So, looking ahead to 2026, what’s the deal with world energy capacity? It’s a bit of a mixed bag, honestly. We’re seeing some big shifts, especially with renewables picking up speed, but there are still plenty of challenges. Geopolitics is still messing with things, and figuring out how to keep the lights on affordably is a constant juggle. Let’s break down what the energy world might look like in the next couple of years.

Key Takeaways

- Global energy demand is expected to grow slowly in 2026, mostly thanks to developing nations, while richer countries might see demand level off or even drop. China is still the biggest player in energy use.

- Renewable energy, particularly solar and wind, is adding more new capacity than fossil fuels. By 2026, solar and wind capacity combined should be bigger than coal and gas power plants, though they won’t produce as much power due to lower capacity factors.

- New technologies like small modular nuclear reactors are moving closer to construction, and electric vehicle sales are climbing fast, especially in China. Sodium-ion batteries are also starting to show up.

- Investment in the energy sector is taking a breather after a big run-up, partly because of global tensions and lower commodity prices. China’s policy changes are also affecting solar and wind investment.

- Companies in the oil and gas sector are trying to be smart with their money, balancing spending on new projects with buying up resources, especially as oil prices are expected to stay lower. Mergers and acquisitions are becoming a bigger part of the strategy.

Global Energy Capacity Trends and Projections

Shifting Dynamics in World Energy Capacity

The global energy scene in 2026 is really a mixed bag, with some areas seeing big changes and others staying pretty much the same. We’re looking at modest growth in overall energy consumption, about 1.2%, which is actually the slowest it’s been since 2022. Most of that push is coming from developing countries in Asia, Latin America, and Africa. Meanwhile, places like Europe and the US are seeing demand level off or even drop a bit. China continues to be the heavyweight, gobbling up about a quarter of all the energy used worldwide. This whole picture is still being shaped by recent global events, which have made everyone rethink how they get their energy and pushed them to look for more stable, diverse options.

Forecasting Global Energy Consumption Patterns

When we look ahead to 2026, a few things stand out in how we’ll be using energy. Coal use is expected to hit its peak globally and then start a slow decline. That’s a pretty big deal. Even with this shift, carbon dioxide emissions from fossil fuels will likely creep up a little, around 0.4%. Natural gas is still going to be important, with consumption growing by 2-3% each year, largely thanks to demand in China and South Asia. However, this growth is being held back in places like Europe and the US. On the flip side, solar and wind power capacity are still on the rise, showing that the move towards cleaner energy sources is definitely underway.

Here’s a quick look at projected consumption changes:

- Developing Asia: Strongest growth driver.

- Developed Economies: Stagnant or declining demand.

- China: Remains the largest single consumer.

The Role of Developing Economies in Energy Growth

It’s pretty clear that developing nations are going to be the main engine for energy demand growth in the coming years. As these economies expand and their populations grow, the need for power and fuel naturally increases. This surge in demand presents both opportunities and challenges. On one hand, it means more business for energy providers and a chance to build out new infrastructure. On the other hand, it raises questions about how this growth will be powered – will it be with cleaner sources, or will it rely on traditional fossil fuels, potentially increasing emissions? The choices made now will have a big impact on the global energy transition.

The Evolving Landscape of World Energy Capacity

The global energy scene is really shifting these days, and it’s not just about more power being needed. Geopolitical stuff, like that whole situation with Russia and Ukraine, has really messed with how energy moves around the world. Countries are now thinking twice about where their energy comes from and are looking for more reliable, diverse sources. This has sped up the move towards cleaner energy options and trying to use what we have more wisely.

Impact of Geopolitical Tensions on Energy Flows

Things like international conflicts and trade disputes have a big effect on where energy goes and how much it costs. When one region has trouble supplying energy, it can cause price spikes and shortages elsewhere. This makes countries really focus on having their own energy sources or getting them from a variety of places they trust. It’s like having too many eggs in one basket – not a great idea when that basket might get dropped.

Accelerated Transition to Alternative Energy Sources

Because of these global pressures, there’s a much bigger push to use things like solar and wind power. We’re seeing more and more renewable energy projects getting started. It’s not just about being green anymore; it’s about having a stable energy supply that isn’t tied to volatile international markets. This transition is happening faster than many expected, driven by both necessity and new technology.

Focus on Energy Security and Diversification Strategies

So, what does this mean in practice? Countries are actively trying to diversify their energy mix. This involves:

- Investing in a wider range of energy sources, from renewables to, in some cases, looking at nuclear power again.

