Trying to figure out exactly how many GPUs Nvidia sells can feel like a puzzle. They make a ton of different chips for all sorts of things, from supercomputers to gaming rigs. It’s not like they just put a number on a billboard. We’re going to break down where their money comes from and what that might mean for the actual number of chips moving out the door. It’s a big company with a lot of moving parts, and understanding their sales involves looking at more than just one number. So, how many GPUs does Nvidia sell? Let’s get into it.

Key Takeaways

- Nvidia’s data center revenue is huge, often making up the bulk of their sales, especially with AI chips like Blackwell being in high demand.

- While gaming GPUs are important, they don’t bring in as much money as the data center side, and sometimes sales can dip a bit quarter-to-quarter.

- Estimating exact GPU unit sales is tough because Nvidia doesn’t release those specific numbers. We have to look at revenue and make educated guesses.

- Factors like the rise of AI, networking equipment sales, and competition all play a role in how many chips Nvidia moves.

- Nvidia is constantly releasing new chip architectures, like Blackwell and Rubin, and building software to keep customers tied to their products, which helps drive future sales.

Understanding Nvidia’s GPU Sales Landscape

When we talk about Nvidia’s sales, it’s easy to just think about the shiny new graphics cards gamers want, but that’s only part of the story. The company’s revenue streams are actually pretty diverse, with some segments doing way better than others.

Data Center Revenue Dominance

This is where the real money is for Nvidia these days. The data center business has been absolutely booming, largely thanks to the massive demand for AI chips. We’re talking billions of dollars here, with sales figures that keep climbing quarter after quarter. It’s not just about the GPUs themselves; networking equipment sold into these data centers also makes up a significant chunk of the revenue. Nvidia’s data center segment is the undisputed heavyweight champion of its sales.

Gaming GPU Market Performance

The gaming side of things, which is what most people probably associate Nvidia with, is still important, but it’s not the main growth engine it once was. While sales can be strong, especially around new product launches or the holiday season, this segment has seen some ups and downs. It seems like the market for gaming GPUs might be reaching a plateau, with sales figures sometimes slipping quarter-over-quarter even when year-over-year numbers look okay. It’s still a huge business, but it’s not the primary driver of Nvidia’s record-breaking financial results anymore.

Professional Visualization and Automotive Segments

Beyond gaming and data centers, Nvidia also has strong showings in professional visualization and the automotive sector. The professional visualization market, which includes powerful workstations for things like design and creative work, has been setting new records. On the automotive front, sales are climbing steadily, driven by the adoption of Nvidia’s platforms for self-driving technology and in-vehicle systems. These segments might be smaller compared to data centers, but they are growing and add to Nvidia’s overall sales picture.

Key Financial Metrics Driving GPU Demand

When we look at Nvidia’s sales, it’s not just about counting chips. We really need to see how the money is flowing and what’s making customers open their wallets. Several financial indicators give us a good picture of what’s happening.

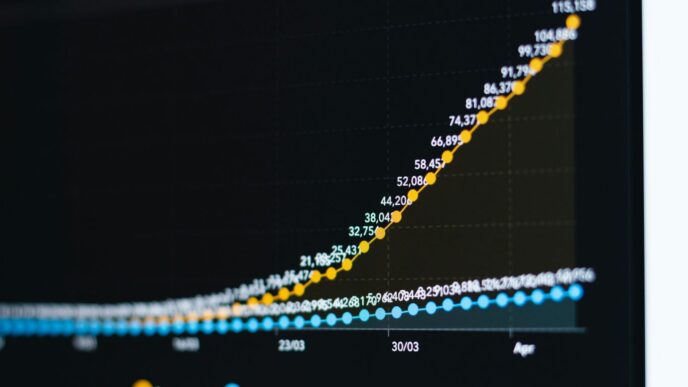

Quarterly Revenue Growth Trends

Nvidia’s revenue has been on a serious climb. For instance, in the third quarter of fiscal year 2026, their total revenue hit a massive $57 billion. That’s a 62% jump from the same time last year and a 22% increase from the previous quarter. This kind of consistent growth shows that demand for their products, especially those powering AI, is really strong. They’re even predicting revenue to reach $65 billion in the next quarter. It’s pretty wild to think about.

