Trying to figure out what’s going to happen with energy prices in 2026 can feel like a guessing game. Things have been pretty wild lately with fuel costs bouncing around and electricity bills doing their own thing. Now, with some policy shifts happening and the way we use energy changing, it’s worth taking a look at what experts are predicting. This isn’t about predicting the future perfectly, but more about understanding the forces that will likely shape the forecast for energy prices.

Key Takeaways

- Natural gas will continue to be a major player in setting electricity prices.

- Demand for electricity is going up, partly because of things like electric cars and new tech like AI.

- Renewable energy sources will still be around, but they won’t be growing as fast as before, meaning they’ll have less of an impact on lowering prices.

- Global events and supply chain issues will still cause price swings.

- Costs for maintaining and upgrading the energy grid are going up, which means higher bills for everyone.

Navigating the 2026 Forecast Energy Prices Landscape

Okay, so looking ahead to 2026, things in the energy market are shaping up to be a bit of a mixed bag. After the wild ride of the early 2020s with prices jumping all over the place, we might see some calmer waters. A big reason for this is a shift in how things are being handled policy-wise, with a renewed focus on producing more energy right here at home. But, and this is a pretty big ‘but,’ we’re still connected to what’s happening globally. So, while it might not be as chaotic as before, don’t expect things to be perfectly smooth sailing either.

Shifting Policy Priorities and Market Fundamentals

It feels like just yesterday that the big push was all about renewables and cutting down on fossil fuels. Now, the tune has changed. The current direction is leaning more towards boosting the production of natural gas, oil, and even coal. This means more drilling, more pipelines, and generally less red tape for traditional energy sources. While this could help stabilize prices by increasing supply, it also means we’re still pretty dependent on these fuels for a while.

- Increased domestic production of fossil fuels.

- Renewables are still part of the picture, but not the main driver of policy.

- Global events will continue to influence U.S. prices.

The Big Picture: Policy Shifts and Market Fundamentals

So, what does this all boil down to for 2026? We’re looking at a market that’s more reliant on traditional energy sources than it has been in recent years. Think of it like this: the foundation of our energy system is being reinforced with fossil fuels, which will play a bigger role in keeping the lights on and influencing the cost of electricity. This doesn’t mean renewables are out, but their growth might slow down, and they won’t be the primary force shaping energy policy or investment decisions like they were before. The energy landscape in 2026 is set to be more fossil-fuel-oriented.

Key Drivers Influencing 2026 Energy Prices

So, what’s really going to move the needle on energy prices in 2026? It’s not just one thing, but a mix of policy changes and how the markets are actually working.

A Renewed Focus on Fossil Fuels

Things are shifting back towards traditional energy sources like natural gas, oil, and coal. The government is pushing for more domestic production and easing up on some regulations. This means more of these fuels will be available for power plants, which can help keep prices from going through the roof. It also affects how much we spend on energy overall and how pipelines and other infrastructure get built.

- More domestic drilling and production.

- Less strict rules for fossil fuel companies.

- Traditional fuels will play a bigger part in keeping the lights on.

Electrification and Load Growth

Even with the focus on fossil fuels, more and more things are running on electricity. Think electric cars, electric heating in buildings, and all the data centers powering AI. This "electrification" means we’re going to use more electricity overall. While efficiency improvements help, the total demand is still going up. This increased demand, especially during peak times, puts pressure on the grid and can lead to higher prices.

Energy Efficiency Gains

On the flip side, we’re getting better at using energy. New heating and cooling systems are more efficient, and businesses are using smarter controls. These improvements help reduce how much energy we need, which can ease some of the strain on the power grid. It’s like having a car that gets better gas mileage – you still drive, but you use less fuel. The net effect is that while total energy use might climb, we’re getting more bang for our buck per unit of energy consumed.

Natural Gas Outlook and Its Impact on Electricity

Market Fundamentals and Supply Dynamics

Natural gas is still the workhorse for electricity generation in the U.S., and that’s not changing much in 2026. We’re seeing policies that encourage more drilling and production, which could mean more gas available domestically. But it’s not that simple. Demand for Liquefied Natural Gas (LNG) is high overseas, especially in Asia and Europe. Plus, extreme weather can cause demand to spike here at home, and sometimes, the pipelines and infrastructure just can’t keep up. All these things mean natural gas prices will likely keep bouncing around.

