So, you’re looking into Bitcoin, but the whole crypto thing feels a bit much? Maybe you’ve heard about something called GBTC. It’s basically a way to get some Bitcoin exposure without actually buying and holding the digital coins yourself. Sounds easy, right? But there’s this thing called the GBTC discount that can really throw a wrench in the works. It’s a bit confusing, and if you’re thinking about investing, you really need to know what’s going on with it. Let’s break down this GBTC discount and what it means for your money.

Key Takeaways

- The GBTC discount refers to when the trust’s share price is lower than the actual value of the Bitcoin it holds.

- This discount can make GBTC shares seem like a bargain, offering a way to buy Bitcoin at a lower effective price.

- Factors like regulatory news, market demand, and concerns about Grayscale’s reserves can influence the GBTC discount.

- While a discount might present an opportunity, it also carries risks, including management fees and market volatility.

- GBTC offers easier access to Bitcoin through traditional accounts but differs from direct ownership in flexibility and control.

Understanding The GBTC Discount

So, what’s this "GBTC discount" everyone’s talking about? Basically, it’s the difference between the price of a share in the Grayscale Bitcoin Trust (GBTC) and the actual value of the Bitcoin that share represents. Think of it like buying a coupon for a product that’s worth $10, but you can get the coupon for only $8. That $2 difference is the discount.

What is the GBTC Discount?

GBTC is a way for people to invest in Bitcoin without actually buying and holding the cryptocurrency themselves. Grayscale, the company behind it, buys and stores Bitcoin, and then sells shares of a trust that holds that Bitcoin. Ideally, the price of one GBTC share should be pretty close to the value of the fraction of a Bitcoin it represents. However, that’s not always the case. Sometimes, the market price of a GBTC share is less than the value of the Bitcoin it’s supposed to represent. This difference is the "discount to Net Asset Value" (NAV). Conversely, sometimes the share price can be higher than the underlying Bitcoin value, which is called a "premium."

How the Discount Impacts Investor Appeal

This discount or premium really matters to investors. When GBTC trades at a significant discount, it can look like a bargain. You’re essentially getting Bitcoin exposure at a lower price than the market rate. This can attract investors looking for a potential upside if the discount narrows or disappears. On the flip side, a persistent or widening discount can signal concerns about the trust itself, Grayscale’s management, or even the broader Bitcoin market. It makes people wonder if they’re really getting what they’re paying for, or if there are hidden risks.

