There’s been a lot of talk lately about Anthropic’s worth, with some numbers flying around that seem pretty wild. You hear figures like $380 billion, and honestly, it makes you stop and wonder. Is that real? How do they even get to numbers like that? This article is going to try and untangle all that buzz, looking at where Anthropic stands in the AI world, how it’s funded, and what all these valuation rumors actually mean for everyone involved. It’s a bit of a puzzle, figuring out the true value of these fast-moving AI companies.

Key Takeaways

- Recent rumors about Anthropic’s valuation, particularly a $380 billion figure, appear unverified and significantly out of sync with known funding data and industry comparisons.

- Much of the investment from major tech companies like Google and Amazon into AI firms like Anthropic involves more than just cash; it often includes substantial cloud computing credits and long-term commitments, blurring traditional valuation metrics.

- Comparing Anthropic to competitors like OpenAI, which has secured much larger funding rounds and reported higher revenues, highlights the difficulty in assessing private AI labs based solely on hype or unconfirmed figures.

- Factors such as Anthropic’s focus on AI safety, its technical model performance, and its ability to attract top talent are important for its market position, but these are hard to quantify directly into a precise valuation.

- The intense focus on high valuations in the AI sector, fueled by investor enthusiasm, can create market hype and set unrealistic benchmarks for other startups, while also attracting regulatory attention regarding market concentration.

Decoding the Anthropic Valuation Rumors

Unpacking the $380 Billion Valuation Speculation

Lately, there’s been a lot of chatter, mostly on social media and some news outlets, about Anthropic potentially raising a massive $30 billion, which would put their valuation at a mind-boggling $380 billion. Honestly, these numbers seem pretty far off from what we know about their actual funding and market position. It’s like hearing a rumor that your neighbor won the lottery, but then finding out they just got a $5 coupon for the local pizza place. It’s a huge difference.

Where do these wild numbers come from? It’s hard to say for sure, but it’s probably a mix-up. Maybe someone saw a big number related to cloud credits or a comparison to a publicly traded company and got things twisted. It’s easy for numbers to get jumbled in the fast-paced world of AI funding. This kind of speculation can really muddy the waters, making it tough to see what’s actually going on.

Fact-Checking the Latest Funding Buzz

When you hear numbers like $380 billion, it’s natural to raise an eyebrow. Let’s look at what’s been reported more reliably. We’ve seen reports from places like The Wall Street Journal and The Decoder suggesting a potential $2 billion investment that could push Anthropic’s valuation to around $60 billion. That’s still a huge number, don’t get me wrong, but it’s a lot more grounded than the $380 billion figure.

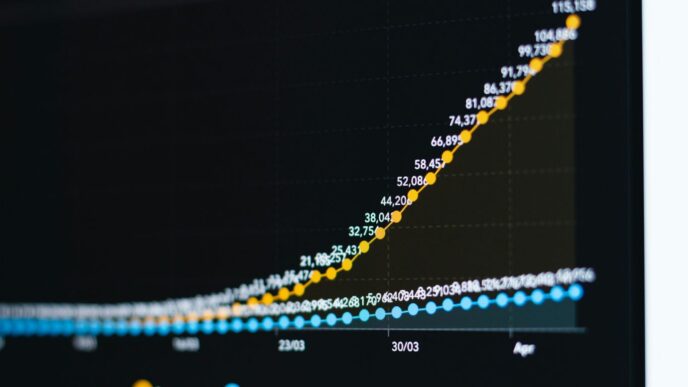

Here’s a quick look at how these figures stack up:

| Valuation Figure | Source Type | Notes |

|---|---|---|

| $380 Billion | Unverified Rumor | Likely a misinterpretation or mash-up of data. |

| $60 Billion | Reported Speculation | Tied to a potential $2 billion funding round. |

| ~$18.4 Billion | Previous Valuation | Based on earlier, more concrete funding rounds. |

It’s important to remember that private company valuations can be tricky. They aren’t always based on the same clear metrics as public companies. Things like future potential, strategic partnerships, and even the hype around AI play a big role. So, while $60 billion is a massive leap, it’s within the realm of possibility for a company like Anthropic in today’s AI market.

Understanding the Market’s Reaction to Valuation Claims

When these big valuation numbers start flying around, the market definitely takes notice. For investors trying to figure out where to put their money, especially in the AI space, these claims can be confusing. It’s like trying to pick a restaurant based on a friend’s vague description – you might get a good meal, or you might end up with something totally unexpected.

Here’s what happens when these rumors spread:

- Investor Confusion: It becomes harder for investors, both big and small, to make informed decisions. They have to sift through the noise to find reliable data.

- Competitive Benchmarking: Other AI companies, like OpenAI or Mistral AI, watch these numbers closely. Wildly inflated figures for one company can skew how others are perceived, even if those figures aren’t accurate.

