Thinking about putting your money somewhere safe? The 5 year t bill might be a good option. It’s a type of government bond, and lots of people use them to keep their money secure. This guide will walk you through what a 5 year t bill is, how it works, and if it’s the right choice for your money. We’ll cover everything from how you buy them to what you can expect in return. So, let’s get started!

Key Takeaways

- A 5 year t bill is a short-term debt security issued by the U.S. government.

- You buy 5 year t bills at a discount, and then you get the full face value back when they mature.

- These bills are very safe because they’re backed by the U.S. government.

- While safe, 5 year t bills usually offer lower returns compared to other types of investments.

- You can buy 5 year t bills directly from the Treasury or through a brokerage.

Understanding the 5 Year T Bill

So, you’re thinking about investing in 5 Year T Bills? Good choice! They’re generally considered a pretty safe investment, but it’s important to know what you’re getting into. Let’s break it down.

Defining Treasury Bills

Okay, first things first: what are Treasury Bills? Basically, they’re short-term securities backed by the U.S. government. When you buy a T-bill, you’re essentially lending money to the government. The government promises to pay you back the face value of the bill on a specific date. They come in different terms, like 4-week, 8-week, and, of course, 5-year.

Key Characteristics of a 5 Year T Bill

So, what makes a 5 Year T Bill special? Well, it’s all about the term. Here’s a few things to keep in mind:

- Maturity Date: A 5 Year T Bill matures in, you guessed it, five years. This is longer than your typical short-term T-bill, but shorter than a lot of other government bonds.

- Fixed Income: You know exactly when you’ll get your money back, which makes planning easier.

- Safety: Backed by the full faith and credit of the U.S. government, so they’re considered super safe. This is a big deal for a lot of investors.

How 5 Year T Bills Differ from Other Treasuries

Treasuries come in all shapes and sizes. You’ve got T-bills, T-notes, and T-bonds. The main difference? The term length. T-bills are short-term (less than a year), T-notes are medium-term (2, 3, 5, 7, or 10 years), and T-bonds are long-term (20 or 30 years). A 5 Year T Bill falls into that medium range. Also, T-bills are sold at a discount, while T-notes and T-bonds usually pay interest every six months. So, if you’re looking for something longer than a typical T-bill but not as long as a bond, the 5 Year T Bill might be a good fit.

How 5 Year T Bills Generate Returns

The Discount Issuance Mechanism

Okay, so here’s the deal with how you actually make money on these things. Five-year T-bills don’t work like your typical bond that sends you interest payments every so often. Instead, they use something called a "discount issuance mechanism." Basically, you buy the T-bill for less than its face value. Then, when it matures (after five years, obviously), you get the full face value. The difference between what you paid and what you get back is your return. It’s like buying something on sale and then getting the original price later – except it’s the government doing the "selling."

Calculating Your Return on Investment

Let’s break down how to figure out what you’re actually earning. It’s not as straightforward as just looking at an interest rate. You need to consider the discount you received when you bought the T-bill. Here’s a simple example:

- Face Value: $10,000

- Purchase Price (Discounted): $9,200

- Return: $10,000 – $9,200 = $800

To get the actual return on investment (ROI), you’d divide your return by the purchase price: $800 / $9,200 = 0.0869, or 8.69%. Now, remember that’s over five years. To get an approximate annual return, you could divide that by five, but that doesn’t account for compounding. For a more precise annual yield, you’d need a more complex calculation, but that gives you a general idea. You can use an investment calculator to help you with this.

No Direct Interest Payments

It’s worth repeating: you don’t get any interest payments during the five years you hold the T-bill. This can be a good or bad thing, depending on your needs. If you’re looking for regular income, T-bills aren’t the best choice. But if you’re okay with waiting five years to get your return, and you like the safety of a government-backed investment, then it could be a solid option. The lack of payments simplifies things a bit, as you don’t have to worry about reinvesting interest or tracking income for tax purposes until the T-bill matures. Just remember that while T-bills offer nearly zero default risk, their returns are typically lower than corporate bonds. Also, keep in mind that T-bills pay no interest payments leading up to its maturity.