Net Income and Profitability Analysis

Beyond just sales, how much profit is Nvidia actually making? In Q3 FY2026, their net income was around $31.9 billion, a 65% increase year-over-year. Their gross margin, which is basically the profit before other expenses, was about 73.4%. While this was slightly down from the previous year, it’s still incredibly high. This high profitability suggests they have a lot of pricing power and that their products are in high demand.

Operating Income by Segment

Nvidia breaks down its business into different parts, and looking at the operating income for each tells us where the real money is being made. The Data Center segment is the clear winner here, bringing in $35.6 billion in Q4 FY2025 alone, a huge 93% increase year-over-year. This segment includes their AI accelerators and networking gear. The Gaming segment, while still significant, saw a dip in Q4 FY2025, down 11% year-over-year to $2.5 billion. Professional Visualization and Automotive segments are also growing, but they’re much smaller compared to the data center’s massive contribution. It’s clear that AI accelerators are the main engine driving Nvidia’s financial success right now.

Here’s a quick look at the revenue by market for Q4 FY2025:

| Market | Q4 FY2025 Revenue | Year-over-Year Change |

|---|---|---|

| Data Center | $35.6 billion | 93% |

| Gaming | $2.5 billion | -11% |

| Professional Visualization | $511 million | 10% |

| Automotive | $570 million | 103% |

Factors Influencing Nvidia’s GPU Sales

So, what’s really driving the demand for Nvidia’s graphics processing units? It’s not just one thing, but a mix of powerful forces.

AI Accelerators as Primary Revenue Driver

Let’s be real, Artificial Intelligence is the big kahuna right now. Nvidia’s data center business is absolutely booming, raking in billions. This isn’t just about selling a few chips; it’s about providing the horsepower for massive AI training and inference tasks. Think about all the AI models being developed – they need serious computing power, and Nvidia’s GPUs are the go-to for that. The demand for AI accelerators is so high that many of their data center GPUs are reportedly sold out. This surge is fueled by everything from cloud hyperscalers to enterprise AI projects and even national AI initiatives. It’s a virtuous cycle, as Jensen Huang, Nvidia’s CEO, put it – more AI development means more demand for their chips, which in turn allows them to invest more in future tech.

Impact of Networking Equipment Sales

It might seem a bit odd to talk about networking when we’re focused on GPUs, but it’s actually a pretty big deal for Nvidia’s overall sales. As AI workloads get bigger and more complex, the need for high-speed networking within data centers grows exponentially. Customers aren’t just buying individual AI servers anymore; they’re moving towards rack-scale solutions. This means they need more sophisticated networking hardware to connect all those powerful GPUs and processors efficiently. Nvidia has seen its networking revenue skyrocket, which goes hand-in-hand with their data center GPU sales. It’s all part of building out these massive, interconnected AI supercomputers. You can see how this ties into their overall strategy for data center hardware sales.

Fluctuations in Market Share

While Nvidia is currently sitting pretty at the top, especially in the AI chip market, things are never static. The chip industry is super competitive, and market share can shift. Nvidia holds a really dominant position, with some estimates putting their share of AI chips for training and deployment between 70% and 95%. That’s a huge chunk! However, they’re not the only player. Companies like Intel and AMD are always working on their own solutions, and big cloud providers are also designing their own AI computing functionality. Plus, there’s the constant technological change and evolving industry standards that Nvidia has to keep up with. They’re committed to releasing new AI chip architectures annually and developing software to keep their ecosystem strong, but staying ahead requires constant innovation and attention to what the competition is doing.

