The world of venture capital is always changing, and 2025 will be no different. If you’re an investor, a new business owner, or just curious about what’s next for startups, there’s a lot to keep an eye on. After a few years of ups and downs, lower company values, and tough fundraising, things are starting to look better. Let’s check out what’s coming for the biggest VC players next year.

Key Takeaways

- The biggest VC firms are being pickier with their investments, focusing on fewer, but higher quality deals.

- These top firms are using their existing connections more, rather than trying to make lots of new ones.

- Leading VC firms are putting more effort into helping the companies they invest in, beyond just giving them money.

- Technology, especially AI, is changing how big VC firms find deals, make decisions, and manage their investments.

- The global reach of big VC funds is growing, with more investment happening in places like the MENA region.

Economic Shifts Impacting Biggest VC Players

The venture capital world is always changing, and 2025 is no different. After years of economic ups and downs, declining company values, and a tough fundraising environment, things are looking better. Let’s explore what’s happening in venture capital next year.

Interest Rate Fluctuations

One of the biggest changes expected is a dip in interest rates. Lower interest rates make borrowing cheaper, which is great for both VCs and startups looking to secure funding. When rates are low, more capital is available, potentially leading to increased investment activity. This can create a more favorable environment for startups seeking growth capital and for VCs looking to deploy funds.

Liquidity Challenges and Opportunities

Liquidity is still a concern for many Limited Partners (LPs). In recent years, LPs have faced a lack of liquidity, which can hinder their ability to reinvest in new funds. However, in 2025, this is expected to improve with more distributions to paid-in capital (DPI). Improved liquidity is crucial for the health of the VC ecosystem. It allows LPs to participate more actively in new investment opportunities, supporting the growth and sustainability of the industry. The transformative potential of artificial intelligence, newly reopened IPO windows, and the current regulatory environment are shifting the venture capital market.

Navigating Market Volatility

Economic uncertainty is always a looming threat. A potential global recession could shift VC focus to more resilient sectors like healthcare and essential goods. During tough economic times, investors tend to become more cautious and risk-averse, which can slow down investment activity. VCs will need to stay agile, adapting their strategies to prioritize sectors that can weather economic storms. This might involve diversifying portfolios or finding innovative ways to support startups in less volatile industries. The dealmaking activities of top VC firms reflect a deliberate shift toward fewer, larger, and higher-quality investments.

Technology’s Transformative Role for Biggest VC Firms

AI-Driven Investment Decisions

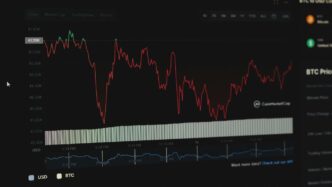

AI is changing how venture capital works. AI-powered tools are helping VCs make smarter choices by improving how they predict trends, find deals, and manage their investments. Imagine using AI to spot market trends and predict which areas will grow the most. This can really improve how quickly and accurately investment decisions are made. For example, many firms now use AI to speed up company research, with 64% using AI to find opportunities faster.

Data Analytics for Deal Sourcing

Data analytics is now super important for finding the best deals. Instead of relying on old methods, VC firms are using data to find promising startups. This means looking at market data, industry reports, and even social media to spot trends and find companies that might be the next big thing. It’s like having a super-powered search engine for investments. This helps them be more selective and focus on higher-quality investments. Deal volume declined for top VCs in 2024, showing a shift to fewer, bigger, and better investments. They’re using data and tech to find these opportunities earlier.

Enhanced Portfolio Management Tools

Managing a portfolio is not easy, but new tools are making it simpler. These tools help VCs keep track of how their investments are doing, spot potential problems, and make changes when needed. It’s like having a real-time dashboard for all their investments. This means they can give better support to their portfolio companies and help them grow. Improved liquidity is key for the VC world, letting LPs invest more in new opportunities and support the industry’s growth.

Key Characteristics of Leading Biggest VC Firms

It’s interesting to see how the top VC firms are setting themselves apart. It’s not just about having deep pockets anymore. Let’s take a look at what makes them tick.

Increased Selectivity in Investments

Top VC firms are becoming more selective, focusing on fewer, higher-quality deals. Deal volume actually went down in 2024 for these guys. They’re using data and tech, like AI to accelerate company research, to find the best opportunities earlier. It’s all about quality over quantity these days. They want to make sure they’re putting their money into something that’s really going to take off.

Prioritizing Existing Networks

Instead of trying to expand their networks like crazy, the best firms are really focusing on the connections they already have. They’re digging deeper with people they know and trust. This means leaning on their existing relationships to find new deals and get the inside scoop. It’s like they’re saying, "Why fix what isn’t broken?" and doubling down on what works. This approach helps them move faster and make smarter decisions because they’re working with people they already know and trust. It’s all about leveraging those existing networks for maximum impact.