Benefits of Investing in 5 Year T Bills

Exceptional Safety and Security

When you’re looking for a safe place to park your money, 5 Year T Bills are often mentioned. They’re backed by the full faith and credit of the U.S. government, which means the risk of default is incredibly low. It’s about as safe as you can get when it comes to investments. This makes them a popular choice for risk-averse investors who prioritize preserving capital over chasing high returns.

Tax Advantages for 5 Year T Bills

One of the nice things about investing in 5 Year T Bills is the tax situation. While you’ll still owe federal income tax on the interest earned, it’s exempt from state and local taxes. This can be a significant advantage, especially if you live in a state with high income taxes. It simplifies your tax filing and can boost your overall return a bit. It’s not a huge difference, but every little bit helps, right?

Liquidity in the Secondary Market

While you’re committing your money for five years, you’re not completely locked in. There’s a secondary market where you can sell your T Bills before they mature. This gives you some flexibility if you need access to your funds earlier than expected. Of course, the price you get will depend on the prevailing interest rates at the time. If rates have gone up, you might get less than you paid. If they’ve gone down, you might get more. Here’s a quick rundown:

- Interest Rates Increase: Buy Existing T-Bill (Price Decreases)

- Interest Rates Decrease: Sell Existing T-Bill (Price Increases)

- Interest Rates Stay the Same: Price Remains Relatively Stable

Having that option to sell provides peace of mind, even if you plan to hold the T Bill until maturity. It’s good to know you have choices, and that’s a key benefit.

Potential Drawbacks of 5 Year T Bills

While 5 Year T Bills offer a safe haven for your money, it’s important to consider the downsides before jumping in. They aren’t a magic bullet, and understanding their limitations is key to making informed investment decisions.

Lower Returns Compared to Other Investments

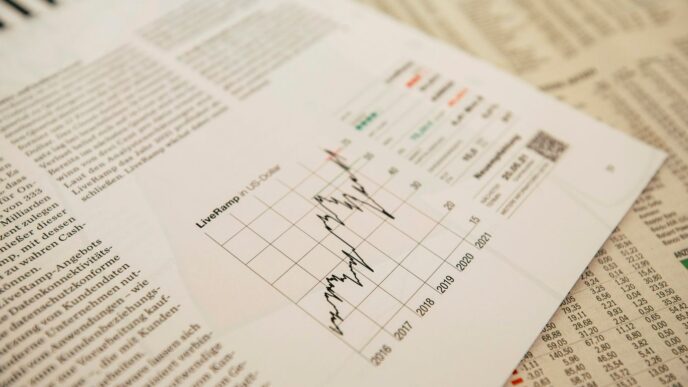

Let’s be honest, you’re not going to get rich quick with 5 Year T Bills. Their safety comes at a price, and that price is lower returns. Compared to riskier assets like stocks or even corporate bonds, the yield on T-bills is generally quite modest. This is because they are considered virtually risk-free, backed by the full faith and credit of the U.S. government. If you’re chasing high growth, you’ll likely need to look elsewhere. Think of it as trading potential gains for peace of mind. For example, you might see something like this:

| Investment Type | Approximate Return (June 2025) |

|---|---|

| 5 Year T Bill | 4.5% |

| Corporate Bond (A-rated) | 5.5% |

| S&P 500 Index | Historically 10-12% (but with much higher volatility) |

Impact of Inflation on 5 Year T Bills

Inflation can be a sneaky wealth-eater. While your T-bill might be earning a positive return, if inflation is higher than that return, your purchasing power is actually decreasing. Let’s say you lock in a 4% yield on a 5 Year T Bill, but inflation averages 3% over those five years. Your real return (after inflation) is only 1%. Not exactly a fortune! It’s important to consider inflation expectations when deciding if treasury bills are the right investment for you. One way to combat this is to consider Treasury Inflation-Protected Securities (TIPS), which are designed to adjust with inflation.

