Looking for ways to potentially grow your money without breaking the bank? You’ve probably heard about penny stocks. These are stocks from smaller companies that trade at really low prices, often under $5 a share. While they can be risky, some people find them exciting because even a small price jump can mean a big percentage gain. We’ve put together a list of what could be the top 10 penny stocks to buy today, focusing on companies showing some real movement. Remember, though, this isn’t financial advice, and doing your own homework is super important before you put any money down.

Key Takeaways

- Penny stocks, often trading below $5, offer accessibility for investors with less capital.

- While potentially rewarding, penny stocks carry significant risk due to company size and volatility.

- Look for stocks on major exchanges, with legitimate company presence, and strong trading volume.

- Understanding the ‘catalyst’ driving a stock’s price is crucial for informed trading decisions.

- Treat penny stocks as speculative trades, not long-term investments, and always verify information.

Luminar Technologies

Luminar Technologies is a company that’s really focused on making self-driving cars safer. They develop lidar sensors, which are basically like the eyes for autonomous vehicles. Think of it as a super-advanced radar that uses light pulses to map out the surroundings in 3D, even in tricky weather conditions where cameras might struggle.

Their main goal is to make sure that when cars drive themselves, they can see everything around them clearly and react quickly. This is a pretty big deal because safety is the number one thing people worry about with self-driving tech. Luminar’s lidar is designed to detect objects far away and with a lot of detail, which is key for high-speed driving and complex city environments.

Here’s a quick look at what makes their tech stand out:

- Long-Range Detection: They claim their sensors can see objects up to 250 meters away. That’s a good distance, giving the car plenty of time to react.

- High Resolution: The data they get is detailed, helping the car distinguish between different types of objects, like a pedestrian versus a plastic bag.

- All-Weather Performance: Lidar generally works better than cameras when it’s foggy, rainy, or super sunny, and Luminar aims to be top-notch in this area.

They’ve been partnering with some big names in the auto industry, which is a good sign. Getting these big car manufacturers to adopt their technology shows that the industry sees the potential. It’s not just about making cool tech; it’s about making it practical and reliable enough for everyday use on the road. The company is still growing, and like many tech companies in this space, it’s a bit of a gamble, but the potential payoff if self-driving cars become widespread is huge.

Mint

Mint is a company that’s been getting some attention lately, and it’s worth a look if you’re into the whole penny stock scene. They’re working in the health data solutions space, which is pretty interesting because, let’s face it, healthcare is going digital, and someone needs to manage all that information securely. Think of it as a digital filing cabinet for hospitals and researchers, but way more advanced and secure.

The big draw here is their platform, which helps different healthcare players share medical images and patient data more easily. This kind of thing is becoming more important as medical technology advances and more data is generated. It’s not just about storing data; it’s about making it accessible and usable for doctors and scientists who need it to do their jobs better.

Now, it’s still an early-stage company, so it’s not exactly a sure thing. They don’t have a ton of revenue yet, which is typical for companies at this stage. This means there’s a good amount of risk involved, which is why it’s on a list of penny stocks. You’re basically betting on their idea and their ability to grow.

Here’s a quick rundown of what makes Mint stand out:

- Focus on Secure Data Sharing: Their core business is about making it safe and efficient for hospitals and researchers to exchange sensitive medical information.

- Growing Market: The digital health sector is expanding, and companies that can handle data effectively are in a good position.

- Recent Trader Interest: The stock has seen spikes in trading volume, which often attracts short-term traders looking for quick moves.

Keep in mind, this isn’t for the faint of heart. It’s a speculative play, and like most penny stocks, it can be pretty volatile. But if you’re looking for something with potential in a growing industry, Mint might be one to watch.

Cypherpunk Technologies

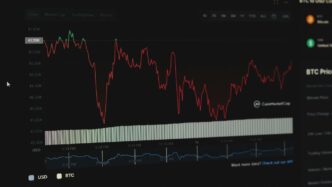

Cypherpunk Technologies is a company that’s been popping up on the radar for those looking for unique investment opportunities. They’re involved in the digital asset space, focusing on areas that blend technology with finance. It’s still a relatively new player, so information can be a bit scarce, but the buzz is around their potential in decentralized systems.