- Hype Cycle Concerns: Such large, unverified numbers can contribute to the general hype around AI. This can lead to unrealistic expectations and potentially a bigger crash later if the reality doesn’t match the fantasy.

Ultimately, sorting fact from fiction is key. While Anthropic is undoubtedly a major player, understanding the real financial picture helps everyone involved – from the company itself to its investors and the broader tech community.

Anthropic’s Financial Landscape and Funding Rounds

Analyzing Past Funding Rounds and Valuations

Anthropic didn’t just appear on the scene overnight. Initially, they were pretty low-key, sharing research ideas and making small deals with venture capitalists who focus on new tech. But as AI became a bigger topic, Anthropic got more attention. Suddenly, venture capital money started pouring in. They managed to raise over $1.5 billion from a mix of big tech partners and well-known investment funds. This wasn’t just about having smart people; it was also about their unique approach to AI safety, which they call ‘constitutional AI.’ That philosophy really seemed to attract both money and top researchers.

The company’s journey from modest beginnings to significant funding rounds highlights the rapidly evolving investment landscape in artificial intelligence.

Here’s a look at how their funding has grown:

- Early Stages: Initial funding rounds were relatively small, focused on establishing research direction and building foundational technology.

- Growth Phase: A significant surge in investment followed, with rounds exceeding $1.5 billion, attracting major tech players and specialized funds.

- Recent Developments: Reports indicate a potential new round aiming for up to $2 billion, which could push their valuation to around $60 billion.

The Role of Hyperscaler Investments

Big tech companies, often called hyperscalers like Amazon Web Services (AWS) and Google, play a huge role in funding AI startups like Anthropic. These companies aren’t just handing over cash; they’re often investing in exchange for cloud computing credits or strategic partnerships. For Anthropic, these investments are critical. They need massive computing power to train their large language models, and hyperscalers provide that infrastructure. In return, Anthropic becomes a key customer, locking in usage of these cloud services for years. This symbiotic relationship helps both sides: Anthropic gets the resources it needs to innovate, and the hyperscalers secure a major client and a stake in a leading AI company.

Distinguishing Cloud Credits from Direct Investment

It’s important to understand what counts as a real investment. When a company like AWS or Google invests in Anthropic, it’s not always a straightforward cash injection. Often, a large portion of the deal involves providing cloud computing credits. Think of it like getting a massive discount or a pre-paid service for their cloud infrastructure. While these credits are incredibly valuable – they represent real cost savings and access to essential resources – they are different from direct cash that can be used for anything, like salaries or acquisitions. Investors and analysts need to look closely at the terms of these deals to get a clear picture of Anthropic’s actual financial health and the true value of the investment. This distinction matters when comparing valuations and understanding how the company plans to spend its capital.

Competitive Positioning in the Generative AI Race

It’s a wild time in the world of AI, and Anthropic isn’t just sitting on the sidelines. They’re right in the thick of it, trying to make their mark against some pretty big players. Think of it like a race, but instead of cars, it’s all about who can build the smartest computer brains.

Anthropic Versus OpenAI: A Valuation Comparison

When people talk about AI, OpenAI often comes up first. They’ve got that ChatGPT thing, which pretty much everyone knows about now. Because of that, OpenAI has gotten a lot of attention and, you know, a lot of money. It’s hard to put an exact number on it, but rumors put their valuation way up there. Anthropic is also getting a lot of investor interest, and while they might not have the same household name recognition as OpenAI yet, their focus on safety and research is attracting a different kind of attention. It’s not just about who’s biggest, but also about who’s building what kind of AI.

The Generative AI Arms Race Dynamics

This whole generative AI thing feels like an arms race, doesn’t it? Everyone’s trying to build the next best thing. OpenAI has a head start, but companies like Google, Meta, and Anthropic are all pushing hard. Anthropic’s approach, focusing on making AI that’s helpful, honest, and harmless, is their angle. They’re not just trying to be the fastest or the loudest; they’re trying to build AI that people can trust. This means they’re spending a lot of time on research and making sure their models, like Claude, are reliable, especially for businesses that need dependable AI tools.

Benchmarking Against Industry Peers Like Mistral AI and Cohere

It’s not just OpenAI and Anthropic, though. There are other companies out there, like Mistral AI from France and Cohere, that are also doing interesting work. Mistral, for example, is known for being pretty open with its technology, which is a different strategy. Cohere is also focused on enterprise clients. So, Anthropic is constantly being compared to these other companies. They need to show that their AI models are not only safe and reliable but also competitive in terms of performance and cost. It’s a balancing act: staying true to their mission while also keeping up with the rapid pace of development and the demands of the market. The key for Anthropic will be to demonstrate a clear path to making their advanced AI useful and profitable for businesses without compromising their core safety principles.

