The world runs on chips, and the people who make them are suddenly in super high demand. Think about it, from your phone to those fancy AI computers, it all comes down to semiconductors. Now, everyone wants to build more chip factories, especially in places like the US. But here’s the catch: you can’t just build a factory; you need smart engineers to run it. This has kicked off a big competition, and companies like TSMC are paying top dollar for these engineers. We’re going to look at what that means, especially when it comes to the TSMC engineer salary.

Key Takeaways

- The massive growth in AI and global efforts to build local chip production have created a huge need for semiconductor engineers.

- Companies like TSMC are significantly increasing pay to attract and keep skilled workers, leading to a ‘salary war’ in the industry.

- Building new chip factories, especially advanced ones, is incredibly expensive and faces many challenges, including finding enough trained workers.

- Despite higher pay, the shortage of engineers is a long-term problem, partly because fewer young people are choosing hardware engineering over software.

- The TSMC engineer salary reflects the high stakes involved in semiconductor manufacturing, but attracting talent also requires building a strong company culture and educational pipeline.

1. The AI Boom

It feels like everywhere you look these days, someone’s talking about AI. And it’s not just talk; there’s a real, massive surge happening. This isn’t your grandpa’s computer program; we’re talking about AI that can do some pretty wild stuff, from writing code to designing new materials. But here’s the thing: all this advanced AI needs some serious computing power. Think of it like a super-fast race car – it needs a top-tier engine to perform. That engine, in the world of AI, is the semiconductor chip.

The demand for these advanced chips has exploded, creating a global scramble for the companies that can actually make them. It’s gotten to the point where some world leaders have said whoever leads in AI will rule the world. That’s a pretty big statement, and it highlights just how important these tiny pieces of silicon have become. Countries are pouring money into AI research and development, and that directly translates into needing more and better chips.

Here’s a quick look at why this is such a big deal:

- Military Edge: AI can be used for everything from drone swarms to complex strategy. The nation with the best AI could have a huge advantage.

- Economic Growth: AI is expected to drive massive economic changes, and the companies and countries that harness it will likely see big gains.

- Scientific Discovery: AI can speed up research in fields like medicine and materials science in ways we’re only beginning to imagine.

This isn’t just a tech trend; it’s becoming a major part of national strategy. And at the heart of it all are the companies that manufacture these cutting-edge semiconductors. They’re the ones holding the keys to the AI future.

2. Geopolitical Strategy

It’s kind of wild when you think about it, but a tiny island, not much bigger than Maryland, is suddenly at the center of global power plays. Taiwan, and specifically TSMC, has become this massive geopolitical flashpoint. We’re talking about a place that manufactures almost all the world’s most advanced computer chips. If something were to happen there, like a major conflict, the economic fallout could be staggering – some estimates put it at around $10 trillion, which is a huge chunk of the global economy.

This whole situation reminds me a bit of the old Cold War, but instead of nuclear weapons, the big prize now is advanced semiconductors. These chips are the building blocks for everything from our smartphones to the supercomputers that will power the next generation of artificial intelligence. Whoever controls this technology, it seems, could have a serious advantage.

Here’s a quick look at why this is such a big deal:

- The AI Race: Nations are pouring money into AI research, and advanced chips are the fuel for that engine. The first country to really master AI could gain a significant edge.

- Global Manufacturing Hub: A huge percentage of electronics are made in Asia, and Taiwan is at the heart of that supply chain for the most critical components.

- Strategic Location: Taiwan sits very close to China, which has its own ambitions regarding chip production and reunification.

It’s a complex web of economics, technology, and national security, all wrapped up in the fate of a few factories on a small island.

3. Supply Chain Vulnerabilities

You know, it’s funny how we all just assumed the chip supply chain was this solid, unbreakable thing. Then, bam! The pandemic hit, and suddenly, we couldn’t get our hands on anything. Cars, phones, even those fancy new gaming consoles – all delayed or just plain unavailable. It really showed how much we relied on a few places to make all the important bits.

