Quantum computing is a pretty wild field, and honestly, it’s hard to keep up with all the buzz. It promises to solve problems that our current computers can’t even dream of tackling. Think about it – solving complex issues in medicine, finance, or even creating new materials. It’s like a whole new level of computing power is on the horizon. But with all this exciting potential, a big question for many people is: what is the best quantum computing stock to buy right now? It’s a bit of a maze, with big tech companies and smaller, specialized firms all playing in this space. Trying to figure out which one to put your money into can feel overwhelming, especially with how fast things are changing.

Key Takeaways

- Quantum computing uses qubits, which can be in multiple states at once, unlike classical computers’ bits (0 or 1). This allows them to tackle incredibly complex problems much faster.

- Major tech companies like Amazon, Alphabet, and Microsoft are heavily investing in quantum computing, often through their cloud services or by developing their own processors.

- Pure-play companies such as IonQ, Rigetti Computing, and D-Wave Quantum focus solely on quantum technology, each with different approaches like trapped ions or quantum annealing.

- Companies providing the ‘picks and shovels,’ like Nvidia for simulations and software platform developers, also stand to benefit significantly from the growth of quantum computing.

- Investing in quantum computing stocks involves high volatility and risk due to the emerging nature of the technology, but the long-term potential for transformative impact is substantial.

Understanding The Quantum Computing Landscape

Quantum computing. It sounds like something straight out of science fiction, right? But it’s actually becoming a real thing, and it’s poised to change a lot about how we do things. Think of it as a completely different way of computing, not just a faster version of what we have now. The real excitement comes from its potential to solve problems that are just impossible for even the most powerful supercomputers today.

The Promise of Quantum Supremacy

This is the big one. Quantum supremacy, or more accurately, quantum advantage, is that moment when a quantum computer can do something a classical computer simply can’t, no matter how much time you give it. We’re not quite there for most practical problems, but the progress is pretty amazing. Companies are racing to get there, and it’s not just about bragging rights. It means new discoveries in medicine, better materials, and maybe even solving climate change.

How Quantum Computing Differs From Classical Computing

Your laptop or phone uses bits, which are like light switches – either on (1) or off (0). Quantum computers use ‘qubits’. Now, qubits are way more interesting. They can be a 0, a 1, or, thanks to a quantum trick called superposition, they can be both at the same time. This might sound weird, but it means quantum computers can explore a huge number of possibilities all at once. Another quantum concept, entanglement, links qubits together so they act in sync, even when far apart. This allows for incredibly complex calculations.

Here’s a simple breakdown:

- Classical Bits: Either 0 or 1.

- Quantum Qubits: Can be 0, 1, or a mix of both (superposition).

- Entanglement: Qubits can be linked, influencing each other instantly.

The Accelerating Pace of Quantum Innovation

It feels like every few months, there’s a new announcement about a quantum breakthrough. Researchers are getting better at building more stable qubits and reducing errors. We’re seeing different types of quantum computers being developed, each with its own strengths. It’s a rapidly evolving field, and while it’s still early days, the pace of innovation is picking up speed. This means the technology is moving from pure research labs into more practical applications faster than many expected.

Identifying Key Players In The Quantum Race

The quantum computing world isn’t just a bunch of scientists in labs anymore. It’s a rapidly developing field with some big names and some exciting newcomers all trying to get ahead. Think of it like a race, and everyone’s trying to build the fastest, most powerful quantum machine.

Tech Giants Investing in Quantum Futures

Some of the biggest tech companies you know are pouring serious money and brainpower into quantum computing. They see it as the next big thing, something that could change everything from how we do research to how businesses operate. These companies have the resources to tackle the really tough problems, and they’re not afraid to take on long-term projects.

- IBM: They’ve been in tech for ages and have a solid track record. They’re putting a lot of quantum systems out there for businesses to use and have a software platform called Qiskit that a lot of people are using to build quantum programs. They seem to have a good handle on what companies actually need.

- Alphabet (Google): Remember when Google announced their Sycamore processor did something faster than a regular supercomputer? That got a lot of attention. They’re still working on making their quantum chips better, especially when it comes to reducing errors. With all their resources, they could really shake things up.

- Microsoft: Microsoft is taking a slightly different path, focusing on a type of qubit that’s supposed to be more stable and less prone to errors. They’re also building out their Azure Quantum cloud service, which is designed to work with different hardware makers. It’s a smart move to try and get businesses hooked on their platform.

Pure-Play Quantum Computing Companies

Besides the giants, there are companies that are only focused on quantum computing. These are the startups and specialized firms that are really pushing the boundaries with new ideas. They might not have the same deep pockets as the big tech players, but they’re often more agile and focused.

