Running a business online can be a real balancing act, especially when it comes to getting paid. For those selling to other businesses, the usual ways of handling money can feel slow and costly. Think about those credit card fees eating into your profits or waiting ages for checks to clear. Shopify has been stepping up its game for B2B sales, and a big part of that is making payments smoother. Now, you can integrate ACH payments directly into Shopify Payments, which could really change how your business handles transactions.

Key Takeaways

- ACH, or Automated Clearing House, is a direct bank-to-bank transfer system that’s great for business-to-business (B2B) transactions, offering a more direct and often cheaper way to move money compared to traditional methods.

- Integrating shopify ach payments is now a native feature within Shopify Payments for eligible U.S.-based Shopify Plus merchants, meaning no extra plugins are needed for a cleaner setup.

- Activating ACH Direct Debit requires meeting specific criteria, including being on Shopify Plus, selling in USD, and having a verified Shopify Payments account, with availability limited to B2B orders.

- Customers paying via ACH go through a secure bank verification process, and while the order status shows as ‘Pending’ during the transfer, the process is automated and generally reliable.

- Faster ACH settlement options, like Same-Day ACH, can significantly improve business cash flow, allowing for quicker access to funds for reinvestment and smoother operations, while understanding potential processing delays and dispute procedures is key to managing expectations and trust.

Understanding Shopify ACH Payments

What is Automated Clearing House (ACH)?

Automated Clearing House, or ACH, is basically the digital plumbing that lets money move between bank accounts in the United States. Think of it as the quiet, behind-the-scenes system that handles things like your paycheck direct deposit, recurring bill payments, and general business transfers every single day. It’s a secure network managed by Nacha, and it’s been around for a while, making electronic fund transfers pretty standard.

Why ACH is Essential for B2B Transactions

For businesses selling to other businesses, ACH isn’t just another payment option; it’s a way to handle larger sums of money more efficiently. Traditional methods like credit cards often come with higher fees that eat into your profits, especially on big orders. ACH cuts out a lot of that friction. It allows for direct bank-to-bank transfers, which can be much cheaper and more predictable for substantial transactions. This makes it a solid choice for companies that are used to dealing with significant amounts and want a reliable way to get paid.

ACH vs. Traditional Payment Methods

When you compare ACH to other ways of getting paid, the differences become pretty clear. Credit cards offer instant confirmation, which is nice, but they usually have processing fees that can add up quickly, sometimes 2-3% or more. Checks, well, they still exist, but they involve manual processing, potential delays, and the risk of bouncing. ACH sits in a different spot. It takes a bit longer for the money to move, usually a few business days, but the fees are significantly lower, and it’s all handled electronically. This makes it a good middle ground for B2B sales where cost and security are more important than immediate confirmation.

Here’s a quick look:

| Payment Method | Typical Fees | Speed | Best For |

|---|---|---|---|

| Credit Card | 2-3%+ | Instant | Small, retail purchases |

| Check | Low (if any) | Slow (days/weeks) | Very small businesses, manual processes |

| ACH Transfer | Low (fixed fee) | 2-4 business days | B2B, large transactions, recurring payments |

Integrating ACH Direct Debit into Shopify Payments

Native Integration: No Third-Party Plugins Needed

Forget about hunting for extra apps or hiring someone to code a connection. Shopify has built ACH Direct Debit right into its payment system. This means you don’t need to add any new plugins to your store. Everything you need is already there, waiting for you to turn it on. It’s like finding a feature you didn’t know you had, but it’s actually super useful.

How ACH Fits Within Shopify Payments

Think of Shopify Payments as the central hub for all your transactions. When you enable ACH Direct Debit, you’re not introducing a separate system that needs to learn how your business works. Instead, you’re activating a payment method that’s designed to work with the order, payout, and refund processes you already use. It’s already aware of your business’s flow, so it fits in without a fuss. This makes managing payments feel much more straightforward.

The Benefits of a Seamless Integration

When ACH is part of Shopify Payments, the whole process feels smoother for everyone. For you, it means less administrative work and a more unified view of your finances. For your customers, especially B2B buyers, it offers a familiar and secure way to pay directly from their bank accounts. This kind of integration helps build trust and makes larger transactions feel less complicated.

Here’s what makes this integration so good:

- Simplicity: No extra software to install or manage.

- Consistency: Works with your existing Shopify order and payout system.

- Security: Leverages the built-in security of Shopify Payments and the ACH network.

- Efficiency: Reduces the steps needed to accept bank transfers.