And it’s not just about getting your hands on a new gadget. Think about it from a national security angle. A huge chunk of the world’s most advanced chips come from Taiwan, and TSMC is the big player there. That’s a pretty big single point of failure, right? Especially with all the geopolitical stuff going on. If something were to happen there, it wouldn’t just affect our tech gadgets; it could mess with military equipment too. It’s a bit of a wake-up call for a lot of countries.

Here’s a quick look at how some regions are feeling the pinch:

- United States: We’re looking at a potential shortage of over half the engineers we’ll need by 2030. That’s a big deal for bringing chip manufacturing back home.

- Taiwan: Even though it’s the heart of chipmaking, local companies are fighting hard for talent, and engineers are getting offers from overseas.

- Europe: They’ve got big plans to ramp up chip production, but their education system isn’t quite ready to churn out the thousands of skilled workers needed.

- South Korea: Similar to others, Samsung and SK Hynix are in a tough spot, competing for a limited pool of top graduates, which could slow down innovation.

It’s clear that building more factories is only half the battle. The real challenge is finding and keeping the smart people who actually know how to run them. This talent crunch is becoming a major headache for everyone involved.

4. Mapping the Deficit

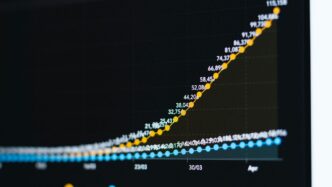

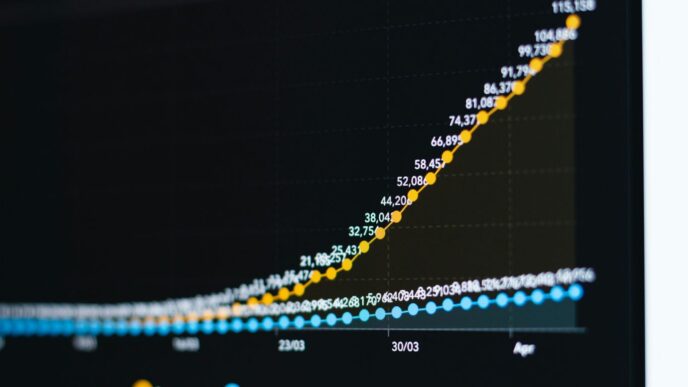

It’s not just a hunch; there’s a real, measurable gap between the number of skilled people the semiconductor industry needs and the number available. This isn’t some vague future problem; it’s happening now and it’s getting worse. Think about it: building a state-of-the-art chip factory is one thing, but finding thousands of engineers and technicians to actually run it? That’s a whole different ballgame.

The numbers are pretty stark. The US semiconductor industry, for example, is looking at a potential shortage of around 67,000 workers by 2030, according to industry reports. And this isn’t just a US issue; it’s a global headache. Countries are pouring money into building new fabs, but the talent pool just isn’t growing fast enough to keep up. It’s like trying to fill a bathtub with a tiny faucet while the drain is wide open.

Here’s a quick look at how different regions are feeling the pinch:

- United States: With ambitious goals like the CHIPS Act, the US needs a lot of workers. Current graduation rates suggest we might only fill about 42% of the jobs needed by 2030. That’s a huge chunk of potential manufacturing capacity that could go unfilled.

- Taiwan: Home to giants like TSMC, Taiwan’s top universities are struggling to supply enough graduates. This leads to fierce competition at home and makes engineers prime targets for recruitment by companies in the US and Europe.

- Europe: The EU’s push to boost its chip production means a massive need for new talent. The current education system isn’t set up to provide this quickly, putting ambitious production targets at risk.

This talent shortage is a major bottleneck for the entire industry’s expansion plans. It means higher labor costs, which can eat into profits, and it makes attracting and keeping the best people a top priority for companies. It’s not just about having the money to build fabs; it’s about having the people to operate them. The challenges in finding skilled construction workers for TSMC’s Arizona fab, for instance, highlight just how difficult it can be to get these advanced facilities up and running in new locations [283d].