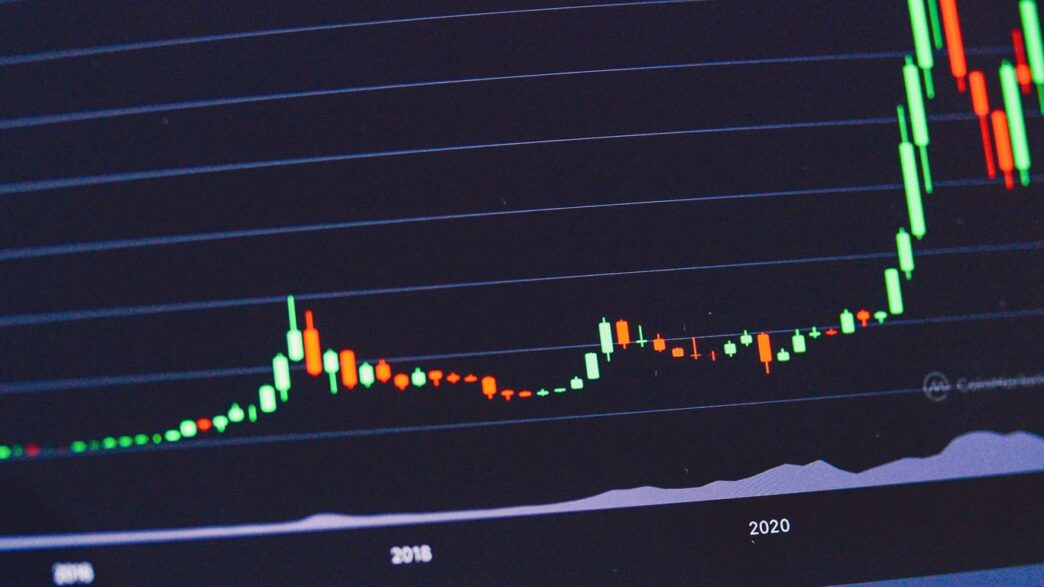

Historical GBTC Discount Trends

The discount GBTC has traded at has been a pretty big deal over the years. For a long time, especially when there was uncertainty about whether GBTC would ever convert into a spot Bitcoin ETF, the discount was quite substantial. We’re talking periods where shares were trading at 30%, 40%, or even close to 50% less than the value of the Bitcoin held. This was largely due to regulatory hurdles and investor skepticism. However, since the approval of the Bitcoin ETF conversion, the discount has significantly narrowed, often trading very close to its NAV, sometimes even at a slight premium. This shift shows how much regulatory news and market sentiment can sway the trust’s valuation relative to its underlying assets.

GBTC’s Role in Bitcoin Investing

So, why do people even bother with GBTC when they could just buy Bitcoin directly? Well, it boils down to a few key things that make it easier for a lot of investors to get a piece of the crypto pie.

Accessibility Through Traditional Brokerages

For many, the biggest hurdle to investing in Bitcoin has been the technical know-how required to set up wallets, manage private keys, and navigate crypto exchanges. GBTC sidesteps all of that. You can buy shares of GBTC just like you would any other stock or ETF, right through your existing brokerage account. This means if you already have an account with Fidelity, Schwab, or Robinhood, you’re pretty much good to go. It’s a familiar process, which makes it way less intimidating for folks who aren’t exactly tech wizards. This accessibility is a huge reason why GBTC became so popular, especially before other regulated Bitcoin investment products became widely available. It’s essentially a bridge between the traditional finance world and the digital asset space.

Simplified Bitcoin Exposure

Think of GBTC as a way to get exposure to Bitcoin’s price movements without actually holding the digital currency yourself. Grayscale Investments, the company behind GBTC, buys and holds the Bitcoin. They handle the storage, security, and all the nitty-gritty details. Your investment is in shares of the trust, which are designed to track the value of the Bitcoin held within it. This simplified approach means you don’t have to worry about the complexities of cryptocurrency custody. It’s a hands-off way to participate in the potential upside of Bitcoin. As Grayscale Bitcoin Trust (GBTC) is a spot bitcoin exchange-traded fund (ETF) provided by Grayscale Investments, it offers a regulated vehicle for this exposure.

Tax Considerations for GBTC Investors

Now, when it comes to taxes, things get a little interesting. Investing in GBTC isn’t exactly the same as holding Bitcoin directly, and this can have tax implications. While the specifics can get complicated and often depend on your individual situation and the ever-changing tax laws, it’s important to be aware. For instance, how gains and losses are treated might differ. It’s always a good idea to chat with a tax professional to figure out exactly how GBTC fits into your tax picture. They can help you understand any potential advantages or specific reporting requirements that come with holding shares in a trust like GBTC, compared to direct crypto ownership.

Factors Influencing the GBTC Discount

So, what makes the price of GBTC shares move around so much compared to the actual value of the Bitcoin it holds? It’s not just one thing, but a mix of different forces at play. Think of it like a seesaw – a lot of things can push it up or down.

Regulatory Uncertainty and its Impact

For a long time, the biggest shadow hanging over GBTC was the U.S. Securities and Exchange Commission (SEC). The SEC was pretty hesitant about approving crypto-related investment products, and GBTC’s journey to becoming a spot Bitcoin ETF was a real rollercoaster. There were applications, rejections, and even court rulings that sided with Grayscale. This back-and-forth created a lot of uncertainty. When regulators seem unsure or are slow to act, it makes investors nervous, and that nervousness often shows up as a wider discount for GBTC. It’s like waiting for a big decision – the longer it takes, the more people start to worry about the outcome.