Activating Shopify ACH Payments for Your Business

So, you’ve decided ACH payments are the way to go for your business-to-business sales. That’s a smart move, especially if you’re dealing with larger orders and want to streamline how money moves. But not every Shopify store can just flip a switch and start taking ACH. Shopify has some benchmarks in place, and honestly, that’s a good thing. It keeps things secure and predictable for everyone involved.

Eligibility Requirements for ACH Direct Debit

Before you can even think about turning on ACH, your store needs to meet a few clear requirements. Think of these as signals that your operation is stable and ready for direct bank transfers. You’ll need to be on the Shopify Plus plan, and your business needs to be based in the United States, with all transactions happening in U.S. dollars. Shopify also looks for a history of at least a hundred fulfilled orders and that your Shopify Payments account has completed identity verification. These aren’t just random numbers; they show that your business is established and trusted enough to handle funds directly between bank accounts. If you’re not on Shopify Plus yet, it might be time to consider migrating to get access to these kinds of advanced features. Remember, ACH is specifically for B2B orders, not your everyday retail checkout. It’s built for business buyers who expect to pay from their company bank accounts.

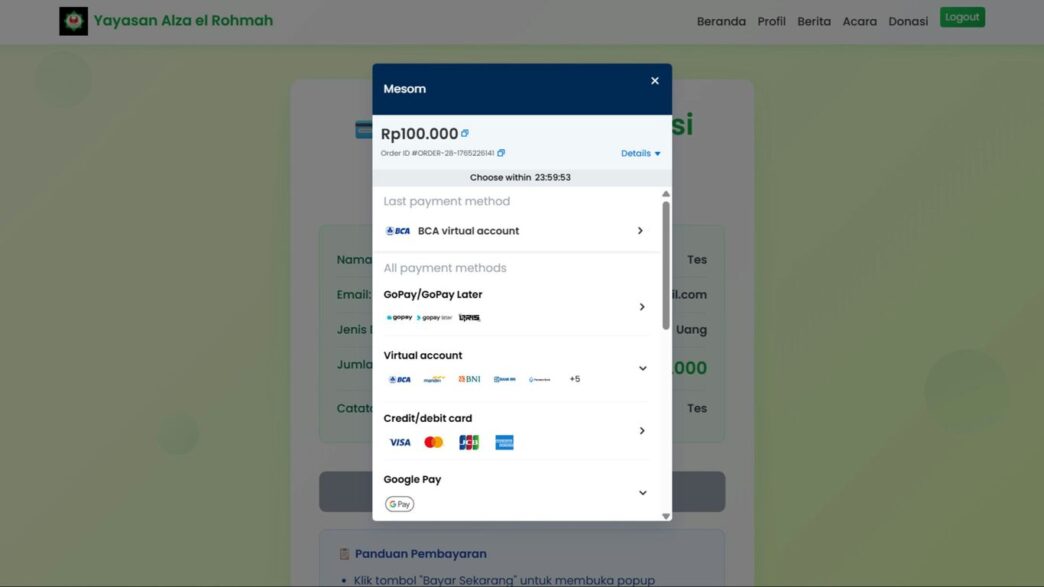

Step-by-Step Activation Guide

Once your store meets the criteria, turning on ACH is surprisingly straightforward. It’s all handled right within your Shopify admin panel, so no need for extra plugins or complicated setups. Here’s how you do it:

- Navigate to Payments: Head into your Shopify admin and go to

Settings→Payments. From there, click onManageunder Shopify Payments. - Find Local Payment Methods: Scroll down until you see the section labeled

Local Payment Methods. You should spotACH Direct Debitlisted there. - Enable and Save: Click to enable ACH Direct Debit. Then, just hit

Save. That’s pretty much it!

Shopify will immediately add ACH as a payment option for your verified business customers. There’s no lengthy approval process or complex connection to make. It’s designed to be a native feature that fits right into your existing flow. If you’re expanding your store’s backend capabilities, our Shopify Plus development team can help customize payment or B2B checkout workflows. Learn more about Shopify Plus.

Ensuring B2B Transaction Readiness

Turning on ACH is more than just a technical step; it’s about signaling that your business is ready to operate with the professionalism that large B2B transactions demand. When a customer chooses ACH at checkout, Shopify guides them through a secure bank account verification process. They’ll log in to their bank, confirm ownership, and approve the transaction. After that, the order status will show as ‘Pending’ while the funds transfer. It’s important to communicate this to your customers so they understand the process. Running a quick test order before you fully roll it out is also a good idea. Place a small order using a test buyer or a trusted client profile and select ACH at checkout to see how it works from start to finish. This helps you get comfortable with the flow and identify any potential hiccups before they affect real sales.

