So, I’ve been looking into the whole Nigerian startup scene lately, specifically around funding. It’s been a bit of a rollercoaster, hasn’t it? You see all these companies getting money, especially in health tech, and then… well, not all of them make it big. This report, the Nigerian startup funding report, tries to make sense of it all. We’re talking about what happened between 2019 and 2025, why some startups seem to get stuck after their first bit of cash, and what investors are really looking for now. It’s not just about the money, though. There are other hurdles these businesses face, and understanding them is key if we want to see more Nigerian startups really succeed and grow.

Key Takeaways

- Lots of Nigerian health tech startups get seed money, but only a few manage to grow much bigger after that. It’s a common problem.

- Getting more funding after the first round (the ‘post-seed’ phase) is tough. Things like unclear rules, people not trusting new tech, and not enough skilled workers make it harder.

- Investors have changed what they’re looking for. They’re more careful now, especially after the big rush in 2021. Things like the economy not being stable also play a big part.

- Some companies have done well by expanding to other countries and focusing on solid business plans. Partnerships are also important for growth.

- It’s not just about cash. Problems with infrastructure, confusing health rules, and needing special funds for later stages are big issues that need fixing for Nigerian startups to really scale up.

Navigating the Nigerian Startup Funding Report Landscape

Right then, let’s get stuck into this Nigerian Startup Funding Report. It’s a bit of a mixed bag, really. We’ve seen some serious ups and downs, especially in the health-tech sector, which has been a bit of a rollercoaster.

The Rise and Fall of Health-Tech Investment

It feels like only yesterday that health-tech was the shiny new thing, attracting a flood of cash. Between 2019 and 2021, there was a real boom. Loads of Nigerian e-health ventures managed to snag seed funding, with cheque sizes that looked pretty healthy. But here’s the kicker: a lot of those companies that got that initial boost just didn’t manage to grow beyond it. It’s like they got the starter pistol but then tripped over their own feet at the first hurdle.

We saw some big names, like Reliance Health, pull off impressive Series B rounds, which was great news. But then, on the flip side, you had companies like 54gene, which went from being a rising star to facing serious cutbacks and valuation drops. It really shows how quickly things can change.

Key Metrics in the Nigerian Startup Funding Report

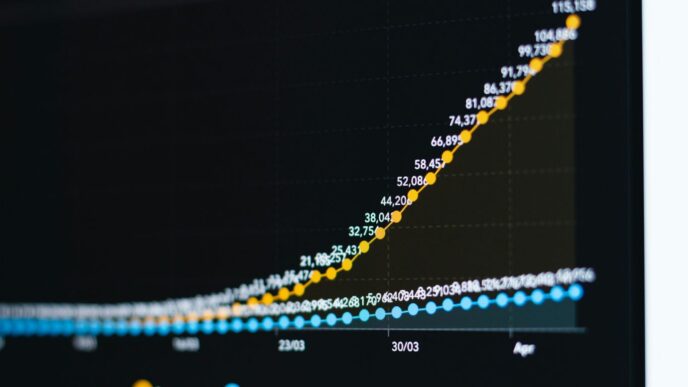

When you look at the numbers, it paints a clear picture. Between 2019 and 2021, dozens of health-tech startups got their foot in the door with seed funding. But fast forward to 2025, and out of about 54 Nigerian health-tech startups that had received any venture funding, only a handful had managed to reach Series A, and even fewer got to Series B. That’s a pretty stark funnel, isn’t it?

Here’s a rough idea of how things looked:

| Funding Stage | Number of Nigerian Health-Tech Startups (Approx. 2025) |

|---|---|

| Any Venture Funding | 54 |

| Series A | 6 |

| Series B | 5 |

It’s clear that getting that first cheque is one thing, but securing the next round is a whole different ball game. By 2024, over half of Nigerian startups surveyed were finding it tough to get follow-on funding.

Understanding the Post-Seed Conversion Challenge

So, what’s the deal with this ‘post-seed conversion challenge’? It’s basically the struggle startups face after they’ve secured their initial seed funding. They’ve got the money, they’ve got the idea, but turning that into sustainable growth and attracting further investment is proving incredibly difficult for many.

The journey from getting seed capital to actually scaling up is proving to be a significant hurdle for many Nigerian health-tech companies. It’s not just about the money; other factors are clearly at play.

This gap between initial funding and sustained growth is where a lot of promising ventures seem to falter. It’s a complex issue, and we’ll be digging into the reasons why this happens throughout this report.

Post-Seed Funding Hurdles for Nigerian Startups

Challenges Beyond Initial Capital Infusion

So, you’ve managed to get that initial seed funding. Great! But honestly, that’s often just the beginning of a whole new set of problems. It’s like getting your driving test passed – it doesn’t mean you’re suddenly a Formula 1 driver. Many Nigerian health-tech startups find themselves in this exact spot. They’ve got their product, maybe a few early users, and a bit of cash in the bank. The real test, though, is turning that early promise into something that actually grows and makes money.

