The UK continues to face deep shifts in supply chain operations as customer expectations evolve and global disruptions shape how goods move through networks. 2021 exposed severe pressure points. Retailers struggled with labour shortages, transport delays, driver scarcity, material backlogs, and unpredictable demand. These shocks revealed weaknesses across logistics frameworks, but one area proved especially vulnerable: the return process. Many UK firms treated returns as an administrative task rather than a strategic function, and this oversight created delays, inconsistent customer experiences, and higher operational costs. Now, a new research study offers the UK a pathway to strengthen this overlooked segment. Titled Standardization Model for Return Merchandise Authorization Processes Across Multi-Vendor Supply Chains, and authored by Oladipupo Fasawe and his team, the study introduces a clear, structured model designed to stabilise return operations. The recommendations emerging from this U.S.-developed framework present an opportunity for the UK to modernise and align return systems that have struggled under pressure.

The UK reported unprecedented operational disruption last year. Thousands of companies faced the impact of labour shortages across warehousing, transport, and distribution. Driver shortages grew rapidly. Delays at ports created ripple effects across entire sectors. Many organisations adopted new tools for supply chain mapping, but improvements were uneven because internal processes remained fragmented. The pressure exposed the fragile nature of return operations, where goods moved unpredictably, data lacked clarity, and customer service teams were often left guessing. Against this backdrop, insights from outside the UK market became increasingly valuable. Oladipupo’s research offers a fresh, external perspective. Working from the United States, he observed similar patterns of inefficiency and saw how inconsistent vendor rules weakened return processes. His model responds directly to the vulnerabilities that UK organisations experienced. The fact that it originates in the U.S. gives UK firms a chance to adopt best-practice principles shaped by a larger, digitally ambitious market, without repeating the mistakes that slowed progress during past disruptions.

Speaking with Oladipupo highlighted how his experience in the United States sharpened his understanding of return process failures. He explained how return systems fall apart when vendors follow different rules. Staff lose hours reconciling mismatched data. Customers receive inconsistent updates. Refunds take longer, eroding trust. He saw these problems across American retail networks, but he recognised the same symptoms in the UK’s 2021 experience. Labour shortages magnified inefficiencies. Warehouse teams handled high volumes of returned goods without clear processes. Transport delays caused stock to sit idle. Customer service volumes increased as buyers tried to understand where their returned items were in the process. These pressures revealed how return systems can become brittle when they lack structure. Oladipupo believes returns should be treated with the same discipline applied to outbound logistics. He said return operations influence customer loyalty, brand strength, and operational resilience. For UK firms seeking to recover from past instability, his model provides a foundation for improvement.

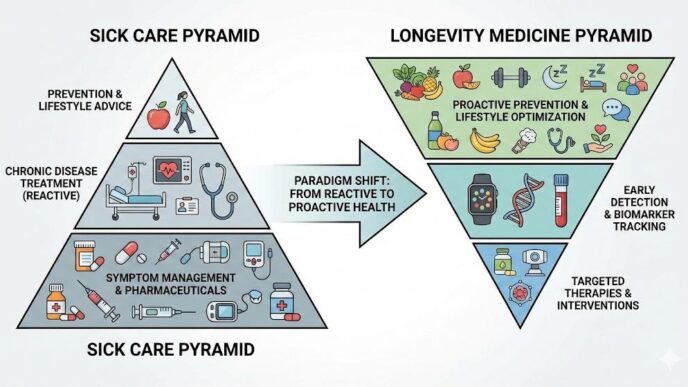

The framework described in the study is built on three connected elements. The first is detailed process mapping. This means defining each step in the return journey so that staff understand exactly what must happen and when. The second is digital integration. Data must move across systems automatically, without manual transfers that create errors or delays. The third is the creation of a shared platform. Every vendor in the network must follow the same return rules, codes, timelines, and documentation standards. In the UK, where supply chains often involve a mix of regional distributors, global manufacturers, and independent suppliers, these three elements have particular relevance. UK companies often struggle to align partners with different systems and operational habits. A shared model simplifies this challenge. Oladipupo’s approach offers UK firms a way to achieve clarity, reduce friction, and accelerate decision-making.

Technology plays a central role in the model, and this aligns strongly with the UK’s movement toward digital transformation. Predictive analytics help organisations forecast return volumes. AI tools identify patterns in product quality and consumer behaviour. Cloud platforms give partners real-time visibility. Blockchain provides reliable audit trails that reduce disputes and improve accuracy. Yet Oladipupo emphasised that digital tools only succeed when placed within a structured process. He noted that many firms in both the UK and the U.S. invested heavily in automation in 2021, but return outcomes did not always improve because the underlying processes remained inconsistent. Technology accelerates progress only when rules stay consistent. Systems must work with the same data. Partners must speak the same operational language. His model gives the UK a way to align structure with technology so that investments deliver real value.

Sustainability is another major force driving his work. The UK has committed to environmental goals that require more efficient logistics. Inefficient return systems increase fuel use, add unnecessary transport miles, and generate higher levels of packaging waste. These outcomes conflict with national sustainability targets and increase operational costs. Oladipupo believes the UK can advance both environmental and financial goals by adopting structured return flows. When returns follow predictable routes, companies save fuel. When forecasting improves, they avoid over-ordering and reduce waste. When data becomes consistent, unnecessary movement declines. The environmental benefits become a natural extension of operational discipline. His model aligns cleanly with the UK’s direction of travel, allowing businesses to meet sustainability expectations while improving core logistics functions.

