This July, the twitter stock price has shot up and it’s got everyone talking. I’ve been poking around the numbers and the new features, and it all feels a bit wild. Whether you’re a long-term holder or just curious, here’s a quick look at what’s behind the spike and what you might want to watch next.

Key Takeaways

- Strong ad demand and fresh tools for users are driving much of the twitter stock price rise.

- A shake-up at the top brought new leaders, a tweaked plan and clearer updates for investors.

- Analysts have lifted their sales and earnings forecasts, nudging price targets higher.

- Traders are using trend plays, hedging with options and spreading bets to handle the swings.

- Main risks include tighter rules, fierce rivals like TikTok and a possible economic slowdown.

Factors Driving Twitter Stock Price Surge

Accelerating Advertising Demand

Okay, so, advertising is a big deal, right? And it looks like Twitter’s been killing it in that department. More companies are throwing money at ads on the platform, which is a major reason why the stock is doing so well. It’s not just about the volume of ads, though. It’s also about how much Twitter is charging for them. If they can keep increasing ad prices while still attracting advertisers, that’s a recipe for serious revenue growth. Plus, with all the new features they’ve been rolling out, advertisers have more ways to target specific audiences, making their ad spend more effective. It’s a win-win.

Innovations In User Engagement

Let’s be real, if people aren’t using Twitter, then the platform is worthless. So, it’s great to see that they’re focusing on keeping users hooked. They’ve been rolling out some pretty cool features lately, and it seems to be working. User engagement is up, which means more eyeballs on ads, which, as we just discussed, is great for revenue. Here’s a quick rundown of some of the key engagement drivers:

- Enhanced Video Features: People love videos, and Twitter’s been making it easier to watch and share them. This keeps users on the platform longer.

- Interactive Polls and Quizzes: These are fun and get people involved. The more interactive the platform, the more time people spend on it.

- Improved Community Features: Building communities within Twitter helps users connect with others who share their interests, making them more likely to stick around. This is similar to how Bitcoin’s value is driven by community support.

New Monetization Initiatives

Twitter’s not just relying on ads anymore, which is smart. They’re exploring new ways to make money, and some of these initiatives are starting to pay off. Think subscriptions, premium content, and maybe even some kind of crypto integration down the line. The key is diversification. The more revenue streams they have, the less reliant they are on any single source. This makes the company more stable and attractive to investors. It’s like they’re saying, "Hey, we’re not just a one-trick pony!" And that’s a good thing.

How Leadership Shifts Influence Twitter Stock Price

Leadership changes at a company like Twitter can really shake things up, and the stock price often reflects that uncertainty or optimism. It’s not just about who’s in charge; it’s about the message those changes send to investors.

New Executive Appointments

When a new CEO or other top executive comes on board, it’s a big deal. The market tries to figure out what this means for the company’s future. A well-regarded leader can boost investor confidence, while an unknown or controversial choice might cause concern. For example, if Twitter appointed someone with a proven track record in user engagement, we might see a positive stock reaction. It’s all about the perceived potential for growth and stability under the new leadership.

Strategic Vision Realignment

New leaders often bring new ideas. This can mean a shift in strategy, which can be exciting or scary for investors. Will they double down on existing strengths, or try something completely different? A clear and compelling vision can rally investors, but a vague or confusing one can lead to hesitation. Think about it like this:

- A new focus on AI-driven content moderation could be seen as a positive step.

- A move away from certain markets might worry some investors.

- A change in monetization strategy could be a gamble that either pays off big or falls flat.

Shareholder Communication Changes

How a company communicates with its shareholders is super important, especially during leadership transitions. Transparency and honesty build trust, while a lack of communication can create doubt. Regular updates, clear explanations of strategic decisions, and open Q&A sessions can help keep investors on board. On the flip side, if the new leadership isn’t forthcoming, or if their messaging is inconsistent, the stock price could suffer. It’s all about keeping investors informed and confident in the company’s direction. Like when Roth Capital issued a Q2 Earnings Forecast for Surge Energy.