Here’s a quick look at how some of these players are often seen:

| Company | Primary Focus | Key Strengths |

|---|---|---|

| OpenAI | Broad AI capabilities, public accessibility | Brand recognition, strong partnerships |

| Anthropic | AI safety, reliability, enterprise solutions | Ethical AI focus, advanced research |

| Mistral AI | Open-source models, European presence | Technical innovation, community engagement |

| Cohere | Enterprise-grade NLP, business applications | Focus on business needs, data privacy |

Factors Influencing Anthropic’s Market Worth

So, what’s really driving the numbers when people talk about Anthropic’s value? It’s not just about how many lines of code they have or how many people work there. A few big things seem to be at play, shaping how much investors think the company is worth.

The Impact of AI Safety and Alignment Ethos

Anthropic has made a big deal about focusing on AI safety and making sure AI systems do what we want them to do – that’s the ‘alignment’ part. This isn’t just some side project; it’s pretty central to their whole identity. Think of it like this: while other companies might be racing to build the most powerful AI, Anthropic is also trying to build the safest and most responsible AI. This approach, often called ‘Constitutional AI,’ where they train models based on a set of principles, is a major selling point. It suggests they’re thinking ahead about the potential problems with advanced AI, not just the benefits. For investors, this could mean a company that’s less likely to face major public backlash or regulatory trouble down the line. It’s a way to stand out in a crowded field, showing they’re building for the long haul, not just the next big feature.

Assessing Technical Prowess and Model Performance

Of course, all the safety talk wouldn’t mean much if the AI itself wasn’t any good. Anthropic has been putting out some pretty impressive models, like Claude. People are looking at how well these models perform on various tasks – how good are they at writing, summarizing, coding, and answering questions? The performance benchmarks and the actual capabilities of their AI systems are a huge part of their market value. When their models can compete with or even beat other leading AI systems, it signals strong technical skill. This involves not just the raw power of the models but also how efficient they are and how well they can be adapted for different uses. It’s about having the tech that businesses and researchers actually want to use.

The Significance of Talent Acquisition and Research Development

Building cutting-edge AI isn’t a solo effort. It takes a lot of really smart people. Anthropic has been attracting top researchers and engineers, many of whom come from backgrounds like OpenAI or have strong academic credentials. The ability to bring in and keep this kind of talent is a direct indicator of the company’s potential. It means they have the brainpower to keep innovating, to push the boundaries of what AI can do, and to solve complex problems related to safety and performance. Think of it as collecting a star team for a very difficult game. The more brilliant minds they have working on research and development, the more likely they are to create the next big breakthrough, which, naturally, increases their perceived worth.

The Broader Implications of Anthropic’s Valuation

So, let’s talk about what all these big numbers swirling around Anthropic actually mean. It’s not just about one company getting a lot of money; it’s a sign of bigger things happening in the whole AI world.

Investor Sentiment and Market Hype in AI

When you hear about valuations like the rumored $60 billion (based on a potential $2 billion investment), it’s easy to get caught up in the excitement. This kind of buzz shows just how much people are betting on AI right now. It feels like everyone wants a piece of the AI pie, and companies like Anthropic, especially with their focus on safety, are seen as really promising. But, you know, sometimes the hype can get a little out of hand. It’s important to remember that these numbers are often based on future potential, not necessarily what a company is earning today. It makes you wonder if we’re seeing a genuine shift in how valuable AI is, or if it’s just a bit of a gold rush.

Setting Benchmarks for AI Startups

What Anthropic is worth, or what people think it’s worth, sets a kind of standard for other AI companies out there. If Anthropic is valued at, say, $60 billion, it makes investors look at other startups and think, "Okay, what’s their potential?" It can push other companies to aim higher, but it also puts a lot of pressure on them to grow fast and meet those high expectations. It’s like a race where the finish line keeps moving.

Here’s a quick look at how some AI companies stack up:

- OpenAI: Often cited with valuations in the $80-90 billion range.

- Anthropic: Rumored to be around $60 billion in recent funding talks.

- Mistral AI: A European player valued at over $6 billion.

- Cohere: Another significant AI firm, also valued in the billions.

This comparison shows that while Anthropic is a major player, the AI landscape is getting crowded with some very highly valued companies.

Regulatory Scrutiny and Concentration Risks

All this money flowing into a few big AI companies, like Anthropic and OpenAI, also gets the attention of regulators. When a handful of companies control so much of the cutting-edge AI technology, it raises questions about fairness and competition. Are these big investments, often backed by the same tech giants (like cloud providers), creating a situation where it’s hard for new companies to break in? It’s something governments are starting to look at more closely, trying to figure out how to keep the AI field open and prevent too much power from being concentrated in just a few hands. It’s a tricky balance between letting innovation flourish and making sure the playing field stays level.

