Running an online store with WooCommerce can get complicated, especially when you start selling to people all over the world. Different countries have different ways they like to pay, and figuring all that out can be a headache. Plus, you want to make sure payments are safe and that you’re following all the rules. This is where conditional payments for WooCommerce come in handy. They let you show the right payment options to the right people at the right time, making things easier for your customers and for you.

Key Takeaways

- Using conditional payments for WooCommerce helps manage international sales by showing customers payment methods they prefer or that are common in their region.

- Plugins are really useful for setting up these conditional payments, making it easier to handle different currencies, comply with rules, and connect with various payment systems.

- You can make payments more customer-friendly by tailoring options based on where someone lives, how much they’re spending, or what they’re shipping.

- Keeping transactions secure and following global payment rules builds trust with customers and avoids legal problems.

- Strategic use of conditional payments can reduce abandoned carts, encourage the use of certain payment methods (like those with lower fees), and ultimately help boost sales.

Understanding Conditional Payments for WooCommerce

Running an online store with WooCommerce can get complicated, especially when you’re dealing with different customers and where they’re buying from. Conditional payments are basically a way to show different payment options or apply specific rules based on certain things. It’s not just about offering a bunch of payment methods; it’s about offering the right ones at the right time.

Addressing International Transaction Complexities

Selling globally means dealing with a lot of different currencies, tax rules, and local payment preferences. A customer in Germany might expect to pay with Giropay, while someone in Japan might prefer to use a local bank transfer. If your store only shows a generic set of payment options, it can be confusing and might even stop a sale before it happens. Making sure the payment options fit the customer’s location is a big deal for international sales. It’s about removing friction and making the checkout process feel familiar and easy for everyone, no matter where they are. This can involve setting up different payment gateways for different countries or even showing prices in local currencies. It’s a bit of work, but it really pays off in customer satisfaction.