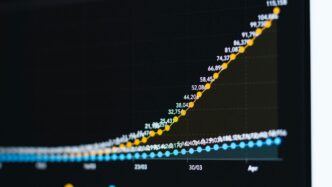

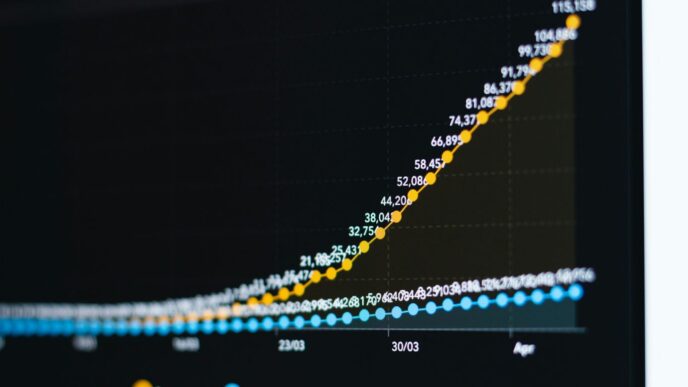

Here’s a quick look at some key figures:

| Year | Natural Gas Spot Price (per MMBtu) | U.S. LNG Exports (Bcf/d) |

|---|---|---|

| 2025 | $3.53 | 15.0 |

| 2026 | $3.46 | 16.4 |

| 2027 | $4.59 | 18.1 |

Even with more domestic supply, the global race for LNG cargoes puts steady upward pressure on average prices.

Gas as the Marginal Fuel for Power Pricing

Because natural gas power plants are often the ones setting the price for electricity in real-time, any changes in gas prices directly affect what we pay for power. When gas prices go up, electricity prices tend to follow.

In 2026, expect:

- Wholesale electricity prices to stay closely linked to how natural gas markets are doing.

- Big swings in prices during peak demand times, like hot summer days or cold winter mornings.

- Natural gas to remain a key player for keeping the lights on when renewable sources aren’t producing enough.

Global Demand and LNG Export Pressures

International demand for natural gas, particularly from Europe and Asia, is a major factor influencing U.S. prices. As more U.S. gas is shipped overseas as LNG, it tightens the domestic supply. This global competition means that even if we have plenty of gas here, international buyers can drive up the price we pay. Geopolitical events and the sheer logistics of shipping LNG also add layers of complexity and potential price shocks. The global appetite for LNG is a significant force shaping domestic energy costs.

Electricity Price Forecast for 2026

So, what’s the deal with electricity prices in 2026? It’s not going to be a wild ride like some years we’ve seen, but it’s definitely not going to be calm either. Think of it as a steady, moderate climb.

Retail Tariffs and End-User Costs

Utilities are facing higher costs these days. They’re spending more on upgrading the grid, getting fuel, and just general operations. All of that means we’ll likely see a bit of an increase in what we pay for electricity. A few things are pushing this up:

- More demand: Electric cars are becoming more common, and businesses are using more power, especially with all the new computing and AI stuff. That all adds up.

- Inflation: The cost of equipment and hiring people has gone up.

- Old infrastructure: Some of our power lines and equipment are getting old and need replacing, which costs money.

Overall, expect your monthly electricity bill to tick up a bit in 2026.

Wholesale Market Behavior and Volatility

At the wholesale level, where power is bought and sold in large amounts, things are going to be interesting. Because natural gas is still the main fuel for a lot of power plants, its price really dictates the electricity price. If gas prices go up, so does electricity.

Here’s what we’re looking at:

- Higher peak prices: When demand is highest, especially during hot or cold weather, prices will likely jump more than usual because of limited supply and our reliance on gas.

- Gas is king: Natural gas plants will continue to set the price for electricity in most markets. So, any bumps in gas prices will directly hit wholesale electricity costs.

- Regional differences: Prices will still vary a lot depending on where you are. Areas with cheap local gas will probably see lower prices than places that have to import fuel.

The Evolving Role of Renewable Energy

Renewables like solar and wind are still part of the picture, but they aren’t the main story anymore. The push for new, large-scale solar and wind farms has slowed down. Instead, money and effort are shifting more towards traditional power sources, natural gas infrastructure, and oil. Renewables will still generate power, but their growth won’t be as fast as it was a few years ago. This means they won’t be pushing electricity prices down as much as they used to. It’s a bit of a mixed bag: less variability in the system, but also less chance of dramatic cost drops from renewables.

Global Market Influences and Supply Chain Risks

Okay, so trying to figure out energy prices in 2026 isn’t just about what’s happening here at home. There’s a whole lot going on globally that can really shake things up. Think of it like this: even if we’re doing our best to manage things locally, a big storm halfway across the world can still affect our backyard.