Future Trajectory and Strategic Capital Allocation

So, Anthropic’s sitting on a pretty big pile of cash, or at least, that’s the rumor. What happens next? It’s not just about having money; it’s about how you spend it, right? Especially when you’re in a race like generative AI.

Potential Uses for New Capital Injections

When a company like Anthropic gets a massive funding boost, the money usually goes to a few key areas. Think of it like this:

- More Brainpower: Hiring top AI researchers and engineers is a huge deal. The best minds are in high demand, and keeping them happy with good compensation and resources is key to staying ahead. This means more people working on making Claude smarter and safer.

- Bigger, Better Models: Training these advanced AI models takes a ton of computing power. We’re talking about massive clusters of specialized chips. More money means they can train larger, more capable models, pushing the boundaries of what AI can do.

- Safety First (Still): Anthropic’s whole thing is AI safety and alignment. So, a good chunk of that cash will likely go into developing better tools and methods to make sure these powerful AIs behave the way we want them to, avoiding those nasty unintended consequences.

- Getting the Product Out There: While they’re known for research, they also need to make money. This funding could help them build out their commercial side, striking deals with big companies that want to use their AI tech for things like customer service or analyzing data.

Scaling Operations and Expanding Offerings

It’s not just about R&D, though. To really make an impact, Anthropic needs to scale up. This means building out their infrastructure to handle more users and more complex tasks. They might also look to expand what Claude can do, perhaps moving into new areas or creating specialized versions of their models for different industries. It’s a balancing act, really – pushing the tech forward while also making sure it’s practical and accessible for businesses.

Navigating Investor Expectations and Growth

Now, all this money comes with strings attached, mostly from the investors. They’re not just giving away cash; they expect a return. This puts pressure on Anthropic to show growth and a path to profitability. It might mean faster timelines for product development and commercialization, which could sometimes clash with their methodical approach to AI safety research. The big question is whether Anthropic can keep its focus on responsible AI development while also meeting the financial demands of its backers. It’s a tricky path, and how they manage it will be telling for the whole AI industry.

Wrapping It Up: What’s Next for Anthropic’s Market Standing?

So, we’ve looked at Anthropic’s market worth, and it’s clear things aren’t always as straightforward as they seem. Those big valuation numbers floating around? They often mix in more than just simple cash. Think long-term deals with cloud providers and strategic partnerships – these play a huge role. It’s not just about how much the company is worth today, but also about the future compute power and services it’s locking in. As the AI race heats up, understanding these complex financial moves is key. It helps us see the real picture, beyond the headlines, and figure out where Anthropic and the whole AI field are headed next. It’s a space to watch, for sure.

Frequently Asked Questions

What’s the big deal about Anthropic’s valuation?

There have been rumors about Anthropic being worth a lot of money, like $380 billion. This is a huge number! But many experts think these rumors aren’t based on real facts. It’s like hearing a wild rumor about a friend’s toy being the most expensive ever – it’s exciting, but probably not true. We need to look at actual money raised and what the company is really doing to figure out its real worth.

How is Anthropic getting money?

Big tech companies like Google and Amazon are giving Anthropic money. But it’s not just like getting cash for nothing. Sometimes, these deals are more like pre-paying for computer power (like renting super-fast computers) that Anthropic will use later. This helps Anthropic build its AI, and it helps Google and Amazon get Anthropic as a long-term customer for their computer services.

Why is Anthropic’s valuation so hard to pin down?

It’s tricky because a lot of the ‘investment’ isn’t just plain cash. It includes promises for future computer use, which is hard to put an exact dollar value on right now. Plus, the AI world is moving super fast, and everyone is trying to guess how valuable these new technologies will be. It’s like trying to price a brand-new invention before anyone has even used it much.

How does Anthropic compare to other AI companies like OpenAI?

Companies like OpenAI are also getting huge amounts of money and attention. OpenAI, with its ChatGPT, is very well-known. Anthropic is seen as a strong competitor, focusing a lot on making AI safe and reliable. Comparing them helps us understand how much each company is worth and how they are doing against each other in this fast-paced race to build the best AI.

What makes Anthropic so special?

Anthropic really cares about making AI safe and fair for everyone. They call it ‘AI safety’ and ‘alignment.’ This is a big deal because as AI gets smarter, we want to make sure it does good things and doesn’t cause problems. Their focus on safety, along with their smart AI models like Claude, makes them stand out.

What will Anthropic do with all the money they raise?

If Anthropic gets a lot of new funding, they’ll likely use it to hire more smart people, build even better AI models, and improve their safety research. They might also use it to help more businesses use their AI technology. It’s all about growing their company and making their AI even more powerful and trustworthy.