- IonQ: They’re known for their trapped-ion quantum computers. These systems are already available through cloud services, which is pretty cool. They’re aiming to connect their quantum computers, which could give them an edge down the road. They’re also working on real-world problems, like battery modeling for car companies.

- Rigetti Computing: Rigetti is doing a bit of everything, from making the quantum chips themselves to providing cloud services. This means they can move pretty fast with new ideas. They have a system that combines regular computers with quantum ones, making it easier for businesses to start experimenting.

- D-Wave Quantum: This company is focused on a specific type of quantum computing called quantum annealing. It’s good for certain kinds of problems, and they’ve been around for a while, working on making this technology more practical.

The Role of Cloud Infrastructure Providers

It’s not just about building the quantum computers themselves. Someone has to make them accessible to everyone else. That’s where cloud providers come in. They’re building platforms that let researchers and businesses access different types of quantum hardware without having to own and manage it all themselves. Amazon Braket, for example, is a service that gives you access to a bunch of different quantum computers and simulators all in one place. This makes it much easier for people to get started and try out quantum computing for their own projects. It’s like a one-stop shop for exploring quantum technology, and it’s a big reason why more people are starting to use these powerful machines. You can find a good overview of the best quantum computing stocks available in the U.S. market this year.

Analyzing Top Quantum Computing Stocks

When we talk about quantum computing stocks, it’s easy to get lost in the hype. This is a really new field, and a lot of the companies involved are still figuring out how to make money from their amazing technology. But some big players are making serious moves, and it’s worth looking at what they’re doing. These aren’t just startups with a dream; these are established companies with the resources to actually build the future.

Amazon’s Cloud-Centric Quantum Strategy

Amazon is playing a smart game with quantum computing, much like they did with cloud services. Instead of trying to build all the quantum computers themselves, they’re focusing on providing access through their Amazon Web Services (AWS) platform. Think of it like this: they’re building the highway, and other companies can drive their quantum cars on it. Their service, Amazon Braket, lets researchers and businesses experiment with different types of quantum hardware from various providers all in one place. This approach means Amazon benefits no matter which quantum technology ends up being the most successful. They’re positioning themselves as the essential middleman for quantum computing access. As more companies want to explore quantum applications, they’ll likely turn to AWS for its convenience and breadth of options. It’s a strategy that worked wonders for them in the traditional cloud space, and they’re hoping to repeat that success here. It’s a way to get involved without taking on all the direct hardware development risks. You can find more about their quantum initiatives on Amazon’s cloud services.

Alphabet’s Advancements in Quantum Processors

Alphabet, the parent company of Google, has been pushing the boundaries of quantum processor development. They’ve been in the news for achieving

Evaluating Pure-Play Quantum Computing Investments

When we talk about quantum computing, it’s easy to get caught up in the big tech names. But there are also companies that are putting all their chips on quantum, and these are often called ‘pure-play’ companies. They’re not just dabbling; this is their main gig. Investing in them can feel a bit more like a gamble, but the potential payoff could be huge if they hit it big. Let’s look at a few of these dedicated quantum players.

IonQ: A Trapped-Ion Innovator

IonQ is doing things a bit differently. Instead of the more common superconducting approach, they’re using something called trapped ions. Think of it like holding tiny charged atoms in place with electric fields. The cool part? This method can potentially work at room temperature, which could make things simpler and cheaper down the line. They’ve already got their systems available through big cloud services, and they’re working on connecting their quantum computers. This focus on a specific, potentially more accessible technology makes IonQ an interesting bet for direct exposure to quantum growth. They’ve even partnered with companies like Hyundai to look at things like battery modeling, showing they’re already finding real-world uses for their tech.

Rigetti Computing: A Full-Stack Quantum Leader

Rigetti is aiming to control the whole process, from making the quantum chips themselves to offering them as a service through the cloud. This ‘full-stack’ approach means they can move pretty fast with new ideas. They’re also big on hybrid systems, which combine quantum power with regular computers. This is seen as a practical way to start using quantum for actual problems today. Having their own factory to build chips gives them a lot of control, which is a big deal in this fast-moving field.

D-Wave Quantum: Specializing in Quantum Annealing

D-Wave is taking a different path, focusing on a type of quantum computing called quantum annealing. This isn’t for every kind of problem, but it’s really good at solving specific types of optimization challenges. Imagine trying to find the absolute best way to route delivery trucks or manage a complex financial portfolio – that’s where D-Wave’s machines shine. They’re building a bridge between classical computing and quantum capabilities for these particular tasks.

