Looking ahead to 2026, the way venture capital firms measure success is changing. It’s not just about the money anymore, though that’s still a big part of it. We’re seeing a shift towards smarter ways of tracking how well investments are doing, using new tools and even AI. This means getting a clearer picture of performance, both for the fund and for the companies it invests in. Let’s break down what’s important for venture capital performance in the coming years.

Key Takeaways

- Understanding your fund’s actual return means looking at Net IRR, not just Gross IRR, because it accounts for all the fees and costs.

- The Multiple on Invested Capital (MOIC) gives a straightforward view of how much money you’ve made back compared to what you put in.

- New tech tools can pull in data automatically and create dashboards, making it way easier to see how all your investments are performing in real-time.

- AI is starting to help find good investment ideas, predict which companies might do well, and speed up checking out new deals.

- Beyond just financial numbers, looking at how companies operate and what’s happening in the market gives a fuller picture of venture capital performance.

Core Metrics Defining Venture Capital Performance in 2026

Alright, let’s talk about how we actually measure if a venture capital fund is doing well, especially as we head into 2026. It’s not just about hoping for a big win; it’s about having solid numbers to back it up. These metrics help everyone, from the fund managers to the investors, understand the real picture.

Internal Rate of Return: Gross vs. Net IRR Explained

The Internal Rate of Return, or IRR, is a big one. Think of it as the discount rate that makes the net present value of all cash flows from a particular investment equal to zero. In simpler terms, it’s a way to figure out the profitability of an investment over time. But in venture capital, you’ll see two flavors of IRR: Gross and Net.

- Gross IRR: This is the return before any of the fund’s expenses, like management fees or carried interest, are taken out. It basically shows how good the fund manager is at picking winning companies. It’s a good indicator of the raw investment skill.

- Net IRR: This is the one that really matters to the people who put their money in. It’s the IRR after all those fees and expenses are subtracted. So, it shows the actual return an investor receives. This is the figure most Limited Partners (LPs) focus on because it reflects the performance of their invested capital.