Estimating Nvidia’s GPU Unit Sales

So, how many of these powerful Nvidia GPUs actually make it into the hands of customers? It’s not as straightforward as just looking at their sales reports. There are a few tricky bits that make getting an exact number a bit of a puzzle.

Challenges in Tracking Decommissioned Hardware

One of the main headaches is keeping track of older hardware. When a data center upgrades, their old GPUs get taken offline. It’s way easier to spot new clusters popping up than it is to know exactly when older ones shut down. This means there’s a chance some hardware might get counted more than once, especially when chips from the secondary market find their way into new setups. While Nvidia’s overall computing power is growing super fast, around 2.3 times each year, this aging hardware does stick around for a while, making the tail end of older GPU generations seem longer than they really are.

Assumptions on GPU Lifespan and Depreciation

To get a handle on things, analysts often make educated guesses. For instance, they might assume a GPU hangs out in a data center for about three years before it’s sold off. They also figure that GPU prices drop pretty significantly each year, maybe by 30%. This kind of aligns with what people see with high-end cards like the A100s and H100s, which can go for about half their original price a couple of years after launch. Even if these depreciation rates change a bit, say from 10% to 40%, the overall growth trend for computing power stays pretty consistent.

Impact of Secondary Market Chips

Then there’s the whole secondary market. When older GPUs are sold off, they can end up in new systems. This makes it tough to get a clean count of new units sold. However, the sheer volume of new hardware being deployed means that the contribution from these used chips, while present, is likely a smaller piece of the overall pie. It’s estimated that the impact of second-hand sales might be less than a twelfth of the total computing power at any given time. This is why understanding Nvidia’s market share, which is around 92% of the discrete GPU market, is so important [1499].

Here’s a simplified look at how some of these factors are considered:

- Tracking New Installations: Monitoring when new GPUs are put into operation each month.

- Estimating Spend: Multiplying the number of new GPUs by their estimated price, factoring in yearly depreciation.

- Accounting for Delays: Adjusting for the time lag between when a GPU is shipped and when it’s actually up and running.

- Scaling for Missing Data: Using Nvidia’s total data center revenue to estimate the portion not captured in known datasets, assuming missing clusters follow similar GPU distribution patterns.

Nvidia’s Product Platforms and Future Outlook

When we talk about Nvidia’s sales, it’s really about their next-generation hardware and how they keep customers locked in with their software. They’re not just selling chips; they’re selling a whole ecosystem.

Blackwell and Rubin Platform Sales

Nvidia has been making waves with its new chip architectures. The Blackwell platform, for instance, has already started bringing in billions in sales, according to CEO Jensen Huang. This isn’t just about raw power; it’s about efficiency too. Blackwell is touted as being significantly more efficient than previous generations, which is a big deal when you’re talking about massive data centers running AI models 24/7. They’re also talking about the upcoming Rubin platform, which shows they’re always planning ahead. This constant refresh cycle is key to their business model.

Annual AI Chip Architecture Releases

It seems like Nvidia aims to roll out a new major AI chip architecture pretty much every year. This rapid pace means they’re always pushing the boundaries of what’s possible in AI computing. Think about it: one year it’s Hopper, the next it’s Blackwell, and then Rubin is on the horizon. This strategy keeps competitors scrambling to catch up and ensures that Nvidia’s customers are always getting the latest and greatest. It’s a bit like how smartphone companies release new models annually, but with much higher stakes and complexity.

Entrenching Chips with Software Ecosystems

Selling hardware is only half the battle. Nvidia is really good at making sure their chips work best with their own software. Platforms like CUDA, which is their parallel computing architecture, are deeply integrated into many AI development workflows. This makes it harder for customers to switch to a competitor, even if they offer a cheaper or slightly better piece of hardware. They also have things like NVIDIA AI Enterprise, which is a software suite designed to help businesses deploy AI. It’s this combination of powerful hardware and sticky software that really solidifies their market position.

