So, you’re looking to get a handle on market cap? It’s a pretty big deal when you’re trying to figure out what an investment is actually worth. Think of it like this: it’s not just about the price tag on a single item, but the total value of everything out there. This guide breaks down what market cap means, why it matters for your money, and how to use it without getting lost in all the numbers. We’ll cover everything from the big players to the smaller ones, and what makes these values change. Let’s get started.

Key Takeaways

- Market cap is simply the current price of an asset multiplied by how many are out there. It shows the total value.

- Don’t confuse a low price with a good deal; market cap gives a better picture of an asset’s actual size and value.

- Understanding market cap helps you figure out the risk and potential for growth in different investments.

- Assets are often grouped by market cap (large, mid, small), which tells you something about their stability and growth chances.

- Use market cap to build a balanced investment mix that fits how much risk you’re comfortable with.

Understanding Market Cap: The Foundation of Valuation

When you’re looking at any kind of investment, whether it’s stocks or digital coins, you’ll hear a lot about "market cap." It sounds fancy, but it’s really just a way to figure out how big something is in the market. Think of it like this: if you’re trying to understand how a company or a digital asset stacks up against others, market cap is your starting point. It gives you a basic idea of its overall value.

What Market Capitalization Represents

Market capitalization, or market cap for short, is basically the total worth of all the available units of an asset. For stocks, it’s the value of all outstanding shares. For cryptocurrencies, it’s the value of all the coins that are out there. It’s a snapshot of the asset’s size in the financial world. It doesn’t tell you everything, of course, but it’s a really common way to get a general sense of scale. A company with a huge market cap is generally seen as more established than one with a much smaller market cap.

The Simple Formula for Market Cap

Figuring out the market cap isn’t complicated. You just need two pieces of information: the current price of one unit of the asset and the total number of units that are currently available. The formula is pretty straightforward:

Market Cap = Current Price × Total Supply

Let’s say a digital coin is trading for $50, and there are 10 million of these coins in circulation. To find the market cap, you’d multiply $50 by 10 million, which gives you $500 million. That $500 million is the market cap. It’s a simple calculation, but it’s used everywhere to compare different assets.

Market Cap vs. Asset Price

It’s easy to get confused between the price of a single asset and its market cap. They’re related, but they’re not the same thing. The price is just what one unit costs right now. The market cap, on the other hand, takes that price and multiplies it by how many units exist. So, you could have an asset with a very high price per unit, but if there aren’t many units out there, its market cap might be lower than an asset with a lower price per unit but a massive supply. For example:

- Asset A: Price = $1,000 per unit, Total Supply = 1 million units. Market Cap = $1 billion.

- Asset B: Price = $10 per unit, Total Supply = 100 million units. Market Cap = $1 billion.

Even though Asset A’s price is 100 times higher than Asset B’s, they have the same market cap because Asset B has a much larger supply. This difference is important because it tells you about the overall value and scale of the asset in the market, not just the cost of a single piece.

Why Market Cap Is Crucial for Investors

So, why should you even bother with market cap? It’s more than just a number; it’s a tool that helps you get a grip on what you’re investing in. Think of it like this: you wouldn’t walk into a new city without a map, right? Market cap is kind of like that map for the investment world.

Assessing an Asset’s Size and Stability

First off, market cap gives you a sense of how big an asset is. A company or a cryptocurrency with a huge market cap is generally seen as more established. It’s been around, it has a lot of its shares or coins out there, and people have put a lot of money into it. This usually means it’s less likely to just disappear overnight. Larger market cap assets tend to be more stable, like a big, old tree that can withstand a bit of wind. Smaller ones, well, they might be more like saplings – they could grow a lot, but they’re also more fragile.

Gauging Risk and Growth Potential

This ties right into the last point. If you’re looking for something that’s likely to grow really fast, you might look at smaller market cap assets. They have more room to increase in value, percentage-wise. But, and this is a big ‘but,’ they also come with more risk. That sapling could become a giant oak, or it could wither. Bigger, established assets might not double or triple in value quickly, but they’re generally a safer bet. It’s a trade-off, and market cap helps you see that.