5. The Golden Handcuffs

It feels like every major chip company is in a bidding war right now, and honestly, it’s getting pretty wild. TSMC, Intel, Samsung – they’re all throwing serious money at engineers. We’re talking about big pay bumps, way beyond the usual yearly raise. Some folks fresh out of grad school are seeing their salaries jump by 20% or more in just one year. It’s like they’re trying to lock down talent with these huge paychecks, hence the term ‘golden handcuffs.’

This isn’t just about making engineers happy, though. It’s a direct reaction to a massive shortage of skilled people in the industry. Think of it like this:

- The Problem: Not enough engineers to go around.

- The Reaction: Companies pay more to get and keep the ones they have.

- The Catch: This just shuffles the same limited pool of talent around, driving up costs for everyone without actually increasing the total number of available engineers.

So, while the pay is great for the engineers lucky enough to be in demand, it’s a short-term fix for a much bigger issue. It’s a high-stakes game of musical chairs, and the real challenge is figuring out how to train more people for these jobs in the long run, not just how to pay the current ones more.

6. Beyond the Paycheck

So, TSMC and other chip giants are throwing serious cash at engineers, right? It’s like a bidding war for brains. But here’s the thing: is just paying more really going to fix the whole problem? It feels a bit like putting a fancy bandage on a deeper issue.

Think about it. For years, software and AI have been the shiny objects, the places where young tech minds wanted to be. Building apps, creating algorithms – that seemed way cooler and faster than designing tiny circuits. The semiconductor world just didn’t have that same buzz. So, this big pay bump? It’s partly an attempt to buy back some of that lost appeal, to make hardware engineering seem exciting again.

But you can’t just buy culture or fix a pipeline problem with money alone. It’s a bit of a zero-sum game, too. Companies are just poaching engineers from each other, driving up costs for everyone, without actually creating more talent. It’s like musical chairs, but with really expensive chairs.

What really matters long-term isn’t just who’s paying the most today. It’s about which companies are building a genuinely appealing place to work and investing in schools to get the next generation excited about this stuff. The real winners will be the ones who make building the foundation of technology as interesting as building on top of it.

Here’s a look at what else engineers might be considering:

- Career Growth: Are there clear paths for advancement within the company? Opportunities to learn new skills and take on bigger projects?

- Work Environment: Does the company culture feel supportive and collaborative, or is it a high-pressure grind?

- Innovation: Is the company working on cutting-edge technology that engineers can be proud of? Are they encouraged to be creative?

- Impact: Can engineers see how their work contributes to something bigger, like advancements in technology that affect everyday life?

7. The 25-Year Fossil Fuel Reality

It’s easy to get caught up in the shiny new tech, right? We talk about AI, advanced chips, and the future. But let’s be real for a second. Building all this advanced manufacturing, especially these massive semiconductor fabs, takes a ton of energy. And right now, a lot of that energy still comes from, well, fossil fuels. We’re talking about a reality that’s likely going to stick around for at least another 25 years, maybe longer.

Think about it: a single chip fab is like a small city when it comes to power consumption. They need constant, reliable electricity, 24/7. While there’s a big push for renewables, the sheer scale of demand means we’re still heavily reliant on traditional energy sources to keep the lights on and the machines running.

This isn’t just a minor detail; it has real implications. For one, it means the semiconductor industry, despite being at the forefront of technological innovation, is still tied to the ups and downs of the fossil fuel market. Prices can fluctuate, and supply can be affected by global events, which adds another layer of risk to an already complex business.

Here’s a quick look at the energy demands:

| Facility Type | Estimated Annual Power Consumption (MWh) |

|---|---|

| Leading-Edge Fab | 500,000 – 1,000,000+ |

| Smaller Fab/R&D | 100,000 – 500,000 |

Beyond the direct energy use, there’s also the whole supply chain. Getting raw materials, manufacturing equipment, and transporting finished goods all require energy, often from sources we’re trying to move away from. So, while TSMC and others are building the chips that power our future, they’re also, for now, deeply embedded in the energy systems of the past.