The company aims to build infrastructure for the next wave of digital finance. This involves exploring technologies that could underpin future financial transactions and asset management. Think of it as trying to get in on the ground floor of something that might change how we handle money and ownership online.

Here’s a quick look at what makes them interesting:

- Focus on Decentralization: They are exploring how decentralized technologies can be applied to financial services, aiming for more open and accessible systems.

- Innovation in Digital Assets: Cypherpunk Technologies is looking into new ways to create, manage, and trade digital assets, which could open up new markets.

- Early-Stage Potential: As a newer company, there’s a chance for significant growth if their projects gain traction and adoption.

When looking at stocks like Cypherpunk Technologies, it’s important to remember they often come with higher risk. Technical analysis suggests resistance around $1.20 and support at $0.93, so keeping an eye on these levels could be useful for short-term traders. Investing in such companies requires a good understanding of the digital asset market and a willingness to accept volatility. It’s definitely not for the faint of heart, but for some, the potential rewards could be substantial.

Sidus Space

Sidus Space is a company that’s really trying to make a name for itself in the aerospace and defense sector. They’re involved in building and launching satellites, which is pretty cool stuff. Think of them as a smaller player trying to get a piece of the growing space economy pie. They’ve been working on developing their own satellite technology and also offering services to other companies that need to get things into orbit.

The company’s focus is on providing integrated space solutions, from design and manufacturing to launch and on-orbit support. This means they’re trying to cover a lot of ground in a complex industry. They’ve had some contract wins recently, which is always a good sign for a company like this. For instance, they’ve secured deals for satellite systems in different parts of the world. They’re also putting effort into research and development, trying to make their satellite links more energy efficient. It’s a tough market, though, and companies like Sidus Space can be pretty sensitive to project timelines and whether they have enough funding to keep things moving.

Here’s a quick look at some key aspects:

- Sector: Aerospace & Defense

- Focus: Satellite technology and space solutions

- Recent Activity: Contract wins, R&D in energy efficiency

- Market Position: Emerging player in a competitive field

In 2024, Sidus Space reported revenue of $4.67 million, which was a bit lower than the $5.96 million they made the year before. It’s a reminder that even with exciting technology, financial performance can fluctuate. For investors looking at this space, it’s important to understand that these kinds of companies can be volatile. They depend a lot on landing new contracts and successfully executing their projects. It’s definitely a space to watch if you’re interested in the future of satellite communications and defense applications.

TJGC Group

TJGC Group is a company that’s been making some noise in the renewable energy sector, specifically with wind turbines. They’re a manufacturer, and it looks like they’re going through a bit of a comeback. The company seems to be getting a steady stream of new orders, which is always a good sign for any business, right?

Here’s a quick look at some of the details:

- Sector: Renewable Energy (Wind Turbines)

- Recent Developments: They’ve been securing new wind power projects, which is pretty neat. Plus, they’ve apparently improved their profit margins after doing some debt restructuring and cost controls. They’re also trying to expand their partnerships for exporting turbines.

- Investor Appeal: For folks looking to get into clean energy, especially in emerging markets, TJGC Group might be worth a look. They’ve actually returned to profitability, and there’s strong demand in their home market. It’s still a bit of a wild ride, as penny stocks often are, but it seems more balanced than some other high-risk options out there.

The company’s focus on expanding international partnerships for turbine exports is a key strategy for future growth. It’s not a guaranteed win, of course, but it shows they’re thinking ahead. If you’re into this kind of thing, keeping an eye on their order flow and profit reports could be interesting.

Impact BioMedical

Impact BioMedical is a company that operates in the healthcare and biotechnology space, focusing on diagnostic testing and providing biomedical supplies. They serve clinics and labs, offering a range of genetic and molecular testing products. The company has gained some attention, especially from retail traders, following noticeable spikes in trading volume and general interest.

While the market for diagnostic testing is growing, Impact BioMedical is still a relatively small operation. They have limited financial history and their revenues are modest. This means the stock can be quite speculative and tends to react strongly to news and short-term market sentiment. It’s definitely a name to watch closely if you’re interested in this sector, but be aware of the risks involved.

