So, I’ve been looking into the Asia Pacific market lately, and wow, it’s a whole different ballgame. Things are changing fast, and it feels like everyone’s trying to figure out what’s next. Whether you’re thinking about investing, running a business, or just curious about how things work, there’s a lot to unpack. It’s not always straightforward, but there are definitely some interesting things happening that are worth paying attention to.

Key Takeaways

- Investor interest is shifting towards Asia Pacific assets, with strong demand for both stocks and alternatives coming from within the region itself. This is happening as global monetary policies start to differ more.

- Fixed income in Asia Pacific is looking pretty good right now. Conservative government spending and lower inflation mean steady returns, making it attractive for investors.

- Companies are getting serious about managing risks like currency swings and interest rate changes. They’re also looking at different ways to get money, like issuing bonds or taking out loans.

- Private markets are seeing more money flow into Asia. Investors are planning to put more capital into the region, partly because new technology makes it easier to manage operations there.

- Mid-sized companies in Asia Pacific are experiencing a growth spurt, especially in areas like banking, tech, and healthcare. Private equity is also expanding its reach in key markets.

Navigating the Shifting Sands of the APAC Market

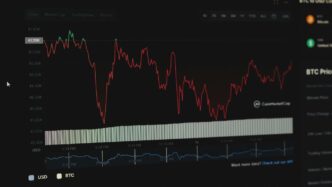

Okay, so the Asia Pacific market right now? It’s a bit of a mixed bag, but honestly, that’s where the interesting stuff usually happens for investors. Things are definitely not as straightforward as they used to be, with different countries doing their own thing policy-wise, which is shaking things up, especially for bonds.

Investor Sentiment Towards Asia Pacific Assets

Globally, people are starting to look at Asia Pacific assets a lot more closely. It’s like everyone’s realizing this region is a pretty big deal for global growth. We’re seeing a real shift, with more money flowing into equities and alternative investments from within APAC itself. It’s not just about chasing the next big thing; it’s about finding places that are holding up well when other parts of the world are a bit shaky. This renewed interest means investors are rethinking how they spread their money around to get the best results.

Policy Divergence and Fixed Income Opportunities

This is where it gets a little tricky but also pretty exciting. Different countries in Asia are marching to the beat of their own drum when it comes to economic policies. The US is doing one thing, and Asia is doing another. This difference, or divergence, is actually creating some sweet spots in the fixed income markets. Think about it: if inflation is lower and governments are being sensible with their spending, you get steadier returns on bonds. Plus, a lot of investors are looking for bonds that are in local currencies, which can offer a bit more protection. It’s a bit of a departure from the old ways of thinking about diversification.

Here’s a quick look at what’s driving this:

- Steady Yields: Conservative fiscal policies in some Asian nations lead to more predictable returns.

- Lower Inflation: This helps preserve the purchasing power of bond investments.

- Local Currency Appeal: Investors are increasingly seeking exposure to Asian currencies for diversification and potential gains.

The Evolving Role of Traditional Diversifiers

When markets get choppy, people usually look to things like gold or certain types of investments that aren’t stocks or regular bonds to balance things out. In APAC, we’re seeing a bit of a comeback for these traditional diversifiers. Gold is getting a second look, and so are what they call ‘liquid alternatives’ – basically, investments that are easier to buy and sell and aren’t your typical stocks or bonds. It’s all part of a bigger picture where investors are trying to build portfolios that can handle whatever the market throws at them, moving beyond just the usual suspects.

Growth Sectors and Investment Themes in Asia Pacific

Alright, let’s talk about where the action is in Asia Pacific right now. It’s not just one big blob; there are specific areas really taking off, and investors are paying attention. We’re seeing a lot of movement in a few key sectors that are shaping the region’s economic future.

