1. Nvidia

When you think about the tech powering robots, Nvidia (NVDA) is probably one of the first names that comes to mind. They’re not exactly building the robots themselves, but they make the super-powerful computer chips – think GPUs – that act like the brains for these machines. These chips are what allow robots to process information super fast, which is pretty important if you want them to see, learn, and make decisions on the fly.

Nvidia has this lineup called "Jetson" modules. They come with built-in AI and machine learning stuff, and companies are using them for all sorts of things, from factory robots and medical equipment to even self-driving cars. It’s like giving robots the ability to understand what’s around them and react in real-time. They’ve also got this "Omniverse" technology that helps companies design and test out robotic factories and new kinds of collaborative robots. The idea is to help businesses deal with worker shortages and bring more manufacturing back home.

Here’s a quick look at some key Nvidia data:

| Metric | Value |

|---|---|

| Market Cap | ~$450 Billion |

| Current Price | ~$185.55 |

| Gross Margin | ~70.05% |

| Dividend Yield | ~0.02% |

Basically, Nvidia is providing the core technology that makes a lot of advanced robotics possible. They’re a big deal in the AI chip world, and that’s directly translating into their importance for the robotics industry. It seems like they’re set up to keep playing a major role as robots get smarter and more common.

2. Intuitive Surgical

When you think about robots in medicine, Intuitive Surgical is probably the first company that comes to mind. They’re the ones behind the da Vinci Surgical System, which has been around for a while now, helping surgeons do all sorts of complex procedures with more precision. It’s pretty wild to think about, but these robots allow for minimally invasive surgeries, meaning smaller cuts, quicker recovery times for patients, and generally better results.

What’s really interesting is that even though they’ve been around since 2000, they’re still very much in a growth phase. Most surgeries today aren’t done with robotic help, so there’s a huge opportunity for Intuitive to keep improving their systems and find ways to use them for even more types of operations. They’ve also got this Ion system for lung procedures, which is another area they’re expanding into. Their business model is pretty solid too; once a hospital buys a da Vinci system, Intuitive keeps making money from selling disposable instruments and providing services and support.

Here’s a quick look at some key aspects:

- Global Reach: The da Vinci system is installed in hospitals all over the world, with tens of thousands of systems out there and millions of procedures already completed.

- Innovation Pipeline: They’re not just resting on their laurels. Intuitive is constantly working on new versions of the da Vinci, like the SP and X models, and adding new software features, including AI tools for training and data analysis.

- Recurring Revenue: A big part of their financial strength comes from the ongoing sales of instruments and service contracts, which provides a steady income stream.

While they’re not exactly a cheap stock, a lot of people in the market believe Intuitive’s strong position and ongoing innovation in surgical robotics make it a good long-term bet. They’ve got a pretty big lead over competitors, and that’s likely to continue into 2026.