Supply Chain and Global Market Risk

This is a big one. We’ve seen how easily things can get disrupted. Right now, there’s still a lot of uncertainty in places like the Middle East, which can mess with oil supplies. Plus, everyone’s trying to get their hands on liquefied natural gas (LNG), and that competition can drive prices up for everyone. Add in the general headaches of getting goods and materials where they need to go, and you’ve got a recipe for price swings. These global pressures mean that even with more domestic production, we’re likely to see continued ups and downs in energy costs.

Geopolitical Tensions and Fuel Market Fluctuations

When we talk about "geopolitics," it basically means how countries get along (or don’t get along) and how that impacts things like oil and gas. Decisions made by groups like OPEC, or conflicts in key regions, can directly affect how much fuel is available and, consequently, how much it costs. For natural gas, the global demand for LNG, especially from places like Asia and Europe, means that U.S. producers are often looking to export, which can tighten up domestic supply and push prices higher. It’s a constant balancing act.

Shipping and Infrastructure Constraints

Even if we have plenty of fuel, getting it to where it needs to go is another challenge. Think about the ships that carry LNG across oceans or the pipelines that move natural gas across the country. If there aren’t enough ships, or if ports are backed up, or if pipelines are old and need repairs, it can create bottlenecks. These kinds of infrastructure issues can slow things down and add to the overall cost of energy. It’s not just about drilling or generating power; it’s about the whole journey the fuel takes.

Implications for Businesses and Households

So, what does all this energy price talk actually mean for your wallet, whether you’re running a business or just trying to keep the lights on at home? It’s not exactly simple, but let’s break it down.

Budgeting for Higher Power Prices

Look, nobody likes paying more for anything, and energy is no exception. For businesses, this means taking a closer look at your operating costs. You might see your electricity bills creeping up, especially if your operations are energy-intensive. Think about it: more electric vehicles on the road, more data centers humming away, and even just the general need to keep things running smoothly all add to the demand. This increased demand, coupled with the ongoing influence of natural gas prices, means you’ll likely need to set aside a bit more cash for your energy expenses in 2026. It’s not a huge jump, but it’s definitely something to plan for.

For households, the impact might feel a bit more direct. While the days of extreme price swings might be behind us for now, expect a modest increase in your monthly electricity bills. This isn’t just about the wholesale market, either. The costs associated with maintaining and upgrading our energy grids are also being factored in, so those charges are going up too. It’s like paying for road repairs – necessary, but it adds to the overall cost.

Strategies for Consumers and Businesses

Okay, so prices might go up a bit. What can you actually do about it? Well, there are a few smart moves.

- For Businesses: If you’re a company, locking in prices for a longer period could be a good idea. Think about signing contracts for 24 to 36 months. This way, you know exactly what you’ll pay, even if the market gets a bit jumpy. Also, keeping an eye on energy market news, like reports from the EIA or global fuel updates, can help you make better decisions.

- For Households: If you’ve got an electric vehicle, charging it during off-peak hours is still your cheapest bet. It’s a simple change that can add up. Also, don’t forget about energy efficiency. Upgrading your appliances, improving insulation, or just being mindful of your usage can make a real difference to your bills. It’s not just about saving money; it’s about using less energy overall.

- Both: Consider exploring options like hedging, if that’s something your business can do. It’s a way to protect yourself from unexpected price spikes. For everyone, understanding your energy usage patterns is key. Knowing when you use the most power can help you find savings.

Long-Term Contract Considerations

When we talk about long-term contracts, especially for businesses, it’s about getting some certainty in an uncertain world. The energy market in 2026 is expected to be more stable than the wild ride of the early 2020s, but it’s not going to be perfectly predictable. Signing a fixed-price contract can shield your business from the ups and downs of wholesale prices and natural gas market fluctuations. However, you also need to weigh this against the possibility that prices might eventually come down. If you lock in too high, you could be stuck paying more than necessary for a while. It’s a bit of a gamble, but one that can pay off if you get the timing right. For households, this usually translates to looking at your utility provider’s fixed-rate plans, if they’re available and make sense for your budget.

So, What’s the Bottom Line for 2026?

Looking ahead to 2026, it seems like the energy market won’t be a total rollercoaster, but it’s definitely not going to be smooth sailing either. We’re seeing a bit more focus on traditional fuels, which might help stabilize things somewhat, but global events and the ongoing shift towards things like electric cars mean prices will still have their ups and downs. For businesses and regular folks, this means keeping an eye on costs and maybe thinking about longer-term plans for energy supply. It’s a bit of a mixed bag, really – less chaos than we’ve seen lately, but still plenty to pay attention to.