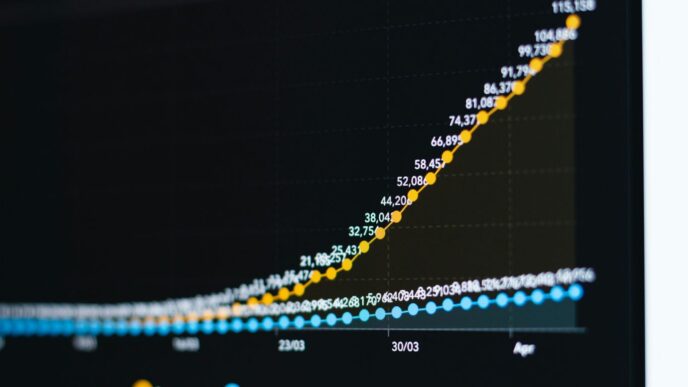

Here’s a quick look at how these companies have performed recently, though remember past performance is no guarantee of future results:

| Company | Recent Performance (Approx.) |

|---|---|

| IonQ (IONQ) | Up over 88% in 2025 |

| Rigetti (RGTI) | Up over 233% in 2025 |

| D-Wave (QBTS) | Up over 345% in 2025 |

It’s worth noting that these stocks can be pretty jumpy. For example, IonQ’s average true range (a measure of how much a stock price moves) is around 8.98%, while Rigetti’s is about 13.08% and D-Wave’s is 11.83%. This means their prices can swing quite a bit day-to-day.

The ‘Picks and Shovels’ of Quantum Computing

When everyone’s rushing to find the next big thing, sometimes the smartest play is to provide the tools everyone else needs. That’s kind of the idea behind the ‘picks and shovels’ strategy, and it’s super relevant in the quantum computing world right now. Instead of betting on one specific quantum computer company, you can look at the businesses that are building the foundational stuff – the hardware, the software, the infrastructure – that all quantum computing relies on. It’s like the gold rush: some people struck it rich finding gold, but the folks who sold them the shovels and picks? They made a killing, no matter who found the gold.

Nvidia’s Essential Role in Quantum Simulations

Nvidia is a big name in this space, and for good reason. Their graphics processing units (GPUs) aren’t just for gaming anymore. They’re becoming incredibly important for quantum computing, especially for running simulations. Think about it: building and testing quantum computers is super complex. You need powerful classical computers to help design the quantum systems, simulate how they’ll work, and even help correct errors once they’re running. Nvidia’s CUDA-Q platform is designed to bridge the gap between classical computing power (like their GPUs) and quantum processors. This makes Nvidia a key player because their technology can speed up quantum simulations by a massive amount, potentially thousands of times faster. As quantum computers get more advanced, they’ll need even more classical computing power to manage them, and Nvidia is perfectly positioned to supply that.

The Importance of Quantum Software Platforms

Beyond the raw hardware, there’s a huge need for software that makes quantum computers usable. This includes everything from programming languages and development kits to cloud platforms that let people access quantum hardware without owning it themselves. Companies that are building these software layers are also in a strong position. They’re creating the tools that researchers and developers will use to actually build quantum applications. For example, cloud providers like Amazon Web Services (AWS) with their Amazon Braket service offer access to various quantum hardware from different companies. This kind of platform approach simplifies things for users and helps drive adoption across the board. It’s about making quantum computing accessible and practical for more people.

Hardware Fabrication and Its Strategic Value

Then there’s the actual manufacturing of quantum computing components. Building qubits and the intricate systems that control them is a specialized field. Companies that can reliably and scalably produce high-quality quantum hardware are incredibly valuable. This could include manufacturers of specialized chips, cryogenics equipment needed to keep some quantum computers super cold, or even the advanced materials used in qubit construction. While it might not be as flashy as a working quantum computer, the ability to produce these critical components is a bottleneck for the entire industry. Getting this part right is a strategic advantage, and companies focused here could see steady demand as the quantum ecosystem grows.

Assessing Risk and Reward in Quantum Stocks

Alright, so you’re thinking about jumping into quantum computing stocks. That’s exciting, but let’s be real, it’s not like picking up a blue-chip stock that’s been around forever. This is new territory, and with new territory comes a whole lot of uncertainty. The potential upside is huge, but so is the possibility of losing your shirt. It’s a bit like investing in a startup, but on a global, technological scale.