Here’s a quick look at some key details:

- Sector: Healthcare and Biotechnology

- Headquarters: Florida, USA

- Trading Volume: Can be high, but it’s not always consistent.

- Risk Level: High, around 9/10, due to volatility and transparency issues.

- Position Size Recommendation: It’s suggested to allocate no more than 1% of your portfolio to this stock.

Recently, they’ve been active:

- Launched new diagnostic services in a few U.S. states.

- Reported some growth in quarterly revenue, thanks to new contracts.

- Worked on expanding their network for distributing testing supplies.

For investors, Impact BioMedical offers a way to get involved in the expanding healthcare diagnostics market. However, its small size and the inherent volatility mean it’s a high-risk, high-reward kind of play.

Amaze Holdings

Amaze Holdings is a company that’s been popping up on the radar for folks looking for smaller, potentially fast-growing stocks. They’re involved in a few different areas, but a big part of their focus seems to be on technology and digital services. Think about companies that help other businesses get their tech sorted out, especially in areas like cloud computing and IT support. It’s the kind of work that’s pretty important these days as everything moves online.

The company is still pretty new to the public market, so there’s definitely a risk involved, but that’s often where the biggest opportunities lie with these kinds of penny stocks. They’ve had some ups and downs, and like many smaller companies, their stock price can move around quite a bit based on news or general market sentiment. It’s not the kind of stock you’d buy and forget about; you’d want to keep an eye on it.

Here’s a quick look at some key things to consider:

- Business Focus: Primarily IT services and technology solutions for businesses.

- Market Position: Operates in a competitive but growing sector.

- Investor Profile: Best suited for those comfortable with higher risk and volatility, looking for potential growth.

It’s important to remember that Amaze Holdings, like many companies in this price range, is still building its track record. Success will likely depend on their ability to land new contracts and keep their clients happy. If they can show consistent growth and expand their services, it could be a good sign for investors. But, as always with penny stocks, do your homework before putting any money in.

Mingteng International

Mingteng International is a company that’s been on the radar for some investors looking for exposure to the Chinese market, specifically within the e-commerce and retail sectors. It’s not exactly a household name, but that’s often where the potential for finding undervalued gems lies, right?

Right now, the company seems to be focusing on expanding its online sales channels and maybe even dabbling in some new product lines. It’s the kind of business that could see a quick jump if they hit the right market trend or secure a significant partnership. However, it’s important to remember that companies like this can be pretty volatile.

Here’s a quick look at some things to consider:

- Market Focus: Primarily targets the Chinese consumer market, which is huge but also quite competitive.

- Business Model: Seems to be a mix of online retail and possibly some distribution services.

- Growth Potential: Depends heavily on their ability to adapt to changing consumer habits and technological advancements in e-commerce.

It’s a bit of a gamble, for sure. You’d want to do your homework and maybe only put a small amount of money into it, just in case things don’t go as planned. Think of it as a small bet on a potentially big payoff, but don’t bet the farm.

Lakeside Holding

Lakeside Holding (LSH) is a company that’s been popping up on the radar for penny stock watchers lately. It’s not a household name, and that’s kind of the point with these kinds of investments, right? You’re looking for those smaller companies that have the potential to really take off.

The company operates in a sector that’s seen some interesting movement, and recent trading activity suggests a growing interest from investors. It’s the kind of stock that can be a bit of a rollercoaster, so it’s definitely not for the faint of heart. You’ve got to be prepared for some ups and downs.

Here’s a quick look at what we know:

- Sector Focus: While specific details can shift, Lakeside Holding is generally associated with industries that are experiencing growth or undergoing transformation. This often means they’re involved in areas like technology, manufacturing, or perhaps even consumer goods, but on a smaller scale.

- Recent Performance: The stock has shown some positive momentum recently, with a noticeable uptick in its price and trading volume. This kind of activity can signal that something is happening, whether it’s new contracts, positive news, or just increased market attention.

- Risk Profile: Like most penny stocks, Lakeside Holding comes with a higher risk level. Its size means it can be more sensitive to market fluctuations and company-specific news. It’s important to do your homework and understand the potential downsides before putting any money in.