This creates a bit of a paradox. We want cutting-edge technology, but we still need a lot of conventional power to make it happen. It’s a balancing act that’s going to be with us for a while. The industry is definitely looking at ways to be more sustainable, but the transition isn’t instant. It’s a long game, and for the next couple of decades, that fossil fuel reality isn’t going anywhere fast.

8. The Glamour Gap

It’s not just about the money, though. There’s this thing called the “glamour gap,” and it’s been a problem for a while now. For the last twenty years or so, the really bright young folks in tech have been more interested in software, AI, and fintech. You know, making the next big app or a cool trading program. It all seems so much faster and less complicated than the world of hardware engineering, which needs tons of money and a lot of patience. The chip industry has a bit of a branding issue; it’s seen as harder, less exciting, and just slower than software. This big pay raise is kind of a desperate move to try and make it seem cooler again. But you can’t fix a culture problem or a broken education pipeline just by throwing cash at it. The real question for anyone looking to invest isn’t who’s paying the most right now, but who’s actually building a place people want to work and investing in getting new engineers ready for the future. The companies that make building the foundation of technology as interesting as building on top of it are the ones that will win long-term.

This whole pay war is basically a zero-sum game. It’s like musical chairs, where a limited number of engineers just move from one company to another, driving up costs everywhere. It doesn’t actually create more engineers; it just makes things more expensive for everyone. The reasons for this shortage go way deeper than just salaries. Think about it:

- The Education Pipeline: University programs in fields like electrical engineering and physics haven’t kept up with what companies need. Sometimes the courses feel old or too theoretical, not really showing students the exciting side of making actual chips.

- Competition from Big Tech: Software companies often have more flexible work setups, quicker paths for advancement, and their products are more visible to everyday people. That makes them super appealing to new grads.

- The Nature of the Work: Designing and building chips is really tough. It takes years of special schooling and requires super careful, detailed work, often in very controlled environments. It doesn’t have that instant reward feeling you get with software.

These issues create a real shortage that money alone can’t fix. The whole system, from how we teach STEM in schools to how companies train their employees, needs a serious rethink. The semiconductor industry faces a significant talent crisis, and just paying more isn’t the whole answer.

The companies that will do well in the future are the ones that have a solid plan for developing their people. Investors should look past just the short-term profits and check out how companies are investing in training, working with universities, and keeping their employees happy. In this new landscape, a company’s ability to attract and keep talent is just as important as its patents or technology.