Here’s a quick way to think about it:

- Large-Cap: Think of these as the big players. They’re usually pretty stable, less risky, but might not offer explosive growth. They’re like the reliable, steady earners.

- Mid-Cap: These are in the middle. They’ve got some stability but still have decent potential to grow. A good balance for many investors.

- Small-Cap: These are the riskier ones with the potential for big gains. They require more attention and can be quite volatile.

Understanding Market Position and Liquidity

Market cap also tells you where an asset stands compared to others. If you see a cryptocurrency with a market cap of, say, $500 billion, you know it’s a major player. If another has a market cap of $50 million, it’s a tiny fish in a big pond. This helps you understand its influence and how easily you can buy or sell it. Assets with higher market caps are usually easier to trade because there are more buyers and sellers around. This is called liquidity. If you need to sell a lot of a small-cap asset quickly, you might have trouble finding buyers without driving the price down. For big-cap assets, selling a lot is usually not a problem.

Categorizing Assets by Market Cap Size

So, you’ve got this idea of market cap, right? It’s basically the total value of all the shares or coins out there for a particular asset. But not all market caps are created equal. We tend to group them into different sizes, and this helps us get a feel for what we’re dealing with. It’s like sorting things into small, medium, and large piles – makes it easier to understand.

The Characteristics of Large-Cap Assets

These are the big players, the household names. Think of the companies or cryptocurrencies that have been around for a while and have a massive market cap, usually over $10 billion. Because they’re so established, they tend to be more stable. They’re not usually going to double in value overnight, but they’re also less likely to completely tank. They’re generally seen as lower risk, and because so many people trade them, they’re easy to buy and sell without messing up the price too much. They’re the reliable ones in your portfolio, the ones you can count on to be there.

Navigating Mid-Cap Opportunities

Then you have the mid-caps, typically sitting between $1 billion and $10 billion in market cap. These guys are kind of in the middle. They’re not as small and wild as the tiny ones, but they’re not as slow-moving as the giants either. Mid-caps often offer a good balance between stability and the chance for decent growth. They’ve proven they can hang around, but they still have room to expand. For investors looking for something a bit more exciting than a large-cap but less risky than a small-cap, mid-caps can be a sweet spot. They might not grab headlines like the small ones, but they can provide steady gains.

Exploring the Potential of Small-Cap Assets

Finally, we get to the small-caps. These are the assets with a market cap under $1 billion. This is where things can get really interesting, but also a bit scary. Small-caps are often newer or less established. They have the potential for huge growth – like, really huge. If you find the next big thing early on, your investment could multiply many times over. But, and this is a big ‘but’, they also come with a lot more risk. They can be super volatile, and there’s a higher chance they might not make it. So, while the upside can be amazing, you have to be prepared for the downside too. It’s a high-risk, high-reward situation, and you need to do your homework before jumping in.

Factors Influencing Market Cap Fluctuations

So, what makes a company’s or crypto’s market cap go up and down? It’s not just one thing, but a mix of factors that can really shake things up. Think of it like a weather report – sometimes it’s sunny, sometimes there’s a storm, and the market cap reflects that.

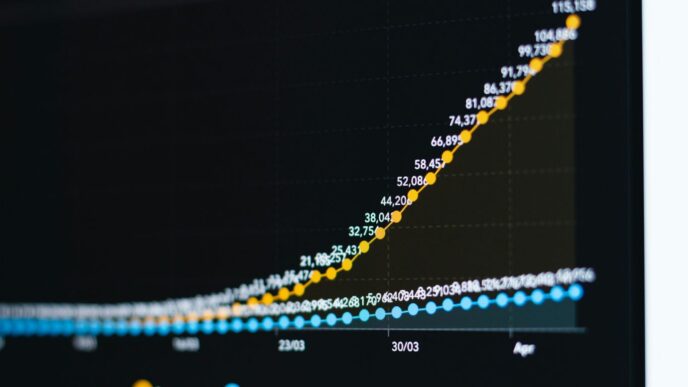

The Impact of Price Volatility

This is probably the most obvious one. If the price of a stock or a digital coin suddenly jumps, the market cap follows right along. Conversely, if the price takes a nosedive, the market cap shrinks. It’s a direct relationship because, remember, market cap is just the price multiplied by the number of shares or coins out there. So, a big price swing means a big market cap swing. It’s like watching a balloon inflate or deflate – the price is the air, and the market cap is the balloon’s size.