Analysts Adjust Forecasts For Twitter Stock Price Growth

It’s interesting to see how analysts are reacting to Twitter’s recent performance. Seems like everyone’s scrambling to update their models. The general consensus is that Twitter’s growth potential is higher than previously anticipated, but there’s still some debate about just how high it can go.

Revised Revenue Projections

Analysts are bumping up their revenue forecasts for Twitter, and it’s not just a little tweak. We’re talking about some significant revisions. A lot of this has to do with the stronger-than-expected ad revenue and the initial success of their new subscription services. Here’s a quick look at how some firms have adjusted their projections:

| Firm | Previous Projection (2025) | Revised Projection (2025) |

|---|---|---|

| Goldman Sachs | $8.5 Billion | $9.8 Billion |

| Morgan Stanley | $8.2 Billion | $9.5 Billion |

| Wedbush | $7.9 Billion | $9.2 Billion |

Earnings Per Share Estimates

Along with revenue, EPS estimates are also getting a boost. The thinking is that if Twitter can keep its costs in check while growing revenue, the bottom line will look pretty good. Of course, there are always risks, but for now, the trend is positive. Keep an eye on tech stocks for 2025 as they can be a good indicator of the overall market.

Price Target Realignments

And finally, the moment everyone’s been waiting for: price targets. Several analysts have increased their targets for Twitter’s stock, reflecting their optimism about the company’s future. It’s worth noting that price targets are just one piece of the puzzle, but they can influence investor sentiment. Here’s a snapshot:

- Analyst A: Increased target from $65 to $80

- Analyst B: Increased target from $70 to $85

- Analyst C: Maintained target at $75, but with a "buy" rating

These adjustments suggest a growing confidence in Twitter’s ability to sustain its current momentum. However, it’s important to remember that the market can be unpredictable, and these forecasts are subject to change based on various factors.

Strategies To Navigate Twitter Stock Price Volatility

Twitter’s stock has been on a wild ride lately, and if you’re holding shares, you’re probably wondering how to handle all the ups and downs. It’s not just about holding on tight and hoping for the best. There are actually some pretty smart ways to manage the risk and maybe even make some money while things are turbulent. Let’s look at a few strategies.

Momentum Trading Techniques

Momentum trading is all about riding the wave. If Twitter’s stock is going up, you buy in, hoping it keeps going up. If it starts to fall, you sell before you lose too much. The key is to identify the trend early and act fast. It’s risky, but it can be profitable if you’re right. You’ve got to watch the charts, read the news, and be ready to jump in or out at a moment’s notice. It’s not for the faint of heart, but some traders swear by it. For example, you might use moving averages to spot when a trend is starting. If the short-term moving average crosses above the long-term moving average, that could be a buy signal. Conversely, if it crosses below, it could be time to sell. Just remember, past performance doesn’t guarantee future results.

Protective Options Strategies

Options can be a great way to protect your investment in Twitter without selling your shares. One popular strategy is buying put options. A put option gives you the right to sell your shares at a specific price (the strike price) before a certain date (the expiration date). If Twitter’s stock price falls below the strike price, you can exercise your option and sell your shares at the higher price, limiting your losses. It’s like buying insurance for your stock. Of course, you have to pay a premium for the option, so it’s not free. But if you’re worried about a big drop, it can be worth it. Another strategy is using a covered call, where you sell call options on shares you already own. If the stock price stays below the strike price, you keep the premium. If it goes above, your shares might get called away, but you’ll still make a profit. It’s a way to generate income from your shares while limiting your upside.

Diversification Approaches

Putting all your eggs in one basket is never a good idea, especially with a volatile stock like Twitter. Diversification means spreading your investments across different companies, industries, and asset classes. That way, if Twitter’s stock tanks, you won’t lose everything. Maybe you could invest in technology stocks or even bonds. The idea is to balance out the risk. Here’s a simple example:

- Stocks: 50% (including Twitter, but also other companies)

- Bonds: 30%

- Real Estate: 10%

- Cash: 10%

This is just an example, of course. The right mix depends on your risk tolerance and investment goals. But the point is, don’t let Twitter be the only thing you own. Diversify, and you’ll sleep better at night.