Focus on Comprehensive Portfolio Support

It’s not enough to just write a check anymore. The leading VC firms are all about giving their portfolio companies a ton of support. They’re helping with everything from finding talent to figuring out their go-to-market strategy. They’re basically acting like an extension of the startup’s team. This hands-on approach is a big deal because it helps the startups grow faster and avoid common pitfalls. Plus, it makes the VC firm more attractive to founders who want more than just money. Totaled investments are only part of the equation; it’s about what happens after the deal closes.

Biggest VC Players in Fintech Innovation

Fintech is still a hot sector, and some VC firms are consistently leading the charge. These firms aren’t just throwing money around; they’re strategically investing in companies that are reshaping how we interact with finance. It’s interesting to see how their approaches differ and where they’re placing their bets.

Tiger Global Management’s Impact

Tiger Global has been a major force in fintech, known for its aggressive investment style and willingness to back high-growth companies. They’ve participated in some huge funding rounds, and their presence often signals confidence in a company’s potential. However, their strategy has also come under scrutiny, with some questioning the sustainability of their rapid-fire approach. They are one of the top VC firms to watch.

Index Ventures’ Strategic Investments

Index Ventures takes a more measured approach, focusing on identifying companies with strong fundamentals and long-term potential. They’ve built a reputation for backing companies that are disrupting traditional financial services, from payment platforms to lending solutions. Their portfolio reflects a commitment to innovation and a keen eye for identifying future industry leaders. They are known for their strategic investments.

Andreessen Horowitz’s Fintech Footprint

Andreessen Horowitz (a16z) has a broad investment portfolio, but their fintech investments are particularly noteworthy. They’ve been early backers of some of the most successful fintech companies, and their deep understanding of technology and finance gives them a unique perspective on the industry. They’re not afraid to invest in bold ideas and are often at the forefront of emerging trends like decentralized finance and blockchain technology. They have a significant fintech footprint.

It’s worth noting that the fintech landscape is constantly evolving, and these firms are likely to adapt their strategies as new opportunities and challenges emerge. The competition for deals is fierce, and the ability to identify and support the next generation of fintech leaders will be crucial for success.

Biggest VC Firms Driving SaaS Growth

SaaS is still a hot sector, and some VC firms are really making waves by backing the next generation of software companies. It’s interesting to see how these firms are placing their bets, especially with the market always changing. Let’s take a look at some of the biggest players.

Sequoia Capital’s SaaS Dominance

Sequoia Capital has a long history of successful SaaS investments. They’ve consistently identified and supported companies that have become household names in the software world. They’ve been around since 1972, so they’ve seen a lot of trends come and go. Their portfolio includes some pretty big hitters. They invest in seed, early stage venture, and late stage venture. They are definitely a major player in the SaaS space.

Here’s a quick look at some key stats:

- Founded: 1972

- Total Funds: 34

- Exits: 422

- Total Investments: 2,141

Accel’s Influence in Software

Accel is another firm that’s been instrumental in the growth of SaaS. They have a knack for finding companies with serious potential. They’ve backed companies that have changed how we work and live. They are known for their dealmaking activities and have a keen eye for identifying promising opportunities early on.

Bessemer Venture Partners’ Enterprise Focus

Bessemer Venture Partners stands out with its focus on enterprise software. They really dig into the nitty-gritty of what makes a successful enterprise SaaS company. They look for solutions that solve real business problems and have staying power. They’ve invested in companies like Slack and Atlassian. They are known for their selectivity and focus on portfolio support. They are definitely one of the top VC firms in SaaS investing.

Emerging Trends for Biggest VC Investments

It’s interesting to see how VC investment is changing. The big players are adapting, and some new trends are really taking off. It’s not just about throwing money at any startup anymore; there’s a lot more strategy involved.

Growth in AI and ClimateTech

AI and ClimateTech are definitely the hot sectors right now. AI is everywhere, from healthcare to law, and investors are pouring money into anything that looks promising. ClimateTech is also gaining traction as people become more aware of environmental issues. It’s not just about feeling good; there’s real money to be made in sustainable solutions. For example, analysts share their picks for top tech stocks, and AI and ClimateTech companies often feature prominently.

Rise of Micro-VC Funds

Micro-VC funds are becoming a bigger deal. These smaller funds can be more nimble and focus on niche areas that the bigger firms might miss. They often provide early-stage funding and mentorship, which can be crucial for startups. It’s a good way for new investors to get into the game and for startups to get the support they need without getting lost in the shuffle of a huge VC firm.