For those looking to get a feel for the company’s stock performance and recent news, checking out the LSH stock information is a good starting point. It gives you the latest quotes and historical data, which are pretty important when you’re thinking about buying something like this.

Bristol-Myers Squibb Company Celegne Contingent Value Rights

Okay, so let’s talk about these Bristol-Myers Squibb Company Celegne Contingent Value Rights. It sounds complicated, I know, but stick with me. Basically, these are like special promises tied to the acquisition of Celgene by Bristol-Myers Squibb back in 2019. When a big company buys another, sometimes they include these ‘contingent value rights’ or CVRs. They’re essentially a way for the seller (Celgene, in this case) to give the buyer’s shareholders a potential payout later on, but only if certain future events happen.

For Bristol-Myers Squibb, these CVRs are linked to the success of specific Celgene drug candidates. If these drugs hit certain development or sales milestones by specific dates, Bristol-Myers Squibb has to pay out more to the former Celgene shareholders who received these rights. It’s a way to bridge the gap when there’s uncertainty about a drug’s future success at the time of the acquisition.

Here’s a breakdown of what makes these CVRs tick:

- Milestone Payments: The CVRs have specific targets. For example, a drug might need to get FDA approval or reach a certain sales number by a deadline. If it does, a payment is triggered.

- Expiration Dates: These aren’t forever. Each CVR has an expiration date. If the milestones aren’t met by then, the rights just expire, and no further payment is made.

- Potential Payout: The amount of money involved can be significant, but it’s not guaranteed. It all hinges on whether those clinical and commercial goals are achieved.

The big question for investors is whether these milestones will actually be hit. It’s a bit of a gamble, and the value of these CVRs can swing quite a bit based on news about the underlying drugs. It’s not a typical stock you buy and hold; it’s more of a side bet on the success of specific pharmaceutical research. Keep an eye on the progress of those Celgene drug candidates – that’s where the real action is for these rights.

Wrapping It Up

So, there you have it. We’ve looked at some penny stocks that could be worth checking out right now. Remember, these kinds of investments are pretty risky, so don’t put all your eggs in one basket. It’s super important to do your own homework on any company before you buy. Keep an eye on the news, look at how much the stock is traded, and make sure the company seems legit. Think of these as speculative plays, not something to bet your life savings on. Good luck out there, and trade smart!

Frequently Asked Questions

What exactly are penny stocks?

Penny stocks are shares of small companies that trade for a really low price, usually less than $5 per share. Think of them as tiny pieces of businesses that are just starting out or haven’t grown much yet. Because they’re so cheap, they can be appealing to people who don’t have a lot of money to invest.

Are penny stocks a good way to get rich quick?

While some people have made a lot of money with penny stocks, it’s not a guaranteed way to get rich. These stocks are super risky. Their prices can jump up really high, but they can also crash down just as fast, sometimes even disappearing completely. It’s safer to think of them as a small part of a bigger investment plan, not the whole plan.

How can I start investing $1000 in penny stocks?

If you decide to invest $1000 in penny stocks, it’s smart to spread that money around. Don’t put it all into one company. Instead, buy small amounts of stock in several different companies across various industries. This way, if one stock does poorly, the others might do well and help balance things out.

What makes a penny stock a good buy?

When looking for penny stocks, check if they trade on a big stock market like the NYSE or Nasdaq, as these have more rules. Also, see if the company seems real – does it have news or reviews? It’s good if the stock is being traded a lot each day, which makes it easier to sell later. Finally, look for signs that the company is doing something interesting, like launching a new product, that could make its stock price go up.

What are the biggest dangers of investing in penny stocks?

The main danger is that these companies are small and might not succeed. Their stock prices can change wildly based on rumors or online hype, not real business success. Some penny stocks are even part of ‘pump-and-dump’ schemes where people artificially raise the price to sell their shares at a profit, leaving others with losses. It’s crucial to be very careful and do your homework.

Should I invest in penny stocks for the long term?

It’s generally not recommended to hold penny stocks for a very long time. They are very unpredictable. It’s usually better to trade them – meaning you buy and sell them relatively quickly, trying to make a profit from short-term price changes. Think of it like a quick gamble rather than planting a tree for shade years down the line.