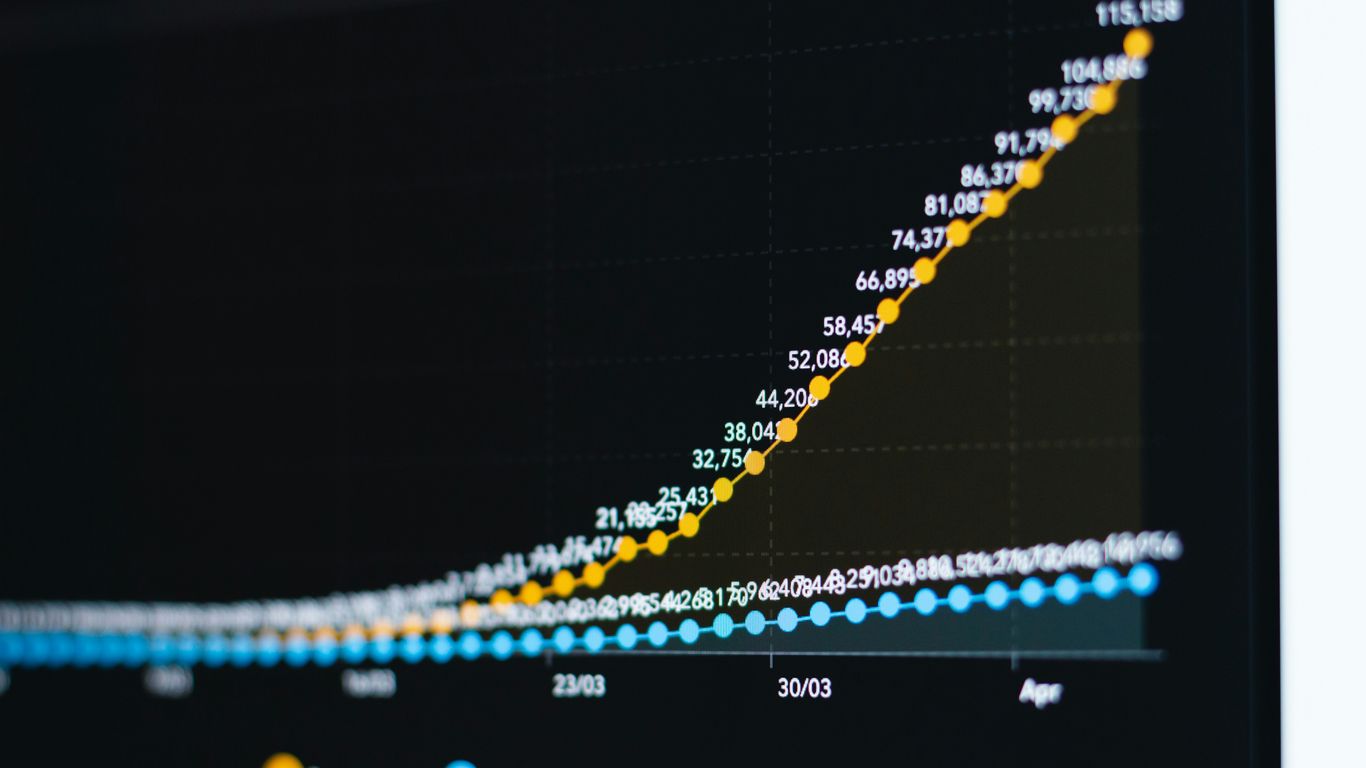

It’s pretty common for Net IRR to be negative in the early years of a fund. This is because setting up and investing in startups costs a lot upfront. It’s often shown as a ‘J-curve’ on a graph. But a successful exit can quickly turn that around.

Multiple on Invested Capital and Its Significance

Another key number is the Multiple on Invested Capital, or MOIC. This one is pretty straightforward: you divide the total money returned by the total money invested. So, if a fund invested $100 million and got back $300 million, the MOIC is 3x. It gives you a clear idea of how much money was made relative to the capital put in. While IRR tells you the rate of return, MOIC tells you the total value generated. Both are important for a full picture. For instance, a fund might aim for a DPI (Distributions to Paid-In Capital) of around 20%-30% as a sign of strong performance, according to recent industry analysis [0f4b].

Benchmarking Across Fund Lifecycles

Comparing your fund’s performance against others is super important. You can’t just look at your own numbers in a vacuum. Benchmarking helps you see how you stack up against similar funds, whether they’re in the same stage, industry, or vintage year. This comparison is done across different stages of a fund’s life. Early on, you’re looking at things like how quickly capital is being deployed and the initial performance of those early investments. As the fund matures, the focus shifts more towards realized returns and the overall multiple generated. It helps identify if your fund is performing as expected or if there are areas needing attention. Tools that can pull in data from thousands of startups make this kind of comparison much easier than it used to be.

Integrating Modern Reporting Tools for Transparent Performance Tracking

Transparency used to be a pain for most VC firms—way too much manual work, endless spreadsheets, and always one team member up late trying to piece things together before a board meeting. Now, with new reporting tools, the script has flipped. These platforms pull portfolio numbers in real-time, cut down on mistakes, and let everyone—GPs, founders, and LPs—see the same numbers at once. Let’s take a closer look at how these tools are making a difference across the board.

Real-Time Data Collection and Automated Dashboards

Real-time collection isn’t just a buzzword anymore; it’s actually become the expectation. Instead of hunting down financials or pinging founders for that one missing figure, new VC tools automatically gather metrics from payroll, accounting, CRMs, and even shared Excel files. You get a live dashboard that always reflects the latest data, which really helps when you’ve got to make a quick decision or keep LPs in the loop. Here’s what’s usually involved:

- Automatic syncing with financial platforms and data warehouses

- Pulling updates from portfolio companies on a schedule (sometimes even every night)

- Live dashboards you can customize for each team or partner

And you can wave goodbye to the old “version control” headache, since everyone works from the same numbers.