Interest Rate Risk Considerations

Interest rate risk is something to keep in mind. If interest rates rise after you’ve purchased your 5 Year T Bill, the market value of your existing T-bill could decrease. This is because new T-bills will be issued with higher yields, making your older, lower-yielding T-bill less attractive. Now, if you hold the T-bill to maturity, you’ll still receive the face value, so this risk is primarily a concern if you need to sell before maturity. Imagine you buy a T-bill yielding 4%, and then a year later, new T-bills are yielding 5%. Suddenly, your T-bill isn’t as appealing, and you might have to sell it at a slight discount if you need the cash. Here are some things to consider:

- Rising interest rates can decrease the value of existing T-bills.

- The longer the maturity, the greater the interest rate risk.

- If you hold to maturity, you avoid this risk, but you miss out on potentially higher yields from newer bonds.

Purchasing 5 Year T Bills

Buying Directly from TreasuryDirect

So, you’re thinking about buying 5 Year T Bills? One of the most straightforward ways to do it is directly through TreasuryDirect. This is a website run by the U.S. Department of the Treasury, and it lets you buy treasury securities without going through a broker. It’s like buying straight from the source.

Here’s a quick rundown:

- First, you’ll need to create an account on the TreasuryDirect website. It’s pretty simple, just like setting up any other online account. You’ll need your Social Security number, bank account information, and a few other details.

- Once your account is set up, you can browse the available securities and choose the 5 Year T Bill. You’ll see the current rates and terms.

- You can then submit your purchase request. Keep in mind that T Bills are sold at auction, so you might not get the exact rate you see initially. The auction determines the final price.

Acquiring Through a Brokerage Account

Another option is to buy 5 Year T Bills through a brokerage account. Most major brokerages offer access to Treasury auctions. This can be a good choice if you already have a brokerage account and prefer to manage all your investments in one place. Plus, you might get some extra research and tools from your broker.

Here’s what to consider:

- Check if your brokerage offers access to Treasury auctions. Not all of them do, so it’s worth confirming.

- You might have to pay a small fee or commission to buy T Bills through a broker. Make sure you understand the fee structure before you proceed.

- Your brokerage account will handle all the paperwork and transactions for you, which can be convenient.

Understanding Auction Processes

Treasury Bills are sold at auction. This means the price isn’t fixed; it’s determined by the bids that are submitted. Understanding how these auctions work can help you get the best possible rate. It’s not as complicated as it sounds, trust me.

Here’s the gist:

- The Treasury announces the auction date and the amount of T Bills being offered.

- Investors submit bids, indicating how much they’re willing to pay. Bids are usually submitted at a discount to the face value of the bill.

- The Treasury accepts the highest bids first until all the T Bills are sold. The lowest accepted bid determines the price for everyone.

- You don’t need to be a pro to participate. Just do a little research and understand the current market conditions. You can find information on past auctions on the TreasuryDirect website. Knowing how to buy treasury bills can be a great way to diversify your portfolio.

Managing Your 5 Year T Bill Investment

Holding to Maturity

The simplest way to manage your 5 Year T Bill is to hold it until it matures. This means you simply wait the full five years, at which point you’ll receive the face value of the bill. No need to worry about market fluctuations or trying to time the market. You get exactly what you expected, assuming you understood the discount issuance mechanism when you bought it. It’s a set-it-and-forget-it approach, perfect for those who don’t want to actively manage their investments.

Selling Before Maturity

Life happens, and sometimes you might need access to your funds before the T Bill matures. The good news is that you can sell your T Bill on the secondary market. However, there are a few things to keep in mind:

- Market conditions matter: The price you get will depend on current interest rates. If rates have gone up since you bought the bill, its value will likely decrease, and vice versa.

- Brokerage fees: Selling through a broker might incur fees, which will eat into your returns.

- Potential for loss: You could end up selling for less than you originally paid, especially if interest rates have risen significantly.

Reinvesting Your Proceeds

Once your 5 Year T Bill matures, you’ll have a decision to make: what to do with the money? Reinvesting is a common option, and here are a few possibilities:

- Buy another T Bill: You could purchase another 5 Year T Bill, or opt for a different maturity length depending on your current financial goals and the prevailing interest rates. Consider the current yield before making a decision.

- Diversify: Use the proceeds to invest in other assets, such as stocks, bonds, or mutual funds, to create a more diversified portfolio. This can help to reduce your overall risk.