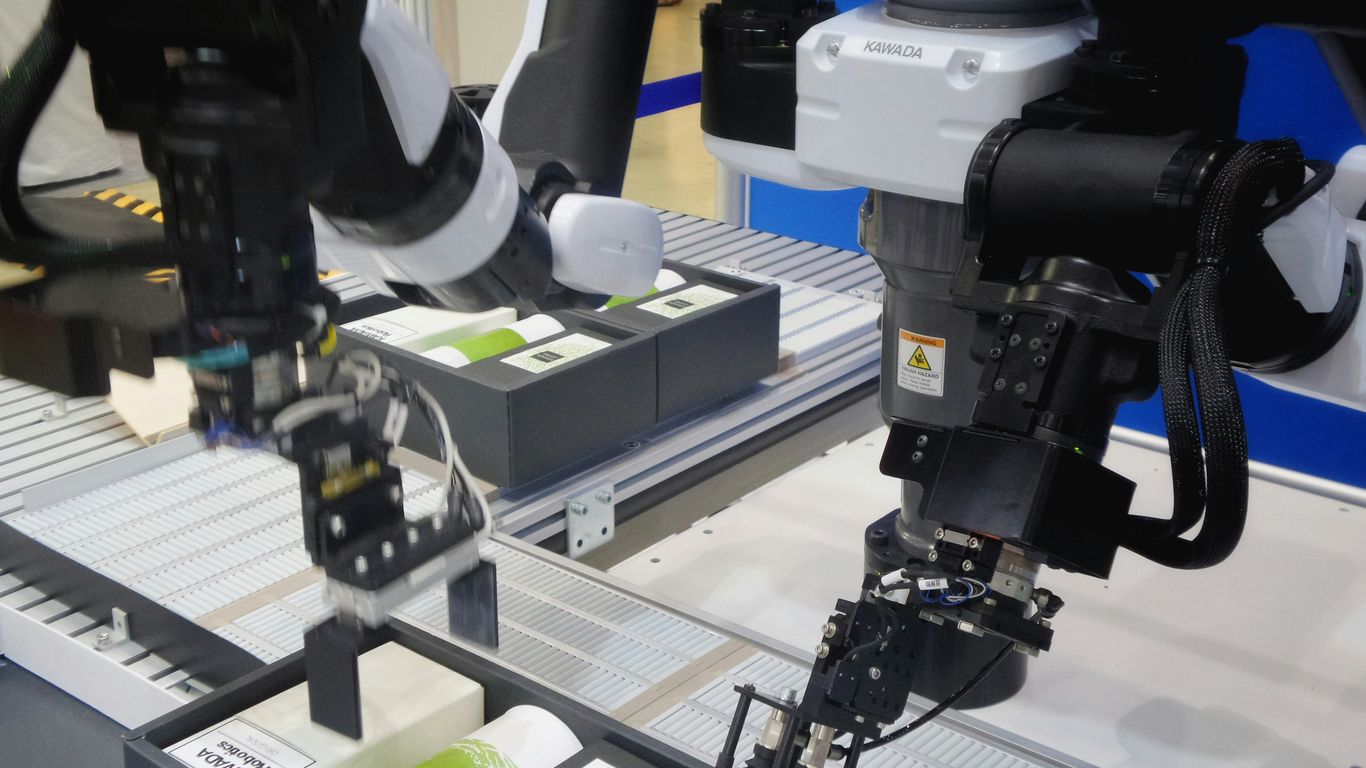

3. Rockwell Automation

Rockwell Automation is a big name in industrial tech. They make the systems, parts, and software that help factories build smarter, more efficient machines. Think of them as the folks who provide the ‘brains’ for a lot of automated processes. Their gear is used everywhere, from making food and drinks to building cars and handling chemicals.

While the industries Rockwell serves aren’t exactly new and shiny, the company is a leader in robotics and the IT services that go with it. They’ve even started using Nvidia’s software to bring AI into their Otto autonomous mobile robots, which are now rolling out in manufacturing plants. It’s a pretty big step for them.

Here’s a quick look at some key data:

| Metric | Value |

|---|---|

| Market Cap | $45 Billion |

| Dividend Yield | 1.32% |

| Gross Margin | 42.22% |

Rockwell’s focus on digital upgrades and software is paying off. They’re seeing good demand for their automation solutions, which is a positive sign for their future growth.

4. Teradyne

Teradyne might not be the first name that pops into your head when you think of robots, but they’re a pretty big deal behind the scenes. They make the equipment that helps other companies automate repetitive tasks, especially in making electronics. Think about testing all those tiny components in your phone or computer – that’s a super tedious job, and Teradyne’s gear helps speed it up and make it more accurate.

What’s really interesting is how they’ve expanded into robotics. They own Universal Robots, which is a major player in collaborative robots, or ‘cobots.’ These are the robots designed to work alongside people on assembly lines. They also bought Mobile Industrial Robots (MiR), which makes those self-driving bots you see zipping around warehouses. So, Teradyne is playing in both the factory automation and logistics spaces.

Here’s a quick look at their robotics segment:

- Universal Robots (UR): A leader in cobots, used for tasks like welding and assembly.

- Mobile Industrial Robots (MiR): Focuses on autonomous mobile robots for moving materials in factories and warehouses.

- AI Integration: Teradyne is putting AI into its robots, like their ‘Physical AI’ solutions, so they can better understand and react to their surroundings.

Teradyne’s strategy seems to be about providing the tools that enable automation across different industries, from chip testing to factory floors. It’s a bit of a "picks and shovels" play in the automation gold rush, meaning they supply the essential equipment rather than the end-user robots themselves. This diversified approach, combining their established test equipment business with growing robotics ventures, positions them well for continued growth as more companies embrace automation.

5. Trimble

Trimble is really making waves in the construction world, especially with how they’re using robots to get things done faster and smarter. They’ve been pushing hard on this front, and it looks like it’s paying off. Back in November, they showed off a new AI platform called Agent Studio. The idea is to make workflows in construction sites more intelligent and automated. Think of it as giving robots and software the ability to figure things out on their own.