Custom Analytics for Cross-Portfolio Comparisons

One of the real perks: not just tracking performance—actually comparing it in detail across your entire portfolio. With modern software, you can line up different funds or companies, spot trends, and see where one stands out (or falls behind). That means:

| Metric | Company A | Company B | Company C |

|---|---|---|---|

| Annual Revenue ($) | 5M | 7M | 4.5M |

| YoY Growth (%) | 48 | 55 | 39 |

| Gross Margin (%) | 59 | 62 | 60 |

Custom reports can be spun up in a few clicks, so you spend more time deciding what to do, not just collecting numbers.

Ensuring Compliance Through Audit-Ready Workflows

Audit season (or surprise audits) used to bring dread, but new reporting systems build audits into the workflow itself. You get an automated trail showing who added what and when, plus you can track data corrections or valuation changes over time. Here’s how audit-ready workflows help:

- Maintains a clear, time-stamped history of all data changes.

- Sets up role-based permissions so only the right people edit sensitive data.

- Generates exports and summary reports that align with ILPA standards or your fund docs almost instantly.

It’s less about scrambling to find paperwork and more about just sending a link, which is a relief for everyone during review crunch time.

In short, integrating these tools isn’t just making things faster—it’s actually changing the day-to-day of VC work. There’s less guesswork, fewer errors, and more time to make decisions that matter.

Leveraging Artificial Intelligence to Enhance Venture Capital Performance

Artificial intelligence isn’t just a buzzword anymore—it’s turning into a standard tool for VC firms trying to keep up with the competition. The new tools are reshaping how deals are found, how opportunities are prioritized, and even how data from existing investments gets used. By 2026, using AI isn’t optional for funds that want real results. Here’s what that looks like.

AI-Driven Deal Sourcing and Opportunity Scoring

Gone are the days when finding new startups meant waiting for a warm intro or sifting through hundreds of pitch decks. With AI, the process gets supercharged:

- Algorithms process thousands of companies a week, tracking everything from hiring spikes to patent grants and product launches for signals of momentum.

- Data from sources like LinkedIn, Crunchbase, and GitHub are scraped and merged, giving a much wider deal funnel.

- Machine learning models score companies based on patterns from historical winners, quickly prioritizing who should get a closer look.

Typical results? Funds using AI-driven sourcing often review three to five times as many qualified opportunities as those relying mostly on referrals.

| Metric | Traditional Sourcing | AI-Driven Sourcing |

|---|---|---|

| Screened opportunities/month | 150-300 | 500-1,200 |

| Initial screening time/company | 45 min | 8 min |

| Qualified opportunities found | 5-10% | 15-20% |

Predictive Modeling for Portfolio Company Success

AI doesn’t just help pick investments; it helps spot which existing bets are most likely to grow (or run into trouble).

- Predictive algorithms use data like burn rate, customer churn, and even team composition to forecast outcomes.

- Early warning systems send alerts if business metrics veer off track, helping firms act before problems spread.

- These tools compare current companies to a giant database of past startups, offering practical risk signals instead of vague gut feelings.

Three common things AI screens for:

- Burn rates climbing faster than revenue

- Deviations from normal hiring or attrition patterns

- Customer or market engagement suddenly fading

Accelerated Due Diligence and Risk Detection

Due diligence used to be an endless paper chase, but AI has taken a red pen to the old way of doing things:

- Natural language tools read legal contracts and business docs, flagging buried risks and inconsistencies that might go unnoticed.

- Key business data is pulled automatically and structured into dashboards—no more manual spreadsheets.

- Common red flags, like founder disputes or weak IP protection, get highlighted instantly, so teams spend less time on routine checks and more on high-impact questions.

Bullet points for streamlining due diligence with AI:

- Contracts automatically checked for problematic terms

- Background checks on founders and early employees run in minutes

- Market comparisons generated in real time for faster benchmarking

This all adds up to decisions that are not just faster, but (most of the time) better-informed too. For firms aiming for results, slow and manual just doesn’t cut it anymore.

Transforming Portfolio Monitoring and Founder Relations

Keeping tabs on your investments and making sure the founders you back have what they need is a big part of the job. It used to mean a lot of manual work, chasing down numbers, and trying to get everyone on the same page. But things are changing, and technology is really stepping up to make this whole process smoother.