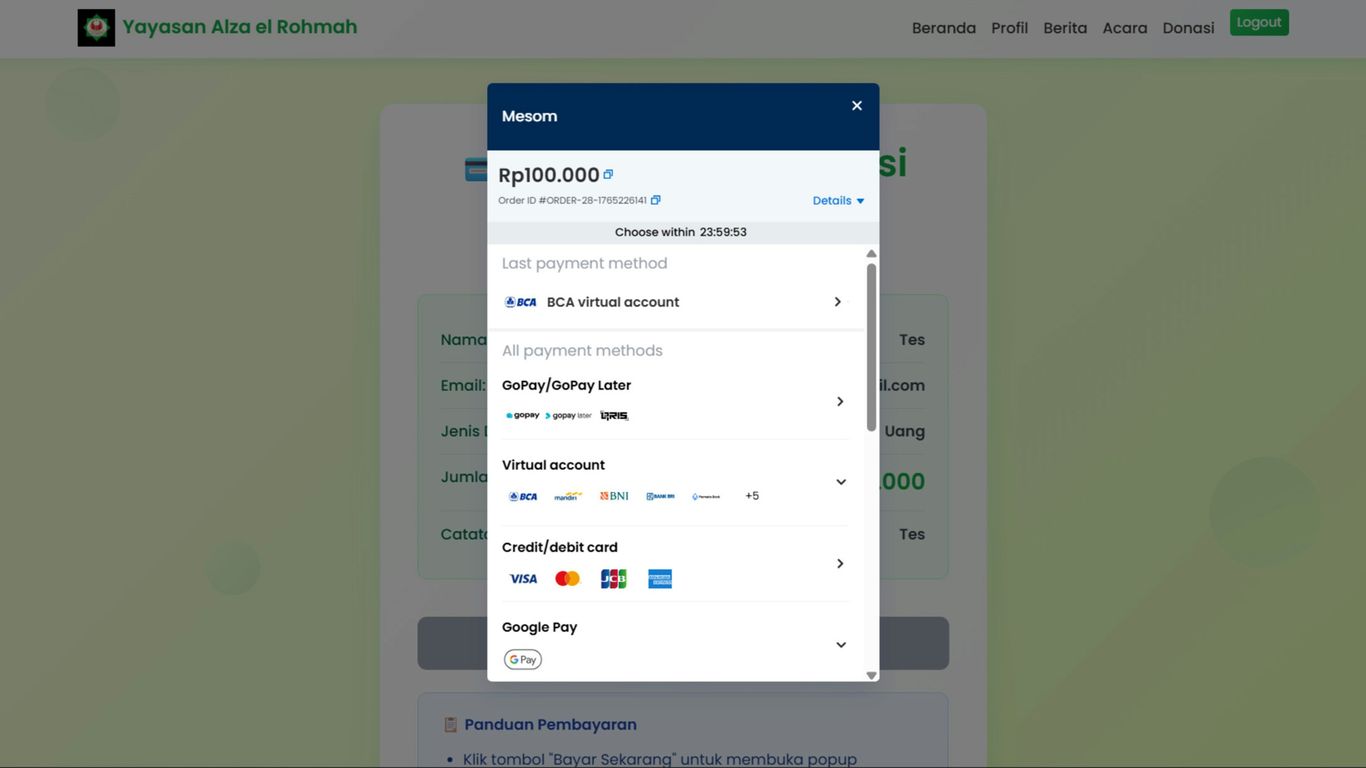

The Role of Plugins in Global Sales

Trying to manage all these international payment variations on your own can quickly become a headache. That’s where plugins come in. Think of them as your helpful assistants. They can automate a lot of the complex stuff, like currency conversion, applying country-specific taxes, and showing the most relevant payment methods. For example, a good plugin can automatically detect a customer’s country and adjust the available payment options accordingly. This means you don’t have to manually set up rules for every single country you ship to. It simplifies things a lot and helps you manage a global business more smoothly. You can find plugins that help with adding different types of fees to your store, which can also be part of a conditional payment strategy.

Enhancing Customer Experience with Tailored Payments

Ultimately, conditional payments are all about making the customer’s life easier. When a customer gets to checkout and sees payment options that make sense to them, they’re more likely to complete the purchase. It shows you’ve thought about their needs. For instance, if you offer a discount for using a specific payment method that has lower transaction fees for you, it’s a win-win. The customer gets a small saving, and you reduce your costs. This kind of thoughtful approach builds trust and can lead to repeat business. It’s not just about the product; it’s about the entire buying journey, and the payment step is a really important part of that.

Strategic Implementation of Conditional Payment Methods

Okay, so you’ve got your WooCommerce store humming along, but now you want to get smarter about how people pay. It’s not just about having payment options; it’s about showing the right options to the right people at the right time. This is where strategic implementation really shines.

Customizing Payment Options by Customer Locale

Think about it: someone in Japan probably has different payment habits than someone in Germany. Maybe Cash on Delivery (COD) is huge in one place, while a specific local e-wallet dominates another. Showing them payment methods they actually use and trust makes a huge difference. If your store doesn’t offer what they expect, they’ll likely just leave. Plugins can help here by looking at where your customer is browsing from and then showing them a tailored list of payment gateways. It’s like having a local shop assistant for every visitor.

Leveraging Cart Subtotal for Payment Gateways

This is a neat trick. You can actually show or hide payment methods based on how much is in the customer’s cart. For example, maybe for smaller orders, you want to push a payment method that has lower transaction fees for you. Or, perhaps for larger, more expensive orders, you want to make sure only your most secure, verified payment options are available. It’s a way to manage risk and costs without making it obvious to the customer.

Here’s a quick look at how you might set that up:

- Condition: Cart Subtotal is greater than $100

- Action: Show Payment Gateway A (e.g., for higher-value, secure transactions)

- Condition: Cart Subtotal is less than $100

- Action: Show Payment Gateway B (e.g., a popular, lower-fee option)

Adapting Payments Based on Shipping Class

This one gets a bit more specific. Sometimes, the way you ship an item might influence the best payment method. For instance, if you’re shipping a fragile item that requires special handling and insurance, you might want to ensure a payment method is used that offers robust buyer and seller protection. Or, if you’re offering local pickup, you might want to enable a ‘Pay on Pickup’ option. By linking payment methods to shipping classes, you add another layer of control and customer convenience, making the checkout process feel more relevant to their specific order.

It’s all about making the payment step feel less like a hurdle and more like a natural part of their shopping journey.

Ensuring Secure and Compliant Transactions

When you start accepting payments from customers all over the world, security and following the rules become really important. It’s not just about making a sale; it’s about protecting your customers’ information and your business.

Mitigating Risks with Robust Security Measures

Dealing with payments online, especially across borders, opens up a few risks. You want to make sure that customer data is handled with care. This means using strong security practices. Think about things like encrypting sensitive information so it can’t be read if it falls into the wrong hands. Also, using secure tokens for transactions helps a lot. These measures build confidence with your buyers. For example, merchants using the PayPal Payments plugin should look into enabling specific features to guard against card-testing attacks and stay compliant with relevant regulations.

Here are some key security steps:

- Data Encryption: Make sure all sensitive customer data is scrambled so it’s unreadable to unauthorized parties.