Changes in Circulating Supply

Beyond just the price, the actual number of shares or coins available can also change the market cap. If a company decides to issue more stock, or if a cryptocurrency has new coins created (minted), the total supply goes up. This can lower the market cap even if the price stays the same. The opposite happens if shares are bought back or coins are destroyed (burned) – the supply goes down, and the market cap can increase. It’s important to keep an eye on how many coins or shares are actually floating around.

The Role of Public Perception and News

This is where things get a bit more psychological. Big news, good or bad, can really sway how people feel about an asset. Positive announcements, like a new product launch or a successful partnership, can make investors excited, driving up demand and, therefore, the price and market cap. On the flip side, negative news, like a regulatory crackdown, a security breach, or even just a bad earnings report, can cause panic. People might rush to sell, pushing the price down and shrinking the market cap. It shows how much sentiment matters in the market.

Integrating Market Cap into Your Investment Strategy

So, you’ve got a handle on what market cap is and why it matters. Now, how do you actually use this info to build a better investment plan? It’s not just about knowing the numbers; it’s about putting them to work for you. Think of market cap as a tool that helps you shape your portfolio and manage your money smarter.

Diversifying Across Market Cap Segments

Putting all your eggs in one basket is rarely a good idea, and that applies to market cap too. A portfolio that’s spread across different sizes of companies or assets can be a lot more resilient. It’s like having different types of tools in your toolbox – you need a variety for different jobs.

- Large-Cap Assets: These are your big, established players. They tend to be more stable, like a sturdy old oak tree. They might not shoot up in value overnight, but they’re less likely to fall over in a strong wind. Think of them as the reliable backbone of your portfolio.

- Mid-Cap Opportunities: These are the companies in the middle. They’ve got some size and stability but still have room to grow. They can offer a nice balance between the safety of large caps and the growth potential of smaller ones. They’re like the young, strong trees that are growing steadily.

- Small-Cap Assets: These are the up-and-comers. They can be a bit more unpredictable, like a sapling. They might grow really fast and offer big rewards, but they also come with more risk. If you’re looking for that high-growth potential, small caps might be part of your plan, but you need to be ready for the bumps.

Aligning Investments with Risk Tolerance

This is a big one. How much risk are you comfortable taking? Your market cap choices should line up with that. If you tend to worry about losing money, sticking mostly to large caps makes sense. They’re generally seen as safer bets. If you’re okay with a bit more ups and downs for the chance of bigger gains, then mixing in some mid-caps or even a small allocation to small caps could work. It’s about finding that sweet spot where you feel comfortable with the potential ups and downs.

Considering Market Cycles and Cap Performance

Markets aren’t always the same. Sometimes things are booming (bull markets), and sometimes they’re not doing so great (bear markets). Different market cap sizes tend to act differently during these times. For instance, during a strong bull market, you might see smaller companies really take off. But when the market gets shaky, those big, established companies often hold their value better. Understanding these patterns can help you adjust your strategy. It’s not about predicting the future perfectly, but about being aware of how different parts of the market tend to behave under different conditions. This awareness helps you make more informed decisions about where to put your money and when.

Distinguishing Market Cap from Related Metrics

Market Cap vs. Fully Diluted Market Cap

When you’re looking at an asset’s market cap, you’re usually seeing the value based on the coins or shares currently available. But there’s another number to consider: the fully diluted market cap. Think of it like this: the regular market cap is what the asset is worth right now, with what’s out there. The fully diluted market cap is what it could be worth if all possible coins or shares were in play.

This difference matters because some assets have a lot of coins or shares that aren’t circulating yet. These might be held by the founders, locked up for a certain time, or set aside for future rewards. The fully diluted market cap gives you a bigger picture of the asset’s total potential value. It’s a way to see the ceiling, not just the current floor.