This is where the ‘proof-to-procurement’ gap comes in. You’ve proven your tech works, perhaps with a pilot project or a small group of users. But getting bigger organisations, like hospitals or government health services, to actually buy into your solution long-term? That’s a different ballgame entirely. It’s not just about having a good idea; it’s about convincing people with budgets to spend money on it, consistently.

Here are some of the common roadblocks:

- The Scale-Up Squeeze: Moving from a pilot to widespread adoption requires a lot more than just the initial funding. You need robust operations, a solid plan for reaching more customers, and the ability to handle increased demand.

- The Trust Deficit: Building confidence with larger clients, whether they’re government bodies or big private healthcare providers, takes time. They need to see reliability and a proven track record, which is hard to have when you’re still a young company.

- The Revenue Riddle: Many startups struggle to figure out how to make consistent money. Demonstrating value is one thing, but getting paid for it regularly is another challenge altogether.

The journey from a successful pilot to a sustainable, scaled business is often where the real difficulties lie for Nigerian startups. It’s not just about securing more money; it’s about overcoming a complex web of operational, market, and trust-related issues that capital alone can’t solve.

The Impact of Regulatory Ambiguity

Nigeria’s regulatory environment can feel a bit like trying to navigate a maze in the dark. The rules for health tech, especially, weren’t really built with digital services in mind. This means there’s often a lot of uncertainty about what’s allowed and what’s not. For instance, telemedicine and e-pharmacies have been in a bit of a grey area for a while. While things are starting to get clearer, especially after COVID-19, this lack of clear guidelines can slow things down. Startups might hesitate to launch new services, or investors might get nervous about potential compliance problems down the line.

Sometimes, new rules can pop up quite suddenly. Imagine a startup having to suddenly find money for new licensing fees or meet unexpected requirements. While these rules are often put in place to protect patients, they can unintentionally make life very difficult for small, growing companies that don’t have deep pockets.

Market Trust and Adoption Barriers

Getting people to trust a new health service, especially one delivered digitally, is a big hurdle. Patients are often wary of online consultations or digital prescriptions, preferring the traditional doctor’s visit. Similarly, healthcare providers might be hesitant to integrate new digital tools into their existing workflows, fearing disruption or a steep learning curve.

This lack of trust isn’t just about individual users; it extends to larger institutions. Government health systems and large private hospitals often have established procurement processes and are slow to adopt new technologies. They need to see clear evidence of effectiveness, cost savings, and reliability before committing to a new solution. Building this market trust is a slow, deliberate process that requires consistent delivery of value and strong relationships. Without it, even the most innovative health-tech solutions can struggle to gain traction beyond initial pilot phases.

Investor Sentiment and Market Corrections

Shifting Investor Focus in African Health Tech

The initial excitement around African health tech, particularly during the pandemic’s peak, has certainly cooled. We saw a lot of money pour into companies promising rapid solutions, but the reality has been a bit more complex. Now, investors are looking much more closely at the fundamentals. It’s not just about having a good idea anymore; it’s about a solid business model that can actually make money over the long haul. Companies that expanded too quickly without a clear path to profitability, like the cautionary tale of 54gene, have made investors more cautious. They’re now prioritising sustainable demand and disciplined execution over sheer growth.

The Role of Macroeconomic Instability

It’s hard to ignore how global economic wobbles affect local markets. Inflation, currency fluctuations, and general uncertainty make everyone a bit more hesitant. For startups, this means funding rounds might take longer to close, valuations could be lower, and investors might demand more proof of resilience. We’ve seen this play out across various sectors, not just health tech. Startups need to be extra sharp about managing their finances and demonstrating they can weather these economic storms. It’s a tough environment, and companies that can show they’re not overly reliant on constant external funding tend to do better.

Emergence of Angel Investors and Grant Funders

While big venture capital might be more selective, there’s a growing role for other types of funding. Angel investors, often individuals with industry experience, are stepping up, bringing not just capital but also valuable mentorship. We’re also seeing more grant funding becoming available, especially for startups with a strong social impact angle or those working on critical health challenges. These sources can be a lifeline, particularly for early-stage companies or those that might not fit the typical venture capital mould. It shows a broadening of the funding landscape, which is a positive sign for the ecosystem’s overall health.

The days of easy money and rapid scaling based on hype alone are largely behind us. Investors are now demanding a clearer demonstration of product-market fit, sustainable revenue streams, and robust operational management. This shift, while challenging for some founders, is ultimately a sign of a maturing ecosystem that is building for the long term.