Market Demand and Supply Dynamics

Just like any other investment, the price of GBTC shares is also affected by basic supply and demand. When lots of people want to buy GBTC, maybe because Bitcoin’s price is soaring and they want easy exposure, the price of GBTC shares can go up, sometimes even above the value of the Bitcoin it holds (a premium). On the flip side, if fewer people are buying or if there’s a lot of selling pressure, the price can drop below the net asset value (NAV), creating a discount. It’s also worth remembering that GBTC trades during specific market hours, while Bitcoin trades 24/7. This difference can sometimes lead to situations where the price of GBTC doesn’t immediately reflect big moves in Bitcoin that happen overnight or on weekends.

Grayscale’s Reserve Transparency Concerns

Another factor that can influence the discount is how much trust investors have in Grayscale itself. When you buy GBTC, you’re essentially trusting Grayscale to hold the Bitcoin it says it holds. After some major crypto company collapses, investors became more cautious and wanted proof that these trusts actually have the assets they claim. Grayscale’s past reluctance to immediately provide detailed proof-of-reserves, citing security reasons, didn’t always help ease these concerns. If investors aren’t fully confident that the underlying Bitcoin is secure and accounted for, they might demand a larger discount to compensate for that perceived risk.

Navigating GBTC’s Premium or Discount

So, you’re looking at GBTC, and you’ve noticed its price doesn’t always match the actual value of the Bitcoin it holds. This difference is what we call the premium or discount to Net Asset Value (NAV). It’s a pretty common thing with closed-end funds, and GBTC has certainly had its share of both. Understanding this dynamic is key to figuring out if GBTC is the right move for you.

Premium to NAV: What It Signifies

When GBTC trades at a premium, it means investors are willing to pay more for a share of the trust than the Bitcoin held within it is actually worth. Think of it like this: if one share of GBTC is supposed to represent $100 worth of Bitcoin, but it’s trading for $110, that’s a 10% premium. This usually happens when demand for GBTC is really high, perhaps because people are excited about Bitcoin’s price going up and want easy exposure. It can also signal strong investor confidence in Grayscale’s management. However, paying a premium means you’re essentially overpaying for the underlying asset, which can eat into your potential gains if the premium shrinks.

Discount to NAV: Potential Opportunities

On the flip side, a discount means GBTC shares are trading for less than the value of the Bitcoin they hold. If that same $100 worth of Bitcoin is represented by a share trading at $90, that’s a 10% discount. This can look like a great deal, right? It’s like buying Bitcoin at a bit of a bargain through a traditional brokerage. Historically, GBTC has spent a lot of time trading at a significant discount, often due to regulatory uncertainties surrounding its structure and potential conversion into an ETF. Buying at a discount can offer a chance for extra profit if the discount narrows or disappears. However, a persistent discount can also be a red flag, suggesting that the market has concerns about the trust itself or the future price of Bitcoin. It’s important to look into why the discount exists before jumping in. You can check out the historical GBTC discount trends to get a better sense of this.

The Role of Market Sentiment

Ultimately, both premiums and discounts are heavily influenced by what investors are feeling about Bitcoin and GBTC specifically. When the crypto market is buzzing and prices are climbing, you’ll often see GBTC trade at a premium as more people rush to get exposure. Conversely, during downturns or periods of uncertainty, the discount can widen. Regulatory news, like the eventual approval for GBTC to convert into a spot Bitcoin ETF, can dramatically shift this sentiment. The market’s overall mood, combined with specific news about the trust, plays a huge part in where its price lands relative to the value of the Bitcoin it holds. It’s a bit of a dance between the perceived value of Bitcoin and the perceived value of holding it through this specific investment vehicle.

GBTC vs. Direct Bitcoin Ownership

So, you’re thinking about getting into Bitcoin, but the whole idea of setting up a digital wallet and keeping your private keys safe feels like a bit much? That’s where something like the Grayscale Bitcoin Trust (GBTC) comes in. It’s basically a way to get exposure to Bitcoin’s price movements without actually holding the Bitcoin yourself. Think of it like buying a stock that tracks an asset, rather than owning the asset directly.