They also beefed up their Trimble Marketplace with over 100 new integrations, many of them using AI. One cool feature they highlighted is ProjectSight 360 Capture, which automatically matches panoramic photos to project plans. That’s a huge time-saver for anyone trying to keep track of what’s happening on site.

Trimble’s also investing in companies that are all about autonomous surveying, like Civ Robotics. Plus, they’re rolling out more robotic total stations and using AI to help with layout tasks. All this seems to be working out well for them. In the third quarter, their revenue went up 11% to $901 million. A big chunk of that, 63%, comes from recurring services, which is always a good sign for steady income. With all this focus on AI and better positioning tech, Trimble seems set for more growth.

Here’s a quick look at some of their recent moves:

- Agent Studio Launch: An AI platform for smarter, autonomous construction workflows.

- Marketplace Expansion: Over 100 new AI-powered integrations, including automatic photo-to-plan mapping.

- Strategic Investments: Focus on autonomous surveying and AI-enhanced layout automation.

- Financials: 11% revenue growth in Q3, with 63% recurring revenue.

6. Deere & Company

When you think of farming, John Deere probably comes to mind. They’ve been making tractors and big green machines for ages. But they’re not just sticking to the old ways. Deere is putting a lot of money into automation, aiming to make their farm and construction equipment smarter and more efficient. They’ve been busy buying up companies that are good at this stuff, like Bear Flag Robotics a few years back to get their autonomous farming tech going, and more recently, SparkAI and Guss Automation. These moves are helping them build a solid platform for automation.

What does this mean for us? Well, they’re already selling fully automated tractors and sprayers. They’re also making self-driving mowers for folks who manage large commercial landscapes. It seems like Deere is really trying to get ahead in helping the agriculture and mining industries automate their operations. This could open up a huge new market for them, potentially worth over $150 billion. It’s a big shift from just selling equipment to selling smart, automated solutions.

Here’s a quick look at some of their recent moves:

- Acquisition of Bear Flag Robotics (2021): Boosted their autonomous farming capabilities.

- Acquisition of SparkAI (2023): Added real-time problem-solving for robots.

- Acquisition of Guss Automation (2025): Strengthened their position in crop automation.

Deere is betting big on making farming and construction more automated, and it looks like they’re well on their way to becoming a leader in this space.

7. ABB

ABB is a big name in industrial tech, and they’ve got a solid robotics division. Think of them as a global player that makes all sorts of equipment, from stuff for electric car chargers to tools for factories. They’re actually the second-largest industrial robotics company out there, right behind Fanuc. Their main products are robotic arms and the controllers that make them work, which are used everywhere from car plants to places making medicine. They also have software to help companies manage these robots and even see them in action using augmented reality.

It’s worth noting that ABB had plans to spin off its robotics unit, but that deal changed. They ended up selling it to Softbank for a pretty penny, with that deal expected to wrap up by the end of 2026. This move means Softbank will be taking the reins, aiming to build an even stronger robotics company by combining it with their own AI and computing tech.

Here’s a quick look at some key aspects:

- Robotic Arms and Controllers: The core of their industrial automation solutions.

- Management Software: Tools to help businesses oversee and optimize their robotic operations.

- Augmented Reality Visualization: A way to monitor robotic systems in real-time.

- Strategic Sale: The recent sale to Softbank signals a shift in their focus but highlights the value of their robotics business.

8. Zebra Technologies

Zebra Technologies might not be the first name that pops into your head when you think of cutting-edge robots, but they’re definitely a company to keep an eye on in the robotics and automation space, especially for logistics. They started out with barcode printers, which feels like ages ago, but they’ve really shifted gears. Now, they’re all about making warehouses and factories run smoother with tech.

Think about it: they make everything from the scanners that beep at the checkout to the fancy RFID tags that track inventory in real-time. But the big move for them was buying Fetch Robotics a few years back. That brought in autonomous mobile robots (AMRs) that can zip around warehouses, moving stuff and picking orders. When you combine those robots with Zebra’s tracking tech, you get these super-smart warehouses that can really speed things up. They also picked up Matrox Imaging, which adds machine vision – basically, helping robots ‘see’ better to do their jobs.