Key Risks Impacting Twitter Stock Price Upside

Okay, so Twitter’s stock is doing well, but let’s not get ahead of ourselves. There are definitely some things that could throw a wrench in the works and send that price tumbling back down. It’s not all sunshine and roses, you know?

Regulatory Compliance Pressures

Social media is under a microscope, and Twitter is no exception. New regulations about data privacy, content moderation, and even political advertising could mean big changes for how Twitter operates. And big changes usually mean big expenses. Think about the EU’s Digital Services Act – that’s a game-changer. If Twitter messes up and doesn’t comply, they could face massive fines. That’s money that could be going into innovation or, you know, keeping the stock price up. It’s a constant balancing act, and the regulatory landscape is always shifting. Keeping up with regulatory compliance is a never-ending battle.

Competitive Platform Threats

Let’s be real, Twitter isn’t the only game in town. There’s always some new platform popping up, trying to steal users and ad dollars. And it’s not just the new kids; established players like Facebook, Instagram, and TikTok are constantly evolving and adding features to keep people hooked. If Twitter doesn’t keep innovating and offering something unique, people might just jump ship. And if users leave, advertisers will follow. It’s a cutthroat world out there. Here’s a quick look at the competitive landscape:

- TikTok: Short-form video dominance continues to attract younger demographics.

- Instagram: Visual content and influencer marketing remain strong.

- Facebook: Massive user base provides a broad advertising reach.

Economic Downturn Concerns

If the economy tanks, everything tanks, right? Advertising is one of the first things companies cut when times get tough. And since advertising is how Twitter makes most of its money, a recession could really hurt. People might also spend less time online if they’re worried about their jobs or finances. Less time online means fewer ad views, which means less revenue. It’s a domino effect. Even if Twitter does everything right, a economic downturn could still bring the stock price down.

Technical Signals Supporting Twitter Stock Price Rally

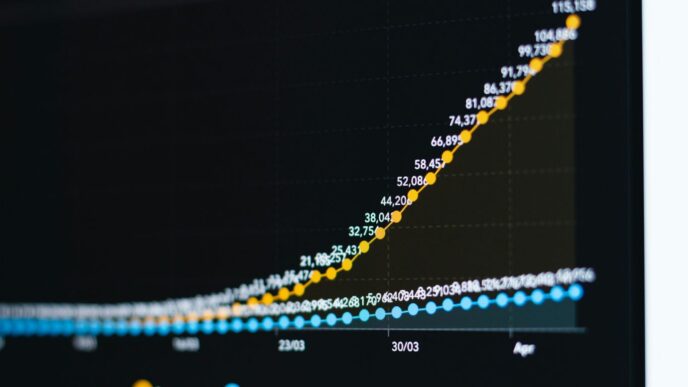

Technical analysis is becoming increasingly important for investors trying to understand Twitter’s stock performance. It’s all about looking at charts and patterns to predict where the price might go next. Forget the news for a minute; let’s talk trends.

Moving Average Breakouts

When Twitter’s stock price consistently pushes above its moving averages (like the 50-day or 200-day), it’s often seen as a bullish signal. This suggests that the upward momentum is strong and could continue. A moving average breakout is a pretty simple concept, but it can be a powerful indicator. It basically means the stock is trading higher than its average price over a certain period, which can attract more buyers.

Volume Surge Confirmation

If the stock price jumps up, that’s interesting, but if it happens with a big increase in trading volume, that’s confirmation. High volume during a price increase suggests there’s real conviction behind the move. It’s like saying, "Yeah, the price is going up, and a lot of people agree!" Volume acts as a confirmation signal, adding weight to the price action. Here’s a quick look at how volume can confirm a price surge:

- Low Volume Surge: Potentially unreliable, could be a short-term blip.