Convenience of Indirect Investment

GBTC is designed to be easy. You can buy and sell shares through your regular brokerage account, just like any other stock or ETF. This means no need to sign up for a crypto exchange, figure out wallet addresses, or worry about the technical side of things. It’s a familiar path for most investors. For many, this simplified access is the biggest draw.

Custodial Security Provided by Grayscale

When you own Bitcoin directly, you’re responsible for its security. This can be a headache, and frankly, a bit scary if you’re not tech-savvy. There’s always the risk of losing your private keys or falling victim to scams. With GBTC, Grayscale handles the storage of the actual Bitcoin. They claim to use industry-leading security measures, which means you’re essentially trusting them to keep the Bitcoin safe. This takes the burden of self-custody off your shoulders.

Differences in Flexibility and Control

Owning Bitcoin directly gives you complete control. You can send it, receive it, or use it for transactions whenever you want. GBTC, on the other hand, is more like a traditional investment. You can’t just ‘take out’ your Bitcoin from the trust. You’re buying shares that represent Bitcoin, and you can only sell those shares. This lack of direct control and flexibility is a key difference. Plus, GBTC comes with annual management fees, which eat into your returns over time, something you don’t have with direct ownership.

Potential Upsides of the GBTC Discount

So, you’re looking at the Grayscale Bitcoin Trust (GBTC) and noticing it’s trading for less than the actual Bitcoin it holds. This "discount" might seem like a bad sign, but for some investors, it can actually be a pretty sweet deal. It’s like finding a popular item on sale – you get the same thing, but you pay less for it.

Buying Bitcoin at a Lower Effective Price

When GBTC shares trade at a discount to their Net Asset Value (NAV), it means you’re essentially buying the underlying Bitcoin at a cheaper rate than if you bought it directly on an exchange. For example, if GBTC is trading at a 10% discount, and the NAV per share is $50, you could theoretically buy that share for $45. This means your investment is effectively buying $50 worth of Bitcoin for only $45. This can be a really attractive proposition for investors who believe in Bitcoin’s long-term potential but want to get in at a more favorable price point. It’s a way to gain exposure to Bitcoin’s price movements without paying the full market price for the actual cryptocurrency. You can find options for GBTC with a February 2026 expiration, offering an alternative to purchasing shares directly at the current market price [cbe1].

Potential for Significant Returns Upon Discount Narrowing

One of the biggest potential wins with GBTC comes from the possibility of the discount narrowing or even disappearing. Historically, the discount has been quite volatile, sometimes reaching close to 50%. If Grayscale manages to convert GBTC into a spot Bitcoin ETF, or if market sentiment shifts positively, the trust’s share price could move closer to its NAV. Imagine buying GBTC at a 30% discount and then seeing that discount shrink to 5%. That 25% difference, on top of any Bitcoin price appreciation, could lead to some really impressive returns. It’s a bit of a gamble, sure, but the payoff can be substantial if things go the right way.

The ETF Conversion Impact

The big news that really shook things up was the SEC’s approval of GBTC’s conversion into a spot Bitcoin ETF. Before this, the discount was a persistent issue, largely due to regulatory uncertainty. Once the conversion was approved, the discount significantly narrowed, and at times, GBTC even traded at a premium. This conversion was a game-changer because it addressed many of the structural issues that led to the discount in the first place. It essentially made GBTC more aligned with the actual value of the Bitcoin it holds, removing a major overhang for investors. This event demonstrated how regulatory outcomes can directly influence the premium or discount dynamics of crypto-related investment products.

Risks Associated with GBTC Investments

While GBTC offers a convenient way to get exposure to Bitcoin, it’s not without its own set of potential problems that investors should really think about. It’s not quite as straightforward as just buying Bitcoin directly, and there are a few things that could eat into your returns or even cause you to lose money.