- Building better infrastructure, like more pipelines and storage facilities, to handle different types of energy.

- Forming new international partnerships to secure energy supplies and share technology.

The goal is to create an energy system that’s less vulnerable to disruptions and can meet future demands reliably. It’s a complex puzzle, but one that’s becoming more important every day.

Renewable Energy’s Ascendancy in World Capacity

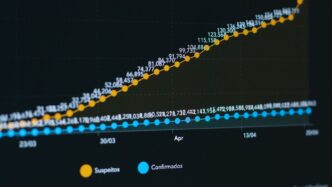

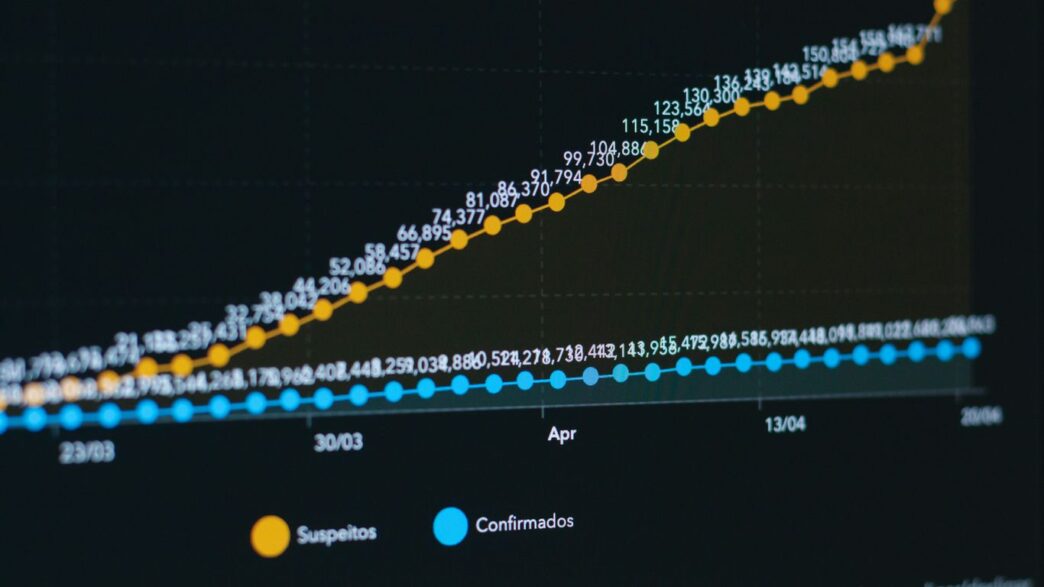

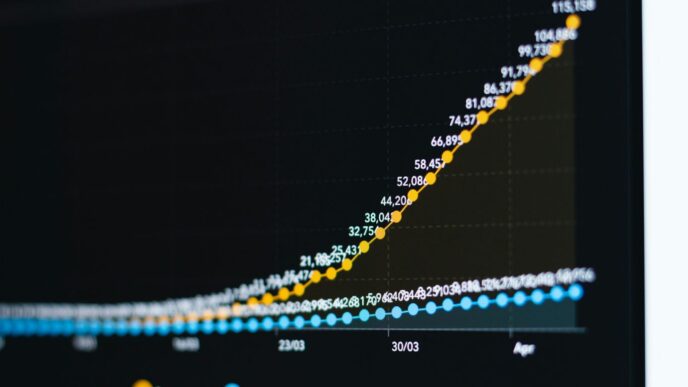

It’s pretty clear that renewable energy is really starting to take center stage when we talk about new power generation. We’re seeing more solar and wind farms popping up globally than new coal or gas plants. By 2026, the combined capacity of solar and wind is expected to hit a massive 4,000 GW. This is a big deal because it means renewables will actually have more installed capacity than coal and gas combined for the first time.

Now, it’s important to remember that solar and wind don’t always produce power at their maximum potential all the time, so their output won’t exactly match that of fossil fuels. But still, the sheer amount of new capacity being added is impressive.

Surpassing Fossil Fuels in New Capacity Additions

This trend of renewables outgrowing fossil fuels in new installations isn’t just a blip; it’s becoming the norm. Developers are committing to building more renewable capacity, and while some new gas plants are still being planned, the momentum is clearly with solar and wind.

Projected Growth in Solar and Wind Power Capacity

Looking ahead, the numbers for solar and wind are only going to get bigger. We’re talking about significant growth that will reshape the energy mix.