Automating Quarterly Reviews and Insights Generation

Remember those marathon sessions trying to pull together quarterly reports? Those days are fading. New tools can pull data from various places automatically. This means you get updated numbers and charts without all the manual data entry. It’s not just about having numbers; it’s about seeing what they mean. These systems can highlight trends or flag companies that might need a closer look. Think of it like having a helpful assistant who sorts through the spreadsheets so you can focus on the big picture.

Here’s a quick look at what this automation can do:

- Faster Report Creation: Pre-built templates and real-time data mean quarterly updates are ready much quicker.

- Clearer Insights: Automated analysis points out key performance indicators (KPIs) and potential issues.

- Consistent Data: Everyone sees the same, up-to-date information, reducing confusion.

Streamlined Communication with Limited Partners

Your investors, the Limited Partners (LPs), need to know how their money is doing. Keeping them informed used to be a constant back-and-forth. Now, platforms can help manage this communication much more efficiently. You can create reports that show exactly what each LP needs to see, without oversharing sensitive information. Some systems even let LPs log in and see their specific updates themselves. This transparency builds trust and saves everyone a lot of time.

- Customizable Reports: Tailor information for different LPs.

- Permission Controls: Ensure data privacy and security.

- Self-Serve Access: LPs can check updates when it’s convenient for them.

Supporting Founder Engagement and Data Accuracy

Getting accurate and timely data from your portfolio companies is key. If the founders find the process too difficult or time-consuming, they might delay or provide incomplete information. The goal is to make it as easy as possible for them. This means simple interfaces, options for how they submit data (like uploading files or using simple forms), and good support when they need it. When founders can easily share their progress, it helps you monitor performance better and offer the right kind of support at the right time. This partnership approach is what really makes a difference in the long run.

Evaluating the Impact of Alternative and Non-Financial Metrics

For a long time, folks in venture capital mainly tracked the usual financial returns — money in versus money out, plain and simple. But these days, that barely scratches the surface.

More funds are looking at different types of data coming from portfolio companies. It’s not just about profit—the story includes company health, founder progress, and even how the company’s market fits with new trends. These extra details give a clearer shot at the real value and risk across the portfolio.

Assessing Company Health Using Operational Data

Sure, dollars matter, but so does everything else happening at the company. Operational data steps in to paint a picture of what’s really going on:

- Employee headcount and turnover rates

- Monthly active users or customer churn

- Product development cycles and release frequencies

- Customer support tickets closed each quarter

Let’s put this side-by-side:

| Metric | Why It Matters | Typical Benchmark |

|---|---|---|

| Employee Growth Rate | Signals scaling or attrition | 5-15%/quarter |

| Customer Churn (%) | Shows product-market match | <10%/month |

| Revenue per Employee | Productivity measure | $120K-$250K/year |

| Burn Multiple | Efficiency of capital usage | <2.0 ideal |

Incorporating Market Signals from Emerging Trends

Sometimes it’s not about what’s happened, but what’s changing. Monitoring broader market signals helps with:

- Spotting new demand areas or niches, especially when tracking web traffic or patent filings (as seen in company financial statements).

- Comparing social media trends and online reviews.

- Viewing competitor hiring as a proxy for growth.

Here’s a quick checklist VCs sometimes use:

- Track circulating industry buzz using web traffic spikes.

- Examine competitor patent applications for fresh innovation.

- Review social following for brand and product excitement.

Using Qualitative Insights for Strategic Decision Making

Metrics tell part of the tale, but stories matter, too. Getting regular input from founders and teams can add context the spreadsheets won’t show:

- Collect founder updates to reveal setbacks or wins.

- Hold feedback calls with customers for real product opinions.

- Include peer review sessions to spot major issues early.

Non-financial insights easily round out the data-driven views. They give everyone—from the fund partners to the limited partners—better tools for making decisions. And in 2026, with the data floodgates wide open, ignoring these metrics could mean missing out on what’s next.

Selecting the Right Technology Stack for Venture Capital Performance Optimization

Picking the right tech tools for your venture capital firm isn’t just about having the latest gadgets; it’s about building a system that actually helps you do your job better. Think of it like building a really good toolkit. You wouldn’t grab just any hammer, right? You’d want one that feels good in your hand and gets the job done without a fuss.