9. TSMC’s Arizona Fab

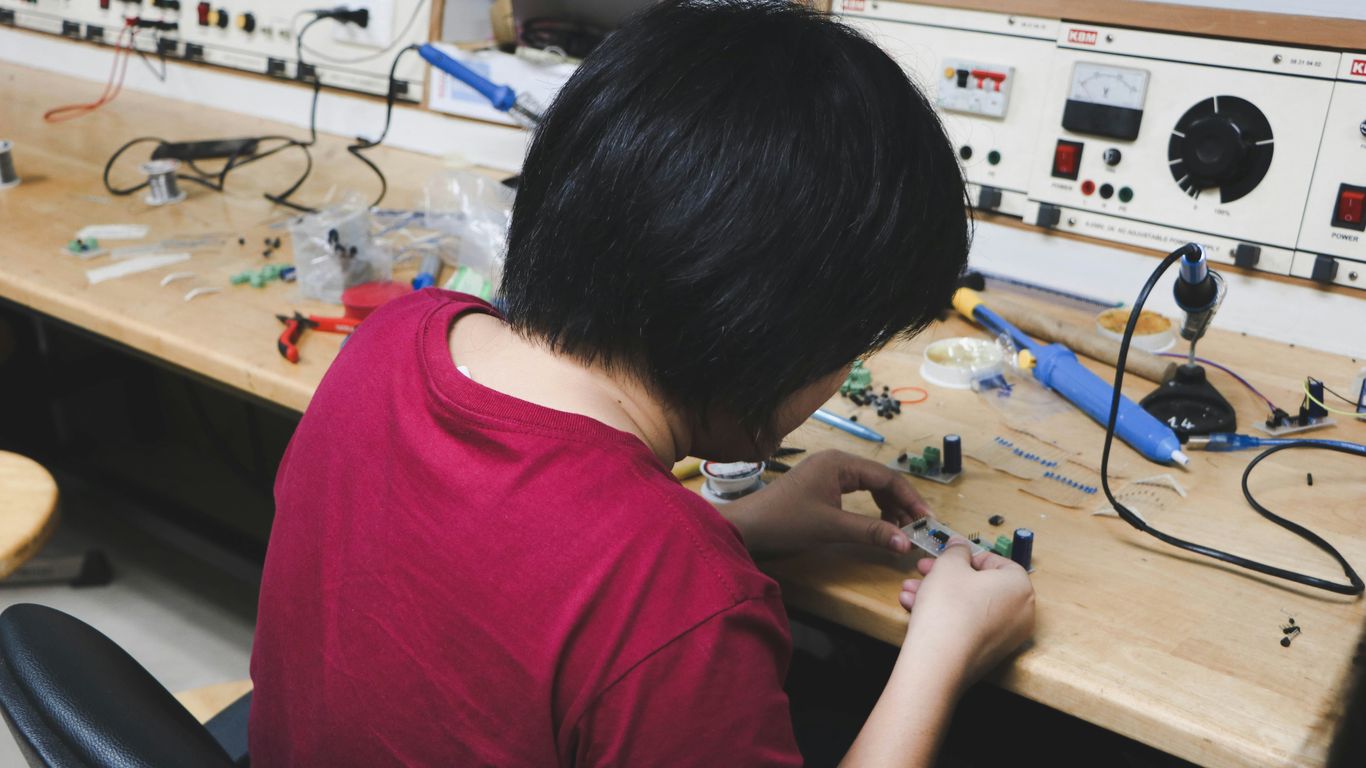

So, TSMC’s big move into Arizona. It’s a pretty massive undertaking, aiming to bring some serious chip manufacturing muscle to the US. They’ve poured billions into building these fabrication plants, or ‘fabs’, near Phoenix. The idea is to produce advanced chips, like the 4nm ones, right here on American soil. By March 2025, they already had about 3,000 people working at the Arizona site.

This Arizona expansion is a huge part of TSMC’s global strategy, but it’s also just a fraction of their total production capacity. While the Arizona fabs are expected to churn out around 600,000 wafers annually, TSMC’s entire output is closer to 16 million. That means the US facilities will represent only a small percentage of their worldwide chipmaking. Plus, building these advanced fabs in the US is way more expensive than in Taiwan. Think higher costs for everything from construction to labor.

Here’s a quick look at what’s happening:

- Initial Production Goals: The plan was to focus on 4nm chips, aiming for a monthly output of 20,000 chips. They’ve said the yield in Arizona is getting close to their Taiwanese plants, which is good news, but the cost is still higher.

- Workforce Development: Getting these fabs running requires a lot of skilled people. TSMC had to send hundreds of American engineers to Taiwan for training because the specialized expertise just isn’t readily available in the US. They’re also working with local universities like Arizona State University to build up that talent pipeline for the future.

- Economic Impact: Beyond the direct jobs at the fab, there’s a ripple effect. Projects like the Halo Vista development are planned nearby, aiming to create thousands more jobs and build out a whole community around the tech hub. It’s a big bet on the region’s future.

It’s not all smooth sailing, though. There are questions about how much this US presence will truly reduce global reliance on Taiwan for cutting-edge chips. Plus, there’s some nervousness back in Taiwan about these big overseas investments, with concerns that it might weaken their strategic position. It’s a complex balancing act, for sure.

10. Intel Foundry Investment

Intel’s push to become a major foundry player, often called ‘America’s Foundry,’ is a big deal, especially when you look at what TSMC is doing. It’s not just about making chips; it’s about national security and having a domestic supply chain. Intel has poured a lot of money into this, getting billions from the US government through things like the CHIPS Act. They’re trying to build out advanced manufacturing capabilities, aiming for nodes like Intel 18A.