Implications of Lower Capacity Factors for Renewables

While the capacity numbers are soaring, we do need to keep an eye on what’s called ‘capacity factor.’ This is basically how much power a plant actually produces compared to its maximum possible output over a period. Solar and wind have naturally lower capacity factors than, say, a gas plant that can be turned on whenever needed. This means that even with huge capacity additions, we still need to think about grid stability and ensuring power is available when demand is high. It’s a bit of a balancing act, really.

Emerging Technologies Shaping World Energy Capacity

It’s not just about more solar panels and wind turbines, though those are definitely getting bigger. The real game-changers for our energy future are the technologies that are starting to come into their own. Think next-gen nuclear, smarter batteries, and even hydrogen making a serious play.

Progress in Next-Generation Nuclear Projects

Nuclear power is getting a bit of a makeover. We’re seeing a lot of movement towards Small Modular Reactors (SMRs). These aren’t your grandpa’s giant power plants. They’re smaller, potentially quicker to build, and could offer a more flexible way to get clean energy online. By 2026, we expect to see a number of these SMR projects moving from the drawing board closer to actual construction. It’s a big step, with a good chunk of potential new capacity lining up for final investment decisions.

Scaling Up Electric Vehicle and Battery Production

Electric cars are really starting to take over the roads. Sales are climbing fast, and they’re making up a bigger slice of all new car sales every year. This boom in EVs means a huge demand for batteries. Companies are not only making more of the lithium-ion batteries we’re used to, but they’re also looking at new types, like sodium-ion batteries, which could be cheaper and use more common materials. This push means more factories, more jobs, and a whole lot more batteries ready to power our cars and even help stabilize the electricity grid.

Advancements in Hydrogen Production and Export Potential

Hydrogen is the buzzword that just won’t quit, and for good reason. It’s seen as a clean fuel for the future, especially for industries that are hard to electrify. While there’s been a lot of talk, 2026 looks like a critical year for hydrogen. We’re seeing big investments and decisions being made, particularly in places like China, which is pushing ahead with green hydrogen production. There’s even talk of countries producing hydrogen cheaply and exporting it, potentially undercutting local production elsewhere. It’s a complex picture, but the technology and the ambition are definitely there.

Investment and Policy Influences on World Energy Capacity

Okay, so let’s talk about the money side of things and what governments are doing, because it really shakes up how much energy capacity we get built. It’s not all smooth sailing, you know? Geopolitical stuff and prices dipping a bit have put the brakes on investment in energy and natural resources. We saw a big jump in spending since 2020, hitting a record last year, but we’re expecting a small dip in 2026. It’s a bit of a pause, really, before things hopefully pick back up, which they need to if we’re going to meet demand and clean things up.

Stalled Investment Growth in Energy and Natural Resources

Investment in power and renewables, which is a huge chunk of the total, is actually going down a bit. A big reason for this is China dialing back its support for solar and wind. After a decade of solid growth, investment in renewables is expected to stay pretty flat for a while. Battery storage is holding steady too, after a big jump last year because prices came down. It’s interesting how much money is going into new low-carbon tech, though it’s still a small slice of the pie. Carbon capture projects are growing, but 2026 could be a really big year for hydrogen – a lot of projects are looking to make final decisions.

Impact of China’s Policy Incentives on Renewables

China’s been a massive player in pushing renewables, especially solar and wind, with its government incentives. But now, they’re pulling back a bit on those policies. This has a ripple effect globally, slowing down the pace of new renewable capacity additions. It’s a bit of a mixed bag; while this might mean less investment in China’s renewables for now, it also pushes other countries and companies to rethink their own strategies and look for opportunities elsewhere, maybe in places like Canada.

Battery Energy Storage Investment Trends

Investment in battery energy storage is holding its ground in 2026. It saw a significant boost last year, largely because the cost of batteries dropped. This stability is important because storage is key to making renewable energy, like solar and wind, more reliable. Without it, we can’t always use that clean power when the sun isn’t shining or the wind isn’t blowing. So, even though overall investment might be a bit shaky, the money going into batteries is a good sign for the grid’s future.

Regional Variations in World Energy Capacity

When we look at the global energy picture for 2026, it’s clear that things aren’t the same everywhere. Different regions are marching to their own energy beats, influenced by local economies, policies, and resources. It’s not a one-size-fits-all situation, not by a long shot.