Intra-Asia Growth Corridors

This is a big one. Companies are increasingly looking to expand within Asia, not just from Asia outwards. Think about it: more businesses are setting up shop in new markets across the region, or creating new hubs to spread out their operations. It’s about building those connections between countries like Thailand, Korea, and Malaysia. Having local teams who really know the ins and outs of each market, including the rules and how money works there, is super important. It’s like having a local guide when you’re exploring a new city. Plus, with all the global trade stuff going on, companies are building backup plans, like alternative supply chains, especially in places like Southeast Asia and India. It’s all about making sure things keep running smoothly even if there are bumps in the road. India and Southeast Asia are getting a lot of attention because the people there are younger and companies are shifting manufacturing to these areas.

Technology and AI Driven Expansion

No surprise here, but technology and Artificial Intelligence are huge drivers. China and India, for instance, are becoming major centers for tech and AI growth. They’ve got a lot of people online, which really helps these industries take off. This isn’t just about startups either; it’s across the board, from small companies to the big players. The demand for things like data centers is growing like crazy because AI needs a ton of power. This is also where private markets are stepping in, especially in places like Japan and Australia, pouring money into tech companies. It’s a cycle: AI grows, needs more tech infrastructure, which attracts more investment. We’re seeing a lot of capital flowing into this space, which is good news for businesses looking for funding. J.P. Morgan, for example, is putting an extra $50 billion into direct lending, and some of that will definitely find its way into APAC markets.

Healthcare Infrastructure Development

Another area seeing a lot of focus is healthcare. As populations grow and age in parts of Asia, the need for better healthcare infrastructure is becoming more pressing. This means building more hospitals, clinics, and improving the systems that support them. It’s a sector that benefits a lot from local demand, so companies focused here often have a strong base. China and India are again leading the charge in developing this infrastructure to meet the rising needs of their populations. It’s a long-term trend that’s supported by demographics and a growing middle class that can afford better healthcare services. This development is key for the region’s overall well-being and economic stability. For a look at how investment ties are shifting in the region, you can check out APF Canada’s Investment Monitor Report "A Rebalancing of Canada-Asia Investment Ties".

Corporate Strategies Amidst Market Volatility

It’s been a bit of a wild ride in the Asia Pacific markets lately, hasn’t it? With all the talk about tariffs and shifting economic winds, companies are really having to think on their feet. It’s not just about reacting, though; it’s about being smart and proactive.

Hedging Currency and Interest Rate Risks

One of the biggest headaches for businesses operating across borders is currency fluctuations. A sudden dip in a local currency can really eat into profits, especially for those with significant operations or sales in places like the U.S. or Europe. So, many larger companies are beefing up their hedging strategies. This means using financial tools to lock in exchange rates or protect against unexpected interest rate hikes. It’s like buying insurance for your money, really. They’re looking at things like:

- Forward Contracts: Agreeing to exchange currencies at a set rate on a future date.

- Options: Giving the right, but not the obligation, to buy or sell a currency at a specific price.

- Interest Rate Swaps: Trading one stream of interest payments for another, often to move from a variable rate to a fixed one.

The goal here is to smooth out earnings and make financial planning a bit less of a guessing game. It’s about building a more stable financial foundation when the global economic forecast looks a bit murky.

Debt Capital Markets and Strategic Financing

When companies need cash, whether it’s for expanding operations, making an acquisition, or just managing day-to-day expenses, they’re looking at all their options. The debt capital markets, which include things like issuing corporate bonds or getting syndicated loans, have become a go-to for many. Instead of just borrowing from a single bank, they might tap into a broader pool of investors. This can sometimes lead to better terms or access to larger amounts of capital. It’s a way to strategically fund growth or manage existing debt, especially when interest rates are a concern. Companies are being pretty deliberate about how they structure their financing, making sure it aligns with their long-term plans and current market conditions.

Supply Chain Resilience and Diversification

Remember when everyone thought just-in-time delivery was the ultimate efficiency? Well, recent global events have shown that relying on a single source or a single route can be risky. Companies are now actively working to make their supply chains tougher. This often means not putting all their eggs in one basket. We’re seeing a move towards:

- Developing parallel supply chains: Having backup suppliers or production facilities in different regions.