Resilience was one of the biggest lessons from the UK’s 2021 supply chain challenges. Manufacturing bottlenecks, fuel shortages, port congestion, and demand surges created conditions where even strong organisations struggled to maintain performance. During this period, return systems became overwhelmed. Delays grew longer, refunds slowed, and customers received mixed communication. Oladipupo explained that fragmented return processes are not resilient. They break under pressure because partners lack alignment. A unified model creates stability by ensuring that each vendor follows the same steps. This structure enables UK firms to handle unexpected events without losing control of return operations. Managers gain accurate, shared data rather than relying on guesswork. Customers receive more predictable service. The research developed by Oladipupo in the United States therefore provides the UK with a tested, practical way to strengthen resilience at a time when supply chain unpredictability remains common.

To support adoption, Oladipupo encourages UK companies to implement the model gradually. He suggests starting with one vendor group or a specific operational region. Staff should receive detailed training. Vendors must align expectations. Performance metrics such as speed, cost, and accuracy should be monitored closely. This phased approach reduces operational risk and mirrors the gradual digital transitions many UK firms already undertake. Dashboards and analytics tools are already familiar features of UK supply chain management. Extending these practices to return operations gives firms a smooth transition path. Oladipupo believes that progress depends on continuous measurement. UK companies that treat return processes as strategic, rather than administrative, will gain advantages in cost control, customer satisfaction, and sustainability.

UK retailers, distributors, and manufacturers are paying close attention to the model because return challenges continue to grow. The rise in e-commerce increased return volumes. Warehouses remain under pressure to process returned goods quickly and accurately. Customer service teams face increasing demands from buyers waiting for updates. Suppliers often lack visibility into the quality issues that returns reveal. Transport partners handle fluctuating routing demands. The UK’s return network has become more complex, yet many processes remain unchanged from older operational models. Oladipupo’s model introduces structure where there has been inconsistency. It supports communication where misalignment has caused delays. It gives the UK a practical way to modernise a part of the supply chain that often lacks dedicated reform.

During our conversation, Oladipupo challenged the assumption that upgrading a single system or department will fix return problems. He noted that returns involve multiple vendors. Improvement must occur across the network. If a UK retailer upgrades its internal system but continues receiving inconsistent data from external suppliers, delays will persist. Refunds will remain slow. Customers will still experience uncertainty. Operational stress will continue. The UK’s 2021 experience demonstrated that weak links quickly affect entire chains. Oladipupo believes the UK can avoid repeating these issues by adopting a shared model that creates alignment across suppliers, distributors, and third-party service providers. His model invites the UK to adopt consistency and collaboration as core principles.

His understanding of frontline challenges also strengthens the relevance of the model for the UK. He spoke in detail about the daily pressure faced by warehouse teams handling incomplete return documentation, missing data, and changing instructions. He described how small inconsistencies expand into larger delays. He highlighted how unclear rules weaken morale and create frustration both for staff and for customers. He argued that clarity drives better performance. His model removes confusion and gives staff workable frameworks rather than overwhelming them with new complexity. This practical grounding resonates strongly with UK logistics environments, which rely on skilled yet overstretched workers.

The UK’s 2021 economic rebound did not erase supply chain instability. While growth improved, operational conditions remained volatile. Many firms focused on digital upgrades but overlooked the strategic value hidden within return data. Oladipupo believes the UK can unlock powerful insights by treating return flows as structured data sources. Structured return processes reveal product behaviour, customer expectations, supplier reliability issues, and operational trends. They support forecasting, demand planning, and continuous improvement. His model transforms returns from a cost burden into an actionable intelligence tool. For UK firms seeking competitive advantage, this shift is significant.

Industry analysts now view Oladipupo as an emerging voice in operational transformation. His work aligns with global shifts toward transparency, structured collaboration, and integrated data systems. The fact that he operates in the United States while addressing problems similar to those faced in the UK adds value. UK organisations often look to U.S. research for wider perspectives on supply chain innovation. His model offers UK firms a practical, structured, realistic tool developed in a market that has tackled large-scale logistical challenges. It aligns with UK priorities such as resilience, sustainability, cost efficiency, and customer trust.

As the UK continues modernising its logistics infrastructure, return operations will determine how companies compete. Poor return performance increases cost. Slow refunds damage loyalty. Inconsistent return rules weaken vendor partnerships. Unclear processes increase stress throughout the chain. Oladipupo’s model provides structure, stability, and shared expectations that the UK can adopt now. It supports companies seeking improved service levels, lower waste, and stronger resilience. It gives the UK a blueprint for treating return operations as a strategic capability rather than an afterthought.

Oladipupo Fasawe’s contribution arrives at a decisive moment for the UK. The 2021 supply chain shocks highlighted gaps that no organisation can ignore. UK firms now recognise that fragmented return systems create risks that spread across operations. His model offers a structured, scalable, and practical path forward. It blends U.S.-based innovation with UK-relevant insight. It combines technology, process discipline, sustainability, and resilience. It prepares organisations for increasing return volumes, higher customer expectations, and stricter performance standards. As the UK seeks to build a modern, efficient, and robust supply chain environment, his work stands out as a blueprint that can support long-term transformation.