdotes and stories related to the financial world.

- A more detailed market trends review on Sundays.

22. Your Money (New York Times)

When you’re trying to get a handle on your personal finances, sometimes you just need straightforward advice without all the market noise. That’s where The New York Times’ “Your Money” newsletter comes in. It’s not really about breaking news or stock tips, but more about practical, everyday money stuff. Think of it as a friendly chat about how to manage your cash better.

This newsletter focuses on actionable tips for things like paying down debt, smart spending habits, and planning for retirement. It’s written by the same folks who cover personal finance for the Times, so you know it’s coming from a place of solid reporting. While the newsletter itself is free, you’ll likely hit a paywall if you want to read the full articles linked within it, which is pretty standard for the Times.

Here’s a look at what you can typically expect:

- Saving Strategies: Tips on how to put more money aside, whether it’s for a rainy day or a long-term goal.

- Debt Management: Advice on tackling credit card balances, student loans, or other debts.

- Retirement Planning: Guidance on making sure you’re set for your later years.

- Budgeting Basics: Simple ways to track your income and expenses.

It’s a good resource if you’re looking for that kind of personal finance news and advice from experienced columnists and reporters. It covers a wide range of topics to help individuals manage their money effectively. If you’re not already a subscriber to the New York Times, it’s a nice way to get a taste of their personal finance coverage without committing to a full subscription right away.

23. Ticker Nerd

Ticker Nerd is a newer player in the stock research game, and their whole idea is to help regular investors spot potential winners before they really take off. They put out a detailed report on two stocks each month. To pick these stocks, they look at a bunch of different data points.

Here’s a peek at what they consider:

- Hedge fund trading patterns

- Wall Street analyst opinions

- What people are saying on social media like Reddit and Twitter

- Basic company financial health (fundamental analysis)

- Number-based analysis (quantitative analysis)

After gathering all this, their team really digs in and writes up their findings. Ticker Nerd is upfront that they aren’t a stock-picking service – you should always do your own homework before investing. Instead, they want to give you a solid starting point for your own research, helping you feel more confident about a potential investment. For $149 a year, you get these monthly reports, which can be a good way to get your due diligence process rolling.

Wrapping It Up

So, that’s a look at some of the top spots for economic news in 2026. It really comes down to what you’re after. Whether you want quick daily updates, deep dives into market trends, or just some solid advice for your own money, there’s something out there for everyone. Don’t feel like you have to pick just one, either. Mixing and matching a few different sources can give you a really well-rounded view of what’s happening. Happy reading, and here’s to staying informed!

Frequently Asked Questions

What makes a good economic news website?

A great economic news site gives you clear, up-to-date information without being too confusing. It should have reliable facts, be easy to look around on, and offer different ways to see the news, like articles, charts, or quick summaries. Good sites also have a solid reputation for being trustworthy.

Do I need to pay to get good economic news?

Not always! Many excellent websites offer free news and basic tools. Some sites have paid options that give you more in-depth analysis, special picks, or advanced features. You can often start with free options and upgrade if you feel you need more.

How often should I check economic news?

It really depends on your goals. If you’re actively trading or investing, checking daily or even multiple times a day might be helpful. For most people, getting a daily or weekly summary of the most important news is enough to stay informed about what’s happening in the economy.

Can I trust all financial news sources?

It’s smart to be a little careful. Some sites are very reliable, while others might be biased or focus too much on sensational stories. Look for sites that explain their sources, have a history of accurate reporting, and offer balanced viewpoints. Reading from a few different trusted sources is a good approach.

What’s the difference between economic news and stock news?

Economic news looks at the big picture, like how the whole country’s economy is doing – think interest rates, job numbers, and inflation. Stock news focuses more on individual companies, like their sales, new products, or how their stock price is moving. They are related, but economic news often influences stock news.

How can economic news help me as an investor?

Understanding economic news helps you make smarter investment choices. For example, knowing about rising interest rates might make you think twice about certain types of loans or investments. It gives you context for why markets are moving and helps you prepare for potential changes.