Success Stories and Scaling Strategies

It’s easy to get bogged down in the challenges Nigerian startups face, but looking at those that have managed to grow offers some really useful lessons. These aren’t just stories of luck; they’re about smart moves and sticking power.

Lessons from Regional Expansion Leaders

Take Helium Health, for instance. They started by trying to get Nigerian hospitals to switch from paper records to digital ones. Honestly, that sounds like a tough sell, right? But they kept at it, improved their product, and got themselves into Y Combinator, which gave them a big boost. After securing Series A funding, they didn’t just stay put. They expanded into Ghana, Liberia, Senegal, and then further into Kenya and Uganda. Their success shows that adapting your approach to fit each country’s specific health system is key to growing across Africa.

The Importance of Business Model Viability

It’s not just about having a good idea; it’s about how you make money from it. Many successful companies, like those in India’s digital health scene, didn’t just stick to one way of earning. They diversified. Some started with software for clinics and then added services for patients. Others found ways to make money through partnerships with employers or by integrating with government health programmes.

Here’s a look at how different models can work:

- Direct-to-Consumer (DTC): Offering services directly to individuals, like telemedicine appointments or health apps.

- Business-to-Business (B2B): Providing solutions to healthcare providers or institutions, such as EMR systems or supply chain management tools.

- Business-to-Business-to-Consumer (B2B2C): Partnering with businesses (like employers or insurers) who then offer the service to their customers or employees.

- Freemium Models: Offering a basic service for free and charging for premium features or support.

Bridging the Gap with Strategic Partnerships

Sometimes, the biggest hurdles aren’t about the tech itself, but about getting people to trust and use it, and getting the necessary capital. This is where partnerships really shine. Think about teaming up with mobile network operators or fintech companies. These established players already have a massive customer base and the infrastructure to reach people. For example, a telecom company might offer health services to its users to keep them from switching providers. This kind of win-win situation can help startups overcome distribution and trust issues that would be incredibly hard to tackle on their own.

Building a successful startup often means looking beyond your own four walls. It’s about finding allies, whether they’re other businesses, government bodies, or even international organisations, who can help you reach your goals. These collaborations can provide the missing pieces – be it market access, funding, or credibility – that are vital for moving from a promising idea to a thriving enterprise.

Ultimately, scaling isn’t a one-size-fits-all process. It requires a blend of product refinement, flexible business strategies, and smart collaborations. The Nigerian startups that are making waves are those that understand this complexity and actively seek out the right support systems to propel their growth.

Addressing Non-Financial Friction Factors

Beyond the obvious need for capital, Nigerian startups, particularly in the health-tech space, face a number of hurdles that aren’t directly about money. These can really slow down progress, even when a company has a great idea and some initial funding. Think of it like trying to drive a car with a perfectly good engine, but the wheels are a bit wobbly and the road ahead is bumpy. It’s not impossible, but it’s certainly harder.

Infrastructural Deficiencies and Talent Gaps

One of the biggest headaches is the lack of solid infrastructure. This isn’t just about internet speeds, though that’s a part of it. It also includes reliable power, which many businesses take for granted elsewhere. For startups trying to build digital solutions, especially those that need to work in remote areas, these gaps are significant. Then there’s the talent pool. While Nigeria has a large, young population, finding people with very specific technical skills, or experience in highly regulated sectors like healthcare, can be a real challenge. Companies often have to invest heavily in training their staff, which eats into resources that could be used for growth.

- Limited access to reliable power grids impacts operational continuity.

- Inconsistent internet connectivity hinders real-time data processing and communication.

- Shortage of specialised technical and clinical talent requires significant investment in training and development.

Navigating Evolving Health Sector Regulations

The healthcare sector is, understandably, heavily regulated everywhere, and Nigeria is no exception. While there are efforts to streamline things, like the Nigeria Startup Act, navigating the rules can still be a maze. Getting approvals, understanding compliance requirements, and adapting to changes in policy takes time and expertise. This regulatory ambiguity can make investors nervous, as it adds a layer of uncertainty to the business’s future. It’s not just about following the rules; it’s about anticipating how they might change and building a business that can adapt.

Startups often find that partnerships with established players, like banks or mobile network operators, can help smooth the path for user adoption and regulatory compliance. These collaborations can provide access to existing customer bases and trusted channels, reducing the burden on the startup to build trust from scratch.

The Need for Specialised Follow-On Funds

As mentioned, getting seed funding is one thing, but securing the next round of investment, especially for health-tech, is another. There’s a noticeable gap in the market for follow-on funding that specifically understands the nuances of the health sector. While fintech and e-commerce might attract a broader range of investors, health-tech often requires a more specialised approach. This means that even promising startups can struggle to find the capital needed to scale up, conduct clinical validation, or achieve the regulatory clearances that investors look for. The ecosystem is seeing some new funds emerge, but there’s still a way to go to bridge this gap effectively. For instance, African startups raised $174 million in January 2026, but deal numbers were low, indicating a need for more targeted investment in specific sectors.