Management Fees and Their Erosion of Returns

One of the most talked-about downsides of GBTC is its management fee. Grayscale charges a yearly fee, and historically, it’s been on the higher side, often around 2%. Now, 2% might not sound like a lot at first glance, but over time, especially if Bitcoin’s price isn’t doing much or is going down, these fees can really start to chip away at your investment. Imagine you’re holding onto GBTC for several years; those annual fees add up, and they directly reduce the amount of money you actually make. It’s like paying rent on your investment, and the longer you hold, the more rent you pay. This is a significant difference compared to holding Bitcoin directly, where you don’t have ongoing management fees eating into your gains. For comparison, some newer Bitcoin ETFs have much lower management fees, which can make a big difference in your net returns.

Volatility and Market Fluctuations

Let’s be real, Bitcoin itself is a pretty volatile asset. Its price can swing wildly in short periods, and GBTC, being tied to Bitcoin’s price, inherits that volatility. So, even though you’re investing through a traditional-looking product, you’re still exposed to the wild ride of the crypto market. This means the value of your GBTC shares can drop significantly and quickly. It’s not uncommon for the price to move double-digit percentages in a single day. This volatility can be exciting for some, but for others, it can be a major source of stress and potential loss, especially if you’re not prepared for it or if you need access to that money soon. You’re essentially betting on Bitcoin’s price movements, and those movements can be unpredictable.

Trust and Counterparty Risks

When you buy GBTC, you’re not actually holding the Bitcoin yourself. You’re trusting Grayscale Investments to hold the underlying Bitcoin on your behalf. This introduces what’s called counterparty risk. What if something happens to Grayscale? While they are a well-known company, the crypto space has seen its share of unexpected collapses. There have been instances where investors have questioned Grayscale’s transparency regarding their reserves, especially after major industry events. The core idea behind Bitcoin is decentralization and not having to trust a single entity, but with GBTC, you are placing a significant amount of trust in Grayscale. If Grayscale were to face financial trouble or if there were ever questions about whether they actually hold all the Bitcoin they claim to, it could severely impact the value of GBTC shares. This is a risk you completely avoid when you hold your Bitcoin directly in your own digital wallet, like the ones used with direct Bitcoin exposure.

Wrapping It Up

So, we’ve looked at what the GBTC discount is all about. It’s basically the difference between what the trust’s shares are worth on paper and what people are actually paying for them. For a long time, those shares were cheaper than the Bitcoin they represented, which was a big deal for investors. Now that it’s an ETF, things are changing, and the discount has mostly gone away. It’s a good reminder that these investment products have their own ups and downs, separate from just the price of Bitcoin itself. Always do your homework before putting your money into anything, whether it’s Bitcoin directly or something like GBTC.

Frequently Asked Questions

What exactly is the GBTC discount?

Think of GBTC like a special fund that holds actual Bitcoin. The ‘discount’ happens when the price of a share in this fund is less than the value of the Bitcoin it holds. It’s like buying something for less than what it’s actually worth inside.

Can anyone buy shares of GBTC?

Yes, pretty much anyone can invest in GBTC. You can buy its shares through regular stock trading accounts, just like you would with other stocks or funds. It’s designed to be easy to access for most investors.

How does the discount or premium affect how people see GBTC?

When GBTC shares are cheaper than the Bitcoin inside (a discount), it might seem like a good deal, but it could also mean people are worried about the fund. If the shares cost more than the Bitcoin (a premium), it shows people are really eager to get in, maybe more than the actual value warrants.

Is investing in GBTC the same as owning Bitcoin directly?

Not quite. With GBTC, you’re buying shares of a trust that owns Bitcoin. It’s simpler because you don’t have to worry about storing the Bitcoin yourself. Owning Bitcoin directly means you hold the actual digital coins.

What are the good things about buying GBTC when it’s at a discount?

When GBTC is at a discount, you’re essentially buying Bitcoin at a lower price than the market rate. If the discount shrinks or goes away, you could make extra money on top of any Bitcoin price gains. It’s like getting a bargain.

Are there any downsides to investing in GBTC?

Definitely. GBTC charges yearly fees, which can eat into your profits over time. Also, while it’s easier to buy, you have less control than owning Bitcoin directly, and you have to trust the company managing the fund to keep the Bitcoin safe.