After a bit of a slow patch, Zebra saw a nice comeback in 2024. Their automation parts of the business, like mobile computers and scanners, grew a lot. They were expecting even more growth towards the end of the year as supply chains got back to normal. This turnaround really helped their stock price. Plus, they’re looking at buying more companies, like an AI firm and a touch-screen maker, which could add even more to their toolkit. They’re also working on improving their profits by managing costs better.

Here’s a quick look at what they offer:

- Warehouse AMRs: Robots for moving goods and picking items automatically.

- RFID Tracking: Systems that show you exactly where your stuff is, all the time.

- Machine Vision: Cameras and sensors that help guide robots and automate quality checks.

- Mobile Computers & Scanners: The tools workers use every day to scan, track, and manage information.

Zebra’s strategy is to tie all these pieces together, giving businesses a complete view of their operations and helping them be more productive. It’s a solid approach, especially with how much online shopping is growing and how companies are trying to make their supply chains more efficient.

9. Tesla

When you think robotics, Tesla might not be the first company that pops into your head, but maybe it should be. Sure, they make those electric cars, but Elon Musk has been pretty clear that Tesla is just as much an AI and robotics company as it is an automaker. They’ve got their Full Self-Driving (FSD) software, which is basically a robot driving a car, using a bunch of sensors and fancy AI to get around. It’s pretty wild to think about, and it puts them right in the mix for robotic vehicle tech.

But that’s not all. Tesla is also building this humanoid robot called ‘Optimus.’ They showed off a prototype a while back, and the idea is that it could eventually do jobs in factories or even in our homes. Musk has even said it might end up being worth more than their car business, which is a pretty bold statement. Plus, their own factories are packed with robots, so they know a thing or two about automation.

Here’s a quick look at where Tesla stands:

- Full Self-Driving (FSD): Uses AI and sensors for autonomous driving.

- Optimus Robot: A general-purpose humanoid robot in development.

- Manufacturing Automation: Extensive use of robotics in their Gigafactories.

Financially, Tesla has seen some ups and downs. Revenue has been growing, but they’ve also had to deal with lower car prices, which has squeezed their profit margins a bit. The stock has had a wild ride, partly because people are excited about AI and Tesla’s growth. If they make real progress with FSD or Optimus, it could open up new ways for them to make money. Some folks are really optimistic about Tesla’s chances in robotics by 2026, seeing Optimus as a potential game-changer. Others are a bit more cautious, pointing out that the robot still needed some help in a demo not too long ago. So, while the potential is huge, the exact timeline is still up in the air.

10. Serve Robotics

Serve Robotics is a company that’s really trying to make a splash in the whole on-demand delivery scene. They’ve got these little sidewalk robots, kind of like small rovers, that are designed to zip around and deliver food and other small packages. Think of them as the little helpers for the last mile of delivery, which can be a real headache for businesses.

Serve’s robots are built to handle the complexities of urban sidewalks, using AI and sensors to navigate safely. They can carry about 50 pounds, which is pretty decent for a quick delivery. The company went public in April 2024, and like many new tech companies, the stock has seen some ups and downs. By early 2025, it was down quite a bit from its initial offering price. But here’s the interesting part: their actual operations seem to be picking up steam. In 2024, they reported some massive revenue growth, even though it was from a small starting point. They’re also planning to have a whole lot of these robots out there by the end of 2025.

So, what’s the big picture here?

- The Market: There’s a growing need for contactless delivery and ways to make logistics cheaper. Serve’s robots fit right into that.

- Technology: They use AI for planning routes and avoiding things, and a cloud system to keep an eye on all the robots. Safety is a big focus to get approval from cities.

- Growth Potential: If they can keep putting more robots out there and work well with partners like Uber, their revenue could keep climbing. They’re a smaller company, so there’s room to grow, but that also means more risk.

It’s a bit of a gamble, for sure. Analysts are watching, and there’s excitement about the idea of robot delivery, but also caution because the company is still young and spending a lot. If Serve can pull it off and make their robot deliveries work smoothly and profitably, they could be a big deal in a few years. But it’s definitely one to watch closely.

Looking Ahead

So, as we wrap up our look at the robotics scene for 2026, it’s clear this field is really taking off. We’ve seen how companies are pushing forward with smarter machines, from factories to hospitals and even our homes. While picking the exact winners can be tricky, keeping an eye on the big players and the innovative newcomers we’ve discussed gives a good starting point. The technology is advancing fast, and it seems like robots are set to become an even bigger part of our lives and the economy. It’s definitely an area worth watching for anyone interested in where technology is headed.