Understanding Stock Volatility in Emerging Tech

Quantum computing stocks have been on a wild ride, and that’s putting it mildly. We’ve seen some serious jumps, followed by pretty sharp drops. It’s not uncommon for these kinds of stocks to swing wildly. For instance, some analysts have pointed out that stocks like IonQ and Rigetti could see significant declines, maybe as much as 62%, if the current market excitement cools down. It’s important to keep an eye on metrics like the Average True Range (ATR), which can give you a sense of how much a stock’s price typically moves. A higher ATR means bigger price swings, which can be a red flag for some investors. For example, as of late 2025, IonQ had the lowest ATR among some of the pure-play quantum companies, but Rigetti and D-Wave had higher ones. This just shows how much these stocks can move around.

The Impact of Partnerships and Commercialization

When you’re looking at quantum companies, who they’re partnering with and how they’re actually starting to make money from their tech is a big deal. Are they working with big names in industries like automotive or pharmaceuticals? That’s a good sign. It means their technology is starting to look practical, not just theoretical. Companies that can show real-world applications and start generating revenue, even if it’s small at first, are generally in a better spot. D-Wave, for example, specializes in quantum annealing and has seen revenue growth, but its reliance on this specific method might mean more risk compared to companies with broader approaches. On the flip side, Amazon’s strategy of using its cloud infrastructure to give access to different quantum hardware providers is a smart move. They’re becoming the middleman, collecting data and positioning themselves as a go-to resource as the technology matures.

Long-Term Potential Versus Near-Term Viability

This is where it gets tricky. Quantum computing promises to revolutionize everything, potentially unlocking trillions of dollars in value down the line. But that’s the long game. The question for investors right now is, which companies have the best shot at surviving and thriving in the near term? Some companies are further along in developing commercially viable systems, while others are still deep in the research phase. It’s a balancing act. You might consider a basket approach, investing a small portion of your portfolio in a high-growth, high-risk quantum play like IonQ, while balancing it with a more stable tech giant like Alphabet that also has quantum interests. This way, you can potentially capture some of the massive upside if quantum computing really takes off, without betting the farm on a single, unproven technology. It’s all about managing your risk while keeping an eye on that incredible future potential.

So, What’s the Takeaway?

Alright, so we’ve looked at a bunch of companies trying to make quantum computing a real thing. It’s pretty wild stuff, and honestly, it feels like we’re still in the early days. Some companies like IonQ are really pushing ahead with practical uses, while giants like Amazon and Google are building the roads for everyone else to use. It’s not a simple ‘buy this one stock’ situation. The market is moving fast, and what looks good today might change tomorrow. For now, it seems like picking a company that’s focused on making quantum tech actually work for businesses, or a big player that’s building the infrastructure, is a decent bet. Just remember, this is a long game, and there’s definitely still a lot of risk involved. Do your homework before putting any money down.

Frequently Asked Questions

What is quantum computing and why is it a big deal?

Imagine a computer that’s super, super powerful, way beyond even the best computers we have today. That’s kind of what quantum computing is aiming for. Normal computers use bits that are either a 0 or a 1. Quantum computers use ‘qubits’ which can be a 0, a 1, or both at the same time! This lets them solve really hard problems much, much faster, potentially changing everything from medicine to how we make things.

Are quantum computers going to replace my phone or laptop soon?

Not anytime soon! Quantum computers are huge, complex machines that are still being developed. They’re being built to tackle giant problems that regular computers can’t handle, not for everyday tasks like browsing the internet or playing games. Think of them as special tools for very specific, very difficult jobs.

Which big tech companies are involved in quantum computing?

Several giant tech companies are putting a lot of money and brainpower into quantum computing. This includes companies like Amazon, which is using its cloud services to give people access to quantum computers. Google (Alphabet) is working on building its own quantum chips, and Microsoft is exploring a special type of qubit that might be more stable and reliable.

Are there smaller companies that are just focused on quantum computing?

Yes, there are! These are often called ‘pure-play’ companies because quantum computing is their main focus. Companies like IonQ are working with a type of quantum computer called ‘trapped ions,’ while Rigetti Computing is building a whole system from the chips to the cloud. D-Wave Quantum is focusing on a method called ‘quantum annealing’ to solve tricky problems.

What does ‘quantum supremacy’ mean?

‘Quantum supremacy’ is a term used when a quantum computer can do a specific task that even the most powerful regular supercomputers can’t do, or would take them an impossibly long time to finish. It’s like a proof that quantum computers can achieve something truly amazing that’s beyond our current reach.

Is investing in quantum computing stocks risky?

Investing in any new, cutting-edge technology can be risky, and quantum computing is no different. The technology is still developing, and it’s hard to know exactly which companies will succeed in the long run. The stock prices can jump around a lot. It’s important to understand that this is a long-term game, and there’s a chance that some companies might not make it.