Prioritizing Features: Security, Integrations, and Scalability

When you’re looking at software, the first thing to consider is security. You’re dealing with sensitive data, so making sure it’s locked down tight is non-negotiable. Then, think about how well these tools play with each other. If your deal sourcing software can’t talk to your portfolio monitoring system, you’re going to end up with a lot of manual data entry, which is a pain. The goal is to have your systems work together smoothly, not create more work. Finally, consider scalability. Will this software grow with your firm, or will you outgrow it in a year or two? It’s better to invest in something that can handle your needs today and tomorrow.

Here’s a quick checklist:

- Security: Does it meet industry standards? Are there regular audits?

- Integrations: Can it connect with your existing tools (CRM, accounting, etc.)?

- Scalability: Can it handle more data and users as your firm expands?

- User Experience: Is it easy for your team to learn and use?

Ecosystem Compatibility and Seamless Data Flows

It’s not enough for individual tools to be good; they need to work as a team. Imagine trying to cook a meal with a bunch of amazing ingredients but no way to combine them. That’s what happens when your tech stack isn’t compatible. You want systems that can share data easily, so information flows from deal sourcing, through due diligence, and into portfolio management without a hitch. This means looking for platforms that use standard data formats or offer robust APIs (Application Programming Interfaces). A well-connected ecosystem means less time spent wrestling with data and more time making smart investment decisions.

Adoption Strategies for Firmwide Engagement

Even the best technology is useless if your team doesn’t use it. Getting everyone on board is key. Start by clearly explaining why these new tools are being implemented – focus on how they make everyone’s job easier and improve firm performance. Provide thorough training, and don’t just leave people to figure it out on their own. Designate internal champions who can help colleagues and answer questions. It also helps to start with a pilot program, perhaps with one team or one specific function, to work out any kinks before a full rollout. Making the transition smooth and showing the benefits early on will get more people excited about using the new tech.

Wrapping It Up

So, we’ve looked at some of the main ways venture capital funds measure their success, like IRR and MOIC. It’s clear that just tracking these numbers isn’t enough anymore. The game is changing, and using smart tools, especially those with AI, is becoming super important. These tools help make sense of all the data, speed things up, and give a clearer picture of what’s really going on. If you want to keep up and make better decisions for your fund, especially looking ahead to 2026, getting a handle on these metrics and the tech that supports them is the way to go. It’s about working smarter, not just harder.

Frequently Asked Questions

What are the most important metrics for measuring venture capital performance in 2026?

The most important metrics include Internal Rate of Return (IRR), Multiple on Invested Capital (MOIC), and how funds compare at different stages of their lifecycle. IRR shows how much money an investment earns over time, while MOIC tells you how many times your original investment has grown. Comparing these numbers across funds helps investors see which funds are doing better or worse.

How do modern VC reporting tools help firms track performance?

Modern VC reporting tools bring all portfolio data into one place, making it easier to keep track of investments. They can collect data in real-time, create automatic reports, and help teams see trends faster. These tools also make it simple to share updates with investors and keep everyone on the same page.

How is artificial intelligence changing the way VCs find and evaluate startups?

Artificial intelligence (AI) helps VCs by scanning lots of startups quickly, scoring new opportunities, and predicting which companies might succeed. AI can also spot risks earlier and speed up the process of checking a company’s background. This means VCs can make better decisions with less guesswork.

Why is it important to use both financial and non-financial metrics when judging a startup?

Financial metrics, like revenue and profit, show if a company is making money. But non-financial metrics, like customer reviews, team strength, or how fast a company is growing, can reveal if a startup is healthy and likely to succeed. Using both kinds of metrics gives a fuller picture and helps avoid surprises.

What features should I look for when choosing VC performance software?

Look for software that keeps your data safe, connects with your other tools, and can grow with your firm. It should also be easy to use, let you compare companies, and help you make reports quickly. Good support and training are also important so everyone on your team can use the software well.

How do VC reporting tools improve communication with founders and investors?

These tools make it easier to collect updates from founders and share important information with investors. They can send reminders, create reports automatically, and let people see data anytime they need it. This keeps everyone informed and saves time for both founders and investors.