China’s Dominance in Energy Consumption and Production

China is still the big player, no doubt about it. They’re consuming a huge chunk of the world’s energy – think about a quarter of the total. And they’re not just consuming; they’re also producing a lot, especially when it comes to renewables. They’ve been putting up solar and wind farms at a breakneck pace. This massive scale means China’s energy choices have a ripple effect across the entire globe. But even here, we’re seeing shifts. While they’ve been a huge driver for solar and wind capacity, policy incentives are being tweaked, which could slow down investment a bit in the short term. Still, their sheer size means they’ll continue to be a central force in global energy trends for the foreseeable future.

Divergent Renewable Energy Outlooks Across Regions

It’s fascinating to see how different parts of the world are embracing renewables. In some places, like parts of Asia and Africa, the growth in renewable capacity is expected to be quite strong, driven by rising demand and the need for more affordable energy. Other regions, however, might see a slower uptake. For instance, while the US is pushing for AI development, the build-out of new solar and wind generation capacity isn’t keeping pace with the demand surge. Europe is also navigating its own path, balancing energy security with its green transition goals. It’s a mixed bag, really.

Here’s a quick look at how renewable capacity might stack up:

- Asia: Continued strong growth, especially in solar and wind, driven by both large-scale projects and distributed generation.

- Europe: Steady expansion, with a focus on offshore wind and grid modernization, though policy shifts can impact investment.

- North America: Significant investment in renewables, but also a continued reliance on natural gas for new power generation to meet immediate demand.

- Africa & Latin America: Growing potential for renewables, particularly solar, as costs fall and energy access becomes a priority.

Energy Affordability Concerns and Policy Responses

Across the board, keeping energy affordable is a major headache. Geopolitical events and fluctuating commodity prices have put a strain on energy markets, making it harder for consumers and businesses to manage costs. This is leading governments to rethink their strategies. We’re seeing a push for diversification, not just in terms of energy sources but also in securing supply chains for critical minerals needed for batteries and renewable tech. Policy responses are varied: some countries are doubling down on domestic production, others are looking at international partnerships, and many are trying to strike a balance between energy security, environmental goals, and keeping the lights on without breaking the bank. It’s a complex puzzle with no easy answers.

Strategic Positioning for Future World Energy Needs

So, how do companies and countries get ready for what’s next in energy? It’s a bit like planning a big trip – you need to pack the right stuff and know where you’re going.

Balancing Capital Discipline with Resource Capture

Many energy companies have been told by investors to "tighten their belts" and not spend too much money, especially with oil prices being a bit shaky. This "capital discipline" has worked well for them. But here’s the catch: most oil and gas companies are going to see their production drop significantly over the next decade. So, they’re trying to do two things at once: keep spending wisely while also figuring out how to grab more resources. This means looking at new projects, exploring more, and sometimes even partnering up with national oil companies, especially in places like Venezuela which might become an option again. It’s a tricky balance, for sure.

Mergers and Acquisitions in the Energy Sector

Because of these pressures, companies are looking at buying or merging with others. For oil and gas, weak prices could actually make it a good time for some big, "transformational" deals. In the metals world, especially for copper, mergers are a big topic. Big mining companies want to add top-notch, low-cost mines to their portfolios. It’s less clear how they’ll get into the "critical minerals" game, though, as those are smaller markets. Governments are definitely interested in securing these critical minerals, so expect more talk about that.

Securing Supply Chains for Critical Minerals

This is a really big deal right now. Think about all the batteries, solar panels, and wind turbines we’re building. They all need specific minerals – things like lithium, cobalt, and rare earth elements. Getting enough of these is becoming a major focus. Countries and companies are trying to make sure they have reliable access to these materials, which often come from just a few places in the world. This means looking at new mining projects, but also thinking about recycling and finding alternative materials. It’s not just about digging them up; it’s about building a stable system to get them where they need to go, from start to finish.

Wrapping It Up: What’s Next for Energy in 2026?

So, looking ahead to 2026, it’s clear the energy world is still in a state of flux. We’re seeing growth, sure, especially in developing parts of Asia and Africa, but it’s not exactly setting the world on fire. Developed nations are kind of holding steady or even seeing demand drop a bit. Geopolitics continues to throw curveballs, making everyone rethink their energy game plans. While coal is finally starting to fade, and natural gas is picking up steam, especially in China, the real story is the continued rise of solar and wind power. It’s not a straight line, and there are definitely bumps in the road, like investment pauses and debates about AI’s impact, but the shift towards cleaner energy sources and smarter ways to use it is definitely underway. It’ll be interesting to see how all these pieces fit together as we move further into the year.