LP Expectations and Revenue-Driven Investing

Limited Partners (LPs) are getting smarter and more demanding. They want to see returns, and they want to see them fast. This is leading to a shift towards revenue-driven investing, where VCs are focusing on companies that can generate revenue quickly, rather than just chasing long-term growth. It’s a more conservative approach, but it’s what the LPs want. Here’s a quick look at what LPs are looking for:

- Clear path to profitability

- Strong management team

- Scalable business model

- Demonstrated market traction

VCs are also becoming more selective. Deal volume declined in 2024, reflecting a shift toward fewer, larger, and higher-quality investments. It’s all about finding the winners and avoiding the losers. This means more due diligence and a greater focus on the dealmaking activities of top VC firms.

Global Reach of Biggest VC Funds

US-Based VC Powerhouses

US-based venture capital firms continue to dominate the global landscape. These firms often set the trends and standards for the industry, influencing investment strategies worldwide. Many of the largest and most successful VC firms, like Sequoia Capital and Andreessen Horowitz, are headquartered in the US, giving them a significant advantage in accessing deal flow and talent. They have a long history of backing innovative companies that have gone on to become global giants. It’s interesting to see how they adapt to the changing global economy and maintain their edge. For example, mega startups like SpaceX have received substantial backing from these firms.

Expanding into MENA Regions

The Middle East and North Africa (MENA) region is becoming an increasingly attractive destination for venture capital. Several factors drive this trend, including a young and growing population, increasing internet penetration, and government initiatives to support entrepreneurship. VC firms are recognizing the potential for high-growth opportunities in sectors such as fintech, e-commerce, and healthcare. 500 Global, for instance, launched the 500 MENA fund to invest in high-growth tech startups in the region. This expansion reflects a broader trend of VC firms seeking opportunities beyond traditional markets. It’s a smart move, considering the untapped potential in these emerging economies. This is a great time to explore venture funding in the region.

Worldwide Investment Strategies

Leading VC firms are adopting increasingly global investment strategies. They are no longer limiting themselves to specific geographic regions but are actively seeking out opportunities around the world. This involves establishing a presence in key international markets, building relationships with local investors and entrepreneurs, and developing a deep understanding of different cultural and regulatory environments. This global approach allows them to access a wider range of investment opportunities and diversify their portfolios. It also enables them to support their portfolio companies in expanding into new markets. The top firms investing in various sectors are based on Dealroom’s Global Combined Investor Ranking. It’s a complex undertaking, but the potential rewards are significant. Here’s a quick look at some key aspects of their global strategies:

- Local Partnerships: Collaborating with local VC firms and angel investors to gain market insights and access deal flow.

- Regional Offices: Establishing offices in strategic locations to build a local presence and network.

- Cross-Border Support: Providing portfolio companies with resources and guidance to expand internationally.

Conclusion

So, there you have it. The world of venture capital is always changing, and 2025 looks like it’ll be a pretty interesting year. We’re seeing some big shifts, from how money moves around to the kinds of companies getting funded. It’s clear that being smart and ready to change is going to be super important for everyone involved. Whether you’re trying to get funding or looking to invest, keeping an eye on these trends will definitely help you out. It’s all about staying on top of things and being flexible.

Frequently Asked Questions

What exactly are Venture Capital (VC) firms?

Venture Capital (VC) firms are companies that invest money in new businesses, usually startups, that have big potential for growth. They provide funding in exchange for a piece of the company, and they also offer guidance and support to help these young businesses succeed. Their main goal is to help these companies grow quickly so they can eventually sell their share for a profit.

What big economic changes are affecting VC firms in 2025?

In 2025, several things are shaking up the VC world. Interest rates are expected to drop, making it cheaper for companies to borrow money. There are also ongoing challenges with how easily investors can get their money out of funds (liquidity), but this is looking up. Plus, the market can be unpredictable, so VCs need to be smart about where they put their money.

How is technology changing how VC firms operate?

Technology is changing how VC firms do business in a big way. They’re using Artificial Intelligence (AI) to help them decide where to invest, like figuring out which companies are most likely to do well. They also use data analysis to find new investment opportunities and special tools to keep track of their investments and help their portfolio companies grow.

What makes the top VC firms different from others?

Leading VC firms are being more careful about where they invest their money, picking fewer but better companies. They’re also leaning on their existing connections and networks to find good deals. And once they invest, they don’t just give money; they offer a lot of help and support to their companies to make sure they succeed.

Which VC firms are the biggest players in Fintech?

In the world of financial technology (Fintech), some of the biggest VC players include Tiger Global Management, Index Ventures, and Andreessen Horowitz. These firms have put a lot of money into companies that are changing how we handle money, from online banking to payment systems.

What new trends are appearing in VC investments?

Looking ahead, VCs are really interested in companies that use AI and those that are working on solutions for climate change (ClimateTech). There’s also a rise in smaller VC funds called ‘micro-VCs.’ And investors in VC funds (LPs) are increasingly looking for investments that show clear revenue and profit, not just future potential.