President Donald Trump has officially established a Strategic Bitcoin Reserve through an executive order, coinciding with the inaugural White House Crypto Summit held on March 7, 2025. This landmark decision aims to position the U.S. as a leader in the cryptocurrency space, utilizing seized assets to bolster the nation’s digital asset strategy.

Key Takeaways

- Trump signed an executive order to create a Strategic Bitcoin Reserve, utilizing Bitcoin seized by the government.

- The reserve aims to hold Bitcoin as a long-term asset, with no plans to sell.

- The initiative includes a Digital Asset Stockpile featuring other cryptocurrencies like XRP, Solana, and Cardano.

- The summit gathered key industry leaders to discuss future regulations and innovations in the crypto space.

Overview Of The Strategic Bitcoin Reserve

The newly established Strategic Bitcoin Reserve will be managed by the U.S. Treasury and will consist primarily of Bitcoin obtained through criminal and civil asset forfeiture. This move is seen as a significant endorsement of Bitcoin as a legitimate reserve asset for the U.S. government.

- No New Purchases Initially: The reserve will not involve new purchases of Bitcoin at this stage, which has led to mixed reactions in the market.

- Future Acquisitions: The executive order allows for future acquisitions of Bitcoin, provided they are budget-neutral and do not impose costs on taxpayers.

The White House Crypto Summit

The Crypto Summit, led by Trump’s crypto czar David Sacks, brought together approximately 30 prominent figures from the cryptocurrency industry, including CEOs from major companies like Coinbase and MicroStrategy. The discussions focused on:

- Regulatory Frameworks: Establishing a clear regulatory environment for cryptocurrencies.

- Innovation in Digital Assets: Encouraging technological advancements and adoption of digital currencies.

- Government Support: Reinforcing the government’s commitment to supporting the crypto industry.

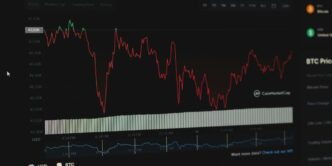

Market Reactions

Following the announcement, Bitcoin’s price initially dipped below $85,000 but quickly rebounded to around $90,700. Other cryptocurrencies also experienced notable movements:

- Ethereum (ETH): Increased to $2,230 from a low of $2,100 earlier in the week.

- XRP: Rose by 21% over the past week.

- Cardano (ADA): Surged nearly 42% in the same timeframe.

Implications For The Future

Trump’s establishment of the Strategic Bitcoin Reserve is viewed as a pivotal moment for the cryptocurrency industry in the U.S. It signals a shift towards a more favorable regulatory environment and could encourage other nations to adopt similar strategies. Industry leaders have expressed optimism about the potential for future legislation that could further solidify the U.S. position in the global crypto market.

- Long-Term Vision: The reserve is likened to a digital Fort Knox, emphasizing Bitcoin’s role as a store of value.

- Potential for Growth: With the U.S. government holding significant Bitcoin assets, there is potential for taxpayers to benefit from future price increases in the cryptocurrency market.

As the administration continues to explore avenues for digital asset management, the establishment of the Strategic Bitcoin Reserve marks a significant step in integrating cryptocurrency into the fabric of U.S. economic policy.

Sources

- white house crypto summit: Trump’s Bitcoin Strategic Reserve: How the White House Crypto Summit will shape the future of digital assets, The Economic Times.

- Trump signs order to establish strategic bitcoin reserve, Reuters.

- White House Draws Line Between Bitcoin And Digital Assets At Its First Crypto Summit, In EO, Bitcoin Magazine.

- Donald Trump boosts crypto with new Strategic Bitcoin Reserve, USA Today.

- Trump signs executive order to establish U.S. strategic bitcoin reserve, YouTube · CNBC Television.