- Diversifying manufacturing hubs: Spreading production across multiple countries, perhaps in Southeast Asia or India, which are seeing increased investment.

- Increasing inventory levels: Holding a bit more stock on hand to buffer against unexpected delays.

It’s a shift from pure cost-cutting to a more balanced approach that prioritizes reliability and the ability to keep operations running even when things get bumpy. This might mean higher upfront costs, but the long-term benefit of avoiding major disruptions is often seen as worth it.

The Rise of Private Markets and Alternatives in APAC

It feels like everywhere you look these days, private markets and alternative investments are popping up in conversations about the Asia Pacific region. It’s not just a small trend anymore; it’s becoming a major part of the investment landscape. Global investors are really starting to pay attention, shifting their focus towards APAC assets as they look for different ways to diversify their portfolios. This isn’t just about chasing returns; it’s about finding stability and growth in a world where traditional options sometimes feel a bit shaky.

GP Capital Deployment Towards Asia

General Partners (GPs) are definitely putting more money to work in Asia. There’s a lot more capital flowing into the region, and it’s not just from local sources. Big players are committing significant amounts, like J.P. Morgan adding an extra $50 billion from its own balance sheet to direct lending, with a good chunk of that heading towards APAC markets. This influx of capital is a big deal for companies looking for funding. It means more opportunities for growth, especially in areas like private credit, which is really taking off as a new and strong trend.

Operational Feasibility Through Technology

As fund managers grow and change, having the right tools makes a huge difference. Think about it: when everyone on the team has access to the same, up-to-date information, making big decisions gets a lot easier and faster. It’s like having a single source of truth for everything. This is where technology comes in. Customer Relationship Management (CRM) platforms, for example, can really help GPs manage their network of contacts – investors, companies they’ve invested in, and other partners. Having all that information organized and visible, instead of scattered across emails and spreadsheets, gives them a real edge. It helps them stay nimble and effective, which is key in such a dynamic market.

Evolving Alternatives Ecosystem and Due Diligence

The whole world of alternatives in Asia is changing quite a bit. There have been some high-profile issues with startups, and with global shifts happening, GPs need to be extra careful. This means beefing up how they check out potential investments. It’s not enough to just look at the numbers; you need to really dig deep. Because of this, more fund managers are realizing the importance of having local teams on the ground in the countries where they want to invest. They’re opening up smaller offices in different places. Some are even moving into completely new types of investments, like private credit. Plus, more global managers are setting up shop in the region, which means more competition, but also more chances for partnerships. It’s a complex but exciting time for alternative investments in APAC.

Opportunities for Mid-Cap Companies in the APAC Market

So, what’s the deal for mid-sized companies looking to grow in the Asia Pacific region? It’s actually a pretty interesting time. We’re seeing a real uptick in both deposits and loans for these companies, which is a good sign, even if the overall economic picture feels a bit fuzzy right now. Companies are definitely planning for the long haul and looking to expand.

Accelerated Growth in Deposits and Loans

This growth isn’t just happening randomly. It’s being fueled by some key sectors that are really taking off locally. Think about it: as economies develop, people need more services and products, and that’s where mid-caps often shine.

Drivers in Technology, Healthcare, and Consumer Industries

Technology and healthcare are big players here. China and India, for instance, are becoming hubs for tech and AI development. Plus, the demand for better healthcare infrastructure is growing fast across the region. And let’s not forget the consumer sector – as more people enter the middle class, their spending power increases, creating a solid base for businesses.

- Tech and AI: Rapid expansion driven by local demand and innovation.

- Healthcare: Developing infrastructure to meet rising needs.

- Consumer Goods: Benefiting from a growing middle class and increased spending.

Private Equity Expansion in Key Markets

Another trend worth noting is the growth in private markets. Places like Japan and Australia are seeing a lot more private equity activity, especially in tech. This is partly because of the massive build-out of data centers needed to support all this AI stuff. It’s not just about having a good idea anymore; it’s about having the capital to back it up. Private capital is becoming a really important way for companies to get the funding they need. It’s good to see that more capital is coming to market to support these growing businesses.