The Customer Experience with Shopify ACH Payments

When your customers choose ACH to pay for their orders, it’s a pretty straightforward process for them, even though there’s a bit more going on behind the scenes than with a credit card. It’s designed to feel secure and professional, which is exactly what B2B buyers are looking for.

Secure Bank Account Verification Process

First off, the customer will need to link their bank account. Shopify makes this simple and safe. They’ll be guided through a process where they log directly into their bank’s online portal. This isn’t about sharing login details with you or even Shopify directly; it’s a secure connection facilitated by trusted third-party services. Think of it like using your bank’s own app to confirm it’s really you. This step is key to making sure the payment is authorized by the account holder and helps prevent fraud. It usually only takes a few minutes to complete.

Understanding Order Status During Transfer

Once the customer authorizes the payment, you’ll notice the order status change to ‘Pending’ in your Shopify admin. This doesn’t mean anything is wrong. It simply indicates that the funds are moving from the customer’s bank account to yours through the Automated Clearing House (ACH) network. This is the standard banking system at work, and it takes a little time. While it’s not instant like a credit card, it’s a reliable way to move money, especially for larger B2B transactions. You can reassure your customers that ‘Pending’ just means the payment is in transit and will be processed shortly. For a better grasp of how payments are handled, check out the details on Shopify Payments.

Managing Expectations for Payment Clearance

It’s important to set the right expectations with your customers regarding how long ACH payments take to clear. Typically, funds are transferred within two to four business days. Once the payment is confirmed, Shopify will automatically update the order status to ‘Paid’, and the funds will be included in your regular payout schedule. To help manage this, consider updating your checkout messaging or order confirmation emails to mention the ACH processing timeframe. This transparency helps avoid confusion and builds trust. Here’s a quick rundown of what happens:

- Authorization: Customer logs into their bank to approve the payment.

- Pending Status: Order shows as ‘Pending’ while funds transfer.

- Clearance: Funds arrive in your account within 2-4 business days.

- Order Update: Shopify automatically changes status to ‘Paid’.

- Payout: Funds are included in your next scheduled payout.

Optimizing Cash Flow with Faster ACH Settlements

When you’re running a business, having cash available when you need it is pretty important, right? ACH payments, while not instant like credit cards, offer a predictable way to get paid. The real magic happens when you can speed up how quickly that money actually shows up in your bank account. This isn’t just about getting paid faster; it’s about having more flexibility to run your business day-to-day.

The Advantages of Same-Day ACH

While standard ACH can take a couple of business days to clear, there’s a faster option available: Same-Day ACH. This means funds can be transferred and available in your account on the same business day. Think about what that means for your operations. Instead of waiting, you can potentially use those funds almost immediately.

Here’s a quick look at how Same-Day ACH can help:

- Immediate Fund Access: Get your revenue into your account the same day you make the sale. This is a big deal for managing immediate expenses.

- Improved Operational Flow: With faster access to cash, you can pay suppliers promptly, cover payroll without stress, or reinvest in inventory sooner.

- Reduced Reliance on Credit: Less need to rely on short-term loans or credit lines just to bridge payment gaps.

Improving Business Flexibility with Rapid Funds Access

Having your money move faster gives you more wiggle room. You’re not constantly playing catch-up or worrying about whether a payment will clear in time for a bill. This kind of predictability lets you plan better and react quicker to opportunities or unexpected costs. It’s like having a smoother engine for your business – everything just runs better.

- Quicker Reinvestment: See a great deal on supplies? With faster funds, you can jump on it. Need to ramp up production? The cash is there.

- Smoother Payroll: No more anxiously checking bank balances before payday. ACH settlements, especially same-day ones, make payroll a non-issue.

- Better Supplier Relationships: Paying your vendors on time, every time, builds goodwill and can even lead to better terms down the line.

Enhancing Customer Experience Through Efficient Processing

It might seem like faster settlements are just about your business, but it actually impacts your customers too. When you have quick access to funds, you can process orders faster. This means less waiting for your customers, quicker shipping, and a generally more positive buying experience. Happy customers tend to come back, and that’s good for business in the long run. It’s a win-win: you get your money faster, and they get their products sooner.

Managing Transactions and Potential Issues

So, you’ve got ACH payments rolling in through Shopify. That’s great! But like anything in business, things don’t always go perfectly. Let’s talk about what happens when payments take a bit longer, or worse, when they don’t go through at all. It’s all part of the process, and knowing how to handle it keeps your business running smoothly.

Understanding ACH Processing Times

ACH payments aren’t instant. Think of them more like a carefully planned delivery than a quick text message. There are a few stages involved, and each takes a little time.