Here’s a quick breakdown:

- Market Cap: Current Price × Circulating Supply

- Fully Diluted Market Cap: Current Price × Total Supply (including all potential coins/shares)

So, if you see an asset with a $1 billion market cap but a $5 billion fully diluted market cap, it means there’s a lot more supply that could come onto the market later. This can affect future prices.

Market Cap and Enterprise Value

Market cap is a good starting point, but it doesn’t tell the whole story, especially for companies. That’s where enterprise value (EV) comes in. While market cap just looks at the value of the company’s stock (or coins), EV digs a bit deeper.

EV tries to figure out the total cost to buy the entire company. It takes the market cap and then adds the company’s debt, because if you buy the company, you’re also taking on its debts. On the other hand, it subtracts any cash the company has on hand, because you can use that cash to pay off some of the debt or just keep it. Basically, EV is a more complete way to value a company, especially when comparing companies with different levels of debt or cash.

- Market Cap: Focuses on equity value.

- Enterprise Value: Considers debt and cash, giving a more holistic view of a company’s total worth and takeover cost.

For crypto, market cap is usually the main number people look at. But for stocks, understanding EV alongside market cap can give you a clearer picture of a company’s financial health and true valuation.

Common Misconceptions About Market Cap

It’s easy to get tripped up when you’re first learning about market capitalization. People often see a low price and think it’s a bargain, or a high market cap and assume it’s automatically a safe bet. Let’s clear up some of the common misunderstandings so you can use market cap more effectively.

Price Alone Does Not Indicate Value

This is a big one. Just because an asset’s price per unit is low doesn’t mean it’s cheap or a better deal. Think about it: if a company has a million shares outstanding and each share costs $1, its market cap is $1 million. Now, imagine another company has only 100 shares outstanding, but each share costs $10,000. That company also has a $1 million market cap. The price per share tells you very little on its own. You need to look at the total market cap to get a real sense of an asset’s overall size and valuation. A $0.01 coin with a $10 billion market cap is actually much larger and potentially more

Wrapping It Up

So, we’ve gone over what market cap is and why it’s a pretty big deal for anyone putting their money into things like stocks or crypto. It’s not just some random number; it actually tells you a lot about how big and stable an investment might be. Think of it as a way to get a feel for the size of the company or coin you’re looking at, which can help you figure out if it’s too risky for you or if it might have some room to grow. Just remember, market cap is only one piece of the puzzle. You still need to do your homework on other stuff too, like what the project is actually doing or how the market is behaving overall. Don’t just pick something because its market cap looks good. Always do your own digging and never put in money you can’t afford to lose. Happy investing!

Frequently Asked Questions

What exactly is market cap?

Market cap, or market capitalization, is like the total price tag for a digital coin or company. You figure it out by multiplying the price of one coin or share by the total number of coins or shares that are out there. It gives you a big picture of how much something is worth overall.

Why is market cap so important for investors?

Market cap helps you understand how big and stable an investment is. Big market caps usually mean more stable investments with less risk, while smaller ones might offer bigger growth but come with more risk. It’s a key way to compare different investments.

How does market cap help me understand risk?

Think of it this way: larger companies or coins with huge market caps are generally more established, like a big, well-known store. Smaller ones with tiny market caps are more like a new shop that could become huge, or it might not. So, bigger market cap often means less risk, and smaller market cap means more risk but potentially more reward.

What’s the difference between market cap and just the price of a coin?

The price is just what one coin costs right now. Market cap is the price of one coin multiplied by ALL the coins available. So, a coin might seem cheap because its price is low, but if there are tons of them, its market cap could be huge, meaning it’s actually a big investment.

Are there different sizes of market caps?

Yes, investors often group things by size. You have ‘large-cap’ (big companies/coins), ‘mid-cap’ (medium-sized), and ‘small-cap’ (smaller ones). Each group has different levels of risk and potential for growth. Large caps are usually safer, while small caps can grow faster but are riskier.

Can market cap change a lot?

Absolutely! Market cap can swing quite a bit. If the price of a coin goes up or down a lot, or if the number of coins available changes, the market cap will change too. Big news or public feelings about an investment can also make its market cap jump or drop.