- Lack of specialised Series A and B funding for health-tech ventures.

- Longer validation cycles in healthcare deter generalist investors.

- Need for blended finance to cover regulatory and clinical trial costs.

Future Outlook for Nigerian Startup Funding

So, where does all this leave Nigerian startups looking ahead to 2026 and beyond? It’s not all doom and gloom, far from it. We’re seeing a definite shift, a kind of maturing of the whole scene. The days of easy money for anything with a .com attached are probably behind us for a while. Investors are definitely more cautious, wanting to see a clear plan for making money, not just a cool idea. But this actually creates opportunities for the really solid businesses.

Signs of Ecosystem Maturation

What does this ‘maturation’ actually look like? Well, for starters, the startups that made it through the tougher times of 2022 and 2023 are often stronger for it. They’ve learned to be lean, to focus on what really works, and to manage their cash carefully. Companies like Helium Health, which managed to raise a significant chunk of cash even when things were tight, are now expanding across Africa. This shows that while the number of deals might be down, the big wins are still possible for the right companies. It’s less about quantity and more about quality now.

Opportunities for Sustainable Growth

This new environment actually opens doors. With traditional venture capital being more selective, we’re seeing other players step in. Angel investors are becoming more active, and grants from development organisations are filling some of the gaps. This means startups have more options for getting that crucial early or mid-stage funding. Plus, the focus is shifting towards business models that are genuinely sustainable, not just reliant on constant new investment. Think about companies that solve real problems in a way that people are willing to pay for, consistently.

Comparative Insights from Peer Markets

Looking at other countries can give us some clues. Places like Kenya have seen their own funding ups and downs, and India has gone through similar cycles of rapid growth followed by a correction. What we can learn is that building a strong foundation – good governance, clear regulations, and a focus on real customer needs – is key. It’s not just about the money; it’s about building a business that can stand on its own two feet, even when the funding taps aren’t gushing.

The Nigerian startup scene is finding its feet again. It’s a more grounded approach, focusing on long-term value rather than quick wins. This is good news for founders who are building businesses with solid fundamentals and a clear path to profitability.

Looking Ahead: What’s Next for Nigerian Health-Tech?

So, what does all this mean for Nigerian health startups looking to make a real impact by 2026? It’s clear that getting that first bit of funding is just the start of a much longer journey. We’ve seen how money alone doesn’t fix everything. Things like tricky rules, patchy internet, and getting people to trust new tech all play a big part. While some companies like Helium Health have managed to grow, others have really struggled. The market has definitely cooled down from the big boom a few years back, and investors are being more careful. But that doesn’t mean it’s all doom and gloom. There’s still a lot of potential here. The key will be for startups to find smart ways to work with the government, maybe get more help from special funds that understand the long game, and really focus on building trust with users and healthcare providers. It’s going to take more than just good ideas and a bit of cash; it’ll need grit, smart partnerships, and a solid plan to overcome the hurdles that aren’t about money.

Frequently Asked Questions

What is the main problem Nigerian health startups face after getting their first funding?

Many Nigerian health startups struggle to grow bigger after receiving their initial money. It’s like getting the first push but then not having enough to keep going. This happens because getting more money later, called ‘follow-on funding’, is really hard.

Why is it so difficult for these startups to get more money after the first investment?

It’s tricky for a few reasons. Sometimes, the rules and laws for digital health aren’t very clear, which makes investors nervous. Also, people and hospitals might not trust or use the new digital health tools right away. Plus, there aren’t always enough skilled people to help the company grow.

Have any Nigerian health startups managed to grow successfully?

Yes, a few have! Companies like Helium Health have managed to raise a lot more money and expand to other countries. These success stories show that it is possible, but they also highlight that it takes more than just money to succeed.

What are some of the biggest challenges beyond just needing money?

Besides money troubles, startups face issues like bad internet in some places, not enough trained workers, and rules that are hard to follow. Sometimes, investors also prefer to put their money into other types of businesses, like finance tech, which are seen as quicker to make money.

Are investors still interested in Nigerian health startups?

Investor interest has changed. While there was a lot of excitement a few years ago, investors are now more careful. They look for companies that are already doing well and have a clear plan to make money. Sometimes, smaller investors or groups that give grants step in to help when big investors are hesitant.

What needs to happen for more Nigerian health startups to succeed in the future?

For more startups to grow, they need better support after the first funding round. This means clearer rules, help with building trust in their services, better infrastructure, and more specialised funds that understand the health tech business. Working together with governments and bigger companies could also make a big difference.