- Secure Payment Gateways: Use reputable payment processors that have strong security protocols in place.

- Regular Security Audits: Periodically check your systems for any vulnerabilities that could be exploited.

- Fraud Detection Tools: Implement systems that can flag suspicious transactions before they cause problems.

Adhering to Global Payment Regulations

Different countries have their own sets of rules for online payments. Not following these can lead to trouble, like fines or other penalties. It’s a lot to keep track of, but it’s necessary for doing business internationally. Things like PCI DSS compliance are standard for handling credit card information. Staying on top of these requirements means your store is seen as a safe and reliable place to shop.

Key areas to focus on for compliance:

- PCI DSS: This is a set of standards designed to protect cardholder data.

- GDPR: If you have customers in the EU, you need to be aware of data privacy rules.

- Local Tax Laws: Understand how taxes apply to sales in different regions.

Building Customer Trust Through Secure Gateways

Ultimately, customers want to feel safe when they buy from you. When they see that you take security seriously and follow all the necessary rules, they are more likely to complete their purchase and come back again. A secure checkout process is a big part of giving customers a good experience. It shows you value their business and their personal information. This trust is what keeps customers coming back and helps your business grow internationally.

Maximizing Conversions with Payment Limitations

Sometimes, limiting your options can actually lead to more sales. It sounds a bit backward, right? But when it comes to payments in WooCommerce, being strategic about which methods you show and when can really make a difference in getting customers to complete their purchase. It’s all about making things easier and more relevant for them.

Reducing Cart Abandonment with Preferred Methods

Think about it: if a customer gets to checkout and the payment options aren’t what they expect or prefer, they might just leave. This is a huge reason for cart abandonment. By using conditional payments, you can make sure that only the most relevant payment methods are shown to specific customers. For example, if you know customers from a certain country almost always use a particular digital wallet, you can prioritize showing that option to them. This removes friction and makes the checkout process feel smoother.

- Show the most popular payment methods first for each region.

- Hide payment options that are rarely used or have high processing fees for certain customer groups.

- Ensure mobile-friendly payment options are displayed prominently on mobile devices.

Encouraging Specific Payment Gateway Usage

There might be reasons you want to steer customers towards certain payment gateways. Maybe one has lower transaction fees, or perhaps it offers better fraud protection for your business. With conditional payments, you can set rules to encourage this. You could even offer a small discount for using a specific payment method, making it a win-win for both you and the customer.

Here’s a quick look at how you might set this up:

| Condition | Payment Method Offered | Incentive (Optional) | Goal |

|---|---|---|---|

| Customer in USA | Stripe, PayPal | None | Broad acceptance |

| Cart subtotal > $100 | PayPal Credit | 5% off | Increase average order value |

| Customer uses mobile | Apple Pay, Google Pay | None | Faster checkout on mobile |

| Specific product in cart | Bank Transfer | None | Avoids chargebacks on high-value items |

Boosting Sales Through Strategic Payment Incentives

Beyond just showing the right options, you can actively use payment methods as a tool to boost sales. Offering a small discount for using a particular payment gateway can be a powerful incentive. This not only encourages checkout completion but can also help you manage costs if certain gateways are cheaper for you. It’s a smart way to guide customer behavior without being pushy. Remember to keep these offers clear and easy to understand so customers don’t get confused at the final step.

Expanding Reach with Diverse Payment Gateways

Reaching customers all over the world means you need to speak their payment language, so to speak. It’s not enough to just offer Visa and Mastercard anymore. Different countries have different favorite ways to pay, and if you don’t offer them, you’re basically leaving money on the table. Think about it: someone in Japan might prefer cash on delivery, while someone in Germany might be all about Sofort. If your store only shows a few options, they might just click away.

Offering a variety of payment methods is key to making sales across borders. It shows you understand your customers and are willing to make things easy for them. This isn’t just about being nice; it directly impacts your sales figures. When people can pay the way they want, they’re much more likely to complete their purchase.

Here’s a quick look at why this matters:

- Wider Customer Base: More payment options mean more people can buy from you, no matter where they are or how they like to pay.

- Better Customer Experience: A smooth checkout process, with familiar payment choices, makes shoppers happy and encourages them to come back.

- Increased Sales: When it’s easy to pay, people buy more. It’s that simple.

Integrating popular payment gateways is also a big part of this. Services like Stripe and PayPal are well-known and trusted globally. Making sure your WooCommerce store works smoothly with these can really help build confidence. For example, using a plugin that supports many gateways means you can easily add new ones as your business grows or as new popular options emerge in different regions. This flexibility is what allows you to truly serve a global customer base without getting bogged down in technical details. It’s about making your store accessible and convenient for everyone, everywhere. You can even look into how payment tokens are managed for secure transactions, which is a big plus for international shoppers WooCommerce 2.6 features a Payment Token API.