- Verification: This is where the customer confirms their bank details. It’s usually pretty quick and handled by the bank itself.

- Processing: This is the main event, where the money actually moves between banks. This can take anywhere from 1 to 4 business days. During this time, your order will likely show as ‘pending’ in Shopify.

- Settlement: Finally, the funds land in your account, and Shopify updates the order status to ‘Paid’.

It’s really important to remember that these are business days. Weekends and holidays don’t count, so a payment initiated on a Friday might not fully clear until the following Wednesday or Thursday.

Handling Payment Failures and Disputes

Sometimes, an ACH payment just doesn’t clear. This can happen for a few reasons:

- Insufficient Funds: The customer’s bank account doesn’t have enough money to cover the transaction. This is probably the most common reason.

- Bank Review: The customer’s bank might put a hold on the transaction for review, especially for larger amounts or if it looks unusual.

- Incorrect Information: Though less common with verification, errors can still happen.

When a payment fails, Shopify will usually notify you. You’ll need to reach out to the customer to figure out what went wrong and see if they can resubmit the payment. There might also be a small fee associated with a failed payment or a dispute, so it’s good to be aware of that. Don’t ship orders until the payment has fully cleared and the order status is ‘Paid’ in Shopify. This one habit can save you a lot of headaches and protect your cash flow.

Maintaining Trust and Protecting Cash Flow

Dealing with payment issues can be tricky, but how you handle them makes a big difference.

- Communicate Clearly: Let your customers know upfront that ACH payments take a few business days to process. A simple note at checkout or in your confirmation email goes a long way.

- Hold Shipments: As mentioned, it’s best practice to wait until the payment has fully settled before shipping out goods. This is your first line of defense against potential losses.

- Be Patient and Professional: When a payment fails, approach the customer with understanding. They might be embarrassed or frustrated too. A calm, helpful tone can de-escalate the situation and encourage them to resolve the issue.

- Review Patterns: Over time, you’ll start to see patterns. Some customers might consistently pay on time, while others might have occasional issues. This information can help you manage your accounts and credit terms more effectively for repeat business.

By understanding the ACH process and having a plan for when things go sideways, you can keep your business finances stable and your customer relationships strong.

Wrapping Up: Making Payments Work for Your Business

So, bringing ACH payments into your Shopify store, especially for B2B sales, really just makes good sense. It cuts down on those annoying fees you get with cards and stops those payment delays that mess with your cash flow. It’s not some complicated tech thing; it’s just a cleaner, more direct way for businesses to pay each other. Once you get it set up, which is surprisingly simple inside Shopify Payments, it just works in the background. Your customers get a professional way to pay, and you get your money faster and with fewer headaches. It’s about making your online store feel more like a solid, reliable business partner, which is exactly what you want when you’re dealing with bigger orders.

Frequently Asked Questions

What exactly is ACH, and how does it work with Shopify?

ACH stands for Automated Clearing House. Think of it as a digital system that lets banks move money directly between accounts in the U.S. Shopify has built this right into its payment system, so businesses can accept payments straight from a customer’s bank account. It’s like a secure pipeline for money, cutting out extra steps.

Why is ACH particularly good for businesses selling to other businesses (B2B)?

B2B sales often involve larger amounts. ACH is great because it handles these big payments without the high fees that credit cards charge. It’s also more reliable for regular business transactions, making it easier to manage invoices and get paid without the hassle of checks or waiting for card approvals.

How do I set up ACH payments on my Shopify store?

It’s pretty straightforward if your store is eligible! You usually need to be on Shopify Plus, based in the U.S., and meet a few other requirements. Once you’re ready, you just go to your Shopify admin settings, find Shopify Payments, and toggle on the ACH Direct Debit option. Shopify handles the rest.

What happens after a customer pays using ACH?

After a customer pays with ACH, the money doesn’t appear instantly. It takes a few business days to move between banks. Your order will show as ‘Pending’ in Shopify during this time. Once the payment clears, Shopify will update the order to ‘Paid,’ and you’ll get your funds according to your usual Shopify Payments schedule.

Can ACH payments ever fail, and what happens if they do?

Yes, sometimes ACH payments can fail, maybe if there isn’t enough money in the customer’s account. If this happens, Shopify might charge a small fee. There’s also a fee if a customer disputes the charge and wins. While it’s not common, it’s good to be aware of these possibilities.

Is ACH faster than other payment methods?

ACH isn’t instant like a credit card. It typically takes 2-4 business days to clear. However, there’s also ‘Same-Day ACH’ which is much faster. The benefit of standard ACH is its lower cost and reliability for larger business transactions, even with the slight delay. It offers a good balance for B2B sales.