Competitive Environment and Market Position

It’s no secret that Nvidia operates in a super competitive space. The chip market is always changing, with new standards popping up and tech moving at a fast pace. For Nvidia, staying ahead means not just making great hardware, but also keeping up with all the industry shifts. They’ve got a lot of rivals out there, from big tech companies designing their own chips to other hardware makers.

Intense Competition in the Chip Market

The landscape is pretty crowded. Nvidia faces competition on several fronts. You have companies like Intel and AMD, who have been in the game for a long time, making processors and graphics cards. Then there are newer players, especially those focused on AI, who are pushing the boundaries with their own designs. Success in this market really comes down to a mix of performance, what products you offer, and how well you can reach your customers and partners. It’s a constant race to innovate and keep costs down.

Key Competitors in AI Computing

When we talk about AI, the competition gets even more interesting. Big cloud providers like Google, Amazon, and Microsoft aren’t just customers; they’re also designing their own AI chips. They want to control more of their hardware stack, which is a direct challenge to Nvidia’s dominance. Companies like Alibaba and even Huawei are also players in this arena, developing their own solutions for AI workloads. It’s a dynamic situation where partnerships and internal development are key.

Nvidia’s Market Share in AI Chips

Nvidia has held a really strong position in the AI chip market for a while now. Their GPUs are the go-to for many AI training and inference tasks. However, this doesn’t mean they’re coasting. The demand for AI accelerators is huge, and that attracts a lot of attention. While Nvidia’s data center revenue has been through the roof, driven largely by these AI chips, other companies are investing heavily to catch up. It’s a market that’s still growing, and while Nvidia has a big piece of the pie, the competition is definitely working to chip away at it. For instance, major tech players like Alphabet and Amazon are actively working to challenge this dominance in the data center chip market.

So, How Many GPUs Does Nvidia Actually Sell?

After looking at all the numbers, it’s clear that Nvidia is selling a massive amount of GPUs, especially for data centers. While exact unit counts are hard to pin down, the revenue figures tell a big story. They’re consistently breaking sales records, with their data center business, powered by AI chips, leading the charge. Even though the gaming side has its ups and downs, the demand for their AI hardware seems unstoppable right now. It looks like Nvidia is in a really strong position, and they don’t seem to be slowing down anytime soon.

Frequently Asked Questions

What is Nvidia’s main source of income from its computer chips?

Nvidia makes most of its money from selling chips for data centers. These chips are super powerful and are used for things like artificial intelligence (AI). While they also sell chips for gaming and other uses, the data center business brings in the most cash.

How does Nvidia’s gaming chip sales compare to its data center sales?

Nvidia’s sales from gaming chips are much smaller than those from its data center chips. Even though gaming chips are popular, the demand for the powerful chips used in data centers, especially for AI, is so high that it brings in way more money.

Why are Nvidia’s data center chips so important?

Data center chips are crucial because they power the complex calculations needed for AI. Companies use them to train AI models, which are like digital brains that can learn and perform tasks. This demand for AI is growing incredibly fast, making these chips Nvidia’s biggest moneymaker.

Does Nvidia sell a lot of different types of computer chips?

Yes, Nvidia sells chips for several different uses. They have powerful chips for data centers (especially for AI), chips for gamers (like the GeForce cards), chips for professional designers and engineers, and chips for cars. Each type serves a different market.

Is it easy to know exactly how many chips Nvidia sells?

It’s actually pretty tricky to know the exact number of chips sold. Nvidia doesn’t release those specific numbers. Plus, it’s hard to track chips that get resold or used in older systems. So, experts have to make educated guesses based on the money Nvidia makes from selling them.

What is Nvidia doing to stay ahead in the chip market?

Nvidia is working hard to stay on top. They plan to release new and improved AI chips every year, which is faster than before. They also focus on creating software that works really well with their chips, making it harder for customers to switch to other companies’ products.