Think about the different types of payments you could support:

- Credit and Debit Cards (Visa, Mastercard, American Express)

- Digital Wallets (PayPal, Google Pay, Apple Pay)

- Bank Transfers

- Buy Now, Pay Later services

- Local payment methods specific to certain countries

Advanced Strategies for Conditional Payments

Beyond the basics, there are some really smart ways to use conditional payments to make your WooCommerce store work better for you and your customers. It’s not just about showing or hiding options; it’s about guiding behavior and saving money.

Payment Method-Based Discounts for Lower Fees

This is a neat trick. You know how some payment gateways charge you more than others? You can actually give customers a small discount if they choose a payment method that’s cheaper for you. It’s a win-win. They get a little off their order, and you save on fees. It’s a simple way to nudge people towards options that are better for your bottom line.

For example, you could set up a rule like: "Get 2% off your order if you pay with Bank Transfer." This encourages customers to use methods that might have lower processing costs compared to, say, a credit card payment.

Here’s how it might look:

- Condition: Customer selects a specific payment method (e.g., Bank Transfer, Check Payments).

- Action: Apply a percentage discount (e.g., 1-5%) to the order total.

- Benefit: Reduces transaction fees for the business, potentially increases use of less common but cheaper payment methods.

Incentivizing Specific Payment Options

This goes a bit beyond just saving on fees. Sometimes, you might want to promote a newer payment method you’ve added, or one that offers better buyer protection. You can offer a small incentive, like a discount or even free expedited shipping, if they use that particular option. It helps customers discover and trust new ways to pay.

Think about it: if you just added a new digital wallet option, offering a "5% off when you pay with [New Wallet]" can get people to try it out. Once they see how easy it is, they might stick with it. It’s a good way to build familiarity and encourage adoption without being pushy.

Streamlining Transactions for Operational Efficiency

Conditional payments can also help make your day-to-day operations smoother. For instance, if certain products are bulky or require special handling, you might want to restrict certain payment methods for those specific items. This prevents issues down the line, like a customer choosing a payment method that doesn’t align with your shipping process for that particular product.

Another angle is using conditional payments to manage cash flow. If you have a lot of high-value orders, you might want to encourage payment methods that clear funds faster or have less risk of chargebacks. This isn’t about limiting choices unfairly, but about aligning payment methods with the practicalities of running your business and managing your money effectively.

Wrapping Up Your Global Payment Strategy

So, we’ve gone over how to make your WooCommerce store work better for everyone, no matter where they’re shopping from. Using tools like conditional payments really helps smooth things out, especially when you’re dealing with different countries. It’s all about making it easy for customers to pay you, reducing headaches for you, and ultimately, helping your business grow. Don’t overthink it; start with what makes sense for your store and your customers. Getting these payment details right can make a big difference.

Frequently Asked Questions

What are conditional payments in WooCommerce?

Conditional payments are like special rules for how customers can pay. You can set them up so certain payment options only show up if specific things are true. For example, maybe you only want to show ‘Cash on Delivery’ if the customer is in a certain country, or perhaps you want to offer a discount if they pay with a specific method.

Why should I use conditional payments for my online store?

Using conditional payments can make your store work better for everyone. It helps you avoid problems with payments from different countries, makes sure customers see payment options they like and trust, and can even help you save money on fees by guiding people to cheaper payment methods. It’s all about making shopping easier and safer.

How do conditional payments help with international sales?

When selling to people in other countries, they might have different favorite ways to pay. Conditional payments let you show them the payment options that are popular and work best in their country. This makes it much easier for them to buy from you, which means more sales for your business.

Can conditional payments help reduce the number of abandoned carts?

Yes, absolutely! If a customer gets all the way to checkout and then can’t find a payment method they like or trust, they might leave. By showing them the right payment options at the right time, conditional payments make the checkout process smoother and less frustrating, which can stop customers from giving up.

Are conditional payments safe to use?

Safety is super important! Conditional payment tools, especially those that work with WooCommerce, are built with security in mind. They use things like encryption to protect customer payment details and follow rules to keep transactions safe. This helps build trust with your customers, so they feel good about buying from you.

Do I need special software to set up conditional payments?

Usually, you’ll need a special add-on or ‘plugin’ for your WooCommerce store. These plugins are like tools that give you the power to create and manage these payment rules. They make it easier to set conditions based on things like where the customer is, how much they’re spending, or what they’re buying.