- Moderate Volume Surge: Suggests some interest, but not overwhelming.

- High Volume Surge: Strong confirmation of the price movement, indicating significant buying pressure.

Strength Momentum Indicators

Indicators like the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) help measure the strength of a trend. If the RSI is above 70, it might mean the stock is overbought and due for a pullback. But if the MACD shows a bullish crossover, it could signal more upside. These indicators aren’t perfect, but they give you extra information about the momentum of the stock.

Here’s a simple breakdown of what to look for:

- RSI (Relative Strength Index): Above 70 = Overbought, Below 30 = Oversold.

- MACD (Moving Average Convergence Divergence): Bullish Crossover = Potential Buy Signal, Bearish Crossover = Potential Sell Signal.

- Stochastic Oscillator: Similar to RSI, helps identify overbought and oversold conditions.

What To Expect For Twitter Stock Price In The Upcoming Quarter

Okay, so what’s the deal with Twitter’s stock price for the next three months? A bunch of things are in play, and it’s not just about tweets anymore. Let’s break it down.

Product Roadmap Milestones

Twitter’s been hinting at some new features, and whether they actually launch (and if people even like them) will be huge. Think about it: a successful new feature could bring in tons of users, but a flop? Not so good. Keep an eye on announcements about new tools for creators and businesses. If they deliver, we could see a nice bump. Here’s a quick look at some potential milestones:

- Launch of enhanced video features.

- Introduction of subscription tiers for exclusive content.

- Rollout of improved analytics dashboards for businesses.

Ad Revenue Growth Drivers

Ads are still the bread and butter, right? So, how well are they doing? Are more companies buying ads on Twitter? Are they paying more? If the answer is yes, then the stock should be looking good. If ad revenue is flat or down, that’s a red flag. The key is to watch for reports on ad sales and how they compare to what analysts are expecting. Also, consider how leading cryptocurrencies are advertised on the platform.

Market Sentiment Trends

Honestly, sometimes it feels like the stock market is just one big popularity contest. If people feel good about Twitter, they’re more likely to buy the stock. But if there’s a scandal or some bad press, watch out. Social media sentiment can shift fast, so pay attention to what people are saying online. Are they excited about Twitter’s future, or are they worried? This can be measured by looking at things like:

- Number of positive vs. negative mentions on social media.

- Trends in search interest for "Twitter stock".

- Overall investor confidence based on news and analysis.

## Conclusion

Phew—that was a whirlwind. Twitter’s share price took off faster than a viral tweet. The push from new ad deals and AI-driven tools has people talking. But remember: this market can flip on a dime. If you’re in it for the long haul and trust the new tweaks will pull in more eyeballs (and bucks), there could be gains ahead. Just don’t throw in money you’ll regret. Keep an eye on user stats, ad sales, and any curveball posts from the top. In short, it looks exciting, but expect bumps. Trade smart, or sit it out.

Frequently Asked Questions

Why has Twitter stock jumped so much lately?

Big brands are spending more on ads, and Twitter rolled out cool new features for users. Plus, they launched fresh ways to make money, like paid subscriptions.

How do new leaders at Twitter affect the stock?

New executives bring fresh ideas and a clear plan. When investors see a strong vision, they often buy the stock, which can push the price up.

What do analysts now expect for Twitter’s revenue and earnings?

Most analysts have raised their predictions. They think Twitter will make more ad money and earn more per share than they first guessed.

What are the main risks for Twitter stock right now?

Rules from the government could get tighter, other social apps keep stealing users, and a weak economy might cut ad budgets. Any of these could slow growth.

How can I protect my money if Twitter stock swings up and down?

You could use simple trading methods like buying on momentum or setting stop-limit orders. Buying a mix of stocks instead of just Twitter also helps spread out risk.

What chart signs show Twitter’s rally might last?

The stock has broken above its moving averages, trading volume is rising, and momentum indicators are strong. Those are good clues that buyers are in control.