But it hasn’t been smooth sailing. Intel Foundry has faced some serious financial challenges, with significant losses. This has led to a lot of leadership changes, which isn’t exactly a sign of stability. The company is really banking on landing big external customers to make these expensive fabs work. They’re looking at tech giants like Microsoft, Google, and Amazon, hoping they’ll sign big contracts, maybe even "take-or-pay" deals where they commit to buying capacity upfront. This could bring in billions and help justify the massive investments.

Intel is also investing heavily in next-generation technology, like high-NA EUV machines, to get ahead. They spent a lot to secure these machines, aiming to simplify chip production for advanced nodes. The success of their 14A chips, which use new designs for better performance and power efficiency, is also key. If Intel Foundry can’t secure major customers for these advanced nodes, it could mean pausing or even stopping development, which would be a huge blow to US chip manufacturing independence.

Here’s a look at some of the financial picture and government support:

- Government Funding:

- CHIPS Act: $7.9 billion awarded.

- Secure Enclave Program: $3 billion secured.

- Key Technology Focus:

- Intel 18A and 14A chip development.

- Investment in high-NA EUV lithography.

- Customer Strategy:

- Seeking large hyperscaler and defense contracts.

- Exploring "take-or-pay" wafer pre-purchase agreements.

So, What’s the Bottom Line on TSMC Engineer Pay?

Alright, so we’ve looked at the numbers and it’s pretty clear: if you’re an engineer aiming for the top in the chip world, TSMC is definitely a place to consider in 2025. They’re paying big bucks, no doubt about it. But it’s not just about the paycheck, is it? Building these advanced chips takes a ton of smart people, and companies like TSMC are in a real race to find them. This high pay is a sign of how important these engineers are, but it also shows the industry is scrambling a bit. It’s a complex picture, with lots of moving parts, but for talented engineers, the opportunities look pretty good right now.

Frequently Asked Questions

Why are chip companies like TSMC paying engineers so much money?

Imagine needing a special ingredient for a cake, but there’s only a tiny amount of it in the whole world. Chip companies are like bakers needing that special ingredient – really smart engineers. With everyone wanting more computers, phones, and AI, there aren’t enough engineers to build all the chips needed. So, companies are offering huge salaries to get the best engineers to work for them.

How much does a TSMC engineer make in 2025?

It’s hard to give an exact number because it depends on experience, location, and the specific job. But, top engineers, especially those with advanced degrees, can earn a lot. Some reports show that new engineers with master’s degrees in places like Taiwan might see their yearly pay jump by around 20%. For experienced engineers in high-demand roles, the total pay, including bonuses and stock options, can be very high, often reaching hundreds of thousands of dollars.

Is TSMC building factories in the US, and how does that affect jobs?

Yes, TSMC is building advanced factories, called fabs, in places like Arizona. This is great news for job seekers because it means thousands of new jobs will be created, not just for engineers but also for technicians and construction workers. However, building these high-tech factories also means they need lots of experienced people, and there aren’t enough of them in the US right now, which is why they’re hiring so aggressively.

Are semiconductor jobs only about high salaries?

While the money is a big part of it right now, it’s not the only thing. Many engineers also care about the interesting projects they get to work on, the chance to learn new things, and the impact their work has on the world. Companies are also trying to make their workplaces more appealing by offering good benefits, training programs, and opportunities for growth.

Why is there a shortage of semiconductor engineers?

There are a few big reasons. First, the demand for chips has gone way up because of things like AI and new technology. Second, for a long time, many bright students were more interested in software or internet companies, so fewer people studied to become chip engineers. Lastly, building and running chip factories is very complex, and it takes many years to train someone to be an expert. It’s like a perfect storm of high demand and not enough skilled people.

What is the ‘glamour gap’ in tech hiring?

The ‘glamour gap’ refers to how, for many years, students and young professionals were more excited about working in software, apps, or internet companies because they seemed cooler and faster-paced. Chipmaking, which is hardware, was seen as more difficult and less trendy. The high salaries are partly an effort by chip companies to make their field seem more attractive and exciting again to bring back those bright minds.