- Other investment options: Explore other options like CDs or corporate bonds, comparing their yields and risk profiles to determine the best fit for your needs. Don’t forget to consider the tax implications of each option. You could even use a Treasury account to automate the process of purchasing T-bills.

Comparing 5 Year T Bills with Alternatives

5 Year T Bills Versus CDs

When you’re trying to figure out where to put your money, it’s smart to look at all your options. Two common choices are 5 Year T Bills and Certificates of Deposit (CDs). Both are pretty safe, but they work a bit differently. T-bills are backed by the U.S. government, while CDs are offered by banks and are usually FDIC-insured.

- T-bills are sold at a discount, and you get the full face value when they mature. CDs, on the other hand, usually pay interest periodically.

- T-bills have their interest exempt from state and local taxes, which can be a nice perk. CDs don’t have this benefit.

- CDs might offer slightly higher interest rates than T-bills, but it depends on the market. It’s always a good idea to shop around and compare rates.

Treasuries have maturities ranging from as little as four weeks to as long as 30 years. On the other hand, the availability of CDs beyond five years is limited in many instances. For investors that desire a greater selection of maturities, Treasuries can make more sense.

5 Year T Bills Versus Corporate Bonds

Corporate bonds are another alternative to consider. These are issued by companies, and they generally offer higher yields than T-bills. However, with higher yields comes higher risk. Companies can default on their bonds, while the U.S. government is highly unlikely to default on its debt. Here’s a quick rundown:

- Risk: T-bills are super safe; corporate bonds have more risk.

- Return: Corporate bonds usually pay more interest.

- Taxes: T-bill interest is state and local tax-exempt; corporate bond interest isn’t.

5 Year T Bills in a Diversified Portfolio

So, how do 5 Year T Bills fit into a bigger investment plan? Well, they’re great for adding stability. Because they’re so safe, they can balance out riskier investments like stocks or corporate bonds. Think of them as the anchor in your portfolio, keeping things steady when the market gets choppy. Here’s why they’re useful:

- Safety Net: They protect your money during economic downturns.

- Diversification: They reduce your overall portfolio risk.

- Liquidity: You can sell them before maturity if you need the cash, though you might not get the full face value. If you want to explore how this works, use our T-bill calculator below.

Conclusion

So, that’s the deal with 5-year T-bills. They’re pretty straightforward, right? You buy them at a discount, and then when they’re done, you get the full amount back. It’s a simple way to put your money somewhere safe, especially if you’re not into big risks. Sure, the returns might not make you rich overnight, but for a steady, reliable option, they’re hard to beat. Just remember, they’re not for everyone, especially if you need cash flow or want super high returns. But for a solid, low-stress investment, a 5-year T-bill can be a good fit for your money.

Frequently Asked Questions

What exactly is a 5-year T-Bill?

A 5-year T-Bill is like a special loan you give to the U.S. government for five years. Instead of getting regular interest payments, you buy it for less than it’s worth, and then when the five years are up, you get the full amount back. The profit you make is the difference between what you paid and what you got back.

How safe are 5-year T-Bills?

T-Bills are super safe because they’re backed by the U.S. government, which is very unlikely to stop paying its debts. This makes them one of the safest places to put your money.

Do 5-year T-Bills pay interest?

You don’t get regular interest payments with a T-Bill. Instead, you buy it at a lower price than its face value. When the T-Bill matures (after five years), you get the full face value back. The money you gain from this difference is your return.

Where can I buy 5-year T-Bills?

You can buy 5-year T-Bills directly from the U.S. Treasury through their website, TreasuryDirect. You can also buy them through a regular brokerage account, which is like a financial company that helps you buy and sell investments.

What are the drawbacks of 5-year T-Bills?

The main downside is that T-Bills usually offer lower returns compared to other investments that carry more risk. Also, if prices for everyday things go up a lot (inflation), the money you get back might not buy as much as it used to.

Can I sell my 5-year T-Bill before it’s due?

Yes, you can sell your 5-year T-Bill before it matures in the secondary market. This is a place where investors can buy and sell T-Bills from each other. However, the price you get might be more or less than what you paid, depending on what interest rates are doing at that time.