Innovation and the Future of the APAC Economy

APAC as a Global Innovation Ecosystem

The Asia Pacific region is really stepping up as a major player in global innovation. It’s not just about catching up anymore; it’s about leading the charge in new technologies and business models. Countries like China and India are now considered top-tier innovation hubs, right up there with the US. This surge is fueled by a few things, but a big one is how many people are online and using digital services across these massive populations. We’re seeing growth across the board in areas like life sciences, technology, and healthcare. China, for instance, is showing strong development in biotech and advanced robotics, with AI powering machines for manufacturing and services. Australia is also seeing a lot of new startups popping up. Meanwhile, Southeast Asia, including places like the Philippines, Indonesia, and Singapore, is buzzing with activity in the fintech space. It’s a dynamic landscape where new ideas are constantly taking shape.

Demographic Support for Innovation

One of the most compelling reasons for APAC’s innovation boom is its people. The demographics here are just fantastic for supporting growth and new ideas. Take India, for example. Its working-age population is set to keep growing for years, peaking around 2041. This large, young, and increasingly skilled workforce provides a massive talent pool for innovation. It means there are plenty of people to drive these new companies and technologies forward. This demographic advantage isn’t just a short-term boost; it’s a long-term foundation for sustained innovation and economic expansion across the region. It’s a pretty big deal when you think about the future.

The Role of Technology in Treasury Management

As companies expand their operations across Asia, managing their money effectively becomes more complex. This is where technology really comes into play, especially for treasury management. Cross-border banking solutions and ways to manage currency fluctuations are becoming super important. Companies are looking for ways to streamline their finances as they set up shop in new markets or build alternative supply chains. Technology helps with this by providing better visibility into cash flows and making it easier to handle different currencies and regulations. It’s about using digital tools to keep everything running smoothly, even when dealing with multiple countries and complex financial situations. This is particularly true for multinational corporations looking to build resilience and manage risks in an unpredictable global trade environment. The digital economy in Southeast Asia is a prime example of how technology is reshaping business operations.

Wrapping It Up

So, what’s the takeaway from all this? The Asia Pacific market is definitely a place to watch. It’s not just about growth anymore; it’s about smart growth, with companies and investors focusing on things like efficiency and managing risks, especially with currency and interest rates. We’re seeing a lot of activity, from big companies hedging their bets to smaller ones looking for capital. Plus, technology is playing a huge role, making it easier to spot opportunities and manage operations. It looks like the region is set to keep evolving, and staying informed is key for anyone looking to get involved.

Frequently Asked Questions

Why are investors paying more attention to Asia Pacific markets now?

Many investors are looking at Asia Pacific because it’s showing strong growth and can help balance out their investments in other parts of the world. Things like different economic policies and growth rates between countries are creating new chances to invest.

What are some growing industries in Asia Pacific that investors should know about?

Key areas include technology and AI, which are expanding quickly. Healthcare is also a big focus, with more money going into building hospitals and clinics. Plus, trade between Asian countries themselves is getting stronger.

How are big companies in Asia Pacific dealing with market ups and downs?

Companies are working hard to protect themselves from changes in currency values and interest rates. They’re also looking for smart ways to borrow money and making sure their supply chains (how they get materials and make products) are strong and not easily broken.

What role do private markets and alternative investments play in Asia?

More investment money is flowing into private markets, like companies that aren’t traded on public stock exchanges. Technology is making it easier for investors to manage these deals. The whole system for these types of investments is growing and becoming more complex.

Are there good opportunities for medium-sized companies in Asia Pacific?

Yes, medium-sized companies are seeing faster growth, especially in areas like banking, technology, and healthcare. Private investment is also increasing in these companies, helping them expand.

How is Asia Pacific becoming a hub for new ideas and innovation?

Asia Pacific is becoming a major center for new inventions and technologies, partly because of its growing middle class and young population. Technology is also helping businesses manage their money and operations more efficiently.